Market Overview

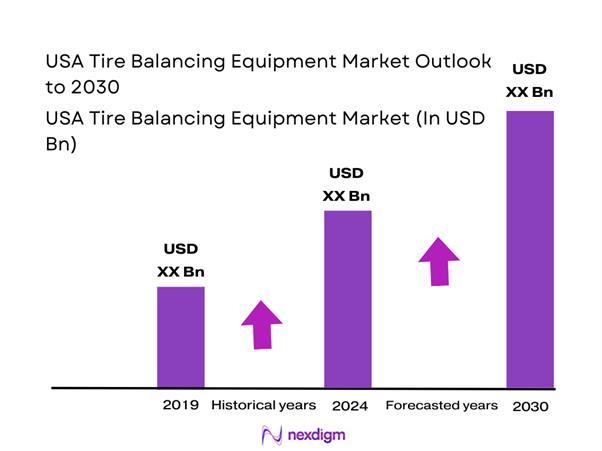

The USA Tire Balancing Equipment Market is valued at approximately USD ~ billion, demonstrating its importance in the broader automotive and transportation sector. Tire balancing equipment is essential for maintaining vehicle stability, ensuring safety, and optimizing tire longevity. Demand for tire balancing solutions is closely linked to the expanding automotive industry, with particular emphasis on passenger vehicles, heavy-duty trucks, and commercial vehicles. The need for proper tire balancing is integral to the overall performance and safety of vehicles, particularly as vehicle ownership rises and as tire technology evolves. The market is growing as consumers and businesses increasingly recognize the value of advanced balancing solutions for enhancing tire life and ensuring vehicle safety.

The dominant regions within the USA are the Northeast, Midwest, South, and West. Within these areas, cities with high automotive service provider concentration, such as Detroit and Los Angeles, lead the demand for tire balancing equipment. These regions are heavily influenced by a combination of automotive manufacturing hubs, growing vehicle fleets, and the demand for automotive maintenance services. The global influence comes primarily from technological advancements and innovation in tire balancing from major international players.

Market Segmentation

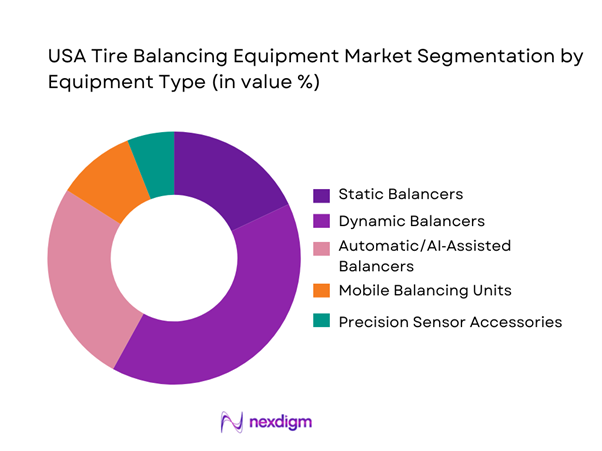

By Equipment Type

Dynamic Balancers dominate the USA segment due to superior accuracy, speed, and ability to handle a wide range of vehicle types including passenger cars and light commercial vehicles. These machines reduce service time and improve maintenance throughput, which is critical for highvolume service centers and fleet operations. Advanced automatic balancing systems with AIenabled diagnostics are becoming rapidly adopted among premium service chains, further expanding this segment’s footprint.

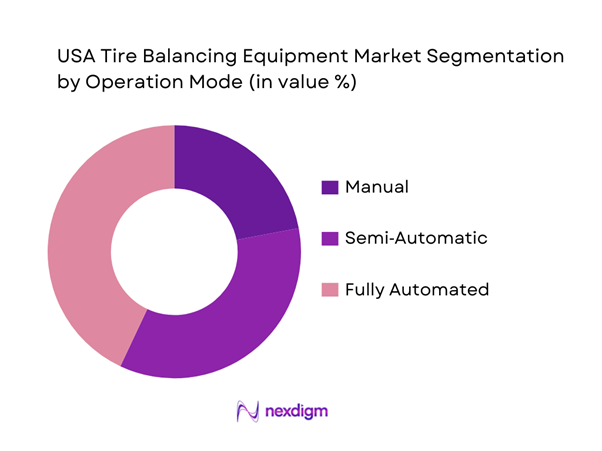

By Operation Mode

Fully Automated balancing equipment shows dominance due to workshop demand for higher throughput and reduced labor requirements. These systems integrate digital sensors and software interfaces that provide realtime diagnostics, leading to service standardization across multilocation dealerships and national auto service chains.

