Market Overview

The USA automotive lighting market is valued at USD ~ billion, reflecting OEM fitment demand for LED headlamps, rear combination lamps, DRLs, and the fast-rising electronics content inside each lamp (LED drivers, thermal control, ECUs, LIN/CAN nodes). The market is projected to reach USD ~ billion, implying a ~ CAGR over the period. The demand is reinforced by the steady shift to advanced headlighting; U.S. rules have explicitly enabled Adaptive Driving Beam (ADB) headlamps, expanding the electronics BOM per vehicle.

Within the USA value chain, Michigan/Ohio/Indiana and the broader Midwest concentrate lighting engineering, validation, and OEM purchasing centers, aligning with Detroit-area program management and platform decisions. On the supply side, high-volume lamp production and sub-assembly are strongly linked to Mexico and Canada via USMCA corridors (molded optics, housings, wiring, and final assembly), while critical electronics—LED packages, driver ICs, sensors, microcontrollers—remain anchored in Japan, Germany, South Korea, Taiwan, and China due to deep semiconductor/LED ecosystems and automotive-grade qualification scale.

Market Segmentation

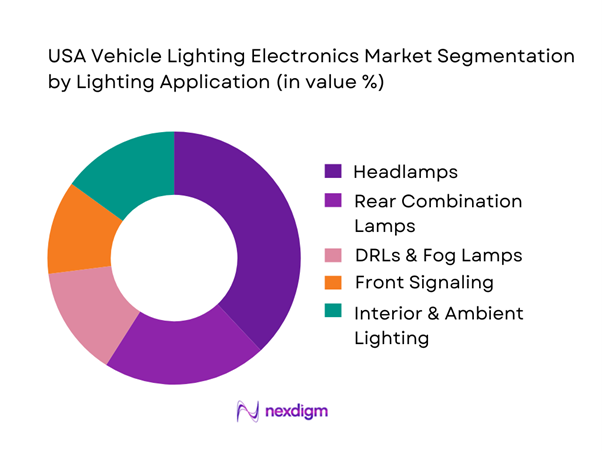

By Lighting Application

The USA Vehicle Lighting Electronics Market is segmented by lighting application into headlamps, rear combination lamps, front signaling (turn/marker), DRLs/fog lamps, and interior & ambient lighting. In ~, headlamps dominate because they carry the highest electronics intensity: multi-channel LED drivers, AFS/ADB control logic, thermal sensing, motor/actuator drivers (leveling and beam shaping), and tighter EMC/functional safety requirements than other lamp groups. The shift from halogen to LED is already largely an OEM default in many trims, but the electronics lift comes from matrix-capable architectures, glare-free high-beam strategies, and software-defined lighting signatures (brand “light identity”)—all of which increase controller complexity and validation hours. Regulatory enablement of ADB in the U.S. increases the probability of adoption over platform refresh cycles, accelerating ECU and sensor integration in the headlamp domain.

