Market Overview

The USA Vehicle Occupant Detection Systems market is valued at USD ~ billion in 2024. This market growth is primarily driven by the increasing need for vehicle safety features and growing awareness of the importance of occupant protection systems in automotive safety. This market is further fueled by advancements in sensor technologies, such as ultrasonic sensors, infrared sensors, and radar-based systems. Regulations such as the Federal Motor Vehicle Safety Standards (FMVSS) are also pushing the automotive industry toward incorporating advanced occupant detection systems in vehicles. As automakers focus on improving vehicle safety, the demand for occupant detection systems continues to rise across both passenger and commercial vehicles.

The USA is a dominant force in the Vehicle Occupant Detection Systems market due to its extensive automotive industry and stringent safety regulations. Cities like Detroit, Michigan, home to the “Big Three” automakers—General Motors, Ford, and Stellantis—are leading in the development and implementation of these safety technologies. The country’s regulatory environment, supported by organizations like NHTSA, mandates advanced safety features such as airbag deployment systems, child safety monitoring, and automatic seat position adjustment. Furthermore, the rapid adoption of autonomous and semi-autonomous vehicles in the U.S. contributes to the continued dominance of this market, as such vehicles require more sophisticated occupant detection systems to ensure safety.

Market Segmentation

By Product Type

The USA Vehicle Occupant Detection Systems market is segmented by product type into ultrasonic sensors, infrared sensors, and radar-based sensors. Ultrasonic sensors are expected to dominate the market in 2024 due to their relatively lower cost and widespread use in vehicle applications, particularly for detecting the presence of an occupant and measuring their position for airbag deployment. However, infrared sensors are gaining traction because of their ability to detect occupants based on body heat, offering a higher level of precision. Radar-based sensors are expected to grow rapidly as they are essential for advanced driver-assistance systems (ADAS) in autonomous vehicles. These sensors enable accurate occupant detection even in low-visibility conditions. The shift towards these advanced sensors is driven by the increasing complexity of vehicle safety requirements and the rise of autonomous driving technologies.

By End-User

The market is also segmented by end-user, with major sub-segments including passenger vehicles and commercial vehicles. Passenger vehicles account for the largest share of the market, driven by the increasing consumer demand for safety features like airbags, seatbelt reminders, and child safety monitoring. The rising adoption of advanced safety technologies in both new and existing vehicles boosts the demand for occupant detection systems in the passenger vehicle segment. The commercial vehicle segment, however, is witnessing significant growth due to regulatory pressures and the need to improve safety standards for drivers and cargo. As commercial fleets modernize their vehicles to meet stringent safety regulations, the demand for such systems is expected to rise rapidly in this segment.