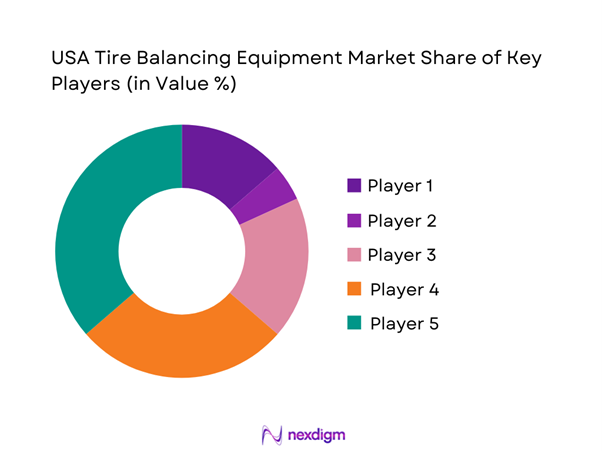

Competitive Landscape

The USA tire balancing equipment market is dominated by a few major players, including Hunter Engineering Company, Coats, Snap-on, and global brands like Bosch, and Hennessy Industries. This consolidation highlights the significant influence of these key companies.

| Company | Headquarters | Established | ASP Range | Product Portfolio Breadth | Service Network | OEM Contracts | Technology Focus |

| Hunter Engineering Company | USA | 1946 | ~ | ~ | ~ | ~ | ~ |

| Snap‑on Inc. | USA | 1920 | ~ | ~ | ~ | ~ | ~ |

| Robert Bosch GmbH | Germany | 1886 | ~ | ~ | ~ | ~ | ~ |

| Corghi S.p.A. | Italy | 1960s | ~ | ~ | ~ | ~ | ~ |

| Hofmann Megaplan | Germany | 1900s | ~ | ~ | ~ | ~ | ~ |

USA Tire Balancing Equipment Market Analysis

Growth Drivers

Technological Advancements in Tire Balancing Equipment

Technological innovations in tire balancing equipment, including the integration of digital systems and laser-based technologies, have significantly enhanced the precision and efficiency of the balancing process. These advancements enable faster tire balancing, improved accuracy, and a reduction in overall service time, making them highly attractive to automotive service providers and vehicle owners. By streamlining the balancing process, these technologies not only improve service center operations but also contribute to customer satisfaction. As a result, there is growing demand for modern tire balancing machines, both in original equipment manufacturing (OEM) and the aftermarket sector.

Increased Vehicle Ownership and Demand for Tire Services

The rise in vehicle ownership across suburban and rural regions in the USA is fueling the growing need for tire maintenance services, particularly tire balancing. As more individuals and families invest in vehicles, there is an increased awareness of the importance of proper tire care to ensure safety and performance. This heightened awareness is driving the demand for tire balancing services. As a result, automotive service providers are compelled to invest in advanced tire balancing technologies to accommodate the growing number of vehicles and meet customer expectations for efficient, accurate, and timely tire maintenance services.

Challenges

High Initial Investment Costs

One of the key challenges in the tire balancing equipment market is the significant upfront investment required for advanced systems, especially fully automatic and digital balancing machines. While these machines offer enhanced precision and operational efficiency, their high initial cost can be prohibitive for smaller service providers, independent repair shops, and garages. Smaller businesses often struggle with budget constraints and find it challenging to invest in these expensive systems. The high capital investment requirement is a barrier to widespread adoption, particularly in markets where price sensitivity remains a critical factor for purchasing decisions.

Limited Awareness in Smaller Regions

Although tire balancing equipment adoption is well-established in urban centers, smaller towns and rural regions in the USA continue to face challenges in awareness and adoption. Many smaller automotive service providers are unaware of the benefits of advanced tire balancing technologies, and in some cases, may not fully recognize the importance of regular tire maintenance. This lack of awareness in less populated regions hinders market expansion, as there is less demand for state-of-the-art equipment and fewer customers seeking high-quality tire services. Educating these markets about the long-term benefits of tire balancing can help bridge this gap and drive adoption.

Opportunities

Advancements in Digital Balancing Technologies

The ongoing development of digital tire balancing technologies presents significant opportunities for market growth. Digital systems, which integrate laser-based diagnostics and automated calibration, are increasingly being adopted for their high accuracy and fast processing times. These technologies allow for more precise balancing, reducing errors and service time. As consumers and businesses seek faster, more reliable solutions, the demand for digital and laser-based tire balancing systems is expected to grow. This presents a lucrative opportunity for equipment providers to expand their product offerings and cater to a market that is increasingly oriented toward automation and enhanced performance.

