Market overview

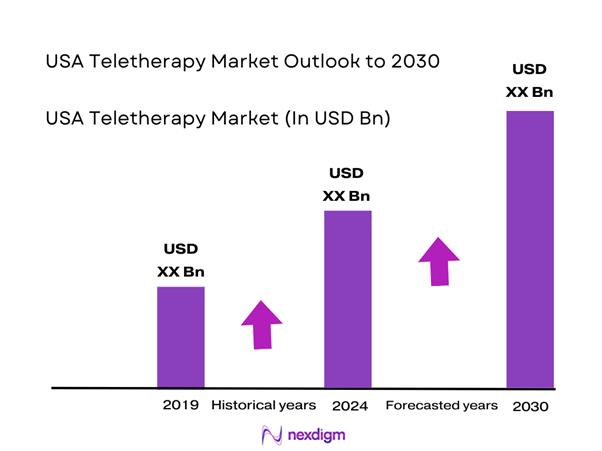

The USA teletherapy market is sized within the broader telehealth spend base: the U.S. telehealth market is valued at USD ~ billion and is projected to reach USD ~ billion by the end of the forecast window. Demand is driven by behavioral health’s high suitability for virtual delivery and by payer/employer willingness to fund access programs; utilization data shows behavioral health represented a majority of virtual encounters, with total behavioral-health telehealth visits moving from nearly ~ million in the prior year to just under ~ million in the most recent year.

Dominance concentrates in major U.S. metros with dense provider networks and employer concentration (e.g., New York City, Los Angeles, San Francisco Bay Area, Chicago, Dallas–Fort Worth) because they combine high insured lives, strong employer benefits adoption, and deep clinician supply. Provider-side readiness is also high: by the prior year, a large majority of psychologists reported using telehealth and many operated hybrid models, reinforcing “virtual-first + in-person backup” delivery in these cities.

Market segmentation

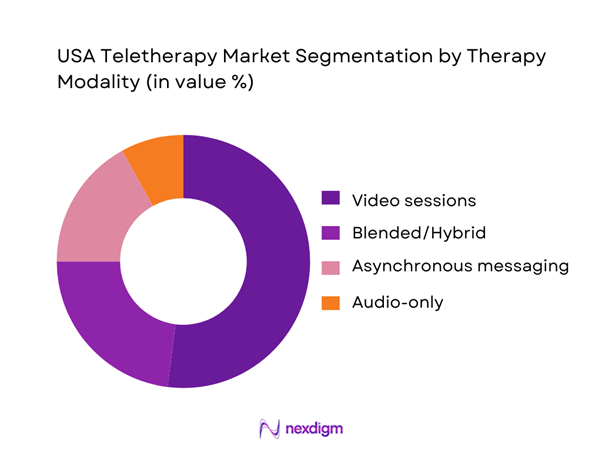

By Therapy Modality

USA teletherapy is segmented by therapy modality into video sessions, audio-only sessions, asynchronous messaging therapy, and blended/hybrid. Video sessions typically dominate because they best replicate in-person care (therapeutic alliance, non-verbal cues), align well with insurer reimbursement rules, and support higher-acuity use cases (risk assessment, structured protocols). Audio-only is an access backstop where bandwidth/privacy constraints exist, while async messaging is popular in DTC models for convenience and lower price points but can face reimbursement limits. Blended models are growing as employers and payers push measurement-based care and continuity (async between live sessions) to improve retention and outcomes.

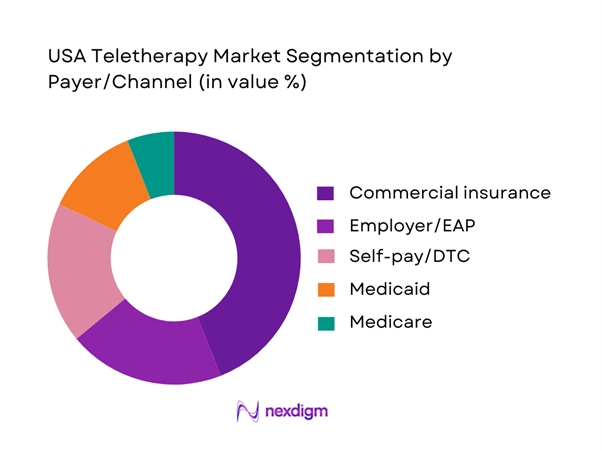

By Payer/Channel

USA teletherapy is segmented by payer/channel into commercial insurance, Medicaid, Medicare, employer/EAP, and self-pay/DTC. Commercial insurance tends to dominate because it aggregates large covered populations, supports network contracting, and funds access KPIs (time-to-first-appointment, provider availability, outcomes reporting). Employer/EAP is a strong accelerator for rapid rollouts (low friction, benefit-led adoption) and is often bundled with coaching and navigation. Medicaid growth is meaningful in states expanding behavioral health access programs but remains constrained by state-by-state policy and provider participation. Medicare tele-behavioral access exists but is shaped by coverage rules and waiver durability. Self-pay/DTC remains important for those seeking speed and privacy, especially via subscription platforms, but price sensitivity and churn can cap share.

