Market Overview

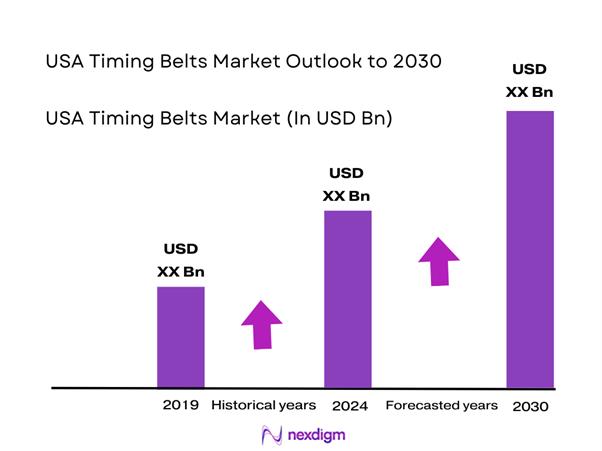

The global automotive timing belt market is valued at USD ~ billion in 2024. This market size reflects a robust demand for internal-combustion engine (ICE) components, driven by ongoing production of gasoline and diesel vehicles, sustained replacement cycles of timing belts, and the increasing use of direct-injection engines requiring precise timing systems. The timing belt remains a critical engine component for millions of vehicles in use, and as long as ICE vehicles dominate the vehicle parc in many regions, replacement and aftermarket demand continues to support the market value.

Within this market, certain countries and regions — notably the United States and greater North America — dominate demand. The North America segment, which includes the US, is forecast to reach revenue of USD ~ million by 2030. The dominance of the US/North America region arises from a large vehicle-in-operation (VIO) base, high vehicle ownership per capita, strong maintenance and aftermarket culture, and relatively high miles driven annually per vehicle. These factors combine to drive heavy replacement demand for timing belts and associated components, sustaining the region’s position as a leading market.

Market Segmentation

By Vehicle Type

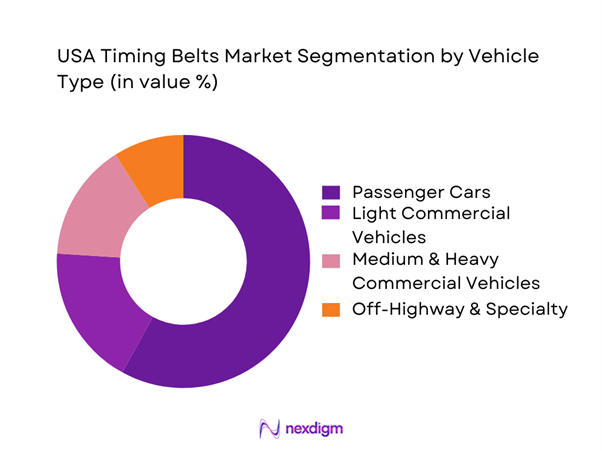

Passenger cars account for the majority of vehicle parc and replacement cycles, leading to their dominance in timing belt demand. High volume of privately owned cars, frequent servicing and replacements over lifecycle, and widespread use of ICE engines that rely on timing belts ensure consistent demand in this segment. Further, passenger cars typically have higher replacement frequency relative to heavy-duty fleets, contributing significantly to overall market volume and value.

