Market Overview

The USA vehicle cybersecurity hardware market is sized at USD ~ million in 2024, reflecting the U.S. portion of North America’s automotive cybersecurity hardware revenues. Demand is pushed by the shift toward connected vehicle stacks where HSMs, secure MCUs, encryption chips, and gateway/IDS hardware become “always-on” safety enablers rather than optional security add-ons. The same source base also shows cybersecurity hardware pull is tightly coupled with connected-vehicle deployments and ADAS integration (with connected vehicles and ADAS called out as major value pools).

The market is dominated by U.S. automotive and mobility ecosystems concentrated in Detroit/Michigan (OEM & Tier-1 engineering + validation), California (SDV/AV compute and security engineering talent), Texas (semiconductor and embedded systems footprint), Arizona (electronics manufacturing and silicon supply chain), and major fleet/logistics corridors (large-scale telematics and OTA operational needs). These locations dominate because cybersecurity hardware decisions are made where E/E architectures, domain controllers, telematics stacks, and high-volume fleet operations are designed, validated, and scaled—rather than where vehicles are merely sold.

Market Segmentation

By Hardware Component Type

The market is segmented by hardware component type into hardware security modules (HSM), secure microcontrollers, encryption/decryption chips, network security controllers, and firewalls/intrusion detection units. HSM is the dominant sub-segment, accounting for ~% of the automotive cybersecurity hardware market in the latest measured year, because it anchors root-of-trust, protects cryptographic keys, and provides deterministic cryptographic performance required across domain/zonal controllers, TCUs, and gateways—the exact nodes that concentrate risk in SDV architectures.

As OEMs consolidate ECUs, the “security perimeter” moves into fewer high-criticality controllers, raising HSM attach rates per controller and increasing the need for certified secure storage and secure execution paths.

By Vehicle Type

The market is segmented into passenger vehicles and commercial vehicles (with commercial further operationally spanning light/heavy and specialty fleets). Passenger vehicles dominate with ~% share, driven by faster adoption of connected infotainment/telematics, digital cockpits, ADAS, and platform-wide OTA strategies—each of which increases cryptographic workloads and gateway security requirements.

Passenger platforms also see higher trim-level feature packaging, which accelerates secure ECU proliferation at scale. Meanwhile, commercial vehicles adopt steadily as fleet operators harden telematics and operational data paths, but their platform cycles and retrofit economics can be slower.

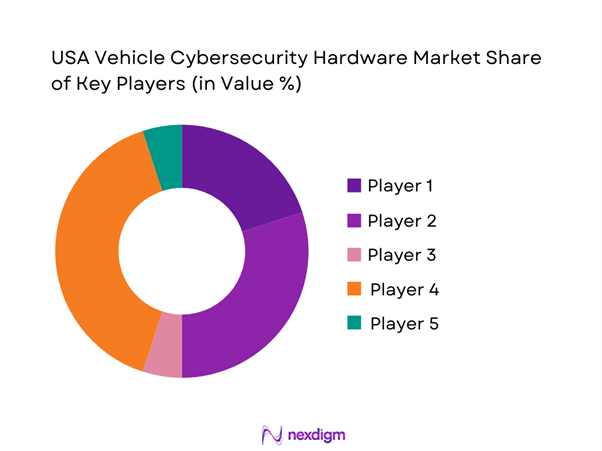

Competitive Landscape

The USA vehicle cybersecurity hardware market is led by a mix of automotive-grade semiconductor leaders and Tier-1 ECU/gateway suppliers that can deliver security at silicon, module, and in-vehicle network layers. The most defensible positions come from vendors that combine automotive-grade secure silicon, reference designs for gateways/TCUs/zonal controllers, and compliance evidence aligned to ISO/SAE ~ and UN R~ expectations.

