Market Overview

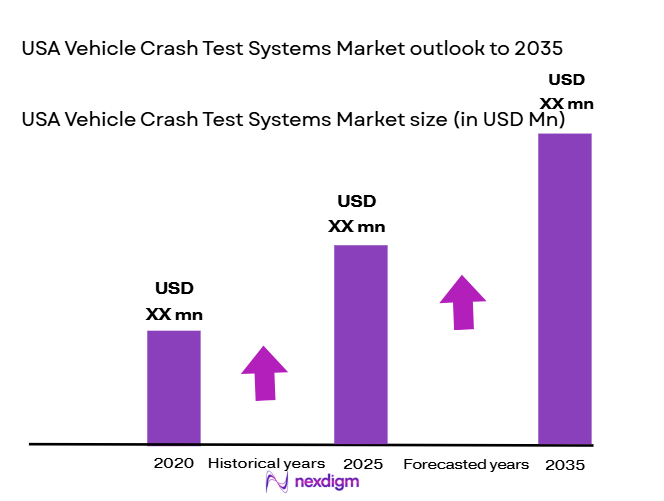

The USA vehicle crash test systems market is valued at approximately USD ~ billion in 2024. This market is driven by a combination of stringent government regulations, increasing safety concerns, and advancements in automotive technologies. The implementation of new safety standards by government agencies such as NHTSA (National Highway Traffic Safety Administration) and the demand for enhanced crash safety features are the primary factors fueling this growth. The market has seen steady investments in crash testing infrastructure, including the development of state-of-the-art test facilities, making it an attractive market for both global and domestic players.

The USA dominates the vehicle crash test systems market primarily due to its stringent regulatory environment and significant presence of automotive giants like General Motors, Ford, and Tesla. These companies have a long-standing commitment to meeting safety standards, driving demand for advanced crash testing solutions. Key cities like Detroit, Michigan, and other areas housing major automotive manufacturers and R&D centers are the epicenters of vehicle safety testing. The collaboration between automakers and regulatory bodies in these regions ensures continuous advancements in safety protocols and crash test systems.

Market Segmentation

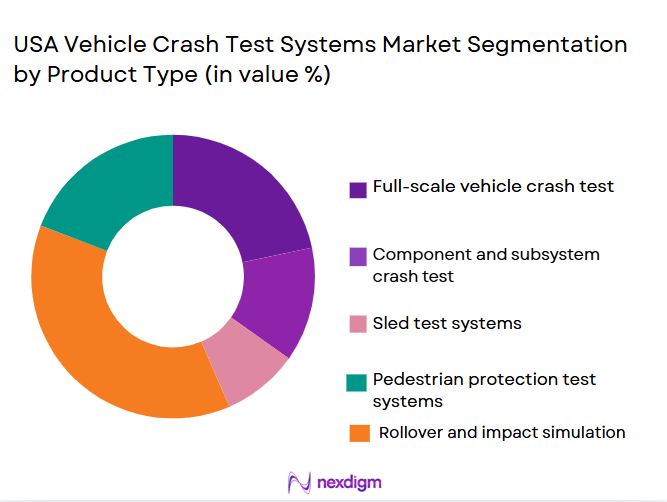

By Product Type

The USA vehicle crash test systems market is segmented by product type into crash test dummies, crash test vehicles, and crash test equipment and tools. Among these, crash test dummies hold the dominant market share in 2024, as they are essential for simulating human responses during collisions. Their importance is underscored by advancements in human body modeling and the increasing demand for precise and repeatable test results. Companies such as Humanetics and TRC (Transportation Research Center) have been investing heavily in creating more sophisticated crash test dummies equipped with sensors to provide detailed data for both frontal and side-impact tests. The integration of AI and machine learning in these systems further boosts the demand for more advanced dummies, driving their dominance in the market.