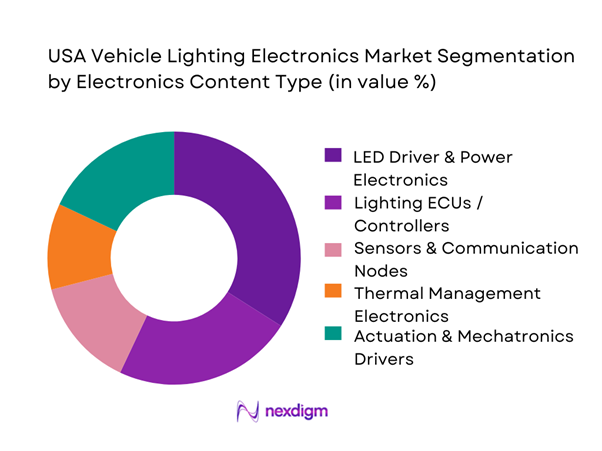

By Electronics Content Type

The market is segmented by electronics content type into LED driver & power electronics, lighting ECUs/controllers (AFS/ADB/light domain controllers), sensors & communication nodes (camera/radar interface signals, LIN/CAN transceivers), thermal management electronics (NTCs, control loops, fan/heat-pipe control), and actuation & mechatronics drivers (leveling motors, shutters, steering modules). In ~, LED driver & power electronics dominate because every LED-based exterior lamp requires stable current regulation, diagnostics, protection, and EMI mitigation—and modern designs increasingly move from simple linear drivers to multi-channel switching architectures to improve efficiency and thermal headroom. This becomes decisive in SUVs, pickups, and EVs where DRL signatures, wide light guides, and pixel/matrix arrays raise channel count and switching complexity. In addition, the push toward platform commonization (shared power stages across multiple lamp variants) increases standardized driver module volumes. While ADB/AFS ECUs grow fastest due to rule enablement and premiumization, the breadth of LED driver deployment across every lamp position keeps it the largest electronics revenue pool.

Competitive Landscape

The USA vehicle lighting electronics market is led by a small set of global Tier-1 lighting integrators with deep OE programs, optics + electronics co-design, and validated supply chains for automotive-grade semiconductors. These players compete on electronics-enabled lighting performance (beam pattern control, glare management, diagnostics), industrialization scale (molding/metalization/assembly), and software toolchains for signature lighting and functional safety.

| Company | Est. Year | HQ | USA Engineering Footprint | Core Electronics Strength | ADB/AFS Capability Depth | Semiconductor Partnerships | Typical OEM Customer Motion | Aftermarket/Service Strategy |

| FORVIA HELLA | 1899 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Marelli | 2019 | Japan/Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Koito | 1915 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Stanley Electric | 1920 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

USA Vehicle Lighting Electronics Market Analysis

Growth Drivers

LED penetration across vehicle platforms

U.S. lighting-electronics demand is scaling with the sheer installed base of new vehicles that are now shipped with LED exterior lighting as a default architecture (requiring LED drivers, diagnostics, thermal monitoring, and vehicle-network nodes). In the latest federal transport series, new vehicle sales were ~ units and ~ units in the two most recent reported periods, keeping OEM lamp programs at high volume and sustaining multi-year sourcing cycles for LED power electronics and controllers. At the macro level, the U.S. economy recorded GDP of USD ~ trillion and GDP per capita of USD ~, supporting continued new-vehicle purchasing capacity and feature-uptrim demand that typically raises lighting-electronics content per vehicle. In parallel, U.S. road usage remains structurally high: the federal safety statistics note vehicle miles traveled increased by ~ miles (to ~ vehicle-miles) in the latest period, which directly links to replacement cycles for exterior lamps, DRLs, and signaling modules (vibration, heat-soak, and moisture ingress exposures drive electronics replacement and warranty scrutiny).

Adaptive driving beam enablement

ADB enablement is a structural catalyst because it converts headlamps from “static photometry” products into sensor- and software-governed electronic systems (multi-channel LED drivers, control ECUs, diagnostics, and precise aiming/leveling actuation). The U.S. regulator issued a final rule amending FMVSS No. 108 to permit certification of ADB headlamps, creating a legally viable pathway for OEM rollout programs without relying on legacy beam switching. The same FMVSS framework is actively refined through petitions and rulemaking actions that reference explicit photometric constraints such as ~ lux and ~ lux maxima in specified intervals, illustrating the compliance-driven electronics sophistication required for glare management and forward visibility. Macro conditions matter because they shape OEM capital allocation and product cadence: the U.S. recorded inflation of ~ and unemployment of ~ in the latest period, enabling a more stable planning environment for electronics-heavy feature deployment versus periods of severe demand shocks. Together, regulatory permission and detailed photometry limits push OEMs toward robust algorithms, higher compute, and validated sensor fusion—raising lighting-electronics content per headlamp program even before broad fleet penetration is complete.

Challenges

FMVSS compliance complexity

FMVSS No. 108 compliance is a major engineering and program-management burden because it translates directly into photometry, aiming, markings, and performance requirements that suppliers must validate across manufacturing variation, vehicle ride height, and thermal drift. The regulation explicitly governs lamps and associated equipment and includes definitional and performance constructs for advanced systems like ADB, which raises the compliance bar from “bulb meets spec” to “software-controlled beam distribution meets spec.” Recent regulatory activity shows how granular the compliance debate is, referencing constraints like ~ lux and ~ lux maxima in defined conditions and intervals—values that force precise calibration, sensor robustness, and repeatable lab-to-road correlation. This complexity sits inside a large-scale production context: new vehicle sales and leases reached ~ units in the latest reported period, meaning a small compliance issue can quickly propagate across high-volume programs and force redesigns and re-validation.

