Market Overview

In 2024, the broader U.S. remote patient monitoring market reached USD ~ billion, underpinned by expanding reimbursed monitoring programs, higher chronic-care caseloads, and stronger platform/device integration across health systems and home health. In 2023, the U.S. remote patient monitoring software & services revenue base was USD ~ million, reflecting rapid scale-up of provider- and payer-funded RPM operations, care-management workflows, and device logistics.

The market is operationally concentrated in metro hubs that combine large provider networks, payer density, and digital health talent. Boston and the San Francisco Bay Area lead due to med-tech and health IT ecosystems plus hospital innovation pipelines. New York City dominates enterprise contracting with national payers and large employer populations. Nashville is influential through hospital operator and care-delivery footprints. Minneapolis–St. Paul remains central for medical device, connected monitoring, and care pathway commercialization.

Market Segmentation

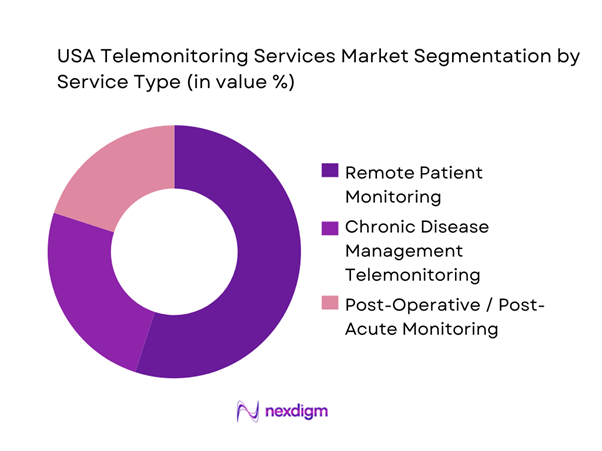

By Service Type

The USA Telemonitoring Services market is segmented by service type into Remote Patient Monitoring (RPM), Chronic Disease Management Telemonitoring, and Post-Operative / Post-Acute Monitoring. RPM is the dominant service line because it is the most “operationalized” model in the U.S.—programs bundle device provisioning, onboarding, adherence nudges, clinician review time, escalation pathways, and documentation into repeatable workflows. RPM also fits multiple buyer motions: health systems reducing readmissions, payers managing risk, and employers purchasing condition programs. It scales across high-incidence pathways (hypertension, diabetes, CHF, COPD) and supports “hospital-at-home” and virtual ward models, making it the default entry point for telemonitoring contracts and renewals.

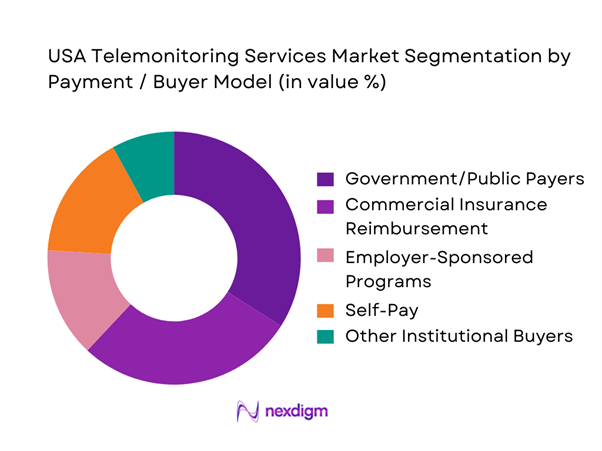

By Payment / Buyer Model

The market is segmented by payment/buyer model into Government/Public Payers, Commercial Insurance Reimbursement, Employer-Sponsored Programs, Self-Pay (Out-of-pocket), and Other Institutional Buyers. Government/public payers dominate because U.S. telemonitoring utilization scales fastest where reimbursement rules, billing pathways, and coverage criteria are clearly routinized. Public payer dominance also reflects the addressable patient mix (older and higher-acuity populations), where continuous monitoring has the strongest clinical and economic rationale. For vendors, public-payer-aligned programs also create durable operating rhythms: standardized eligibility checks, consistent cadence of review, and clear audit/documentation expectations—driving higher renewal probability versus purely discretionary spend.