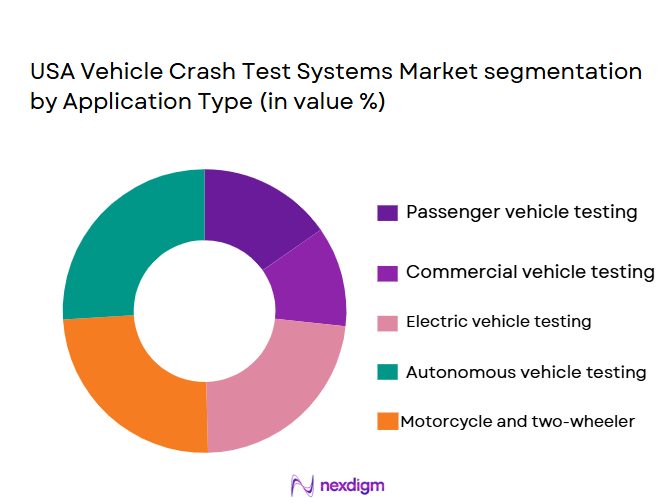

By Application

The vehicle crash test systems market is also segmented by application into automotive safety testing, crashworthiness testing, and pedestrian protection testing. Among these, automotive safety testing is the largest segment in 2024. This is due to increasing government regulations mandating crash tests for various safety standards, such as the NCAP (New Car Assessment Program) ratings. The rise in consumer awareness regarding vehicle safety has led automakers to prioritize safety performance, making automotive safety testing the dominant application segment. Furthermore, with advancements in autonomous vehicles and the need for new safety standards, automotive safety testing is expected to continue its dominance.

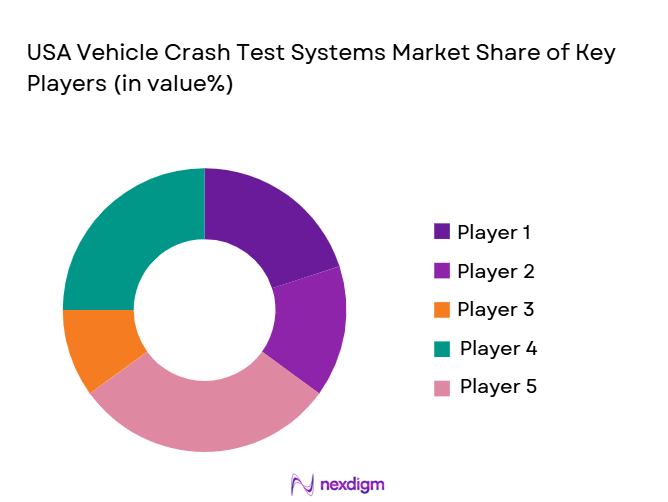

Competitive Landscape

The USA vehicle crash test systems market is highly competitive, with a few prominent players holding a significant market share. Leading players in the market include Humanetics, TRC (Transportation Research Center), DEKRA, Applus+ IDIADA, and ARA (Applied Research Associates). These companies dominate due to their extensive experience, advanced testing facilities, and strong relationships with automotive manufacturers and regulatory agencies.

| Company Name | Establishment Year | Headquarters | Product Focus | Key Partnerships | Market Reach | Revenue (2024) |

| Humanetics | 1980 | Farmington Hills, MI | ~ | ~ | ~ | ~ |

| TRC | 1964 | East Liberty, OH | ~ | ~ | ~ | ~ |

| DEKRA | 1925 | Stuttgart, Germany | ~ | ~ | ~ | ~ |

| Applus+ IDIADA | 1995 | Barcelona, Spain | ~ | ~ | ~ | ~ |

| ARA | 1979 | Albuquerque, NM | ~ | ~ | ~ | ~ |

USA Vehicle Crash Test Systems Market Dynamics & Trends

Growth Drivers

Regulatory Stringency & Five‑Star NCAP Push

The increasing regulatory pressure on automotive safety and the emphasis on achieving five-star ratings in crash tests are significant growth drivers for the vehicle crash test systems market. In the United States, the National Highway Traffic Safety Administration (NHTSA) has made substantial strides in tightening vehicle safety standards. In 2024, NHTSA is focusing on adopting stricter protocols for crashworthiness assessments, pushing manufacturers to meet high crash test performance standards. The U.S. government’s continuous revisions of safety regulations in line with global standards have intensified, enhancing the demand for advanced crash testing. For instance, NHTSA mandates that vehicles be subject to frontal, side, and rollover crash tests, with the aim to enhance overall safety ratings. This intensifying regulatory framework, paired with the desire to earn five-star ratings, is accelerating the growth of the crash test systems market, requiring manufacturers to adopt more accurate testing methods and systems to comply with these evolving safety standards.