By Sales Channel / Distribution Channel

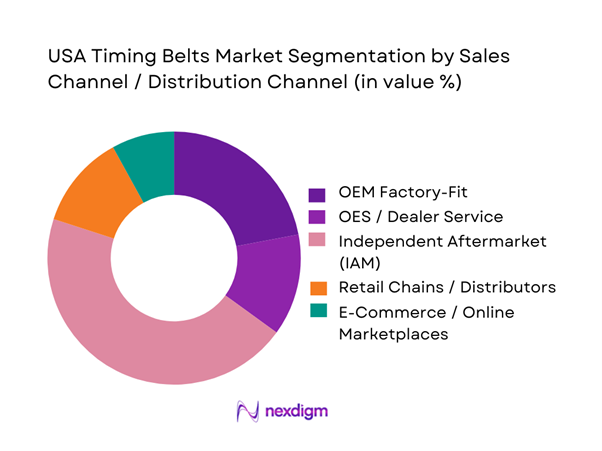

Independent aftermarket (IAM) and retail chains combined hold dominant share in belt replacements. This is because many vehicles on the road are out of warranty, and owners prefer cost-effective servicing through independent garages or purchase belts from retail chains rather than OEM dealers. Additionally, the proliferation of warehouse distributors, national auto-parts chains, and online marketplaces simplifies access to replacement belts, boosting aftermarket penetration. The flexibility, competitive pricing, and broad vehicle coverage offered by IAM players make this channel the primary choice for timing belt replacements.

Competitive Landscape

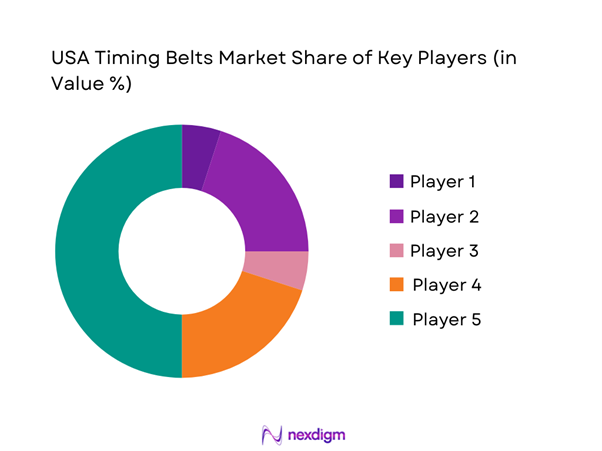

The USA timing belts market exhibits a moderately consolidated competitive landscape: a small number of global and regional players with deep technical expertise, broad distribution networks, and both OE and aftermarket presence dominate. This consolidation underscores the influence these companies wield over pricing, availability, technological standards and replacement cycles.

The above companies represent a cross-section of legacy belt manufacturers, OEM suppliers, and aftermarket specialists. Their portfolios differ — some emphasize premium belts and long-life materials; others focus on full kits and affordability. Their distribution strength and channel presence heavily influence their market share.

| Company | Year of Establishment | Headquarters (Country) | Typical Belt Material / Technology Portfolio | OE vs Aftermarket Presence (US) | Kit Strategy (Belt-only vs Full Kit) | Distribution & Channel Strength | Warranty / Quality / Certification Recognition |

| Gates Corporation | 1911 | United States | ~ | ~ | ~ | ~ | ~ |

| Continental (ContiTech) | 1871 | Germany (US operations) | ~ | ~ | ~ | ~ | ~ |

| Dayco Products LLC | 1905 | United States | ~ | ~ | ~ | ~ | ~ |

| Mitsuboshi Belting Ltd (MBL USA) | 1922 | Japan (US subsidiary) | ~ | ~ | ~ | ~ | ~ |

| Cloyes Gear & Products Inc. | 1925 | United States | ~ | ~ | ~ | ~ | ~ |

USA Timing Belts Market Analysis

Growth Drivers

Vehicle Parc Expansion and Aging

The USA timing belts market is anchored by a very large and mature vehicle parc that keeps replacement demand structurally high. Federal Highway Administration (FHWA) data show that all motor vehicles in the United States number ~ units, including ~ automobiles and trucks, based on the most recent national registration table. This total captures a mix of older passenger cars, light trucks and commercial vehicles that continue to operate for well over a decade in many states, especially in rural and suburban areas where car dependence is high. As vehicles age and accumulate mileage, timing belt replacement becomes a mandatory maintenance event, directly supporting steady aftermarket volumes across dealerships, independent workshops and fleet service networks.

High Annual Miles Driven and Stop–Go Duty Cycles

Timing belt wear in the USA is heavily influenced by how intensively vehicles are used, particularly under urban stop–go conditions. The U.S. Department of Transportation reports that drivers covered ~ trillion vehicle miles on U.S. roads, with road travel rising by ~ billion miles over the previous year and setting a new record for national mileage. Federal Reserve/FHWA time series show that moving 12-month vehicle miles traveled reached about ~ million miles by late 2025, confirming that high usage levels have been sustained. Urban corridors contribute a disproportionate share of this mileage, with monthly traffic volume reports indicating hundreds of billions of vehicle miles per month on urban roads, where frequent acceleration, idling and temperature cycling accelerate timing belt fatigue. For belt manufacturers and distributors, this large and intensively used parc ensures recurring demand for replacements and heavy-duty belt constructions.

