Market Overview

The USA Turboprop Aircraft Market current size stands at around USD ~ million, supported by steady fleet utilization and replacement demand across multiple aviation segments. Aircraft deliveries remained stable with approximately ~ units operationally active, while average utilization hours increased during recent periods. Regional connectivity programs and fleet modernization initiatives sustained consistent procurement interest. The market reflects balanced demand between commercial, cargo, and government applications, supported by favorable operational economics. Fleet age profiles indicate gradual renewal cycles supported by maintenance optimization strategies. Overall market activity remains resilient despite cost pressures and competitive transport alternatives.

The market is primarily concentrated across the Midwest, Southern, and Western regions due to strong regional air connectivity needs. High density of regional airports, cargo hubs, and military bases drives sustained turboprop utilization. States with dispersed populations rely heavily on turboprops for short-haul connectivity. Mature aviation infrastructure, established MRO networks, and favorable state-level aviation policies further reinforce regional dominance. Coastal regions demonstrate growing adoption driven by logistics expansion and island connectivity requirements.

Market Segmentation

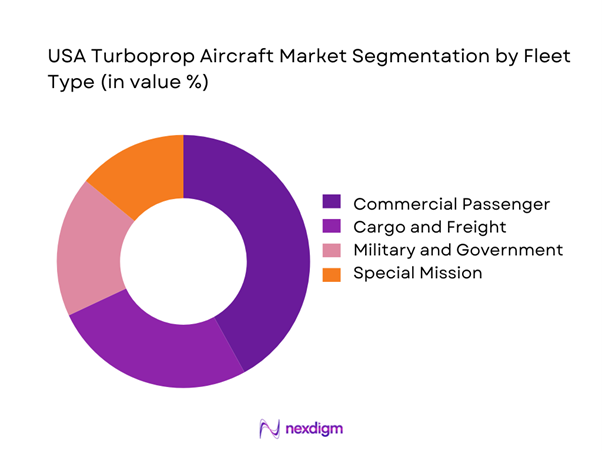

By Fleet Type

The market is dominated by commercial and utility turboprop fleets, driven by consistent regional connectivity demand and cost-efficient operations. Cargo-configured turboprops continue gaining traction as logistics operators prioritize short-haul efficiency and rapid turnaround. Military and government fleets remain stable, supported by surveillance, transport, and training requirements. Special mission aircraft are increasingly deployed for border surveillance, disaster response, and maritime patrol operations. Fleet diversification has increased as operators seek multi-role capabilities and lifecycle cost optimization. Replacement of aging aircraft remains a major contributor to sustained demand.

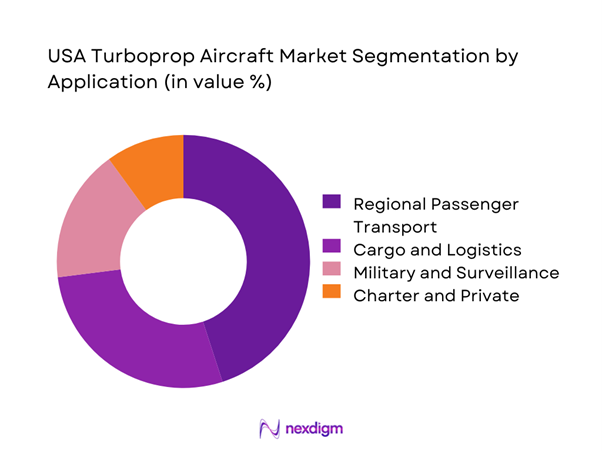

By Application

Regional passenger transport represents the largest application segment due to its efficiency on short routes and underserved corridors. Cargo operations have expanded significantly as e-commerce networks demand reliable feeder aircraft. Military and surveillance usage remains steady, supported by modernization programs and homeland security priorities. Charter and private operations contribute moderate volumes, driven by flexibility and operational cost advantages. Application diversification has strengthened fleet utilization and improved asset lifecycle management. Operators increasingly prefer turboprops for their adaptability across varied mission profiles.

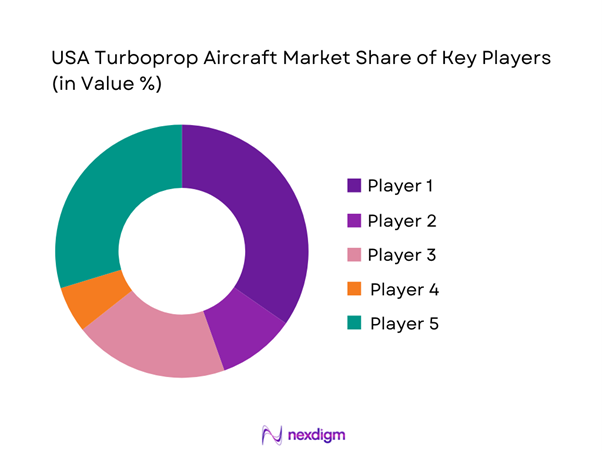

Competitive Landscape

The USA turboprop aircraft market features a moderately consolidated structure supported by established manufacturers and specialized service providers. Competition is shaped by aircraft performance, lifecycle support capability, and delivery reliability. Long-term service contracts and fleet modernization programs strongly influence competitive positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ATR | 1981 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| De Havilland Canada | 1928 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Textron Aviation | 2014 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Pilatus Aircraft | 1939 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