EV & AV Structural Testing Complexity

The growth of Electric Vehicles (EVs) and Autonomous Vehicles (AVs) is driving the need for more complex and varied vehicle crash testing. The structural testing of EVs, for example, includes testing for battery pack integrity and protection during collisions. In 2024, EV sales in the U.S. are expected to surpass ~units. This increased production and adoption of EVs necessitate rigorous testing of their structural integrity, particularly in terms of battery safety and crash performance. Meanwhile, the complexity of AV testing goes beyond human-centric crash testing by also evaluating software, sensor systems, and the interaction of the vehicle with its environment. The U.S. Department of Transportation (DOT) has recognized the need for updated crash test protocols to cater to these new vehicle types, further fueling demand for sophisticated crash test systems. The advancement of EV and AV technologies will push manufacturers to enhance crash test equipment and simulation models to assess their performance accurately.

Market Challenges

Cost of High‑Fidelity Crash Dummies & Test Rigs

The high cost associated with crash dummies and test rigs is a significant restraint for the vehicle crash test systems market. In 2024, a single high-fidelity crash test dummy, like the THOR-06, can cost up to $~, while the associated test rigs and facilities can exceed millions of dollars. The U.S. automotive industry is grappling with these expenses as it strives to meet stricter testing standards. Moreover, the maintenance and calibration of these testing systems add an additional layer of financial burden. With the increasing demand for more complex crash testing scenarios (including for EVs and AVs), the costs are expected to rise, making it challenging for some manufacturers, especially smaller ones, to keep up with the necessary investment. This high-cost barrier slows the overall market’s growth.

Legacy Equipment Retrofit Challenges

Upgrading legacy crash testing equipment to meet modern standards is another challenge faced by manufacturers in the U.S. The push towards more detailed and specific crash test results, especially for EVs and AVs, requires that older testing systems be retrofitted or replaced with newer, more accurate technologies. This process can be both expensive and time-consuming. The U.S. automotive industry is faced with the dilemma of balancing between the cost of upgrading existing equipment and the need to comply with stricter crash test regulations. Retrofitting legacy systems to handle complex crash scenarios, including those related to electric powertrains and advanced driver-assistance systems (ADAS), remains a significant financial and logistical burden for many companies, potentially delaying new product releases and raising operational costs.

Market Opportunities

AI‑Driven Crash Analytics & Predictive Simulation

The integration of artificial intelligence (AI) in crash testing and vehicle safety analysis is creating a robust growth opportunity for the market. AI-driven predictive simulation models are capable of forecasting vehicle crash behaviors under various conditions, significantly improving the accuracy of crash test predictions. As of 2024, the use of AI in crash simulations is growing rapidly, with advancements in machine learning algorithms enabling more efficient data processing and test predictions. The U.S. government has acknowledged AI’s potential in improving safety through the use of predictive models that assess crash outcomes before actual tests are conducted. The incorporation of AI-powered systems in vehicle testing procedures will help manufacturers and regulators alike improve safety standards more quickly and cost-effectively, leading to faster vehicle development cycles and better safety outcomes.

Gender & Anthropometric Diversity in Dummy Models

The growing focus on gender and anthropometric diversity in crash testing is opening new opportunities in the vehicle crash test systems market. Traditionally, crash test dummies were modeled primarily on male anthropometrics, but there is increasing demand for the inclusion of gender-specific dummies, like the THOR-05F, a female-specific dummy model that has been adopted in several advanced crash testing programs. The U.S. Department of Transportation has recognized the need for more diverse crash test models to ensure that vehicles are safe for all passengers, regardless of gender or body size. This shift towards gender-inclusive testing and the adoption of new, more representative dummies will create a demand for specialized testing equipment and infrastructure, positioning the market for future growth.

Future Outlook

Over the next six years, the USA vehicle crash test systems market is expected to grow significantly, driven by increased demand for vehicle safety and stricter government regulations. The market will also benefit from technological advancements in crash test dummies and testing equipment, alongside the rising need for crashworthiness testing in emerging vehicle categories, such as electric vehicles and autonomous vehicles. Continuous efforts to improve pedestrian safety and enhance occupant protection systems will further drive innovation in the crash testing sector.

