Market Overview

The USA telehealth services market is valued at USD ~ billion in the latest year, supported by sustained demand for remote access to care across chronic disease management, behavioral health, and follow-up consultations, alongside deeper integration of virtual care into provider workflows and payer benefit designs. In the prior year, an alternate industry estimate placed the market at USD ~ billion, reflecting differences in scope (telehealth vs. broader virtual care value chain coverage). Core growth levers remain provider capacity constraints, consumer convenience, and digital infrastructure maturity.

Within the USA, large metro ecosystems—New York City, San Francisco Bay Area, Boston, Los Angeles, Chicago, Dallas–Fort Worth, and Washington DC—continue to shape telehealth scale because they concentrate (a) large integrated delivery networks, (b) high commercial insurance density, (c) employer-sponsored benefits decision makers, and (d) digital health talent and investment capital. These hubs also host leading academic medical centers and payer headquarters, accelerating pilots (RPM pathways, virtual-first plans, telebehavioral networks) and shortening procurement cycles. Regionally, coastal and large Sun Belt markets typically adopt earlier due to provider competition and consumer expectations.

Market Segmentation

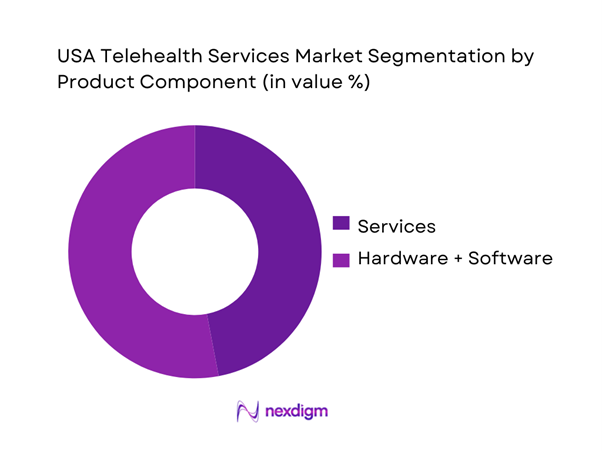

By Product Component

The USA telehealth services market is segmented into hardware, software, and services. Recently, services hold a dominant share because virtual care value is increasingly captured in “care delivery and operating layers,” not only in tools. Providers and payers are scaling virtual urgent care, teleprimary triage, specialty teleconsults, telebehavioral, and remote patient monitoring (RPM) programs as managed offerings that bundle clinician time, care coordination, analytics, and adherence workflows. This pushes spend toward per-member-per-month, per-visit, and program fees rather than one-time platform licenses. Services also expand faster as hospitals and insurers outsource implementation, staffing, scheduling, and ~ coverage models to specialist vendors—especially for behavioral health, after-hours coverage, and chronic care pathways—making services the most monetized and repeatable revenue pool.

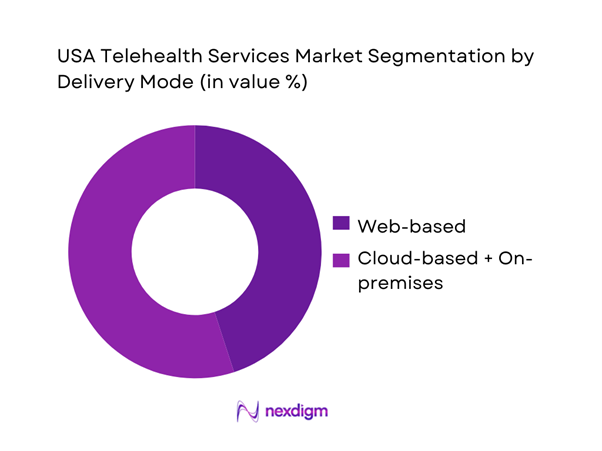

By Delivery Mode

The USA telehealth services market is segmented into web-based, cloud-based, and on-premises delivery. Recently, web-based leads because it minimizes friction for both patients and clinicians: browser-first workflows reduce app downloads, accelerate first-visit conversion, and support rapid rollout across distributed provider groups. Web-based platforms also integrate more easily with scheduling, patient intake, messaging, and e-prescribing using standard authentication and embedded video, which is critical for health systems operating multiple EHR instances and disparate clinic networks. For employers and payers, web-based access improves utilization by enabling “click-to-care” entry from benefits portals. In parallel, web-based delivery supports scalable RPM dashboards and care team tasking without heavy local IT dependencies—particularly valuable for multi-state provider groups navigating credentialing and operational standardization.