Thermal and electromagnetic interference constraints

Lighting electronics face harsh constraints: high-lumen LEDs generate localized heat, while switching drivers and multi-channel control create EMI risk that can interfere with vehicle networks and safety systems. The operational exposure is measurable: the latest safety brief links the period to ~ vehicle-miles traveled, with ~ miles of incremental usage versus the prior period—more runtime amplifies thermal cycling and the probability of electronics drift or connector degradation. Reliability issues can become safety issues, and they are visible in the compliance ecosystem: regulatory filings document noncompliance cases such as headlamps missing required optical reference markings, with recall populations including ~ vehicles for one model configuration and ~ vehicles for another—small numbers, but illustrative of how “minor” marking or build issues still trigger FMVSS No. 108 exposure and remediation work. Macro indicators reinforce high utilization: GDP per capita of USD ~ is consistent with high vehicle ownership and usage levels that keep thermal and EMI robustness a continuous engineering requirement rather than an edge case.

Opportunities

ADB rollout programs

ADB rollout programs represent a forward-growth opportunity because they upgrade headlamps from basic electronics to high-content, software-controlled subsystems without requiring forward-looking projections to justify the trajectory. The U.S. already has the enabling regulatory foundation, making large-scale OEM program planning feasible within the FMVSS framework. The operational need is also visible in current safety conditions: ~ fatalities were estimated in the latest period, with ~ vehicle-miles traveled, keeping visibility, glare management, and night-driving safety on the policy and consumer agenda—exactly where ADB provides tangible benefits. Volume scalability exists today: new vehicle sales reached ~ units and new vehicle sales and leases totaled ~ units, giving OEMs enough scale to amortize ADB electronics and validation investments across multiple platforms and trims.

Pixel-level lighting personalization

Pixel-level personalization (addressable LED arrays, dynamic animations, region-selective dimming, and software-updatable signatures) is an opportunity because it expands lighting from a hardware-only domain into a feature platform—creating recurring electronics demand through higher channel counts, stronger drivers, controllers, memory, and secure communications. The compliance and engineering baseline is already moving toward pixel-capable systems because ADB concepts require dynamic beam modification, and the regulatory framework establishes the dynamic control direction for U.S. headlighting. Consumer-market scale supports SKU proliferation: net migration of ~ and GDP of USD ~ sustain a large addressable base where OEMs can monetize distinctive lighting identities across multiple brands and trims. Road usage is also structurally high at ~ vehicle-miles, increasing exposure to night driving and adverse conditions where adaptive and pixel control is a visible feature differentiator.

Future Outlook

Over the next five years, the USA vehicle lighting electronics market is expected to expand steadily as OEMs increase LED penetration in value trims, roll out ADB-capable platforms, and invest in software-defined lighting signatures that differentiate brands at night. Electronics content per vehicle rises as headlamps shift toward multi-channel architectures, integrated diagnostics, and communication with vehicle domain controllers. U.S. regulatory acceptance of ADB lowers adoption friction for glare-free high-beam systems and encourages broader deployment across premium and upper-mid segments.

Major Players

- FORVIA HELLA

- Valeo

- Marelli

- Koito Manufacturing

- Stanley Electric

- ZKW Group

- ams OSRAM

- Lumileds

- Nichia

- Seoul Semiconductor

- Texas Instruments

- NXP Semiconductors

- Infineon Technologies

- STMicroelectronics

Key Target Audience

- Automotive OEM Product Planning & Electrical/Electronics Architecture Teams

- Tier-1 Lighting System Suppliers & Module Integrators

- Automotive Semiconductor & LED Package Manufacturers

- Aftermarket Lighting Brands and National Parts Distribution Networks

- Fleet Operators and Fleet Maintenance Integrators

- Vehicle Upfitters

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

We construct a lighting-electronics ecosystem map covering OEMs, Tier-1 lamp integrators, LED/IC suppliers, optics/mechatronics vendors, and validation labs. Desk research consolidates technology, regulatory, and program signals to define key variables (electronics BOM, channel count, ECU complexity, validation needs).

