Market Overview

The USA Vehicle Infotainment Chips market is valued at USD ~ billion. It is a critical sub-segment of automotive electronics semiconductors — aligns with the broader automotive infotainment systems and automotive semiconductor markets, which are experiencing rapid expansion. The global automotive infotainment market was valued at approximately USD ~ billion, with infotainment systems increasingly embedded across vehicle segments due to demand for connectivity, multimedia, and navigation features. Concurrently, the broader automotive semiconductor market valued at USD ~ billion in ~ in total semiconductors with North America contributing roughly USD ~ billion, indicating robust regional demand that directly drives infotainment chip uptake. Infotainment chips, including system-on-chip solutions, are essential to these systems and benefit from rising vehicle production, connected car features, and digital cockpit adoption.

In the USA infotainment chip ecosystem, Silicon Valley California anchors innovation and design, with heavyweights like Qualcomm, NVIDIA, and other semiconductor designers headquartered in the region, driving chipset development and automotive partnerships. Detroit and the broader Great Lakes auto manufacturing belt remain dominant due to proximity to OEMs General Motors, Ford, Stellantis and Tier-1 integrators, fostering faster design-wins and supply alignment. Austin Texas also plays a strategic role given its growing semiconductor footprint and automotive R&D clusters. These hubs combine advanced semiconductor design expertise with automotive manufacturing collaborations, accelerating infotainment chip deployment.

Market Segmentation

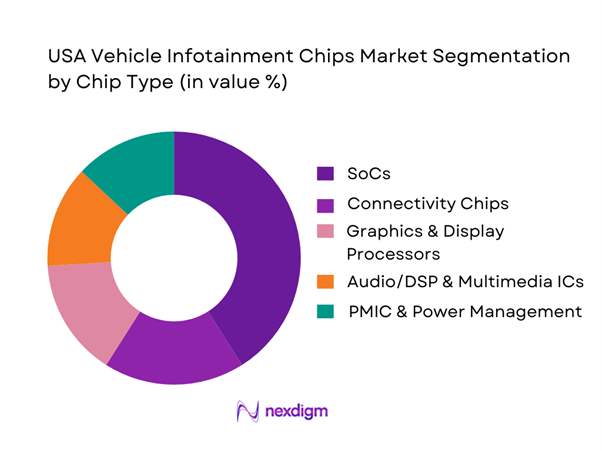

By Chip Type

The USA vehicle infotainment chip market is segmented by chip type into SoCs, connectivity chips, graphics display processors, audio DSP ICs, and power management ICs. SoCs dominate due to their integration of compute, multimedia, and connectivity functions critical for modern infotainment platforms. OEMs increasingly adopt high-performance SoCs that can efficiently handle multi-display rendering, navigation, voice control, and application environments like Android Automotive OS, consolidating multiple discrete chips into a single high-value package. The dominance of SoCs is reinforced by strong investment from major semiconductor players and their strategic partnerships with automotive OEMs and Tier-1s in North America. Connectivity chips follow, driven by growing demand for Bluetooth, Wi-Fi, and cellular features in infotainment stacks. Graphics display processors are key for high-resolution panels and multiple screen environments in premium vehicles, while audio DSP and PMIC segments cater to specialized multimedia features and power efficiency needs.

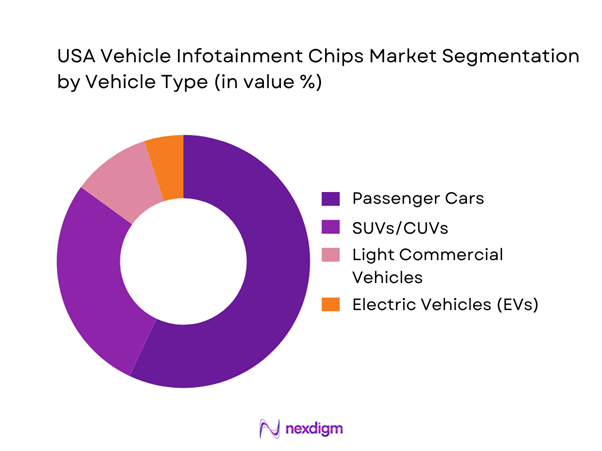

By Vehicle Type

The segmentation of infotainment chips by vehicle type shows passenger cars leading due to sheer production volume and infotainment feature penetration across entry to premium models. SUVs and crossovers follow, reflecting strong consumer demand for connected features and larger cabin spaces that host advanced infotainment systems. Light commercial vehicles adopt infotainment at a lower rate but are growing as fleet management and telematics converge. Electric vehicles EVs, while smaller in volume, command higher infotainment chip content per vehicle given advanced digital cockpits and integrated user interfaces, positioning them as a high-value growth niche. The higher infotainment content in EVs elevates silicon demand despite lower unit counts relative to passenger cars.

