Market Overview

The USA Tire Valve Stems Market was valued at USD ~ billion and the market is supported by the U.S.’s very large in-use vehicle base—~ registered vehicles, rising from ~ in the prior period—because every registered vehicle creates recurring demand for replacement stems, cores, caps, seals, and TPMS service kits through preventive maintenance and wheel/tire refresh cycles. The tire valve stems market is best read as a service-volume-driven components market tied to tire replacements, wheel/rim service, and TPMS maintenance cycles.

Dominance concentrates in major U.S. vehicle and service ecosystems—especially large metro regions and freight corridors in states such as California, Texas, Florida, and the industrial Midwest—because these areas combine high vehicle density, large fleets, and high throughput in tire retail chains and independent workshops. U.S. demand is further reinforced by TPMS regulation for light vehicles, which expands routine replacement of TPMS-compatible stems/grommets/valve hardware during tire changes and sensor servicing, keeping higher-value valve-stem assemblies active across replacement cycles.

Market Segmentation

By Valve Stem Type

Snap-in rubber valve stems typically dominate unit volumes in the U.S. because they are the default fitment across a large portion of the passenger vehicle parc and are replaced frequently during tire changes and leak-related service events. They also win on workshop economics: fast installation, broad rim compatibility, and standardized service procedures make them the preferred “quick-turn” solution for high-throughput tire retailers and independent shops. Even as TPMS increases the value share of sensor-linked hardware, conventional snap-in stems remain a staple because many replacements involve standard wheels, seasonal tire swaps, and routine valve refresh recommendations to prevent slow leaks. The U.S.’s massive registered vehicle base supports this steady cadence, and the density of tire retail networks keeps these SKUs moving consistently through distributor and retail channels.

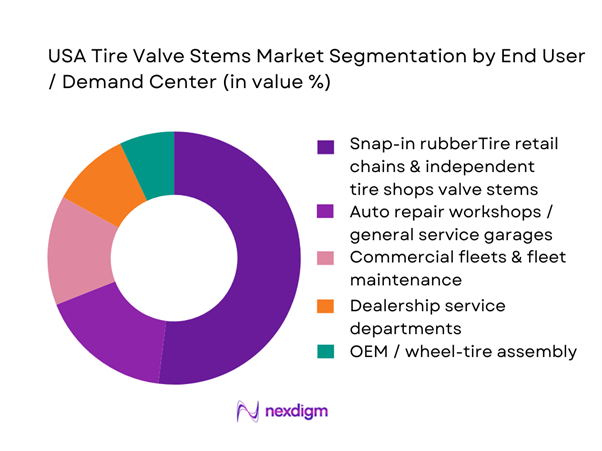

By End User / Demand Center

Tire retail chains and independent tire shops usually dominate consumption because valve stems are most commonly replaced at the same touchpoints where tires are mounted, balanced, repaired, or rotated. This channel captures the highest “incident rate” of stem interaction—every mount/dismount event is an opportunity to replace the stem, core, cap, grommet, or TPMS-related sealing hardware as preventive maintenance. The U.S. tires market’s scale (used here as a service-volume proxy for tire-change activity) reflects how much throughput sits in the replacement channel; large tire retailers optimize bay time and standardize replacement recommendations, which structurally increases stem unit turnover. This channel also benefits from bundled TPMS servicing, where valve-stem-related hardware is routinely swapped to reduce comebacks and leakage risk.

Competitive Landscape

The U.S. tire valve stems market is characterized by a mix of specialist valve hardware manufacturers, TPMS ecosystem players, and aftermarket distribution brands supplying high-velocity SKUs (snap-in stems, clamp-in stems, cores, caps, and TPMS service kits). Competition is shaped by TPMS compatibility breadth, distributor penetration, SKU coverage across passenger + light truck + commercial applications, and quality/compliance consistency that reduces leakage returns and workshop comebacks.

| Company | Est. Year | HQ | Core Offering Focus | TPMS/Service Kit Depth | Channel Strength | Manufacturing/Footprint Signal | Quality/Compliance Posture | Workshop Enablement / Cataloging |

| Sensata Technologies (Schrader) | 1915 (Schrader brand) | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| HALTEC Corporation | 1970 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Dill Air Controls (DILL) | 1909 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Pacific Industrial (PACIFIC) | 1930 | Japan (strong US OE links) | ~ | ~ | ~ | ~ | ~ | ~ |

| Alligator (Ventilfabrik / ALLIGATOR) | 1920s (brand legacy) | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