Step 2: Market Analysis and Construction

We compile historical demand indicators by lamp type (headlamp/rear/DRL/interior) and electronics content (drivers, ECUs, comms, actuation). Bottom-up modeling is built from platform fitment logic, trim-mix, and electronics architecture benchmarks, then normalized to the published market totals.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions via CATIs with lighting engineering leaders, purchasing managers, semiconductor sales teams, and aftermarket channel partners. Insights focus on sourcing constraints, redesign triggers, ASP drivers (channel count, thermal limits), and validation timelines.

Step 4: Research Synthesis and Final Output

We triangulate findings against regulatory updates, OE feature roadmaps, and supplier announcements, then finalize segment shares, competitor positioning, and adoption curves for ADB/AFS and signature lighting—ensuring internal consistency with the reported market size.

- Executive Summary

- Research Methodology (Market definitions & scope boundary, product mapping & BOM logic, OEM vs aftermarket split approach, shipment/value triangulation, plant-to-platform mapping, primary interview framework, secondary source hierarchy, data validation & exception handling, limitations and confidence grading)

- Definition and Scope

- Market Genesis and Evolution of Lighting Electronics

- Ecosystem Timeline of Technology Milestones

- Business Cycle and Platform Cadence

- Supply Chain and Value Chain Map

- Growth Drivers

LED penetration across vehicle platforms

Adaptive driving beam enablement

Styling-led differentiation through lighting

Electronics consolidation within vehicle E/E architectures

Safety and visibility priorities

Fleet uptime and durability requirements - Challenges

FMVSS compliance complexity

Thermal and electromagnetic interference constraints

Semiconductor supply volatility

Counterfeit and non-compliant aftermarket products

Calibration and service capability gaps

Software validation burden - Opportunities

ADB rollout programs

Pixel-level lighting personalization

Sensor-fused intelligent lighting

Commercial vehicle ruggedization demand

Compliant retrofit opportunities

Smart rear communication lighting - Trends

Matrix and pixel lighting scale-up

Software-defined lighting architectures

Cybersecurity integration in body networks

Lighting diagnostics and predictive maintenance

Modular lamp ECU adoption

Sustainable materials and reparability - Regulatory & Policy Landscape

FMVSS No.108 compliance framework

Adaptive Driving Beam regulatory enablement

Aftermarket enforcement and liability considerations

Industry standards and testing protocols - SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger vehicles

Light commercial vehicles

Medium and heavy trucks

Off-highway and industrial vehicles - By Application (in Value %)

Headlamp electronics

Rear-lamp electronics

Fog and auxiliary lamp electronics

Daytime running lamp modules

Interior and ambient lighting controllers

Signaling modules - By Technology Architecture (in Value %)

Halogen control systems

HID ballast systems

LED static systems

LED matrix and pixel systems

Laser-assisted lighting

OLED rear lighting modules - By Connectivity Type (in Value %)

Standalone lighting controllers

LIN-based lighting nodes

CAN-based lighting nodes

Ethernet-integrated lighting systems - By End-Use Industry (in Value %)

OEM vehicle manufacturing

Aftermarket and replacement services

Fleet and commercial vehicle operators - By Region (in Value %)

Northeast

Midwest

South

West

- Market share analysis by value and volume

- Cross Comparison Parameters (ADB and matrix software maturity, LED driver and ECU channel scalability, US manufacturing and localization footprint, OEM platform wins and nomination cadence, photometry and compliance engineering depth, quality metrics including warranty and PPM, vertical integration across emitters drivers and modules, cost-down roadmap and supply assurance)

- Competitive moat and differentiation mapping

- Strategic moves and partnerships

- SWOT Analysis of Key Players

- Company Profiles

Koito Group North American Lighting

Stanley Electric

Valeo

FORVIA HELLA

Marelli Automotive Lighting

ZKW Group

Continental

Flex-N-Gate

ams OSRAM / OSRAM SYLVANIA

Lumileds

Nichia

Infineon Technologies

Texas Instruments

NXP Semiconductors

Microchip Technology

- OEM & Tier-1 Sourcing

- Aftermarket Demand Mechanics

- Fleet & Commercial Vehicle Needs

- Key Decision Criteria

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030