Competitive Landscape

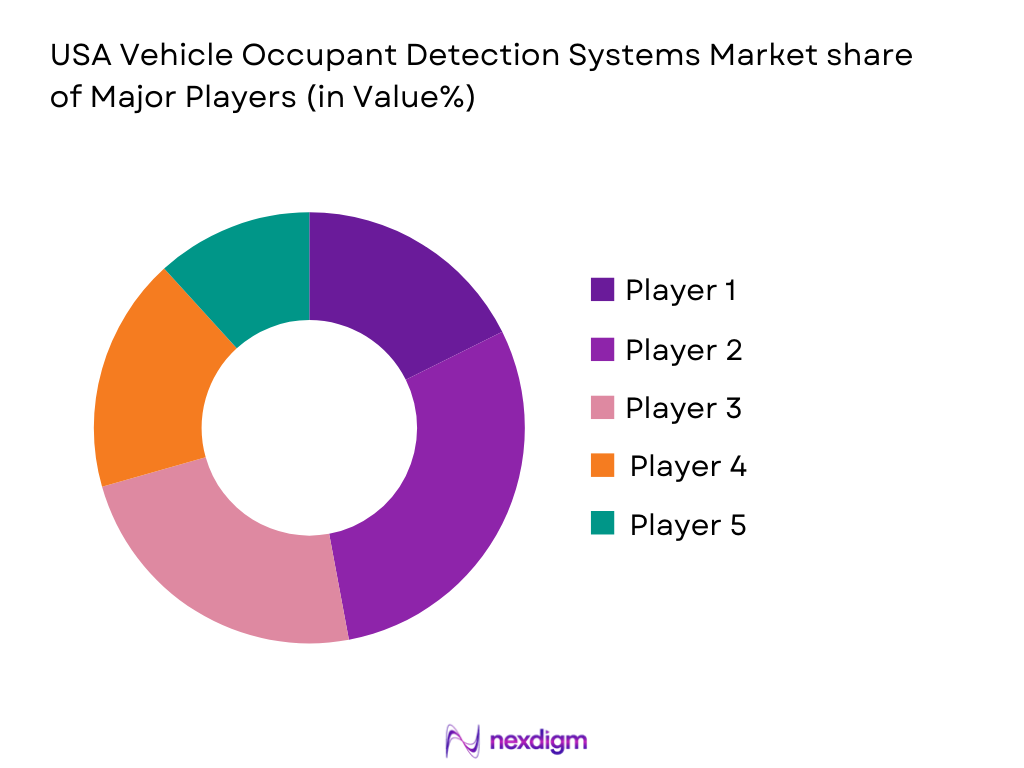

The USA Vehicle Occupant Detection Systems market is dominated by key players that lead the industry with their technological innovations and extensive product portfolios. Companies like Continental AG, Robert Bosch GmbH, and Denso Corporation are key players in the development and deployment of advanced occupant detection systems. These companies are focusing on integrating ultrasonic, infrared, and radar-based sensors into vehicles, meeting the increasing safety regulations in the automotive industry. Additionally, partnerships with automotive manufacturers and technology companies are crucial for maintaining competitiveness, especially in the rapidly evolving market for autonomous and semi-autonomous vehicles. The dominance of these companies is attributed to their strong research and development capabilities, long-standing relationships with major automakers, and substantial investment in safety technologies.

| Company | Establishment Year | Headquarters | Product Type | Key Technology | Strategic Focus | Market Segment |

| Continental AG | 1871 | Hanover, Germany | ~ | ~ | ~ | ~ |

| Robert Bosch GmbH | 1886 | Stuttgart, Germany | ~ | ~ | ~ | ~ |

| Denso Corporation | 1949 | Kariya, Aichi, Japan | ~ | ~ | ~ | ~ |

| Magna International | 1957 | Aurora, Ontario, Canada | ~ | ~ | ~ | ~ |

| Autoliv Inc. | 1953 | Stockholm, Sweden | ~ | ~ | ~ | ~ |

USA Vehicle Occupant Detection Systems Market Analysis

Growth Driver

Increasing Federal Safety Regulations and Standards

Federal traffic safety standards are directly driving demand for occupant detection technologies. The National Highway Traffic Safety Administration (NHTSA) recently amended Federal Motor Vehicle Safety Standard (FMVSS) No. 208 to require advanced seat belt use warning systems for both front and rear seats, expanding requirements for occupant crash protection. These regulations are designed to ensure that occupant status is recognized and safety responses (like airbags or warnings) are triggered appropriately. Such regulatory enhancements are pushing automakers to integrate sophisticated occupant detection systems as a compliance necessity rather than optional equipment.

Rising Importance of Airbag Suppression and Deployment Precision

Occupant detection systems are critical for airbag systems to determine when and how to deploy restraints safely. Industry analysis highlights that occupant classification and detection technologies help differentiate between adults, children, and empty seats, optimizing airbag behavior to reduce injury risk. These technologies align with FMVSS updates focused on reducing unnecessary deployment while improving protection for diverse occupant profiles, motivating automakers to integrate precise detection systems to comply with safety mandates.

Challenges

Technical Complexity of Sensor Integration

One significant restraint for the occupant detection systems market is the technical complexity of integrating multiple sensing technologies (e.g., ultrasonic, infrared, radar). Automakers must coordinate hardware with vehicle electronics and restraint systems while ensuring reliability under various environmental conditions. This complexity increases development and testing demands, leading to longer integration cycles and higher engineering overhead before deployment. The complexity also affects standardization, with differing approaches required for different vehicle models and seat layouts.

High Safety Certification Burden and Compliance Testing

Occupant detection systems must pass rigorous safety certification and crashtest validation before they can be deployed. With agencies like NHTSA and FMVSS certifying occupant protection systems, manufacturers incur significant validation costs and extended testing timelines to meet certification standards. This regulatory testing ensures systems work reliably in realworld crashes but also increases time to market. As safety laws evolve (e.g., expanded seat belt warning requirements), adapting detection systems to meet them adds compliance burden for suppliers and OEMs.

Opportunity

Adoption of Advanced Vehicles with Automated Features

Growth in advanced driver assisting systems (ADAS) and automated vehicle technologies expands opportunities for occupant detection solutions. As vehicles move toward higher autonomy levels, occupant monitoring becomes essential for determining occupant attention, seating posture, readiness for control handoff, and safety system optimization. Increased deployment of ADAS functions such as automated emergency braking, lane keeping, and adaptive cruise control influencers also elevate the need for accurate occupant detection to ensure that safety systems respond correctly to human presence and status inside the vehicle.