| Company | Est. Year | HQ | Hardware cybersecurity focus | Automotive-grade security building blocks | Typical vehicle domains | Compliance readiness signals | U.S. footprint relevance | Go-to-market motion |

| NXP Semiconductors | 2006 | Eindhoven, NL | ~ | ~ | ~ | ~ | ~ | ~ |

| Infineon Technologies | 1999 | Neubiberg, DE | ~ | ~ | ~ | ~ | ~ | ~ |

| STMicroelectronics | 1987 | Geneva, CH | ~ | ~ | ~ | ~ | ~ | ~ |

| Renesas Electronics | 2010 | Tokyo, JP | ~ | ~ | ~ | ~ | ~ | ~ |

| Microchip Technology | 1989 | Chandler, USA | ~ | ~ | ~ | ~ | ~ | ~ |

USA Vehicle Cybersecurity Hardware Market Dynamics and Performance Analysis

Growth Drivers

Regulatory and compliance pull

U.S. vehicle cybersecurity hardware demand is being pulled by a compliance stack that is increasingly “hardware-aware” (secure boot roots, HSM/TPM-class anchors, cryptographic accelerators, secure key storage, and authenticated diagnostics gateways). On-road usage intensity matters because the attack surface scales with exposure: monthly U.S. Vehicle Miles Traveled was ~ million miles (Oct), reinforcing why regulators prioritize resilient in-vehicle controls for safety-critical functions over long operating lifetimes. In parallel, the macro capacity to fund compliance and enforcement is supported by U.S. GDP of USD ~ trillion and GDP per capita of USD ~, which sustains public-sector program spend and OEM compliance budgets across software-defined platforms that increasingly require hardware-based trust anchors.

Finally, federal reporting and oversight mechanisms for advanced automation create continuous pressure for provable integrity across ADAS/ADS stacks: the Third Amended Standing General Order takes effect ~ and sustains a multi-year reporting obligation framework that elevates expectations around event integrity, tamper resistance, and traceable incident data pipelines—requirements that typically land on secure ECUs, in-vehicle networks, and hardware-backed logging.

Software-defined vehicle and OTA deployment scale-up

Software-defined vehicle roadmaps increase the value of hardware security because OTA turns every vehicle into a long-lived endpoint requiring authenticated updates, rollback protection, and key custody across multiple ECUs. The U.S. new-vehicle throughput that must be provisioned with hardware roots of trust is large: “Total Vehicle Sales” shows annual sums of ~, ~, and ~, indicating a large installed base intake that OEMs must seed with secure elements/HSMs for lifecycle updateability. Safety governance reinforces OTA hardening because recall execution is increasingly software-mediated: vehicle safety recalls in a single year underscore the operational reality that large recall volumes incentivize remote remediation—where hardware security (signing, verification, secure download channels, and anti-tamper storage) becomes non-negotiable to prevent malicious “update-as-attack.” The macro environment supports this SDV transition: a population of ~ people and a USD-scale economy sustain high vehicle utilization and a large service ecosystem (dealers, fleets, telematics providers) that expands the number of diagnostic sessions, certificates, and keys handled per vehicle—pushing OEMs toward hardware-backed key storage and secure gateways rather than software-only controls.

Challenges

Cost and latency trade-offs in hardware security

In-vehicle cybersecurity hardware faces a persistent engineering trade-off: stronger cryptography, secure enclaves, and deep packet inspection can add latency, silicon area, and power draw—especially across high-bandwidth in-vehicle Ethernet and centralized compute. In V2X contexts, field deployments highlight why latency is a practical constraint: connected vehicle pilots report real-world RF interference and data-exchange degradation events, which means hardware security must be efficient enough to avoid compounding throughput limitations under stressed RF conditions. At the same time, the scale of U.S. vehicle utilization—~ million miles traveled in a single month—raises the operational penalty of small latency and reliability degradations when multiplied across millions of endpoint-hours. Macroeconomic strength (GDP USD ~ trillion) supports adoption, but it also raises expectations: U.S. fleets and consumers demand seamless performance, pushing suppliers to deliver hardware security that meets deterministic real-time requirements rather than “best effort” software controls. The net effect is a design challenge for OEMs and silicon suppliers: achieve cryptographic strength, tamper resistance, and secure key operations without introducing perceptible delays in safety messaging, OTA apply cycles, diagnostic sessions, or gateway forwarding—especially in centralized architectures where a single security bottleneck can affect multiple domains.