USA Tire Valve Stems Market Analysis

Growth Drivers

TPMS service stem replacement frequency

TPMS penetration structurally increases valve-stem service events because most TPMS rebuild/service actions are tied to the valve interface (seal, core, cap, grommet/washer) during tire dismount/remount cycles. In the U.S., the operating base of vehicles that routinely cycle through tire service is large: total registered motor vehicles are ~ and total travel is ~ million vehicle-miles (up from ~ million vehicle-miles), creating steady “touch” frequency for inflation checks, rotations, puncture repair, and sensor-related work orders. Macro conditions also support consistent utilization: inflation at ~ and unemployment at ~, conditions that typically keep commuting and freight activity resilient, sustaining workshop throughput rather than collapsing service volumes. Regulation also anchors the installed base: the federal TPMS standard requires warning when tire pressure is ~ below placard pressure (light vehicles), keeping TPMS-equipped vehicles in circulation and making TPMS-compatible stems (snap-in and clamp-in) a recurring replacement category in tire bays and fleet lanes.

Expansion of tire service touchpoints

The valve-stem market rises with the count and distribution of places that physically mount, balance, and service tires—dealers, independent tire chains, quick lube with tire bays, mobile tire services, and fleet service providers—because every tire dismount/remount creates a stem/valve-core/cap decision. Two demand-side numbers show why touchpoints keep expanding: total U.S. tire shipments are reported at ~ units and vehicle travel totals ~ million vehicle-miles, both supporting high rotation rates across passenger and commercial segments. Digital commerce further multiplies SKU availability and channel competition for service kits: U.S. retail e-commerce sales in a single quarter reached USD ~ billion (not adjusted basis), creating a fast-moving channel for “TPMS service kits,” “snap-in stems,” and “clamp-in stems” that feeds both DIY and installer procurement. Macroeconomic scale matters too: population at ~, which correlates with dense metro service networks and high vehicle utilization across major corridors, supporting high bay productivity and recurring replenishment cycles of stems/cores/caps. This mix—high unit tire flows, high miles driven, and rising online sourcing—pushes more retailers and installers to stock broader stem assortments (rubber vs metal, different lengths/angles, TPMS-specific service packs), increasing the number of “touchpoints” where valve stems are purchased, replaced, or upsold during service.

Challenges

Counterfeit and specification-drift risk

Valve stems are small parts where material and dimensional drift (rubber compound, durometer, plating thickness, thread tolerances, grommet compression behavior) can produce outsized failure risk, and e-commerce expansion increases exposure to nonconforming parts moving through long-tail sellers. The challenge scales with the size of the service system: ~ registered vehicles and ~ million vehicle-miles traveled, so even low single-basis failure rates can translate into large absolute counts of leaks, comebacks, and warranty friction. Online volume is also huge: U.S. retail e-commerce sales reached USD ~ billion in a quarter, providing a high-throughput pathway for both compliant and noncompliant kits. Macro stability doesn’t eliminate the risk; it can intensify it by keeping demand steady: inflation at ~ and population ~, sustaining consistent purchases of automotive maintenance items. Specification drift is particularly sensitive in TPMS-related applications because the regulatory expectation for TPMS warnings is triggered when a tire is ~ below placard pressure (for covered vehicles), which means pressure integrity is foundational to both safety outcomes and compliance perception. When nonconforming stems/cores/caps enter installer workflows, the immediate effect is not just leakage—it’s increased technician time (rework, reseal, re-torque), bay congestion, and customer dissatisfaction. For distributors and installers, the cost is operational: more returns, more brand switching, and tighter incoming QC requirements that slow replenishment.

Installer torque and seal failures

A recurring failure mode in valve-stem systems is not the stem itself but the installation process—improper tightening, contaminated sealing surfaces, re-used grommets, damaged cores, or caps seized by corrosion—leading to slow leaks and repeat visits. This matters at scale because the U.S. service environment is massive: ~ tire shipments indicate the volume of tire mounting activity, and ~ million vehicle-miles traveled keeps demand for rotations/repairs high, increasing exposure to workmanship variability across thousands of bays. Evidence of sensitivity to install conditions appears even in government technical documentation: a research report on TPMS installation notes fit/clearance issues on certain wheel types that make it challenging for installers to ensure proper tightness in constrained openings. Macro conditions can unintentionally worsen the challenge by keeping labor markets tight enough that training consistency varies: unemployment at ~ implies sustained demand for skilled technicians, and when hiring/training throughput struggles to match bay volume, variance in torque discipline rises. The TPMS regulatory baseline (warning at ~ below placard) raises the consequence of leakage and underinflation, because underinflation increases rolling resistance and heat build-up and can drive more service events and comebacks. Additionally, safety pressure remains high: preliminary reporting shows ~ traffic deaths, reinforcing the broader environment in which shops are expected to reduce avoidable mechanical risks.