Competitive Landscape

The USA Telemonitoring Services market is moderately consolidated at the enterprise end (large health systems, national payers, multi-state providers) while remaining fragmented in SMB clinics and regional provider groups. Scale players win by combining: device + connectivity logistics, clinical protocols and staffing models, EHR integration and automation, and compliance-grade reporting for reimbursement and audits. Partnerships between digital health platforms and connectivity/device enablers also intensify competition, as buyers prefer “single throat to choke” program delivery.

| Company | Establishment Year | Headquarters | Primary Telemonitoring Focus | Care Model & Staffing | Device/Logistics Model | Integration Depth (EHR/Claims) | Reimbursement Enablement | Typical Buyer Channel |

| Teladoc Health | 2002 | Purchase, NY | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips (incl. connected care) | 1891 | Amsterdam (U.S. ops nationwide) | ~ | ~ | ~ | ~ | ~ | ~ |

| OMRON Healthcare | 1933 | Kyoto (U.S. ops nationwide) | ~ | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Dublin (U.S. ops nationwide) | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994 | Chicago, IL | ~ | ~ | ~ | ~ | ~ | ~ |

USA Telemonitoring Services Market Analysis

Growth Drivers

Reimbursement and Billing Expansion

Medicare’s growing RPM reimbursement footprint is a direct demand driver because it normalizes provider workflows for device setup, data review, and documentation at scale. In Medicare, payments for remote patient monitoring exceeded USD ~ in 2024, and federal oversight is now defining measurable “billing signals” to monitor utilization patterns—both of which reinforce RPM as an established, auditable service line rather than an experimental program. The macro backdrop supports sustained utilization: U.S. healthcare spending reached USD ~, creating a large reimbursed base where telemonitoring competes as a care-management lever. At the same time, the U.S. economy scale—USD ~ GDP—supports payer and provider IT investment cycles tied to reimbursed operational programs. These numbers matter for telemonitoring because reimbursement converts monitoring from “nice-to-have” digital tools into repeatable clinical production lines: enrollment, adherence prompts, clinician review minutes, escalation, and compliance-ready records.

Provider Financial and Operational Incentives

Telemonitoring adoption is increasingly driven by operational math: it helps systems shift work upstream (earlier intervention) while stabilizing staffing pressure through protocolized triage. The U.S. provider environment is large enough that even small workflow gains scale materially: hospital expenditures were USD ~ and physician & clinical services were USD ~ in the most recently reported national totals, which signals the sheer volume of encounters and clinical minutes that care teams try to manage more efficiently. Telemonitoring is used to reduce unmanaged variability—standard vitals capture, structured symptom check-ins, and escalation rules—so clinicians focus on the highest-risk patients instead of low-signal follow-ups. The macro base remains supportive: the U.S. population is ~, expanding the chronic-care panel size providers must manage. Combined with GDP scale—USD ~—this environment rewards solutions that compress care cycles and reduce avoidable acute utilization without building new physical capacity. Telemonitoring vendors that enable staffing models (nurse triage hubs, escalation SLAs, EHR-embedded documentation) fit directly into these incentives.

Challenges

Patient Activation and Adherence

Telemonitoring programs fail operationally when enrollment does not convert into sustained readings and actionable data, and the barrier is often activation: device setup, connectivity, digital literacy, and persistence over weeks. Even with strong national infrastructure—~ broadband availability at ~—a non-trivial minority of locations still lack robust service options, and connectivity quality differences can disrupt day-to-day measurement capture and timely escalation. The scale of the challenge is amplified by the size of the addressable population: ~ residents implies activation frictions affect huge absolute numbers of potential users, especially among older, multi-morbid cohorts. On the system side, the cost of drop-off is real in operational terms: national physician & clinical services spending at USD ~ reflects a workforce environment where wasted outreach attempts and incomplete monitoring cycles add workload without clinical yield. While EHR adoption is high (~ of non-federal acute care hospitals with certified EHR), the patient-facing portion—device pairing, measurement routines, and adherence—still requires high-touch operational design. As telemonitoring expands, adherence becomes the differentiator: programs must reduce friction using multilingual onboarding, proactive coaching, kit logistics, and patient-specific nudges that keep data flowing consistently enough to justify clinical staffing and escalation protocols.

