Market Overview

The USA Vehicle Cybersecurity market, valued at USD ~ billion, is driven by the increasing need to secure connected and autonomous vehicles. As vehicle systems become more integrated with digital technologies, the demand for robust cybersecurity solutions grows. This surge is primarily fueled by the rising threat of cyberattacks on vehicle systems, coupled with the rapid adoption of connected and autonomous vehicle technologies. In 2024, the market is expected to reach USD ~ billion, reflecting strong growth driven by regulatory pressures, advancements in vehicle technologies, and increasing incidents of cyber threats targeting automotive systems.

The USA leads the vehicle cybersecurity market due to its strong automotive industry presence, home to major players like General Motors, Ford, and Tesla. Cities such as Detroit, known as the “Motor City,” are at the heart of automotive innovation and cybersecurity development. Furthermore, California is a key region due to its dominance in electric vehicle (EV) production and autonomous vehicle testing. Additionally, states with major tech hubs like Silicon Valley contribute to the increasing integration of cybersecurity in next-generation vehicles, making the USA a global leader in this market.

Market Segmentation

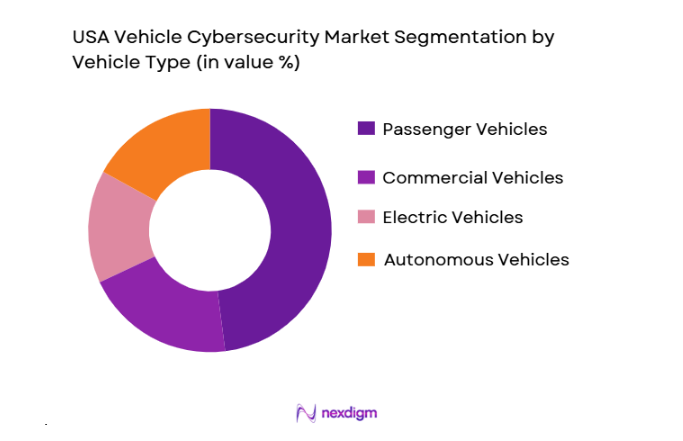

By Vehicle Type

The USA Vehicle Cybersecurity market is segmented by vehicle type into passenger vehicles, commercial vehicles, electric vehicles (EVs), and autonomous vehicles. Among these segments, passenger vehicles currently dominate the market share. This is primarily driven by the growing adoption of connected vehicle systems that require robust security solutions to prevent unauthorized access and protect driver data. Automakers in the passenger vehicle segment are focusing on integrating cybersecurity measures like secure communication protocols and intrusion detection systems. The increasing incidence of cyber threats on infotainment systems and telematics further accelerates the demand for enhanced cybersecurity measures in this segment.

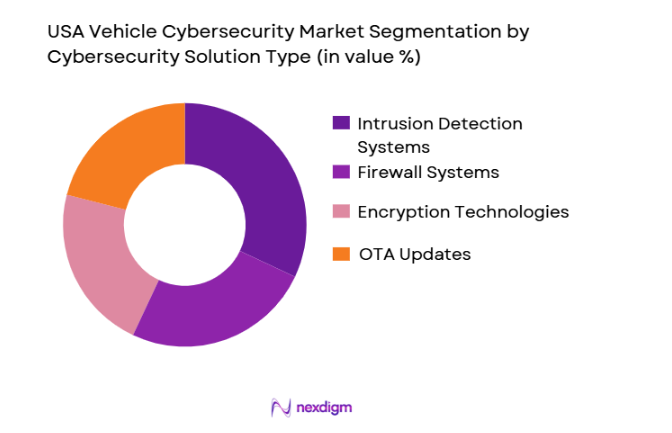

By Cybersecurity Solution Type

The market is also segmented by cybersecurity solution type into intrusion detection systems (IDS), firewall systems, encryption technologies, and over-the-air (OTA) updates. Among these, intrusion detection systems (IDS) dominate the market due to their critical role in identifying and preventing unauthorized access to a vehicle’s network. With the growing complexity of in-vehicle networks and the increasing number of cyberattacks, IDS provides real-time monitoring, detection, and protection of connected systems. This technology is vital for both OEMs and aftermarket suppliers, who are heavily investing in IDS solutions to secure their vehicle networks and customer data.