Opportunities

Premium corrosion-resistant valve solutions

Premium corrosion-resistant valves (coated clamp-ins, improved grommet materials, compatible cap/core metallurgy, sealed caps) have strong runway because the U.S. corrosion environment is both widespread and persistent, and the economic cost of comebacks is high in a high-throughput service ecosystem. Salt sold/used at ~ million tons and domestic production at ~ million tons quantify the broad chloride exposure that directly attacks valve caps/cores and accelerates pitting and seizure events. Weather volatility compounds corrosion exposure: ~ billion-dollar disasters correlate with severe storms and precipitation extremes that increase road treatment and contamination loads. The opportunity is amplified by scale: ~ registered vehicles and ~ million vehicle-miles traveled, so premium upgrades can convert a small fraction of service events into significant absolute unit volumes. Macro support comes from inflation at ~ and population ~, sustaining mobility demand and the geographic breadth of service networks that can adopt premium SKUs at scale. Importantly, premium corrosion solutions reduce pain points that are visible to customers (stuck caps, slow leaks, repeated top-offs) and can be sold as “reliability” rather than as a discretionary add-on.

Universal TPMS service kits

Universal TPMS service kits are a scalable growth lever because they convert fitment complexity into standardized installer behavior—replacing seals/cores/caps (and where appropriate stems) as a routine step during tire service rather than a discretionary decision. The underlying service frequency is supported by big system numbers: ~ U.S. tire shipments, and ~ million vehicle-miles traveled with ~ registered vehicles, creating continuous cycles of mounting, balancing, and inflation checks where kit usage can be embedded into SOPs. E-commerce accelerates kit adoption by making standardized packs easy to source in bulk: retail e-commerce sales of USD ~ billion for a quarter support high availability of service kit assortments that independent shops and mobile installers can procure without deep distributor relationships. Macro indicators support the operational case: unemployment at ~ implies a labor market where reducing rework and comebacks is valuable; inflation at ~ supports stable purchasing and inventory planning for high-turn consumables. Regulatory context reinforces the logic: the TPMS standard expects timely warning when pressure is ~ below placard for covered vehicles, so maintaining sealing integrity and valve health is not optional in the customer’s eyes—especially when TPMS warnings trigger return visits and service disputes. Universal kits, when designed correctly, also help mitigate the “specification drift” issue by bundling validated components and reducing technician improvisation.

Future Outlook

Over the next planning cycle, the U.S. tire valve stems market is expected to expand steadily on three reinforcing vectors: a very large in-use vehicle parc sustaining replacement demand, continued TPMS servicing intensity driven by safety requirements and workshop best practices, and rising complexity in wheels/tires (larger rim sizes, higher pressures, EV-related load profiles) increasing adoption of higher-value clamp-in and TPMS-compatible stems. Regulatory requirements for TPMS performance in light vehicles keep TPMS-related servicing structurally embedded in the market, while the scale of U.S. tire retail throughput ensures recurring volumes of standard snap-in replacement parts.

Major Players

- Sensata Technologies

- Continental

- ZF Friedrichshafen

- Parker Hannifin

- Trelleborg

- BorgWarner

- Eaton

- HALTEC Corporation

- Dill Air Controls

- Pacific Industrial

- Alligator

- Hamaton

- BH Sens

- Myers Tire Supply

Key Target Audience

- Tire retail chains & multi-store tire dealers

- Aftermarket parts distributors & wholesalers

- Commercial fleet operators & fleet maintenance networks

- Vehicle OEMs & platform procurement teams

- Wheel and rim manufacturers

- TPMS sensor and diagnostic tool companies

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We map the U.S. wheel-end service ecosystem: tire retailers, distributors, TPMS suppliers, fleets, and OEM interfaces. Desk research consolidates vehicle parc indicators, TPMS regulatory requirements, and tires replacement throughput proxies to define the variables that drive stem demand.

