Market Overview

The USA Vehicle Black Box Systems Market is valued at approximately USD ~ billion in 2023, driven by a surge in demand for vehicle safety, autonomous vehicle testing, and data logging for accident reconstruction. The market is heavily influenced by increased regulatory requirements for Event Data Recorders (EDRs) and the broader adoption of telematics and fleet management solutions. The expansion of autonomous vehicles and advanced driver-assistance systems (ADAS) has also been pivotal in accelerating the growth of this market. The market’s growth is further supported by the rising demand for insurance telematics, where data from black box systems is used to assess driver behavior for insurance premium adjustments. The key drivers include vehicle safety requirements, the growth of connected car technologies, and the increasing role of black box data in accident investigation and liability determination.

The USA dominates the market for vehicle black box systems due to its robust automotive sector and high adoption of safety and connectivity technologies. Major cities such as Detroit, Los Angeles, and Chicago are hubs for automotive manufacturing, research, and development of new vehicle technologies, driving demand for black box systems. Additionally, the USA is home to many of the largest vehicle manufacturers, including General Motors, Ford, and Tesla, which contribute significantly to the adoption of these systems in both personal and commercial vehicles. Furthermore, the regulatory environment set by organizations like the National Highway Traffic Safety Administration (NHTSA), which mandates the use of EDRs in vehicles, also supports market dominance in the region.

Market Segmentation

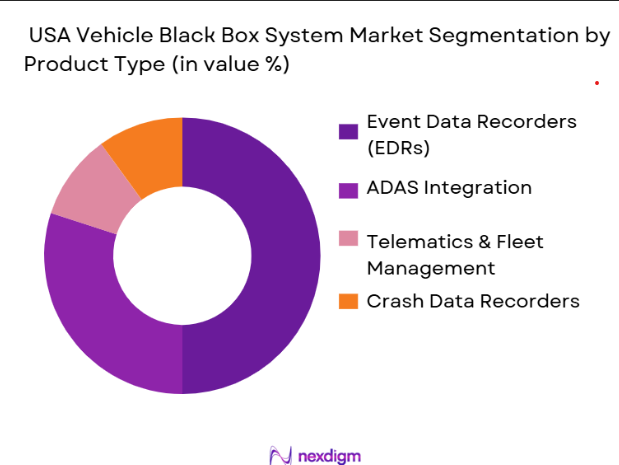

By Product Type

The USA Vehicle Black Box Systems market is segmented by product type into Event Data Recorders (EDRs), Advanced Driver Assistance Systems (ADAS) Integration, Telematics and Fleet Management Systems, and Crash Data Recorders. EDRs lead the market due to regulatory enforcement and the essential role they play in insurance and accident investigations. Their high adoption is driven by safety regulations, while ADAS integration is gaining momentum due to advancements in autonomous vehicle technology.

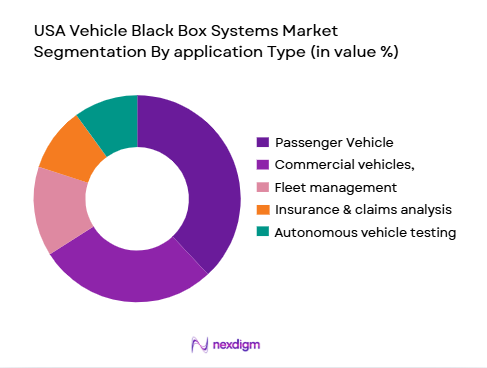

By Application

The market is segmented by application into passenger vehicles, commercial vehicles, fleet management, insurance & claims analysis, and autonomous vehicle testing.

The demand for black box systems in passenger vehicles is the highest, driven by consumer interest in safety features and insurance telematics. Regulatory pressures and safety requirements further fuel adoption. Fleet operators use black box systems to monitor vehicle performance, optimize routes, and track driver behavior. This segment is growing due to increased demand for real-time data for fleet efficiency and maintenance. Passenger vehicles dominate due to the increasing demand for safety features, with fleet management systems expanding in usage as logistics and transportation companies look to enhance operational efficiency.