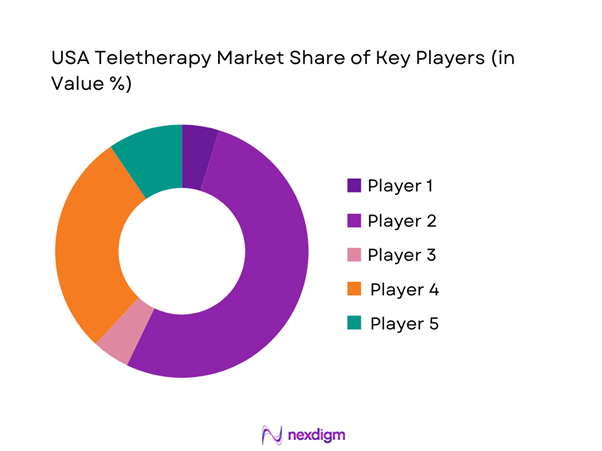

Competitive landscape

The USA teletherapy market is led by a mix of scaled DTC platforms and covered-benefit networks embedded in payer and employer ecosystems. Consolidation is visible at the top where brand scale, clinician supply, and contracting capability create durable advantages, while mid-tier platforms compete on faster access, specialty pathways (anxiety/depression, trauma), and employer-integrated outcomes reporting.

| Company | Established | Headquarters | Primary channel | Core teletherapy modalities | Clinician network signal | Enterprise contracting signal | Differentiation | Compliance / security posture |

| Teladoc Health (BetterHelp) | 2013 (BetterHelp) | U.S. | ~ | ~ | ~ | ~ | ~ | ~ |

| Talkspace | 2012 | New York City, NY | ~ | ~ | ~ | ~ | ~ | ~ |

| Amwell | 2006 | Boston, MA | ~ | ~ | ~ | ~ | ~ | ~ |

| Included Health (Doctor On Demand) | 2013 (Doctor On Demand) | San Francisco, CA | ~ | ~ | ~ | ~ | ~ | ~ |

| Lyra Health | 2015 | U.S. (Burlingame, CA) | ~ | ~ | ~ | ~ | ~ | ~ |

USA Teletherapy Market Analysis

Growth Drivers

Behavioral Health Visit Intensity

Teletherapy demand is anchored in high, recurring visit frequency for common conditions managed with ongoing sessions (depression, anxiety, SUD comorbidity), which makes remote delivery operationally efficient for both clinicians and payers. On the public-payer side, Medicare fee-for-service data show behavioral health service use at ~ visits per ~ beneficiaries and then ~ visits per ~ beneficiaries in the period analyzed, underscoring a large, repeat-visit service base where modality shifts (in-person → teletherapy) materially change delivery capacity without changing underlying clinical need. In parallel, U.S. macro capacity to pay for health services remained strong: GDP (current) is USD ~ trillion and GDP per capita is USD ~, which supports employer coverage, Medicare tax receipts, and household ability to sustain therapy utilization when available. Health-system spending intensity reinforces this: U.S. personal consumption expenditures on health care services rose from USD ~ billion to USD ~ billion, expanding the spending pool in which behavioral health and virtual delivery models compete for share.

Employer Demand

Employer-sponsored insurance remains a primary access channel for working-age behavioral health, and employer demand for teletherapy is fundamentally a productivity and retention strategy under sustained mental health burden and tight hiring conditions in care delivery. While teletherapy is not “extra” utilization so much as a channel shift, employers tend to favor it because it compresses time-to-first-appointment, reduces work-time lost to travel, and expands provider choice beyond local networks—especially relevant where in-person therapist supply is constrained. Workforce constraints are visible in federal shortage designations: ~ million people live in a mental health Health Professional Shortage Area, indicating structurally limited local capacity that employers must work around via virtual networks. At the same time, the macro backdrop shows strong ability to fund benefits: GDP per capita (current) at USD ~ supports premium affordability and richer behavioral health benefits design in higher-income regions and large employers. Household spending dispersion also matters for benefit strategy: average annual expenditures ranged from USD ~ (lowest income quintile) to USD ~ (highest), pushing employers to use teletherapy to control access inequities and reduce out-of-pocket friction for covered dependents.