Increasing Consumer Demand for Enhanced Vehicle Safety

With ongoing focus on road safety, U.S. consumers increasingly expect advanced safety features as standard in new vehicles. Public health data shows thousands of preventable occupant fatalities each year—nearly 600 child passengers under age 12 killed in crashes in 2022, with many unrestrained at the time—highlighting a clear case for better occupant monitoring and alerts to improve restraint use in critical moments. This consumer prioritization of safety drives OEMs to invest in occupant detection technologies to meet buyer expectations.

Future Outlook

Over the next several years, the USA Vehicle Occupant Detection Systems market is expected to show significant growth driven by advancements in vehicle safety standards, increasing adoption of autonomous vehicles, and the rising demand for smart vehicle technologies. The introduction of fully autonomous vehicles will fuel the demand for more sophisticated occupant detection systems that can accurately monitor the presence and positioning of passengers in real-time. Additionally, government regulations and safety mandates will continue to play a significant role in driving the market, as automakers and component suppliers look to meet evolving safety standards. The increasing importance of AI, machine learning, and radar technologies in the development of smart safety features is expected to further enhance the capabilities of occupant detection systems, pushing the market toward greater innovation and growth.

Major Players

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Magna International

- Autoliv Inc.

- ZF Friedrichshafen AG

- Valeo SA

- Aisin Seiki Co. Ltd.

- Delphi Technologies

- Panasonic Corporation

- Hyundai Mobis

- TRW Automotive

- Sensata Technologies

- Luminar Technologies

- Veoneer

Key Target Audience

- Automotive Manufacturers

- Original Equipment Manufacturers

- Tier-1 Automotive Suppliers

- Automotive Technology Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies Fleet Operators

- Consumer Electronics and IoT Technology Companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables in the Vehicle Occupant Detection Systems market, such as sensor technologies, end-user applications, and regulatory requirements. Secondary research is conducted using government reports, industry publications, and market surveys to define these variables.

Step 2: Market Analysis and Construction

Market analysis is conducted by collecting data from automotive OEMs, suppliers, and sensor technology companies. The market structure, growth drivers, and challenges are analyzed in-depth through historical data and current trends.

Step 3: Hypothesis Validation and Expert Consultation

The formulated hypotheses are validated through consultations with industry experts, including automotive manufacturers, sensor technology companies, and government bodies. These consultations help refine the data and provide a deeper understanding of market dynamics.

Step 4: Research Synthesis and Final Output

The final report integrates insights from primary and secondary research to offer a comprehensive overview of the market. This includes market sizing, segmentation, competitive analysis, and future outlook. The findings are verified with experts to ensure the accuracy and reliability of the data.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Market Definitions and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Focus on Vehicle Safety Regulations

Advancements in Sensor Technology

Rising Adoption of Autonomous and Semi-Autonomous Vehicles - Market Challenges

High Installation and Maintenance Costs

Integration Complexity with Existing Vehicle Systems

Regulatory and Compliance Challenges - Opportunities

Demand for Smart Vehicle Technologies

Expansion in Emerging Markets

Technological Advancements in Sensor Integration - Trends

Rising Demand for Contactless and Non-Invasive Sensing Technologies

Integration of AI and Machine Learning in Occupant Detection Systems

Integration with Connected and Autonomous Vehicle Technologies - Government Regulation