Step 2: Market Analysis and Construction

We compile historical signals around tire service volumes and channel behavior, then structure demand by stem type (snap-in/clamp-in/TPMS) and by end user. We also normalize for workshop practice patterns (preventive replacement) and TPMS service kit attach rates.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions via CATIs with tire retail operators, distributors, fleet maintenance heads, and TPMS service professionals. Discussions focus on SKU velocity, failure/return drivers (leaks, corrosion, core issues), and the real-world mix of snap-in vs clamp-in vs TPMS stems across service events.

Step 4: Research Synthesis and Final Output

We reconcile bottom-up channel intelligence with component ecosystem benchmarks and regulatory context, then finalize the sizing model, segment splits (where auditable), and competitive positioning. Outputs include fitment logic, procurement checklists, and go-to-market implications by channel.

- Executive Summary

- Research Methodology (Market Definitions & Scope Boundaries, Assumptions & Data Normalization, Abbreviations, Sizing Approach—Bottom-Up (Parc × Replacement Cycles) & Top-Down (Tire Service Throughput), Primary Research Framework (Tire Dealers/Fleets/OE Channels), Secondary Research Sources, Triangulation & Validation Logic, Pricing/Unit Economics Framework, Limitations & Confidence Scoring, Analyst Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Business Cycle and Demand Rhythm

- Supply Chain and Value Chain Analysis

- Standards, Fitment Logic, and Interoperability

- Growth Drivers

TPMS service stem replacement frequency

Expansion of tire service touchpoints

Formalization of fleet preventive maintenance programs

Corrosion-driven clamp-in replacement demand

Growth of e-commerce SKU proliferation - Challenges

Counterfeit and specification-drift risk

Installer torque and seal failures

Galvanic corrosion in mixed-metal wheels

Fitment complexity across wheel families

Price compression in commodity snap-in stems - Opportunities

Premium corrosion-resistant valve solutions

Universal TPMS service kits

Heavy-duty and OTR high-flow valve systems

Private-label distributor programs

Smart workshop compliance packs - Trends

Service-kit-first replacement policies

Aluminum clamp-in adoption in premium wheels

Salt-belt specific SKU specialization

Standardized torque tools and installation SOPs

Consolidation in tire distribution networks - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger Cars

Light Trucks and SUVs

Medium and Heavy Commercial Vehicles

Off-the-Road Construction and Agriculture

Motorcycle, Powersports, Trailer and RV - By Application (in Value %)

Rubber Snap-In Valve Stems

High-Pressure Rubber Snap-In Valve Stems

Metal Clamp-In Valve Stems

Heavy-Duty Truck Valve Systems

TPMS Service and Replacement Valve Stems - By Technology Architecture (in Value %)

EPDM Rubber and Brass Core

Aluminum Clamp-In Anodized

Brass Clamp-In and Specialty Brass

Nickel-Plated Corrosion-Resistant Variants

Hybrid Service-Kit Configurations - By Connectivity Type (in Value %)

Standard Tubeless Valve Systems

High-Pressure Valve Systems

TPMS-Integrated Valve Systems

High-Flow Commercial Valve Systems

Specialty and Low-Profile Valve Systems - By End-Use Industry (in Value %)

OEM and OE-Service Channels

Tire Dealers and Independent Workshops

Auto Parts Retail Chains

Fleet, Government and Industrial MRO

E-commerce and Marketplace Sales - By Region (in Value %)

Northeast

Midwest

South

West

Non-Contiguous and Special Logistics Zones

- Market share of major players

- Cross Comparison Parameters (TR coverage and fitment breadth, pressure rating portfolio, material and corrosion engineering, TPMS service compatibility, quality and standards alignment, failure and return performance, channel and distribution strength, installer enablement)

- SWOT analysis of major players

- Pricing and SKU benchmarking

- Detailed profiles of major companies

Schrader

Dill Air Controls

Haltec Corporation

ALLIGATOR

Continental

Huf

Pacific Industrial

Standard Motor Products

Bartec USA

ATEQ

Myers Tire Supply

McGee Company

Mohawk Tire Products

AA Aftermarket Valve Programs

- Demand and utilization by end user

- Purchasing criteria and technical requirements

- SOP and compliance requirements

- Needs, desires and pain-point analysis

- Decision-making process and procurement logic

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030