Certification and validation burden

Certification and validation are a structural bottleneck because automotive-grade cybersecurity hardware must prove behavior across temperature, EMC, safety, and long lifecycle constraints—then integrate into vehicle cybersecurity process governance. “Cybersecurity Best Practices for the Safety of Modern Vehicles” explicitly references alignment with modern standards and enumerated recommendations, which strengthens expectations around secure development, risk management, and system-level validation—driving additional qualification workload for hardware-backed trust anchors and secure gateways. V2X adds another layer: connected vehicle pilots cite device certification requirements as a learning and schedule factor, reflecting real-world friction where test procedures and equipment stabilization consume time before suppliers can scale deployments. The U.S. macro environment supports large-scale compliance programs (GDP per capita USD ~), but the operational impact is still real—engineering teams must allocate significant time to documentation, audit trails, cryptographic module validation, and interoperability proofs. This burden directly affects hardware cybersecurity roadmaps because security modules cannot be swapped “late” without requalification, so OEMs and Tier-1s must lock security silicon earlier, validate longer, and carry more program risk when architectures shift toward centralized compute.

Opportunities

Post-quantum-ready automotive security silicon

A high-value opportunity is “PQ-ready” automotive security silicon—hardware that can support crypto agility (ability to swap algorithms), larger key sizes, and accelerated validation without forcing complete ECU redesign. The U.S. market context is favorable because it combines high vehicle utilization (~ million miles traveled in one month) with increasingly connected V2X/ADAS stacks that depend on long-lived cryptographic trust; once cryptography is deployed in vehicles, it must remain secure for many years, which elevates the value of silicon that can adapt to evolving cryptographic requirements through hardware-assisted flexibility. U.S. industrial capacity-building also supports this direction: advanced packaging awards of USD ~ billion help enable domestic production pathways for more sophisticated security devices (multi-die secure modules, tamper-resistant packaging, and high-reliability integration), which can shorten supply risk and support automotive qualification for next-generation security silicon. Deployment evidence from V2X pilots—~ RSUs licensed and thousands of equipped vehicles—shows the U.S. is already operating at a scale where credentialing and cryptographic operations are central to safety applications, making the transition path to crypto-agile hardware commercially relevant even without “future stats.” Macro strength (GDP USD ~ trillion) further supports OEM willingness to invest in hardware refreshes where PQ-readiness can be bundled with SDV controller upgrades.

Secure in-vehicle Ethernet backbones

As vehicles shift to Ethernet-rich backbones, a major opportunity is hardware that secures high-throughput in-vehicle data paths (secure gateways, MACsec-capable PHY/MAC solutions, line-rate encryption/authentication accelerators, hardware-based intrusion detection taps, and timing-safe key distribution). Connected vehicle pilots show why network robustness matters under real-world interference and operational constraints: deployments encountered RF interference events and throughput degradation in backhaul and data exchange during acceptance testing, reinforcing that the end-to-end system must be resilient and performant—security features cannot “break the network” under stress. In the U.S., high driving activity (~ million miles in a month) multiplies the value of resilient, secure communications because reliability issues scale into safety and uptime consequences for fleets, transit assets, and city deployments. The economic base supports adoption: GDP per capita of USD ~ signals a market that can absorb higher electronic content and centralized compute architectures, which typically increase Ethernet adoption and elevate the attach rate for secure gateways and hardware accelerators.

Future Outlook

Over the next five years, the U.S. market will be shaped by three forces: centralized E/E architectures (domain/zonal), security expectations embedded into product lifecycle engineering via ISO/SAE 21434, and policy-driven supply-chain risk reduction in connected-vehicle ICTS. As gateways consolidate traffic (CAN/Ethernet) and SDV platforms increase OTA cadence, hardware that provides deterministic crypto performance, tamper resistance, and secure provisioning will be pulled earlier into platform definition—shifting competition toward vendors with stronger reference architectures, validation tooling, and long-term support guarantees.

Major Players

- NXP Semiconductors

- Infineon Technologies

- STMicroelectronics

- Renesas Electronics

- Microchip Technology

- Texas Instruments

- Qualcomm

- Robert Bosch

- Continental

- Aptiv

- Denso

- Harman

- ZF Friedrichshafen

- Valeo

Key Target Audience

- OEM cybersecurity & E/E architecture leadership

- Tier-1 ECU and gateway platform procurement heads

- Fleet telematics and safety technology heads

- Automotive semiconductor sourcing & category managers

- Mobility/robotaxi platform operators and security leads

- Investments and venture capitalist firms

- Government and regulatory bodies

- Auto insurers’ vehicle risk & safety technology leadership

Research Methodology

Step 1: Identification of Key Variables

We map the U.S. ecosystem across OEMs, Tier-1s, and semiconductor suppliers, defining variables such as secure silicon attach-rate, gateway penetration, OTA intensity, crypto workload per domain controller, and qualification lead times. This is built using structured desk research plus an engineering-led taxonomy aligned to automotive cybersecurity standards.