Competitive Landscape

The USA Vehicle Cybersecurity market is highly competitive, dominated by both traditional automotive companies and cybersecurity specialists. Companies like Tesla and General Motors lead in integrating cybersecurity measures into their vehicles, while cybersecurity firms such as Blackberry QNX and NXP Semiconductors focus on providing solutions. This competitive landscape highlights the growing trend of partnerships between automotive OEMs and cybersecurity providers to enhance vehicle security against evolving cyber threats.

| Company | Establishment Year | Headquarters | Cybersecurity Solutions | Vehicle Types | R&D Investment | Strategic Partnerships | Market Focus |

| Tesla | 2003 | Palo Alto, CA | ~ | ~ | ~ | ~ | ~ |

| General Motors | 1908 | Detroit, MI | ~ | ~ | ~ | ~ | ~ |

| Blackberry QNX | 1985 | Waterloo, ON | ~ | ~ | ~ | ~ | ~ |

| NXP Semiconductors | 1953 | Eindhoven, NL | ~ | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Hannover, DE | ~ | ~ | ~ | ~ | ~ |

USA Vehicle Cybersecurity Market Analysis

Growth Drivers

Urbanization

The rapid urbanization across the United States continues to be a major driver for the growth of vehicle cybersecurity. In, approximately ~% of the U.S. population lived in urban areas, with this number projected to increase as urban centers expand (World Bank, 2023). As more people rely on personal and shared transportation in urban areas, the vulnerability of vehicles to cyberattacks increases, thus creating a strong need for robust cybersecurity solutions to protect connected and autonomous vehicles. The growing interconnectivity between vehicles, city infrastructure, and public networks exacerbates this risk, thereby fueling demand for secure vehicle systems. The U.S. urban population increase will contribute directly to the growing demand for vehicle cybersecurity solutions.

Industrialization

The U.S. industrial sector plays a critical role in driving the adoption of vehicle cybersecurity measures. In 2025, the manufacturing sector contributed over USD ~ trillion to the U.S. economy, with a significant portion directed towards the automotive and technology industries. The proliferation of advanced manufacturing techniques such as automation and AI in the automotive industry introduces new vulnerabilities that need to be mitigated. With vehicles becoming increasingly integrated with manufacturing systems, industrial sectors are heavily investing in cybersecurity solutions to secure both in-vehicle and manufacturing data, making cybersecurity a vital area for innovation and investment.

Restraints

High Initial Costs

The high initial costs of implementing vehicle cybersecurity solutions remain one of the biggest challenges for automakers. In 2025, the average cost of integrating cybersecurity technologies into a new vehicle was estimated to be over USD ~ per unit. While this cost is expected to decrease with the advancement of technology and economies of scale, it remains a barrier for widespread adoption, especially for smaller automakers and fleet operators. The need for continuous updates and maintenance of cybersecurity systems further contributes to the cost burden, slowing the pace of mass adoption in the automotive market.

Technical Challenges

One of the significant technical challenges faced by the vehicle cybersecurity market is the integration of diverse vehicle systems. Modern vehicles now include a multitude of interconnected systems, from infotainment units to advanced driver-assistance systems (ADAS), each with different security requirements. As of 2025, the U.S. automotive sector faced challenges in standardizing cybersecurity protocols across these systems, leading to potential vulnerabilities. For instance, securing the communication between autonomous vehicle systems and external networks requires highly specialized encryption methods, which continue to evolve. This technical complexity slows down the deployment of comprehensive security solutions.

Opportunities

Technological Advancements

Ongoing advancements in technology present significant opportunities for the growth of vehicle cybersecurity. In 2023, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into vehicle systems became more prominent, enabling real-time threat detection and automated response mechanisms. These technologies help identify new attack vectors and enhance the vehicle’s ability to prevent cyberattacks autonomously. The continued evolution of AI and ML technologies is expected to enhance vehicle cybersecurity, making it more proactive and effective in defending against sophisticated cyber threats.

International Collaborations

The global nature of the automotive industry provides ample opportunities for international collaborations to enhance vehicle cybersecurity standards. The U.S. has already engaged in partnerships with European and Asian automotive manufacturers to develop common cybersecurity protocols and standards. In 2025, the U.S. government participated in joint cybersecurity efforts with European counterparts, focusing on securing vehicle-to-vehicle communication and autonomous driving systems These collaborations are critical for creating unified cybersecurity frameworks and fostering innovations that benefit the global automotive industry.

Future Outlook

Over the next 5-6 years, the USA Vehicle Cybersecurity market is expected to grow rapidly. The growth will be driven by the increasing complexity of vehicle technologies, rising incidences of cyberattacks, and stricter regulatory standards. With advancements in autonomous driving and connected vehicle systems, the market will witness enhanced demand for advanced cybersecurity solutions. Regulatory bodies are also expected to impose stricter mandates for vehicle cybersecurity, propelling investment in secure technology and increasing the integration of secure communication protocols, IDS, and OTA updates in vehicles.