Growth of the Aftermarket Sector

The expansion of the aftermarket sector offers a promising opportunity for tire balancing equipment providers. As vehicles age and accumulate mileage, tire balancing becomes an essential service to maintain performance and safety. The growing demand for aftermarket services, driven by the rising number of vehicles on the road, creates a strong need for high-quality tire balancing solutions. Consumers are increasingly looking for reliable and efficient tire balancing services post-purchase, which presents an attractive market segment for businesses. This growing demand for tire balancing in the aftermarket space provides substantial growth potential for manufacturers and service providers.

Future Outlook

The future of the USA tire balancing equipment market looks promising, with continued innovation in technology and an expanding service industry. The rise in vehicle numbers and the push for efficient tire care will drive market demand, while advancements in digital and fully automated solutions will shape the next generation of tire balancing systems. The market is expected to grow as more automotive service centers invest in cutting-edge equipment.

Major Players

- Hunter Engineering Company

- Coats

- Snap-on

- Bosch

- Hennessy Industries

- Saimo

- Carlo Meccanica

- Cemb

- Ravaglioli

- Techno Wheels

- Corghi

- Teco

- Lionheart Industries

Key Target Audience

- Automotive Service Providers

- Car Manufacturers

- Tire Manufacturers

- Heavy-Duty Vehicle Service Centers

- Retail Tire Shops

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (USA-specific)

- Automotive Technology Developers

Research Methodology

Step 1: Identification of Key Variables

Market drivers, growth opportunities, technological advancements, and key market trends were identified and prioritized.

Step 2: Market Analysis and Construction

A comprehensive market sizing and segmentation framework was created, utilizing historical data and forecasting models.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts and key stakeholders helped validate hypotheses and refine the market insights.

Step 4: Research Synthesis and Final Output

Final outputs synthesized market data, providing a detailed, actionable report that meets client needs.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Tire Balancing Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- USA Industry / Service / Delivery Architecture

- Growth Drivers

Technological Advancements in Tire Balancing Equipment

Increased Vehicle Ownership and Demand for Tire Services

Rising Awareness of Tire Maintenance Benefits

Government and Environmental Regulations

Growth of Automotive and Heavy-Duty Vehicle Markets - Challenges

High Initial Investment Costs

Limited Awareness in Smaller Regions

Challenges with Equipment Calibration and Accuracy

Competition from Low-Cost Imports

Regulatory Compliance and Standards - Opportunities

Advancements in Digital Balancing Technologies

Growth of the Aftermarket Sector

Expansion of Vehicle Service Centers

Increasing Demand for Energy-Efficient Solutions

Rising Interest in Automated Solutions - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Equipment Type, 2019–2024

- By Operation Mode, 2019–2024

- By Distribution Channel, 2019–2024

- By Automotive Type (in Value %)

Automotive

Commercial

Heavy-Duty

Passenger

Light-Duty - By Operation Mode (in Value %)

Manual

Semi-Automatic

Fully Automatic - By Technology / Product / Platform Type (in Value %)

Conventional Balancers

Digital Balancers

Laser Balancers

Spin Balancers

Computerized Balancers - By Deployment / Delivery / Distribution Model (in Value %)

OEM

Aftermarket

Service Centers - By End-Use Industry / Customer Type (in Value %)

Automotive Service Providers

Car Manufacturers

Tire Manufacturers

Heavy-Duty Vehicle Service Centers

Retail Tire Shops - By Region (in Value %)

Northeast

Midwest

South

West

- Competition ecosystem overview

- Cross Comparison Parameters (Technology, Service Life, Pricing, Equipment Type, Regional Presence, Brand Recognition, Market Coverage, Innovation, Customer Support, Warranty)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Hunter Engineering Company

Snapon Incorporated

Robert Bosch GmbH

Corghi S.p.A.

Ravaglioli S.r.l

Hofmann Megaplan

Rotary Lift

Coats Group

Mahle Service Solutions

John Bean Technologies (Snapon)

Nussbaum Automotive Equipment

John Bean Wheel Balancers

BendPak Holdings LLC

Tecalemit Group

Julius Schmid Group

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Equipment Type, 2025–2030

- By Operation Mode, 2025–2030

- By Distribution Channel, 2025–2030