Competitive Landscape

The USA Vehicle Black Box Systems market is competitive, with a few key players controlling a significant portion of the market. Major automotive OEMs such as General Motors, Ford, and Tesla are the primary drivers of demand for these systems, either through in-house development or partnerships with specialized suppliers. The market also features notable technology companies such as Verizon, Geotab, and Bosch that provide telematics and data analysis solutions integrated with black box systems. The presence of a few dominant players indicates high consolidation, with strong barriers to entry for new competitors due to the need for advanced technology and adherence to strict regulatory requirements.

| Company | Year Established | Headquarters | Core Focus | Vehicle Type | Distribution Channels | Key Technologies |

| General Motors | 1908 | USA | ~ | ~ | ~ | ~ |

| Ford Motor Company | 1903 | USA | ~ | ~ | ~ | ~ |

| Tesla | 2003 | USA | ~ | ~ | ~ | ~ |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ |

| Geotab | 2000 | Canada | ~ | ~ | ~ | ~ |

USA Air Quality Monitoring System Market Analysis

Growth Drivers

Urbanization

USA’s rapid urbanization significantly elevates the need for air quality monitoring systems as population density and pollutant sources concentrate in metropolitan centers. Indonesia’s total population of 281,190,067 highlights substantial urban growth, with megacities like Jakarta and Surabaya becoming air pollution hotspots due to vehicular emissions and construction activities. Jakarta and its surrounding metro area routinely record elevated PM2.5 levels, indicating poor air quality frequently exceeding healthy thresholds, underscoring urbanization’s role in intensifying pollution and requiring precise and expanded monitoring infrastructure to protect public health.

Industrialization

Industrial emissions are a major contributor to air pollution, especially from sectors such as manufacturing, energy production, and transportation. In 2024, Indonesia’s PM2.5 annual average concentration was 35.5 µg/m³ approximately seven times higher than the WHO guideline of 5 µg/m³reflecting substantial industrial pollutant loads in urban and peri‑urban areas. This level of particulate matter underscores the need to deploy sophisticated monitoring systems near industrial zones to consistently track pollutant concentrations and enforce emissions controls as factories, power plants, and logistics hubs expand.

Restraints

High Initial Costs

Deploying a comprehensive air quality monitoring network requires significant upfront investment in sensor hardware, calibration equipment, and data integration platforms. Advanced monitoring systems that measure multiple pollutants (PM2.5, PM10, NO2, O3, SO2) involve substantial capital outlays for high‑precision instruments and installation across dispersed urban and rural sites, posing budgetary constraints for regional governments and local agencies, particularly in provinces with limited fiscal capacity, which slows deployment pace.

Technical Challenges

Effective air quality monitoring demands high‑quality, calibrated instrumentation and robust data management infrastructure. Variability in PM2.5 measurements across different monitoring stations (ranging from under 15 µg/m³ to over 80 µg/m³ in cities such as Jakarta and Surabaya) highlights the technical complexity of capturing accurate ambient data across diverse micro‑environments, complicating efforts to standardize reporting and enforce uniform data quality standards in networks lacking advanced calibration and QA/QC processes.’

Opportunities

Technological Advancements

Emerging sensor technologies and IoT‑enabled monitoring tools provide opportunities to expand air quality networks at lower cost with robust data capture at distributed sites. Highly portable and networked air monitoring devices can collect real‑time data on PM2.5, NO2, and O3 levels, enabling municipalities to rapidly assess air quality fluctuations. These advancements support better decision‑making, empower early warnings for pollution spikes, and facilitate integration with public dashboards and mobile apps to inform residents of health risks based on precise measurements.

International Collaborations

Collaborations with international environmental bodies and development agencies can enhance monitoring capabilities. Joint efforts involving global research partners introduce advanced training programs and data infrastructure improvements that strengthen domestic capacity for sophisticated air quality assessments. Such collaborations often include technology transfer, shared analytical tools, and harmonized methodologies that enhance Indonesia’s ability to benchmark air quality against global standards and draw on best practices for deployment and interpretation of monitoring data.

Future Outlook

Over the next several years, the USA Vehicle Black Box Systems market is poised to experience significant growth. This expansion is driven by continuous advancements in autonomous vehicle technology and driver assistance systems, which integrate black box functionalities for real-time vehicle data collection. The adoption of telematics in fleet management continues to rise as companies seek to optimize routes, improve fuel efficiency, and track driver behavior. Meanwhile, the regulatory landscape, including safety mandates and data requirements, is expected to keep pushing the demand for black box systems in both passenger and commercial vehicles.