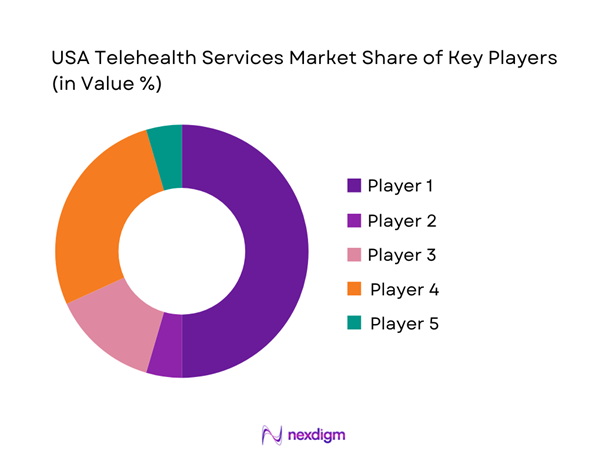

Competitive Landscape

The USA telehealth services market is competitive and innovation-led, with scale advantages in clinician networks, payer contracts, care navigation, and integrated virtual-first models. Large platforms (virtual care + mental health + chronic care + navigation) increasingly compete against payers/providers building in-house virtual care and against focused specialists (telepsychiatry, women’s health, dermatology, GLP-~ /weight management). Consolidation is visible through acquisitions and partnerships as players pursue distribution, employer access, and lower CAC.

| Company | Est. Year | HQ | Core Care Verticals | Go-to-Market | Clinician Network Model | Payer/Employer Contract Depth | EHR/Workflow Integration | RPM & Chronic Pathways | Differentiation Lever |

| Teladoc Health | 2002 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Amwell | 2006 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Included Health (incl. Doctor on Demand) | 2011 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| MDLIVE (Evernorth/Cigna) | 2009 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Amazon One Medical / Amazon Clinic | 2007 / 2022 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

USA Telehealth Services Market Analysis

Growth Drivers

Broadband and Device Readiness

The operating base for telehealth keeps widening because the U.S. economy and digital infrastructure can sustain high-frequency virtual utilization at scale: the U.S. nominal GDP is at USD ~, which underwrites federal and state digital buildouts and provider IT spend. On the access side, the BEAD program is funded at USD ~ to expand high-speed internet coverage—a direct enabler for video visits in rural and underserved ZIP codes. Adoption readiness is also pulled by Medicare’s documented telehealth use patterns, which normalize virtual care workflows across older populations and providers, reinforcing device and connectivity expectations for appointments beyond in-person.

Provider Capacity Constraints

Telehealth scales clinician time and expands coverage reach amid persistent access gaps, especially where physical capacity is structurally limited. There are ~ designated primary care Health Professional Shortage Areas with nearly ~ residents living in them, and a large share of designated primary care shortage areas are rural—meaning travel time and appointment scarcity are baked into the access problem telehealth can partially offset. Macro conditions support the “capacity multiplier” logic: the U.S. nominal GDP level of USD ~ correlates with large multi-site systems investing in centralized virtual teams to address appointment backlogs without adding physical exam rooms. In short, telehealth is increasingly deployed as throughput infrastructure—reducing friction for follow-ups, medication management, and post-acute check-ins when local capacity is constrained.