Major Players in the Market

- Humanetics

- TRC (Transportation Research Center)

- DEKRA

- Applus+ IDIADA

- ARA (Applied Research Associates)

- Autoliv

- Bosch

- Toyota Engineering Society

- Volvo Cars

- Hyundai Motor Company

- BMW Group

- General Motors

- Ford Motor Company

- Magna International

- Tesla

Key Target Audience

- Automotive Manufacturers

- Vehicle Safety Testing Laboratories

- Automotive Tier 1 Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (NHTSA, EPA)

- OEMs (Original Equipment Manufacturers)

- Technology Providers for Crash Test Systems

- Automotive R&D and Innovation Departments

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves gathering extensive data from secondary research sources such as government reports, industry publications, and proprietary databases to identify the key variables impacting the vehicle crash test systems market. This step aims to map the ecosystem of stakeholders and understand the dynamics of the market.

Step 2: Market Analysis and Construction

In this phase, historical data and current trends related to market size, demand, and key technologies are analyzed. We assess factors like regulatory standards and industry spending on safety technologies. This phase ensures a comprehensive understanding of the market structure.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews with industry specialists from automotive manufacturers, safety testing labs, and regulatory bodies are conducted to validate hypotheses and ensure accuracy. These consultations provide insights into the practical challenges and opportunities within the market.

Step 4: Research Synthesis and Final Output

The final output integrates all the insights gathered through data analysis and expert consultations. This phase also includes validating findings with key players to ensure the completeness and reliability of the market report.

- Executive Summary

- USA Vehicle Crash Test Systems Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Stringent vehicle safety regulations and compliance requirements

Rising adoption of advanced driver assistance systems and EVs

Increased investment in automotive safety R&D - Market Challenges

High capital and maintenance costs of crash test facilities

Long testing cycles and complex certification procedures

Limited availability of skilled technical personnel - Market Opportunities

Growing demand for autonomous vehicle safety validation

Expansion of virtual and hybrid crash testing solutions

Upgrades of legacy test facilities to support new vehicle architectures - Trends

Integration of digital sensors and high-speed data acquisition

Shift toward combined physical and simulation-based testing

Increased focus on pedestrian and vulnerable road user safety - Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value 2019–2024

- By Installed Units 2019–2024

- By Average System Price 2019–2024

- By System Complexity Tier 2019–2024

- By System Type (In Value%)

Full-scale vehicle crash test systems

Component and subsystem crash test rigs

Sled test systems

Pedestrian protection test systems

Rollover and impact simulation systems - By Platform Type (In Value%)

Passenger vehicle testing platforms

Commercial vehicle testing platforms

Electric vehicle testing platforms

Autonomous vehicle testing platforms

Motorcycle and two-wheeler testing platforms - By Fitment Type (In Value%)

Fixed indoor crash laboratories

Outdoor crash test tracks

Modular and reconfigurable test setups

Mobile and transportable test systems

Integrated multi-test facility installations - By EndUser Segment (In Value%)

Automotive OEMs

Tier I and Tier II automotive suppliers

Government safety and regulatory agencies

Independent testing and certification labs

Automotive research institutions - By Procurement Channel (In Value%)

Direct manufacturer procurement

Engineering, procurement, and construction contracts

Government and regulatory tenders

Long-term service and upgrade agreements

Research grant and funded project procurement

- Market Share Analysis

- Cross Comparison Parameters

[Test accuracy, System scalability, Technology integration, Service capability, Cost of ownership] - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

HORIBA

MTS Systems

Humanetics Innovative Solutions

Kistler Group

Siemens

Dassault Systèmes

AVL

Anthony Best Dynamics

MESSRING

Dekra

Applus+ IDIADA

TÜV SÜD

TÜV Rheinland

Element Materials Technology

Hitachi Automotive Systems

- OEMs emphasize compliance with evolving federal safety standards

- Suppliers focus on component-level validation and cost efficiency

- Testing labs prioritize accuracy, repeatability, and throughput

- Regulatory bodies demand standardized and transparent testing protocols

- Forecast Market Value 2025–2030

- Forecast Installed Units 2025–2030

- Price Forecast by System Tier 2025–2030

- Future Demand by Platform 2025–2030