Challenges

Provider Burnout

Teletherapy can reduce some clinician burdens (no commute, flexible scheduling), but it also introduces “always-on” risks, higher session density, documentation load, and boundary erosion—especially in high-demand periods. The challenge is not just subjective burnout; it is capacity instability in a sector already stretched by shortages. Federal workforce analysis shows the U.S. health care industry employed over ~ million people and still reports ~ million residents living in a mental health Health Professional Shortage Area, indicating that any clinician attrition or productivity loss has outsized access impact. Labor churn adds operational strain: industry tables show health care and social assistance quits levels in the hundreds of thousands (e.g., ~ in one reporting row shown), signaling persistent turnover pressure that large teletherapy networks must absorb via recruiting, onboarding, and clinical supervision infrastructure. Macro context matters because employer and payer expectations remain high when the economy can fund benefits: GDP (current) of USD ~ trillion means teletherapy demand is less likely to “cool” purely from affordability; networks must solve capacity via clinical workforce design (caseload engineering, measurement-based care workflows, supervision ratios) rather than waiting out demand cycles.

Fraud, Waste, and Abuse Controls

Teletherapy expands access, but it also expands the compliance surface: identity verification, medical necessity documentation, upcoding risk, improper prescribing referrals, and billing for non-rendered services. Federal enforcement intensity remains material: in FY ~, civil health care fraud settlements and judgments under the False Claims Act exceeded USD ~ billion, and more than USD ~ billion was returned to the Federal Government or paid to private persons (including relator shares) due to health care fraud and abuse control efforts. In addition, expected recoveries and receivables of USD ~ billion were reported in a recent semiannual reporting period, reinforcing that program integrity activity is not episodic—it is ongoing and large-scale. For teletherapy operators, this translates into non-negotiable investment in audit trails, session evidence, clinical notes completeness, credentialing checks, and payer-policy alignment. The macro frame again raises the stakes: a USD ~ trillion economy with expanding healthcare services spending is attractive to bad actors; controls must scale in parallel with network growth.

Opportunities

Value-Based Behavioral Health Contracts

The near-term growth path for teletherapy is increasingly tied to value-based arrangements that reward access + outcomes + total-cost impact (e.g., reduced acute episodes, better adherence, coordinated comorbidity management) rather than pure visit volume. Federal policy direction supports this: the Innovation in Behavioral Health Model identifies participating state Medicaid agencies (e.g., Michigan, New York, Oklahoma, South Carolina) and is designed to improve integrated behavioral and physical health care for Medicaid/Medicare populations—creating a policy-backed environment where teletherapy networks that can document outcomes and coordinate care become preferred partners. Community infrastructure is also expanding: planning and demonstration-related funding actions include one-year planning grants of USD ~ per recipient to ~ states and Washington, D.C., signaling sustained public investment in structured behavioral health delivery that teletherapy can plug into (triage, follow-ups, care coordination). The macro base is supportive of contracting innovation: GDP (current) at USD ~ trillion and a growing health services spend pool provide room for employers and payers to fund value-based pilots while scaling what works.

Integrated Care

Integrated care is a structural opportunity because behavioral health demand is high, provider supply is uneven, and physical/mental comorbidity is common—meaning the “next wave” of teletherapy growth will come from embedding therapy into primary care, chronic care management, and community behavioral health rather than operating as a standalone benefit. The constraint that creates the opportunity is measurable: ~ million residents live in a mental health Health Professional Shortage Area, which makes integration (shared care plans, stepped care, collaborative care) a practical solution to supply limits. Federal investments in primary care research and infrastructure also create enabling conditions; reports note USD ~ million committed to new primary care research projects in FYs ~–~ and USD ~ million invested across active primary care research projects spanning multiple years—supporting implementation know-how, tools, and models that teletherapy operators can align with (workflow redesign, digital care coordination, disparities reduction). Finally, the macro and spending environment supports integration scale: health care services personal consumption expenditures at USD ~ billion and GDP per capita of USD ~ help payers and health systems fund integrated behavioral health staffing models that combine teletherapy capacity with in-person escalation pathways.

Future outlook

USA teletherapy is expected to expand through payer normalization of virtual behavioral health, employer demand for faster access, and technology-led workflow efficiency (triage, matching, measurement-based care). Even with some utilization cooling from pandemic peaks, behavioral health remains a large portion of virtual care and is structurally “tele-suitable” (low need for physical exam), supporting continued platform investment and new contracting models. A key swing factor will be policy durability (coverage rules, parity enforcement, and program-specific waivers), alongside provider supply constraints and quality oversight.