Challenges

Reimbursement Volatility

Telehealth growth is constrained when payment rules shift frequently across Medicare, Medicaid, and commercial plans because providers cannot plan staffing models, licensure coverage, and virtual panel capacity with confidence. Medicare policy has repeatedly relied on time-bound flexibilities, highlighting that coverage for certain telehealth services can be temporary and modality-specific, underscoring how categories can expand and contract based on federal action. At the same time, national scale dependence is real—over ~ Medicare beneficiaries used telehealth in a single year of expanded access, so even modest reimbursement rule changes can ripple across large beneficiary volumes. The macro environment, with nominal GDP at USD ~, supports investment, but volatility forces conservative deployment to avoid stranded clinical labor and technology spend.

Cross-State Licensure and Credentialing Friction

Cross-border practice remains operationally complex because provider licensure and credentialing are state-based, and multi-state virtual panels must manage compliance, onboarding, and renewals across jurisdictions. The Interstate Medical Licensure Compact is active in ~ states plus Guam and the District of Columbia, and has granted nearly ~ licenses since activation—showing both scale of demand and the administrative machinery required to enable cross-state telehealth at volume. Even with compacts, large systems still must manage credentialing, payer enrollment, and privileging workflows that add time-to-productivity for virtual clinicians. Macro demand remains supported by the U.S. nominal GDP of USD ~, which encourages national virtual-first strategies; however, licensure friction can force providers to design region-bounded telehealth networks rather than truly national coverage.

Opportunities

Hybrid Care Pathways

A major growth lever is building hybrid pathways where telehealth becomes the default “front door” and in-person capacity is reserved for exams, imaging, procedures, and high-risk cases. This model is supported by the scale of U.S. health spending at USD ~, which enables systems and payers to invest in scheduling orchestration, virtual triage, and coordinated follow-ups. Hybrid demand is also reinforced by chronic access gaps, with ~ primary care shortage areas covering nearly ~ residents, creating a persistent need for “right-site care” that reduces unnecessary travel while maintaining clinical safety. At the macro level, nominal GDP of USD ~ supports employer and payer adoption of navigation-heavy designs that can improve throughput without building new bricks-and-mortar capacity.

Remote Patient Monitoring Enabled Chronic Programs

Chronic care programs become more scalable when telehealth is paired with remote monitoring and structured follow-ups, letting providers manage larger populations with earlier intervention signals. Slightly more than ~ Medicare enrollees received remote patient monitoring, indicating RPM is already operating at large absolute volume inside Medicare—creating a real base for chronic pathways that can be wrapped with virtual check-ins and escalation rules. Medicare broadly covers RPM for physiologic data collection across chronic and acute conditions, supporting standardized reimbursement pathways for program design. The macro environment, with nominal GDP at USD ~, supports device logistics, analytics layers, and care management staffing needed to run these programs at scale.

Future Outlook

Over the next planning cycle, the USA telehealth services market is expected to expand as virtual care becomes a default access layer rather than an “alternate channel.” Growth will be shaped by payer reimbursement continuity, rising behavioral health demand, RPM scaling for cardiometabolic and post-acute pathways, and deeper AI enablement. Provider capacity constraints and consumer preference for convenience will keep utilization resilient, while competitive intensity will push vendors to prove outcomes, reduce unit costs, and integrate tightly with EHR and claims workflows.

Major Players

- Teladoc Health

- Amwell

- Included Health

- MDLIVE

- Amazon One Medical / Amazon Clinic

- CVS Health

- Optum

- Talkspace

- Hims & Hers Health

- Ro (Roman)

- PlushCare

- Wheel

- Doxy.me

- VSee Health

Key Target Audience

- Health systems & hospital networks

- Commercial payers & managed care organizations

- Employer benefits & HR leadership

- Telehealth platform and virtual-care operators

- Remote patient monitoring and connected device vendors

- Pharma & life sciences patient support leaders

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the telehealth ecosystem across payers, providers, employers, platforms, and device/RPM enablers. Desk research consolidates regulatory levers (privacy, licensure, reimbursement), utilization signals, and technology shifts that influence adoption and monetization.

Step 2: Market Analysis and Construction

We compile historical indicators and current-year commercialization signals to structure revenue pools by component and delivery mode. This step aligns market sizing with observable industry monetization pathways (subscriptions, visit fees, enterprise contracts, RPM programs).