Competitive Landscape

The USA Vehicle Infotainment Chips Market features intense competition among major semiconductor suppliers specializing in automotive-grade silicon and integrated chip solutions. U.S. tech leaders like Qualcomm and NVIDIA leverage their SoC expertise for infotainment and adjacent automotive systems, while traditional automotive semiconductor players compete on reliability and qualification credentials. This consolidation highlights influential chipset providers shaping automotive infotainment capabilities globally and within the USA.

| Company | Est. Year | Headquarters | Infotainment Product Focus | Automotive Qualification | Regional Footprint | Partnerships with OEMs | Tech Differentiators |

| Qualcomm | 1985 | USA | ~ | ~ | ~ | ~ | ~ |

| NVIDIA | 1993 | USA | ~ | ~ | ~ | ~ | ~ |

| Texas Instruments | 1930 | USA | ~ | ~ | ~ | ~ | ~ |

| NXP Semiconductors | 2006 | Netherlands/USA | ~ | ~ | ~ | ~ | ~ |

| Renesas Electronics | 2010 | Japan | ~ | ~ | ~ | ~ | ~ |

| Infineon Technologies | 1999 | Germany | ~ | ~ | ~ | ~ | ~ |

| Broadcom | 2005 | USA | ~ | ~ | ~ | ~ | ~ |

| STMicroelectronics | 1987 | Switzerland | ~ | ~ | ~ | ~ | ` |

| AMD | 1969 | USA | ~ | ~ | ~ | ~ | ~ |

| MediaTek | 1997 | Taiwan/USA offices | ~ | ~ | ~ | ~ | ~ |

USA Vehicle Infotainment Chips Market Analysis

Growth Drivers

Multi-display cockpit adoption

U.S. infotainment SoC demand rises with cockpit screen count moving from single-center stacks to multi-display layouts cluster plus center plus passenger, plus rear entertainment in some trims. This is happening alongside sustained U.S. vehicle delivery volumes, which keep the base of new HMI-equipped vehicles large: total vehicle sales ran at ~ SAAR in the first month of the year and reached ~ SAAR in the last month of the year, indicating steady OEM build cadence that pulls more display pipelines, touch controllers, and cockpit compute per unit. With U.S. GDP at USD ~ trillion and GDP per capita at USD ~, buyers continue to pay for higher-trim UX packages where multi-display cockpits are most common, raising silicon attach rate per vehicle.

Richer HMI and UI compute requirements

As cockpits add high-resolution graphics, animated instrument clusters, and multi-app layouts, OEMs need higher GPU throughput, faster memory bandwidth, and more deterministic boot suspend behavior—pushing them from head unit processors to automotive-grade infotainment cockpit SoCs with stronger safety partitioning and longer supply commitments. This shift is reinforced by the scale of U.S. connectivity infrastructure that enables heavier UI workloads maps, streaming, OTA UI updates: the FCC reports ~ fixed connections in service, with ~ at downstream speeds between ~ and ~ Mbps and ~ at downstream speeds at above ~ Mbps—conditions that make richer in-vehicle UI experiences more usable and therefore more demanded. U.S. macro capacity also supports OEM software roadmaps; GDP growth is listed at ~ in the latest snapshot, which is consistent with continued consumer and fleet replacement cycles that keep new cockpit-compute platforms flowing into the parc.

Challenges

Supply allocation volatility

Infotainment chips face allocation swings because automotive competes with consumer electronics and data-center demand for leading nodes, while auto programs need stable supply for years. The U.S. is actively addressing this with CHIPS-scale interventions, but the transition period still creates volatility: the U.S. Department of Commerce proposed up to USD ~ billion for Intel under CHIPS preliminary terms, and announced up to USD ~ billion for TSMC Arizona—large actions that underscore how strategic and stressed supply has become. Even with these actions, OEM build rates remain high enough that small supply interruptions ripple quickly: total vehicle sales moved from ~ SAAR in one mid-year month to ~ SAAR in the final month of the year, meaning millions of units’ worth of electronic BOMs depend on just-in-time component flow. World Bank macro indicators GDP USD ~ trillion reflect an economy with sustained consumption, which can keep demand pressure high across electronics categories that share upstream wafer capacity.