Major Players

- Tesla

- General Motors

- Ford Motor Company

- NXP Semiconductors

- Continental AG

- Blackberry QNX

- Aptiv

- Harman International

- Bosch

- Qualcomm

- Intel Corporation

- Check Point Software Technologies

- Cisco Systems

- Uber Technologies

- Denso Corporation

Key Target Audience

- Automobile Manufacturers (OEMs)

- Cybersecurity Providers

- Government and Regulatory Bodies (NHTSA, FCC)

- Automotive Suppliers and Tier-1 Suppliers

- Investments and Venture Capitalist Firms

- Technology Developers and Innovators

- Fleet Operators and Transportation Services

- Telematics & Infotainment System Providers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying all relevant variables impacting the USA Vehicle Cybersecurity market. Through desk research and secondary data analysis, we map out key drivers, challenges, and trends influencing the cybersecurity needs of vehicles. We also conduct expert interviews to gain a clear understanding of critical market factors.

Step 2: Market Analysis and Construction

We analyze historical data, penetration rates of cybersecurity solutions, and assess market performance in terms of revenue generation. Additionally, we examine consumer trends, technological advancements, and regulatory policies that shape the demand for vehicle cybersecurity.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by conducting interviews with industry experts, including representatives from OEMs, cybersecurity solution providers, and government agencies. These consultations refine the data and provide valuable insights into the operational realities of the market.

Step 4: Research Synthesis and Final Output

We consolidate data from secondary research, expert consultations, and market analysis to deliver a comprehensive report. This synthesis ensures the accuracy and reliability of the final output, providing a detailed market outlook for the USA Vehicle Cybersecurity market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, USA-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across OEMs, Cybersecurity Providers, Government Agencies, and Industry Experts, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution Pathway

- USA Vehicle Cybersecurity Industry Timeline

- Vehicle Cybersecurity Business Cycle

- Vehicle Cybersecurity Supply Chain & Value Chain Analysis

- Market Trends Shaping the Vehicle Cybersecurity Landscape

- Regulatory Landscape Impacting Vehicle Cybersecurity Systems

- Key Growth Drivers

Increasing Threat Landscape and Cyberattacks on Vehicles

Rise of Autonomous and Connected Vehicles

Government Mandates and Regulatory Compliance for Cybersecurity

Technological Advancements in Vehicle Security Solutions

- Market Opportunities

Growing Demand for Secure Over-the-Air Updates

Increased Investment in Autonomous Vehicle Security

Strategic Partnerships with OEMs for Enhanced Cybersecurity Integration

- Key Trends

Shift Towards Secure and Encrypted In-Vehicle Networks

Growing Use of AI and Machine Learning for Threat Detection

Rising Investments in Vehicle Cybersecurity by OEMs

Convergence of Automotive and Cybersecurity Sectors

- Regulatory & Policy Landscape

US Federal Regulations on Vehicle Cybersecurity NHTSA, NIST Guidelines

State-Specific Cybersecurity Policies for Vehicles

Global Cybersecurity Standards Impacting US Manufacturers

- SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Vehicle Type Adoption, 2019-2025

- By Cybersecurity System Type, 2019-2025

- By Region, 2019-2025

- By Vehicle Type (In Value %)

Passenger Vehicles

Commercial Vehicles

Electric Vehicles (EVs)

Autonomous Vehicles

Heavy-Duty Vehicles - By Cybersecurity Solution Type (In Value %)

Intrusion Detection Systems (IDS)

Firewall Systems

Encryption Technologies

Secure Communication Protocols

Over-the-Air (OTA) Update Solutions - By Deployment Type (In Value %)

On-Premise Solutions

Cloud-Based Solutions

Hybrid Solutions - By Application (In Value %)

Vehicle-to-Vehicle (V2V) Security

Vehicle-to-Everything (V2X) Security

Infotainment & Telematics Systems Security

ADAS (Advanced Driver Assistance Systems) Security - By Region (In Value %)

West Coast

East Coast

Midwest

Southern USA

- Market Share Analysis (Value & Volume Contribution)

By Vehicle Type

By Cybersecurity Solution Type

- Cross Comparison Parameters (Product Portfolio Breadth, Cybersecurity Efficiency, Regulatory Approvals, Distribution Footprint, Manufacturing & Localization Capabilities, R&D Investment & Technological Advancements, Strategic Partnerships & Collaborations)

- SWOT Analysis of Key Players

- Pricing Analysis

Pricing Trends for Different Cybersecurity Solutions

Comparison of Prices Across OEMs and Tier-1 Suppliers

- Detailed Company Profiles

Tesla Inc.

Ford Motor Company

General Motors

Bosch

Aptiv

Continental AG

Harman International

NXP Semiconductors

Qualcomm Technologies, Inc.

Intel Corporation

Blackberry QNX

Uber Technologies, Inc.

Check Point Software Technologies

Carmignac

Guardtime

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles for Cybersecurity Solutions

- Compliance & Certification Expectations

- Consumer Needs, Desires & Pain-Point Mapping

- Decision-Making Framework for OEMs & Suppliers

Cost vs. Security Prioritization

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Selling Price, 2026-2030

- USA Vehicle Cybersecurity Market Outlook 2030