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions through expert consultations with platform executives, provider virtual-care leaders, payer product owners, and employer benefits managers to confirm pricing constructs, utilization drivers, and procurement patterns.

Step 4: Research Synthesis and Final Output

Findings are synthesized using triangulation across credible secondary sources and operator feedback. We stress-test results for internal consistency (channel mix, buyer economics, regulatory feasibility) to deliver decision-ready insights and competitive benchmarks.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions and Exclusions, Assumptions and Conversions, Abbreviations, Market Sizing Framework, Triangulation Logic, Provider Payer Employer Interview Approach, Claims and Utilization Proxy Mapping, Company Revenue Attribution Logic, Limitations and Validation Protocol)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Broadband and Device Readiness

Provider Capacity Constraints

Rising Mental Health Demand

Payer Virtual-First Steering

Employer Healthcare Cost Optimization Programs - Challenges

Reimbursement Volatility

Cross-State Licensure and Credentialing Friction

Privacy and Security Compliance Burden

Clinical Appropriateness Guardrails

Provider Burnout in Virtual Panels - Opportunities

Hybrid Care Pathways

Remote Patient Monitoring Enabled Chronic Programs

Specialty eConsult Networks

Virtual Pharmacy and Medication Adherence Programs

AI-Enabled Triage and Clinical Documentation - Trends

Virtual-First Health Plan Designs

Retail Clinic Virtual Expansion

GLP-1 and Metabolic Care Teleprograms

Hospital-at-Home Enablement

Contact Center Consolidation - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Visit Volume and Encounter Mix, 2019–2024

- By Average Realization per Encounter and PMPM Equivalents, 2019–2024

- By Care Modality (in Value %)

Synchronous Video Visits

Audio-Only Visits

Asynchronous Messaging

eConsults

Remote Patient Monitoring - By Clinical Service Line (in Value %)

Primary Care

Urgent Care

Behavioral Health

Specialty Care

Chronic Care Management - By Care Setting and Buyer Type (in Value %)

Health Systems

Physician Groups

Payers

Employers

Direct-to-Consumer Platforms - By Payment and Reimbursement Model (in Value %)

Fee-for-Service

Value-Based Care

Per Member Per Month

Bundled Episodes

Employer Subscription - By Delivery Platform Type (in Value %)

EHR-Integrated Virtual Care

Standalone Telehealth Platforms

Contact-Center-Led Virtual Care

Digital Therapeutics Adjacent Platforms

Pharmacy-Linked Virtual Care - By End-User Demographics (in Value %)

Pediatrics and Guardians

Working Adults

Senior Population

Rural and Frontier Users

Chronic Care Patients - By Geography and Regulatory Operating Footprint (in Value %)

Multi-State Coverage

Compact-Enabled Coverage

Single-State Operations

- Market Share of Major Players by Platform Revenue Visit Volume and Buyer Type

- Cross Comparison Parameters (EHR Integration Depth, Multi-State Clinical Coverage Density, Payer Contract Breadth, Behavioral Health Capacity Utilization, RPM Program Attach Rate, Provider Credentialing Cycle Time, Claims Denial Rate Exposure, Data Privacy and Security Maturity)

- SWOT Analysis of Major Players

- Go-To-Market and Partnership Analysis

- Pricing and Packaging Benchmarking

- Detailed Profiles of Major Companies

Teladoc Health

Amwell

Included Health

MDLive

CVS Health MinuteClinic Virtual Care

PlushCare

HealthTap

Talkspace

BetterHelp

Hims and Hers Health

Ro (Roman)

Sesame

Doxy.me

Zoom for Healthcare

- Market Demand and Utilization Patterns

- Purchasing Power and Budget Allocation

- Compliance and Risk Expectations

- Needs Desires and Pain Point Mapping

- Decision Making Process

- By Value, 2025–2030

- By Visit Volume and Encounter Mix, 2025–2030

- By Average Realization per Encounter and PMPM Equivalents, 2025–2030