Step 2: Market Analysis and Construction

We construct the market bottom-up by translating platform architectures into cybersecurity hardware BOM (secure MCU/HSM/crypto IC/gateway IDS units) and multiplying by production/fitment volumes, then validate with top-down checks using published market totals and segment anchors.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses via CATIs with OEM E/E architects, Tier-1 gateway/TCU product owners, and semiconductor field application engineers to confirm real attach rates, qualification gating factors, ASP ranges, and design-win concentration patterns.

Step 4: Research Synthesis and Final Output

We synthesize inputs into an integrated model covering segment splits, buyer decision flows, and competitive benchmarking. Findings are cross-validated against published standards and U.S. regulatory guidance shaping cybersecurity expectations.

- Executive Summary

- Research Methodology (market definitions & scope boundary, hardware-only inclusion/exclusion rules, terminology (HSM/SE/TPM/TEE), assumption book, data triangulation, bottom-up build (BOM-to-vehicle) + top-down sanity checks, primary interview framework (OEM/Tier-1/semiconductor/channel), pricing normalization (ASP/wafer-to-device), supply-constrained adjustments, limitation log)

- Definition and Scope

- Market Genesis and Evolution

- Architecture Shift Timeline

- Cyber-Physical Risk Context

- Value Chain Map

- Growth Drivers

Regulatory and compliance pull

Software-defined vehicle and OTA deployment scale-up

V2X infrastructure rollout

Zonal and centralized E/E architecture adoption

Secure automotive supply-chain mandates - Challenges

Cost and latency trade-offs in hardware security

Certification and validation burden

Hardware lead-time and capacity constraints

Multi-ECU interoperability complexity

Key lifecycle and update management complexity - Opportunities

Post-quantum-ready automotive security silicon

Secure in-vehicle Ethernet backbones

Fleet cybersecurity retrofit demand

Hardware-accelerated intrusion detection

Zero-trust vehicle network architectures - Trends

HSM integration into zonal controllers

Hardware-assisted anomaly detection

Secure gateway consolidation

Software bill of materials linked to device identity

Silicon-to-cloud key orchestration - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Unit Shipments, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

Specialty and Off-Highway Vehicles - By Application (in Value %)

Central Gateway Security

Telematics Control Unit Security

ADAS and Autonomous Compute Security

Infotainment and Digital Cockpit Security

Powertrain and EV System Security - By Technology Architecture (in Value %)

Hardware Security Modules

Secure Microcontrollers

Encryption and Decryption Accelerators

Network Security Controllers

Firewall and Intrusion Detection Hardware - By Connectivity Type (in Value %)

Connected Vehicles

Semi-Autonomous Vehicles

Highly Automated Vehicles

Limited or Non-Connected Vehicles - By End-Use Industry (in Value %)

OEM Manufacturing Programs

Tier-1 ECU and Gateway Suppliers

Fleet and Logistics Operators

Public Transit and Municipal Fleets

Defense and Government Mobility Programs - By Region (in Value %)

Automotive Manufacturing Clusters

Autonomous Vehicle and Mobility Corridors

Semiconductor and Electronics Hubs

Fleet-Dense Logistics Regions

- Market concentration and positioning

- Cross Comparison Parameters (HSM and secure element portfolio breadth, automotive-grade qualification depth, secure boot and root-of-trust implementation, key provisioning model, secure gateway throughput and Ethernet readiness, OTA security acceleration capabilities, vulnerability response cadence and long-term support, U.S. supply-chain footprint and sourcing resilience)

- Strategic partnerships and alliances

- SWOT Analysis

- Pricing and commercial models

- Porter’s Five Forces

- Competitive risk and moat assessment

- Company Profiles

NXP Semiconductors

Infineon Technologies

STMicroelectronics

Renesas Electronics

Microchip Technology

Texas Instruments

Qualcomm

Robert Bosch

Continental

Aptiv

Denso

Harman (Samsung)

ZF Friedrichshafen

Valeo

- OEM platform decision workflow

- Tier-1 integration strategies

- Fleet and mobility operator requirements

- Buyer pain-point assessment

- By Value, 2025–2030

- By Unit Shipments, 2025–2030

- By Average Selling Price, 2025–2030