Market Challenges

Price Pressure and Proliferation of Low-Cost/Private-Label Belts

Price pressure in the USA timing belts market is reinforced by the broader influx of low-cost parts and counterfeit products entering U.S. supply chains. U.S. Customs and Border Protection (CBP) reports that in fiscal 2023 it seized ~ shipments containing nearly ~ million counterfeit goods with an estimated manufacturer’s suggested retail price (MSRP) above USD ~ billion, covering many automotive-related categories. In a single quarter, CBP documented total IPR-related seizures with an MSRP of USD ~, including USD ~ attributed specifically to belts, showing how aggressively low-priced imitations are entering the market via express, vessel and mail channels. These counterfeit flows intensify competition for legitimate belt manufacturers, compress margins for branded products and push distributors toward private-label and imported belts whose lower price points can undermine quality expectations, especially in price-sensitive segments of the aftermarket and online sales channels.

Complex Fitment on Modern Powertrains and Packaging Constraints

The evolution of U.S. vehicles toward more powerful yet efficient platforms is increasing timing-system complexity and packaging constraints. EPA Automotive Trends data show that average new-vehicle fuel economy has risen to 27.1 mpg, while average CO₂ emissions have fallen to 319 grams per mile, even as many vehicles grow in size and capability. To achieve these outcomes, manufacturers are deploying dense combinations of turbochargers, EGR hardware, balance shafts and compact accessory drives in tight engine bays, with GDI engines installed in 51% of the model-year fleet and GDPI engines in 23%. These configurations often require intricate belt routing, low clearances and integrated engine-front modules, making replacement on transverse engines and compact SUVs time-consuming and error-prone. For timing belt suppliers, this complexity raises engineering and cataloging demands, as each new engine variant may require unique belt lengths, tooth profiles, tensioning strategies and installation tooling to ensure correct fitment and noise-vibration-harshness (NVH) performance.

Market Opportunities

Premium Long-Life Belts and Extended-Warranty Kits

Current driving intensity and parc characteristics in the United States create strong headroom for premium timing belts engineered for extended service intervals. FHWA data confirm that national vehicle miles traveled reached ~ trillion miles in one year, with moving 12-month totals around ~ million miles according to FRED’s aggregation of FHWA series, indicating that individual vehicles frequently accumulate well over 15,000 miles annually in many use cases. The ~ba million business-owned vehicles captured in the 2022 VIUS survey include delivery vans, rental cars and corporate fleets that routinely exceed national averages, making downtime and repeat belt services particularly costly. At the same time, EPA Automotive Trends show improved fuel economy at 27.1 mpg and lower CO₂ emissions of 319 grams per mile, implying more efficient but highly stressed engines where failures are unacceptable. Together, these conditions favor premium belts with advanced materials, reinforced cords and OE-level tensioning components that can support extended warranties bundled by OEMs, dealers and independent workshops, creating a differentiated value proposition versus low-cost alternatives while locking in customers for associated service kits and inspection routines.

Timing Belt Kits with Water Pump and Ancillaries

Integrated timing belt kits that include water pumps, tensioners, idlers and hardware are a strategic opportunity in the USA, where vehicles are operated for long lifespans under demanding thermal cycles. National registration statistics show more than ~ million motor vehicles in service, with ~ automobiles and trucks forming the core timing-belt-relevant parc. Many of these vehicles are equipped with belt-driven water pumps in tightly packaged engine bays, where labor to access the timing drive may exceed the cost of parts. Given total annual travel above 3 trillion miles, cooling systems see sustained load in regions with high ambient temperatures and heavy congestion. Replacing the water pump, tensioners and seals concurrently with the belt reduces failure risk between intervals and lowers lifetime labor cost per mile for owners and fleets. For suppliers, complete kits raise average invoice value and solidify brand preference with installers who appreciate matched components and technical support, while also aligning with broader U.S. maintenance trends that favor preventive replacement of high-risk components during major service events.