USA Turboprop Aircraft Market Analysis

Growth Drivers

Rising demand for regional connectivity and short-haul routes

Regional air connectivity continues expanding as operators seek efficient alternatives for short-distance travel across dispersed geographic markets. Infrastructure investments have improved airport accessibility, enabling turboprops to serve secondary and tertiary destinations efficiently. Passenger preference for direct routes supports increased deployment of regional turboprop services nationwide. Government-supported connectivity programs enhance operational viability for low-density travel corridors. Airlines increasingly prioritize turboprops to optimize seat economics and reduce operational complexity. Fleet utilization rates have improved steadily across multiple states due to route network expansion. Turboprops offer favorable turnaround performance compared to larger jet aircraft on short routes. Operational flexibility allows operators to adjust capacity based on fluctuating regional demand patterns. Airport congestion management further encourages turboprop deployment at constrained regional hubs. These combined factors consistently reinforce demand for turboprop aircraft operations.

Growing cargo and e-commerce driven feeder aircraft demand

E-commerce expansion has increased demand for efficient short-haul cargo aircraft across domestic logistics networks. Turboprops enable cost-effective feeder services connecting regional hubs with major distribution centers. Cargo operators benefit from turboprop versatility across varied runway conditions and weather environments. Increasing parcel volumes require reliable aircraft with frequent daily operations. Logistics providers prioritize aircraft with lower operating costs and rapid turnaround capabilities. Turboprops fulfill these requirements while supporting high-frequency delivery schedules. Network optimization strategies continue to favor turboprop integration within multimodal logistics chains. The rise of regional fulfillment centers further supports consistent aircraft utilization. Cargo fleet expansion has accelerated alongside digital commerce growth. This demand trend continues strengthening turboprop market fundamentals.

Challenges

Competition from regional jets

Regional jets present strong competition due to higher speed and passenger capacity advantages. Airlines often favor jets for premium routes and longer regional sectors. Passenger perception sometimes favors jet aircraft for comfort and travel time. Fuel efficiency improvements in regional jets reduce the historical cost advantage of turboprops. Fleet standardization strategies also influence operator preferences toward jet platforms. Infrastructure upgrades enable greater jet accessibility across regional airports. Leasing availability for jets creates additional competitive pressure on turboprop adoption. Operational flexibility of jets challenges turboprop dominance on certain routes. Market perception remains a barrier despite turboprop efficiency gains. These factors collectively restrain turboprop fleet expansion rates.

High acquisition and maintenance costs

Aircraft acquisition costs remain a significant barrier for small and mid-sized operators. Maintenance expenses increase with aging fleets and component replacement cycles. Limited supplier base for specific components elevates lifecycle support costs. Skilled labor shortages impact maintenance turnaround times and operational efficiency. Regulatory compliance requirements add complexity to maintenance planning. Financing constraints affect fleet expansion decisions for regional carriers. Currency fluctuations also influence procurement affordability for imported aircraft. Cost pressures encourage extended fleet utilization rather than new acquisitions. Budget limitations restrict rapid modernization across operator segments. These cost-related challenges impact overall market growth dynamics.

Opportunities

Expansion of regional air mobility networks

Regional mobility initiatives are strengthening air connectivity between underserved communities. Policy support encourages development of short-haul aviation corridors nationwide. Public-private partnerships facilitate investment in regional aviation infrastructure. Turboprops align well with emerging mobility frameworks emphasizing efficiency and accessibility. Network expansion enables new route development with manageable operational costs. Airports increasingly accommodate turboprop operations through infrastructure enhancements. Digital scheduling tools improve route viability and utilization efficiency. Community air service programs further stimulate aircraft deployment. Fleet renewal aligns with sustainability objectives across regional aviation. These factors collectively create long-term growth opportunities.

Growth in cargo feeder aircraft demand

Cargo networks continue expanding due to rising consumer expectations for faster delivery services. Regional distribution centers increasingly rely on turboprop feeder aircraft for time-sensitive shipments. Operational reliability makes turboprops suitable for high-frequency cargo rotations. Fleet scalability allows logistics providers to adjust capacity efficiently. Airport accessibility supports seamless cargo transfer across smaller hubs. Demand for overnight and same-day delivery sustains aircraft utilization levels. Turboprops enable flexible routing with minimal infrastructure requirements. Cargo operators prioritize aircraft with lower operating risk profiles. Continued logistics digitalization supports long-term cargo aircraft demand. These trends reinforce growth opportunities across the turboprop segment.