Major Players

- Ford Motor Company

- Tesla

- Bosch

- Geotab

- Continental AG

- Denso Corporation

- Delphi Technologies

- Lear Corporation

- Mobileye

- TomTom

- ZF Friedrichshafen AG

- Aptiv PLC

- Valeo

- Magna International

- General Motors

Key Target Audience

- Telematics & Fleet Management Service Providers

- Insurance Providers & Brokers

- Government and Regulatory Bodies

- Fleet Operators and Logistics Companies

- Automotive Aftermarket Suppliers

- Telecom and Data Analytics Firms

- Investments & Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

In this phase, key variables such as market growth drivers, regulatory trends, and technology adoption rates will be identified through secondary research and expert consultations.

Step 2: Market Analysis and Construction

Historical market data will be analyzed, including market penetration and regulatory requirements, to build a market model that estimates future growth and segment dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses based on historical data will be validated through interviews with industry experts and key market players, allowing for refinement of market assumptions.

Step 4: Research Synthesis and Final Output

The final output will include a comprehensive market report, including a detailed analysis of market share, trends, growth drivers, and projections.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Primary Research Methodology, Key Insights from Industry Interviews, Limitations, and Future Conclusion Points)

- Definition and Scope

- Market Genesis & Evolution Path

- Timeline of Major Players

- Business Cycle & Technology Life Cycle|

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Road Safety Concerns

Insurance Data Utilization and Telematics Integration

Regulatory Compliance & Government Mandates

Increasing Adoption of Autonomous Vehicles and ADAS - Market Challenges

Privacy and Data Security Concerns

High Initial Installation and Integration Costs

Fragmentation of Standards and Lack of Unified Regulations - Opportunities

Technological Advancements in Sensor and Storage Capabilities

Growing Trend of Connected Vehicles and IoT Integration

Expansion in Emerging Markets - Trends

Adoption of Artificial Intelligence in Data Analysis

Integration of Black Box Systems with Smart City Infrastructure

Expansion of Subscription-based Telematics Solutions for Consumers - Government Regulation

Data Protection Laws (GDPR & CCPA) and Impacts on Data Usage

Emission and Environmental Monitoring Integration - SWOT Analysis

- Porter’s Five Forces Analysis

- Market Ecosystem & Stakeholder Mapping

- Competition Ecosystem

- By Value, 2019–2025

- By Volume, 2019–2025

- By Price Per Unit, 2019–2025

- By Geographic Segment, 2019–2025

- By Product Type (In Value %)

Event Data Recorders (EDRs)

Advanced Driver Assistance Systems (ADAS) Integration

Elematics & Fleet Management Systems

Crash Data Recorders

OEM-installed vs Aftermarket Systems - By Application (In Value %)

Passenger Vehicles

Commercial Vehicles

Fleet Management

Insurance & Claims Analysis

Autonomous Vehicle Testing - By Distribution Channel (In Value %)

OEMs

Aftermarket Suppliers

Automotive Dealerships

Online Retailers - By Region (In Value %)

Northeast

Midwest

South

West - By Vehicle Type (In Value %)

Passenger Cars

Light Trucks & SUVs

Heavy-Duty Trucks & Buses

- Cross Comparison Parameters (Product Range, R&D, Distribution, Customer Base, Cost Efficiency, Partnerships)

- SWOT Analysis of Leading Market Players

- Pricing Analysis by Segment & Region

- Detailed Profiles of Major Companies

Bosch

Continental AG

Verizon

Geotab

Ford Motor Company

General Motors

Daimler AG

Delphi Technologies

Lear Corporation

Magneti Marelli

Aptiv PLC

Mobileye

TomTom

BlackVue

Lytx

- Market Demand and Utilization Trends

- Purchasing Power & Budget Allocation in Vehicle Fleet Management

- Adoption of Black Box Systems in the Automotive Sector

- Regulatory Compliance & Safety Standards for End Users Decision-Making Process

- By Value 2026-2030

- By Volume 2026-2030

- By Average Price Per Unit 2026-2030