Future Outlook

Over the next several years, the USA Timing Belts market is expected to grow steadily, with demand driven by the large ICE vehicle parc that continues to require maintenance and replacement parts. As internal combustion engines remain prevalent in passenger cars, light commercial vehicles and many commercial fleets, timing belt aftermarket demand — particularly through independent repair channels and e-commerce distribution — is likely to remain robust.

However, technological shifts such as increased hybridization and potential long-term shift to electric vehicles (EVs) may gradually reduce demand for traditional timing belts. In response, belt manufacturers may increasingly focus on premium, high-performance belts, belt-in-oil solutions, extended-life kits, and targeting niches such as performance, heavy-duty, and off-highway vehicles. Additionally, value-added services (digital VIN-lookup, online distribution, fleet maintenance bundles) will become more critical for securing future growth.

Major Market Players

- Gates Corporation

- Continental

- Dayco Products LLC

- Mitsuboshi Belting Ltd

- Bando USA Inc.

- Optibelt Corporation

- Megadyne Group

- Aisin Corporation

- Cloyes Gear & Products Inc.

- Schaeffler

- SKF Group

- Denso Corporation

- CRP Industries Inc.

- Timken Belts / Goodyear Belts program

Key Target Audience

- Automobile OEMs and powertrain suppliers

- Tier-1 belt manufacturers and component suppliers

- Automotive aftermarket distributors and jobbers

- Independent repair shops and maintenance chains

- Fleet owners and fleet maintenance service providers

- E-commerce platforms focusing on automotive parts

- Investments and venture capitalist firms evaluating aftermarket or automotive component businesses

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We constructed an ecosystem map covering vehicle parc, engine type distribution, replacement cycles, channel types (OEM, OES, IAM), belt technologies, and distribution networks. We used secondary data from published reports, parts catalogs, vehicle parc databases, and industry publications to define these variables.

Step 2: Market Analysis and Construction

Historical data (global and regional) was compiled to establish a baseline market size. We then applied a bottom-up model, estimating timing belt replacements per vehicle, belt kit attach rates, and share of aftermarket vs OEM/OES to approximate annual demand and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

We validated our assumptions (replacement intervals, belt types, channel share) via interviews with industry experts from belt manufacturers, major aftermarket distributors and independent repair networks in North America, to verify real-world replacement patterns and demand drivers.

Step 4: Research Synthesis and Final Output

Combining bottom-up calculations, expert inputs, and recent market reports, we finalized estimates for current market size, segmentation shares, competitive dynamics, and future outlook under different scenarios (ICE continuation, hybrid growth, EV penetration).

- Executive Summary

- Research Methodology (Market Definitions, System Boundaries and Assumptions, Data Sources and Triangulation Framework, Market Sizing and Forecasting Approach, Segmentation Logic and Taxonomy, Primary Research Coverage and Respondent Mix, Validation, Sensitivity Checks and Scenario Building, Study Limitations and Data Interpretation Guidelines)

- Definition, Scope and Functional Role in Powertrain

- Evolution of Engine Timing Systems and Belt-in-Oil Concepts

- Timing Belts vs Timing Chains vs Gear Drives: Positioning in US Powertrain Design

- Business Cycle: From Polymer/cord to Installed Timing Belt Kit

- Supply Chain, Value Chain and Margin-Flows Mapping

- Growth Drivers

Vehicle Parc Expansion and Aging

High Annual Miles Driven and Stop–Go Duty Cycles

Shift Toward High-Load, High-Temperature Engine Architectures

Rising Hybridization with Belt-Driven Timing Solutions

Expansion of Fleet, Leasing and Mobility Platforms - Market Challenges

Price Pressure and Proliferation of Low-Cost/Private-Label Belts

Complex Fitment on Modern Powertrains and Packaging Constraints

Competition from Timing Chains and Alternative Drive Concepts

Counterfeit Belts and Quality Variability in the Grey Channel

Technician Skill Gaps and Installation Error Risks - Opportunities

Premium Long-Life Belts and Extended-Warranty Kits

Timing Belt Kits with Water Pump and Ancillaries

Coverage Expansion for Late-Model, Downsized and Hybrid Engines

Value-Added Services: Technical Training, Installation Support, Warranty Programs