SWOT Analysis

Porter’s Five Forces

Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

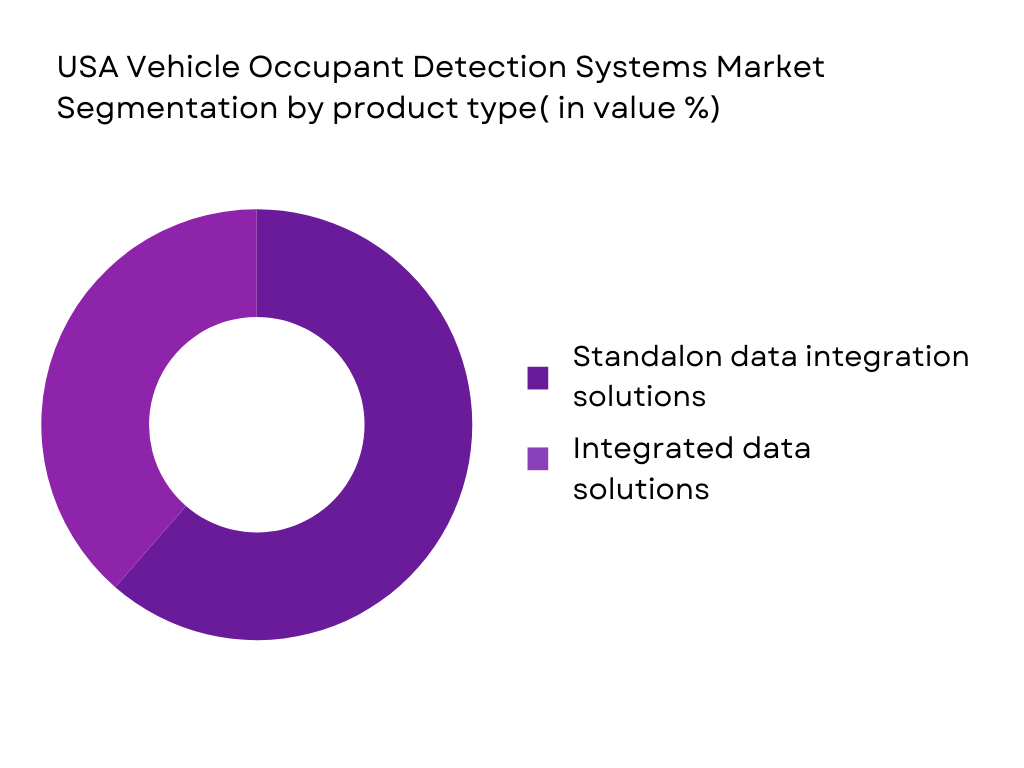

- By Product Type (In Value %)

Standalone Data Integration Solutions

Integrated Data Solutions - By Delivery Mode (In Value %)

On-Premise Solutions

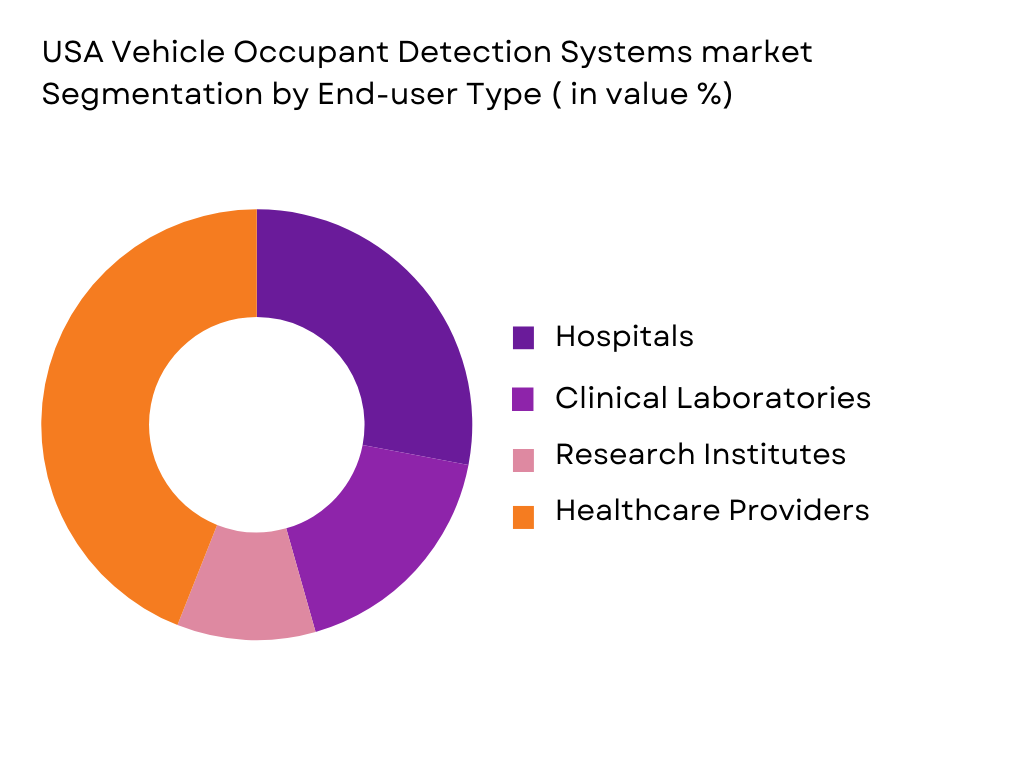

Cloud-Based Solutions - By End-User (In Value %)

Hospitals

Clinical Laboratories

Research Institutes

Healthcare Providers - By Region (In Value %)

North America

Europe

Asia-Pacific

Rest of the World - By Technology (In Value %)

Data Analytics Integration

Real-time Data Management

Artificial Intelligence and Machine Learning

- Market Share (Value/Volume)

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Occupant Detection System, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and Others) SWOT Analysis of Major Players

- Pricing Analysis

- Detailed Profiles of Major Companies

Cerner Corporation

Meditech

McKesson Corporation

Oracle Health Sciences

GE Healthcare

Siemens Healthineers

Labcorp

Intersystems

IBM Watson Health

Philips Healthcare

Sunquest Information Systems

Xifin

Cognizant

Health Catalyst

Healthstream

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Price, 2026-2030