Clinical Workflow Friction

Workflow friction remains a core constraint because telemonitoring creates new operational objects: alerts, exceptions, triage queues, and escalation steps that must integrate into already saturated clinical environments. The economic context shows why health systems are sensitive to added friction: hospitals account for USD ~ in expenditures and physician/clinical services USD ~, indicating massive clinical throughput where poorly designed telemonitoring can add noise rather than reduce burden. Although EHR adoption is high (~ certified EHR in acute care hospitals), integration quality varies—standalone portals, weak identity matching, and non-embedded documentation can force clinicians into extra clicks and duplicate work. The scale of the U.S. economy—USD ~ GDP—supports broad digital tooling, but also means enterprise buyers demand high integration maturity and measurable productivity improvements rather than pilots. Clinically, the disease burden driving telemonitoring is non-trivial: ~ heart disease deaths and ~ cancer deaths in 2024 highlight why care teams prioritize high-signal pathways; they will not tolerate alert fatigue or poorly tuned escalation rules. This is why workflow design (thresholds, suppression logic, triage tiers, physician sign-off norms) is now a competitive requirement, not a “services add-on.”

Opportunities

Condition and Pathway White Spaces

The strongest near-term opportunity is expanding telemonitoring into under-optimized pathways where the U.S. burden is measurable today, and where home signals can prevent high-cost deterioration. The latest mortality data underscores the clinical “surface area” for expansion: ~ deaths from heart disease and ~ deaths from unintentional injury in 2024 indicate large cohorts where post-event monitoring, rehab adherence, and risk surveillance can be operationalized beyond core hypertension/diabetes programs. Hypertension burden remains structurally high at ~ of adults in the latest reporting window, which supports continued expansion of BP-centric pathways into broader cardio-renal-metabolic programs (multi-parameter kits, medication titration loops, and comorbidity management). On the payer side, the RPM reimbursement base is already material—Medicare RPM payments exceeded USD ~—which creates an operational foundation for adding new pathways while keeping billing and compliance rails consistent. Macro capacity supports broad rollout: USD ~ in healthcare spending and population ~ imply large addressable cohorts for condition expansion without relying on speculative future adoption assumptions.

AI-Enabled Triage and Clinical Decision Support

AI-enabled triage is a growth opportunity because it attacks the central bottleneck in telemonitoring scale: clinical capacity to interpret incoming data, reduce false alerts, and route interventions quickly. The current workload environment is visible in national spend and disease burden: USD ~ in physician & clinical services expenditure signals the scale of clinician time that can be redeployed if triage and documentation are automated safely. The clinical risk base is large—~ heart disease deaths in 2024—making deterioration detection and escalation accuracy a high-value operational target, especially for CHF/COPD post-discharge windows and multi-morbid cohorts. Digital foundations are also strong: ~ certified EHR adoption in acute care hospitals supports integration of AI triage outputs into clinical workflows (notes, flowsheets, task queues) rather than as standalone dashboards. Finally, home data availability is structurally feasible with ~ broadband availability at ~, supporting continuous ingestion of readings that AI can prioritize and summarize for clinicians. In this environment, AI opportunity is not “future hype”; it is a current operational lever to raise signal-to-noise, shorten response times, and scale telemonitoring programs without linear increases in staffing.

Future Outlook

Over the next five to six years, U.S. telemonitoring services will shift from “program adoption” to “program optimization.” Buyers will increasingly demand measurable reductions in avoidable utilization, tighter adherence management, and faster escalation loops. Competitive differentiation will move toward workflow automation, condition-specific pathways (cardiology, metabolic, respiratory, behavioral), and improved patient experience to reduce churn. Expect stronger convergence of telemonitoring with hospital-at-home, virtual nursing, and payer care management—driving larger multi-year enterprise deals.

Major Players

- Teladoc Health

- Koninklijke Philips / Philips Healthcare

- OMRON Healthcare

- Medtronic

- GE HealthCare

- Masimo

- ResMed

- iRhythm Technologies

- BioIntelliSense

- VitalConnect

- Validic

- Health Recovery Solutions

- CoachCare

- AMD Global Telemedicine

Key Target Audience

- Integrated Delivery Networks (IDNs) & Large Health Systems

- Home Health & Hospice Operators

- Medicare Advantage & Managed Care Organizations

- Commercial Health Insurers

- Employer Benefit Buyers

- Healthcare Private Equity / Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Device OEMs and Connectivity/IoT Platform Providers serving healthcare

Research Methodology

Step 1: Identification of Key Variables

We map the U.S. telemonitoring ecosystem across service vendors, device OEMs, connectivity partners, payers, and provider delivery models. Desk research is supported by secondary databases to define variables such as reimbursement alignment, workflow maturity, device logistics intensity, and integration depth.