Long qualification lead times

Automotive infotainment chips must clear long OEM Tier-1 validation cycles functional safety expectations for mixed-criticality partitions, thermal soak, EMC EMI compliance, software stack stability, and PPAP-style production readiness. That long lead time collides with fast-moving compute roadmaps. The U.S. market scale makes this painful because platform decisions lock across large volumes: vehicle sales readings such as ~ SAAR spring month and ~ SAAR late-year month indicate big production programs where a late silicon change can cascade into widespread launch risk. Meanwhile, the connectivity environment FCC reporting ~ fixed connections raises consumer expectation for always-up services, which pressures OEMs to ship faster software iterations—but qualification gates still constrain how quickly hardware can change underneath. On the macro side, GDP per capita at USD ~ is consistent with a market that penalizes poor UX and glitches, forcing more validation and longer sign-off cycles for infotainment compute platforms.

Opportunities

Cockpit-as-a-platform monetization

Infotainment chips are becoming platform anchors: secure compute plus graphics plus AI plus networking that can host revenue-generating features after sale feature unlocks, premium navigation layers, media bundles, in-car apps, and insurance usage-linked services. The opportunity is strongest where connectivity and consumer digital behavior are already mature. FCC data reports ~ fixed connections, including ~ at above ~ Mbps—an environment where consumers expect high-performing digital services that can translate into in-vehicle recurring services when UX is strong. Continued U.S. vehicle throughput e.g., ~ SAAR in a spring month and ~ SAAR in the year’s final month means the platform install base expands consistently, which is essential for at-scale monetization models tied to infotainment compute. With GDP per capita at USD ~, the addressable audience for paid digital convenience is broad, enabling OEMs and ecosystem partners to justify higher-performance infotainment silicon to protect UI smoothness and security both directly linked to subscription conversion and retention.

Multi-OS virtualization

Multi-OS cockpit consolidation—running cluster plus infotainment plus ancillary apps on fewer ECUs using virtualization—reduces wiring complexity and improves feature reuse, but it raises the bar for compute isolation, determinism, and security. This creates a clear pull for higher-end infotainment cockpit chips with hardware-assisted virtualization support and stronger safety partitioning. The U.S. environment supports this shift because OEMs can justify consolidation when connectivity-driven experience loads are high: FCC reports ~ fixed connections in the ~ to ~ Mbps tier and ~ at above ~ Mbps, reinforcing demand for simultaneous, bandwidth-heavy use cases nav plus streaming plus calls plus assistant that benefit from consolidated compute scheduling. The opportunity is amplified by industrial policy and capacity build-out that reduces long-term platform risk: the Department of Commerce described support for TSMC Arizona with up to USD ~ billion in direct funding and a planned investment described as more than USD ~ billion, strengthening confidence that advanced-node compute needed for virtualization-heavy cockpits can be sourced for automotive programs. GDP USD ~ trillion sustains premium vehicle mix where consolidation architectures are adopted first.

Future Outlook

The USA Vehicle Infotainment Chips Market is poised for strong expansion, driven by continuous consumer demand for connected and personalized in-vehicle experiences, integration of advanced features such as voice-controlled interfaces, high-resolution displays, and AI-enhanced navigation systems. Growth in electric and software-defined vehicles will further elevate the complexity and silicon content in infotainment domains. OEMs’ commitment to over-the-air updates and deep smartphone integration reinforces long-term demand for robust chips. Advancements in connectivity and cloud-linked services will support richer infotainment experiences and sustained chip growth into the next decade.

Major Players in the Market

- Qualcomm

- NVIDIA

- Texas Instruments

- NXP Semiconductors

- Renesas Electronics

- Infineon Technologies

- Broadcom

- STMicroelectronics

- AMD

- MediaTek

- Samsung Semiconductor

- Microchip Technology

- On Semiconductor

- Analog Devices

Key Target Audience

- Automotive OEMs Original Equipment Manufacturers

- Tier-1 Automotive Suppliers Infotainment Modules

- Semiconductor Manufacturers and Chip Designers

- Automotive Electronics Integrators

- Auto OEM R&D Innovation Labs

- Investment and Venture Capitalist Firms Automotive Tech and Semiconductor

- Automotive Standards and Regulatory Bodies

- Hardware and Software Platform Providers for Connected Vehicles

Research Methodology

Step 1: Identification of Key Variables

The research initiated with a comprehensive ecosystem mapping of infotainment chip value chain components — detailing OEM platforms, Tier-1 integrations, and semiconductor supplier roles within the USA market. Secondary sources, trade data, and proprietary databases were used to define critical variables that influence market size and demand.