Digital Cataloging, VIN-Based Lookup and E-Commerce Enablement - Trends

Timing Belt-in-Oil Solutions in the US Engine Parc

Advanced Materials (HNBR, Aramid, PTFE Coatings) and NVH Optimization

Longer Replacement Intervals and “Lifetime” Belt Narratives

Telematics- and OBD-Based Maintenance Reminders and Predictive Replacement - Regulatory, Standards and Policy Environment

- Vehicle Parc and Timing Belt Replacement Diagnostics

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- Market-Level SWOT Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Application and Fitment, 2019-2024

- By Vehicle Class, 2019-2024

- By Belt Construction, 2019-2024

- By Vehicle Type (in Value %)

Passenger Cars

Light Commercial Vehicles

Medium and Heavy Commercial Vehicles

Off-Highway, Agricultural and Construction Equipment

Powersports, Recreational and Specialty Vehicles - By Engine Fuel and Configuration (in Value %) [Equation]Gasoline ICE Engines

Diesel ICE Engines

Full and Plug-In Hybrids (Belt-Driven Timing Architectures)

CNG/LPG and Alternative Fuel Engines

High-Performance and Racing Engines - By Application and Fitment Type (in Value %) [Equation]OEM Factory-Fit Timing Belts

OES Dealer Service Belts and Kits

Independent Aftermarket Replacement Belts

Performance, Racing and Tuning Applications

Industrial and Non-Automotive Timing Belt Uses Linked to Automotive Customers - By Belt Construction and Material (in Value %)

Rubber Timing Belts

HNBR and High-Temperature Elastomer Timing Belts

Polyurethane Timing Belts

Reinforcement Cords

Tooth Profile Types - By Sales and Distribution Channel (in Value %)

OEM Dealership Service Networks

General Repair Garages and Engine Specialists

Retail Chains and Jobber Stores

Warehouse Distributors and Buying Groups

Online Marketplaces and Direct-to-Consumer e-Commerce - By End-User Fleet Category (in Value %) [Equation]Individual Vehicle Owners

Commercial Fleets

Leasing and Rental Companies

Government and Municipal Fleets

Ride-Hailing, Car-Sharing and Mobility Providers - By Region (in Value %)

Northeast

Midwest

South

West

- Market Share of Major Players by Value and Volume

Market Share by Vehicle Type Coverage

Market Share by Application

Market Share by Belt Construction and Technology Tier - Cross Comparison Parameters (Company Overview and US Timing Belt Portfolio, US Vehicle Parc and SKU Coverage, OE vs Aftermarket Mix and Presence in Timing Systems and Kits, Belt Construction and Material Technology, Timing Belt Kit Strategy (Idlers, Tensioners, Water Pump, Seals) and Coverage, Distribution Footprint and Channel Partnerships, Warranty, Mileage Coverage and Quality Certifications, Pricing Positioning, Promotions, Training and Technical Support Programs)

- SWOT Analysis of Major Players

- Pricing and Positioning Analysis

- Detailed Profiles of Major Companies

Gates Corporation

Continental

Dayco Products LLC

Mitsuboshi Belting / MBL (USA) Corporation

Bando USA Inc.

Optibelt Corporation

Megadyne Group

Aisin Corporation

Cloyes Gear & Products, Inc.

Schaeffler

SKF Group

Denso Corporation

CRP Industries Inc.

Timken Belts / Goodyear Belts Program

- Demand Patterns and Timing of Replacement

- Purchasing Power, Ticket Size and Service Bundling

- Pain Points and Unmet Needs

- Decision-Making Process Across Channels

- Fleet and Commercial Customer Behavior

- By Value, 2025-2030

- By Volume, 2025-2030

- By Application and Fitment, 2025-2030

- By Vehicle Class, 2025-2030

- By Belt Construction, 2025-2030