Step 2: Market Analysis and Construction

We compile historical commercialization signals across RPM program footprints, provider adoption patterns, and payer contracting behaviors. Bottom-up market construction uses program-level constructs (enrolled lives, monitoring cadence, review staffing, and revenue realization logic) to build the service economics.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions via CATIs with provider program leaders, payer care-management heads, and vendor operations executives. These interviews pressure-test utilization, adherence, alert fatigue, escalation rules, and documentation practices that influence revenue conversion.

Step 4: Research Synthesis and Final Output

We triangulate insights from vendor offerings, reimbursement pathways, and provider workflow evidence to finalize segmentation, competitive positioning, and buyer decision criteria. The output is cross-validated through targeted follow-ups to ensure consistency between top-down market signals and bottom-up operating realities.

- Executive Summary

- Research Methodology (Market Definitions & Service Boundaries, Telemonitoring Taxonomy (RPM/RTM/CCM), Assumptions & Exclusions, Data Triangulation Framework, Bottom-Up Patient-Month Modeling, Top-Down Spend & Utilization Modeling, Primary Interviews (Providers/Payers/Vendors), CPT/HCPCS Reimbursement Validation, Sensitivity & Scenario Design, Limitations)

- Definition and Scope

- Market Genesis and Evolution

- Industry Timeline

- Business Cycle and Demand Cyclicality

- Telemonitoring Service Models

- Care Pathway Placement

- Growth Drivers

Reimbursement and Billing Expansion

Provider Financial and Operational Incentives

Clinical Outcome Pull

Hospital Throughput and Post-Acute Strategy

Consumerization and Home Diagnostics - Challenges

Patient Activation and Adherence

Clinical Workflow Friction

Reimbursement and Audit Exposure

Data Quality and Signal Integrity

Interoperability Constraints - Opportunities

Condition and Pathway White Spaces

AI-Enabled Triage and Clinical Decision Support

Payer-led RPM at Scale

Hospital-at-home and Advanced Care at Home

Pharmacy and Diagnostics Convergence - Trends

Device Fleet Evolution

Connectivity Strategy

Program Design Shifts

Commercial Model Innovation - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- Market Performance and Operating Benchmarks

- By Value, 2019–2024

- By Service Volumes, 2019–2024

- Service Revenue Mix, 2019–2024

- By Fleet Type (in Value %)

Physiologic RPM

Therapeutic RTM

Cardiac Remote Monitoring

Sleep and Respiratory Monitoring

Continuous Glucose Monitoring-linked Monitoring - By Application (in Value %)

Hypertension

Diabetes

Congestive Heart Failure

COPD and Asthma

Post-acute and SNF-at-home

Maternal and fetal monitoring - By End-Use Industry (in Value %)

Health Systems and IDNs

Physician Groups

Home Health Agencies

Payers and Medicare Advantage Plans

ACOs and IPAs

Employers - By Technology Architecture (in Value %)

Clinical staffing-led platforms

Device and platform-led services

Hospital-at-home integrated systems

Nurse triage hub models

Physician-supervised monitoring programs - By Connectivity Type (in Value %)

Connected medical devices with hubs

Smartphone and app-based monitoring

Cellular-enabled kits

Wearable biosensors

Patch-based monitoring systems - By Region (in Value %)

Northeast

Midwest

South

West

Urban care density markets

- Competitive Intensity Map

- Market Share Assessment Framework

- Cross Comparison Parameters (Reimbursement Enablement Depth, Device Fleet Breadth and Connectivity Mix, Clinical Operations Model, Alert Intelligence and Risk Stratification, EHR and Interoperability Readiness, Implementation and Onboarding Performance, Compliance and Cybersecurity Posture, Outcomes Evidence and Contracting Flexibility)

- Positioning and Differentiation Matrix

- Partnership Ecosystem

- Pricing and Commercial Model Review

- SWOT of Major Players

- Detailed Profiles of Major Companies

Teladoc Health

Amwell

MDLive

Included Health

Philips

Medtronic

Dexcom

Abbott

iRhythm Technologies

ResMed

Masimo

Biofourmis

Current Health

Health Recovery Solutions

CoachCare

- Health Systems

- Physician Groups

- Payers and Medicare Advantage Plans

- Home Health and Post-Acute Providers

- Employers and Clinics

- By Value, 2025–2030

- By Service Volumes, 2025–2030

- Service Revenue Mix, 2025–2030