Major players

- Teladoc Health

- Talkspace

- Amwell

- Included Health

- Lyra Health

- Headspace Health

- Spring Health

- Brightside Health

- Cerebral

- Rula (Path)

- SonderMind

- Thriveworks

- Alma

- Headway

Key target audience

- Commercial health insurers and behavioral health managed care organizations

- Self-insured employers and benefits leaders

- Investments and venture capitalist firms

- Government and regulatory bodies

- Hospital systems and outpatient behavioral health networks

- Community mental health center operators and behavioral health nonprofits

- Telehealth platform vendors and digital health infrastructure providers

- Pharmacy benefit managers and care navigation aggregators

Research methodology

Step 1: Identification of Key Variables

We map the USA teletherapy ecosystem (payers, employers, platforms, clinicians, regulators) and define variables such as visit volumes, modality mix, payer mix, reimbursement rules, and capacity indicators. Secondary research and structured database reviews are used to establish baseline market logic.

Step 2: Market Analysis and Construction

We compile historical utilization patterns and translate them into revenue pools using channel-specific pricing models (PMPM, per-session, subscription ARPU) and capacity constraints (clinician hours, utilization). We also test sensitivity around denial rates and churn.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses via CATIs with payers, employer benefits leaders, platform executives, and clinicians, focusing on access KPIs (time-to-first-appointment), network adequacy, contracting terms, and clinical governance.

Step 4: Research Synthesis and Final Output

We triangulate findings across stakeholder interviews, published benchmarks, and policy rules to finalize market sizing and segment splits, ensuring internal consistency across revenue, visits, and active patient estimates.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Teletherapy Market Sizing Approach, Consolidated Research Approach, Primary Interviews With Providers Payers Employers, Secondary Research and Database Triangulation, Claims and Utilization Model, Regulatory Compliance Validation, Limitations and Key Considerations)

- Definition and Scope

- Evolution of Teletherapy Adoption Pathways

- Patient Journey Mapping

- Care Pathways and Clinical Workflows

- Data Privacy Security and Trust Framework

- Technology Stack Overview

- Growth Drivers

Behavioral Health Visit Intensity

Employer Demand

Hybrid Care Preference

Network Expansion - Challenges

Provider Burnout

Fraud Waste Abuse Controls

Regulatory Variability

Outcomes Skepticism - Opportunities

Value Based Behavioral Health Contracts

Integrated Care

Youth Mental Health Access

Rural Coverage - Trends

AI Assisted Triage

Measurement Based Care

Digital Therapeutics Adjacency

Async to Live Conversion - Regulatory and Policy Landscape

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Sessions Visits, 2019–2024

- By Active Patients, 2019–2024

- By Provider Capacity, 2019–2024

- By Average Realized Price, 2019–2024

- By Fleet Type (in Value %)

Video Sessions

Audio Only Sessions

Asynchronous Messaging Therapy

Blended Hybrid - By Application (in Value %)

CBT

DBT

Trauma Focused EMDR Informed

Couples and Family

Group Therapy - By Technology Architecture (in Value %)

Anxiety

Depression

PTSD Trauma

Substance Use Disorders

ADHD Neurodiversity Support - By Connectivity Type (in Value %)

Pediatrics Adolescents

Adults

Geriatrics - By End-Use Industry (in Value %)

Commercial Insurance

Medicaid

Medicare

Employer EAP

Self Pay DTC - By Region (in Value %)

Northeast

Midwest

South

West

- Market Structure and Competitive Intensity

- Cross Comparison Parameters (Clinician Network Scale, State Licensure Coverage Footprint, Payer Employer Contract Penetration, Average Time to First Appointment, Modality Mix, Measurement Based Care Adoption, Claims Acceptance and Denial Rate Management, Security and Compliance Posture)

- Competitive Positioning Map

- Pricing and Packaging Benchmarking

- SWOT Analysis of Key Players

- Partnership and Channel Strategy Review

- Recent Developments and Product Roadmaps

- Detailed Profiles of Major Companies

Teladoc Health BetterHelp

Talkspace

Amwell

Included Health Doctor On Demand

Lyra Health

Headspace Health Ginger

Spring Health

Brightside Health

Cerebral

Rula Path

SonderMind

Thriveworks

Alma

Headway

Quartet Health

- Commercial Payers

- Employers and Benefits Buyers

- Health Systems and Clinics

- Government Programs

- Patient Segments

- Purchasing and Contracting Process

- By Value, 2025–2030

- By Sessions Visits, 2025–2030

- By Active Patients, 2025–2030

- By Provider Capacity, 2025–2030

- By Average Realized Price, 2025–2030