Future Outlook

The USA turboprop aircraft market is expected to maintain steady momentum through continued regional connectivity expansion and cargo network development. Fleet modernization initiatives will support demand stability across commercial and government segments. Technological enhancements will improve operational efficiency and environmental performance. Policy support for regional aviation is expected to strengthen long-term market fundamentals.

Major Players

- ATR

- De Havilland Canada

- Textron Aviation

- Pilatus Aircraft

- Leonardo

- Viking Air

- Beechcraft

- L3Harris Technologies

- Northrop Grumman

- Lockheed Martin

- Sierra Nevada Corporation

- MAG Aerospace

- RUAG Aerospace

- Textron Systems

- General Atomics

Key Target Audience

- Commercial airline operators

- Cargo and logistics service providers

- Regional airport authorities

- Aircraft leasing companies

- Defense and homeland security agencies

- Federal Aviation Administration

- State transportation departments

- Investment and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market scope, aircraft categories, operational roles, and application areas were identified through structured industry mapping. Data points were aligned with fleet deployment, utilization trends, and regulatory considerations.

Step 2: Market Analysis and Construction

Quantitative and qualitative indicators were assessed to construct market structure and segmentation. Demand drivers and operational constraints were evaluated through industry-level data synthesis.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert discussions with aviation operators, maintenance specialists, and regulatory professionals. Insights were refined to ensure accuracy and market relevance.

Step 4: Research Synthesis and Final Output

All data points were triangulated and consolidated into a structured analytical framework. Final outputs were reviewed for consistency, relevance, and decision-making applicability.

- Executive Summary

- Research Methodology (Market Definitions and fleet classification logic, Aircraft platform segmentation and configuration mapping, Bottom-up fleet and delivery-based market sizing, Revenue attribution across OEM and aftermarket streams, Primary interviews with operators lessors and MROs, Data triangulation using FAA fleet data and OEM disclosures, Assumptions based on utilization cycles and replacement rates)

- Definition and scope

- Market evolution

- Usage and operational role across aviation segments

- Ecosystem and value chain structure

- Supply chain and distribution channels

- Regulatory and certification environment

- Growth Drivers

Rising demand for regional connectivity and short-haul routes

Growing cargo and e-commerce driven feeder aircraft demand

Lower operating costs versus regional jets

Fleet modernization and replacement cycles

Government and defense procurement support

Increased use in remote and underserved regions - Challenges

Competition from regional jets

High acquisition and maintenance costs

Pilot availability and training constraints

Noise and emissions compliance requirements

Limited airport infrastructure in some regions

Volatility in fuel prices - Opportunities

Expansion of regional air mobility networks

Growth in cargo feeder aircraft demand

Adoption of fuel-efficient and hybrid turboprops

Military fleet modernization programs

Increased charter and utility aircraft usage

Aftermarket and MRO service expansion - Trends

Shift toward fuel-efficient turboprop models

Integration of advanced avionics and connectivity

Rising use of turboprops in cargo logistics

Fleet life extension through retrofits

Focus on sustainability and emissions reduction

Growth in public service and surveillance roles - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Commercial passenger turboprops

Cargo and freight turboprops

Military and government turboprops

Special mission and utility aircraft - By Application (in Value %)

Regional passenger transport

Cargo and logistics operations

Military transport and ISR

Aerial surveillance and special missions

Charter and private aviation - By Technology Architecture (in Value %)

Conventional turboprop

Advanced turboprop with digital avionics

Hybrid-assisted turboprop

Short takeoff and landing optimized turboprop - By End-Use Industry (in Value %)

Commercial aviation operators

Defense and homeland security

Cargo and logistics providers

Charter and business aviation operators

Government and public service agencies - By Connectivity Type (in Value %)

Analog avionics

Digitally integrated avionics

Satellite-enabled connectivity

Flight data and fleet management systems - By Region (in Value %)

Northeast

Midwest

South

West

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Fleet size, Aircraft performance range, Pricing and cost structure, Technology adoption, Aftermarket support strength, Delivery timelines, Geographic presence, Customer base diversity)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

ATR

De Havilland Canada

Textron Aviation

Pilatus Aircraft

Leonardo S.p.A.

Viking Air

Beechcraft

Lockheed Martin

Northrop Grumman

L3Harris Technologies

General Atomics Aeronautical Systems

MAG Aerospace

Textron Systems

Sierra Nevada Corporation

RUAG Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035