Step 2: Market Analysis and Construction

Historical data on automotive infotainment system deployments, semiconductor content per vehicle, and automotive production figures were compiled and analyzed. Commercial databases and industry reports were used to ensure accurate revenue estimation and trend validation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses and growth assumptions were validated through interviews with industry stakeholders such as automotive electronics engineers, silicon vendors, and Tier-1 procurement leads. These consultations provided operational insights and helped refine forecast models.

Step 4: Research Synthesis and Final Output

The final phase involved cross-verification of bottom-up build-ups with vendor revenue disclosures and OEM platform roadmaps. This ensured robust validation and helped align forecast outcomes with actual industry directional trends.

- Executive Summary

- Research Methodology (Market definitions and scope boundary, chip taxonomy mapping, platform inclusion and exclusion logic, primary interview universe design, OEM and Tier-1 validation loops, top-to-bottom sizing model, bottom-to-top BOM and design-win build-up, data triangulation and reconciliation, ASP normalization rules, scenario framework, data integrity checks, limitations and assumptions)

- Definition and Scope

- Market Genesis: Evolution from Head Unit SoCs to Cockpit Domain Compute

- Infotainment Compute Evolution Timeline

- Demand Cycle Mapping

- Supply Chain and Value Chain Analysis

- Growth Drivers

Multi-display cockpit adoption

Richer HMI and UI compute requirements

Voice assistants and AI-based features

Connectivity-led in-vehicle experiences

Subscription-based infotainment services - Challenges

Supply allocation volatility

Long qualification lead times

Thermal and EMI constraints

Software fragmentation

Vehicle lifecycle versus silicon cadence mismatch - Opportunities

Cockpit-as-a-platform monetization

Multi-OS virtualization

AI cockpit copilots

Centralized compute reuse across trims

Aftermarket infotainment modernization - Trends

GPU and AI acceleration in cockpit SoCs

Higher-resolution and multi-display pipelines

In-cabin camera and sensor integration

Secure enclave and hardware security module adoption

OTA and software update hardening - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Chip Content per Vehicle, 2019–2024

- By Technology Architecture (in Value %)

Infotainment and cockpit application SoCs

Connectivity chips

Memory and storage

Audio DSP and amplifier companion ICs

PMICs and power management ICs - By Fleet Type (in Value %)

Passenger cars

SUVs and CUVs

Pickup trucks

Light commercial vehicles

Fleet-oriented trims - By Application (in Value %)

Head unit-centric systems

Integrated cockpit systems

Cockpit domain controllers

Zonal and E/E consolidated cockpit compute

Aftermarket and retrofit infotainment platforms - By Connectivity Type (in Value %)

Android Automotive OS–based stacks

QNX-based IVI stacks

Automotive Linux stacks

Proprietary OEM stacks

Hybrid virtualization stacks - By End-Use Industry (in Value %)

Advanced-node process technology

Mature-node process technology

Advanced packaging and substrates

Automotive-grade memory integration

Thermal design strategies - By Region (in Value %)

OEM-nominated silicon sourcing

Tier-1 sourced silicon

Module and compute card procurement

Authorized distribution channels

Gray market exposure pockets

- Market Share Analysis by Value and Volume

Market Share Analysis by Architecture and Vehicle Class - Cross Comparison Parameters (process node and compute class, GPU and AI capability, multi-display support, safety enablement level, cybersecurity hardware features, memory and storage interfaces, software ecosystem depth, supply assurance strategy)

- Strategic Benchmarking

Partnership and Ecosystem Analysis

Recent Developments Tracker - Detailed Profiles of Major Companies

Qualcomm

NVIDIA

NXP Semiconductors

Renesas Electronics

Texas Instruments

Intel

AMD

Samsung Semiconductor

MediaTek

Broadcom

Infineon Technologies

STMicroelectronics

Microchip Technology

ON Semiconductor

Marvell Technology

- Passenger Vehicle OEMs

- Electric Vehicle (EV) Manufacturers

- Tier-1 Automotive Infotainment System Integrators

- Fleet and Commercial Vehicle Operators

- Aftermarket Infotainment System Manufacturers

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030

- By Chip Content per Vehicle, 2025–2030