Market Overview

The USA Wheel Alignment Systems market is valued at USD ~ billion in 2024. This market is primarily driven by the growing demand for precision and high-speed wheel alignment systems in both automotive repair shops and commercial fleets. The increasing adoption of advanced technologies such as 3D and computerized wheel alignment systems has significantly transformed the market. The shift towards automated solutions that provide faster service, reduce errors, and improve vehicle safety is another key driver. Furthermore, the surge in vehicle numbers and the need for regular maintenance in light of longer vehicle lifespans continue to propel market growth.

The USA’s wheel alignment systems market is predominantly concentrated in states with large automotive repair and service infrastructures like California, Texas, and New York. These regions account for significant demand due to the high number of vehicles requiring regular maintenance. Additionally, the influence of global technology leaders in Europe and Asia, such as Bosch and Hella Gutmann, has brought cutting- edge advancements and operational efficiencies to the USA market, ensuring its dominance in global supply chains for automotive service equipment.

Market Segmentation

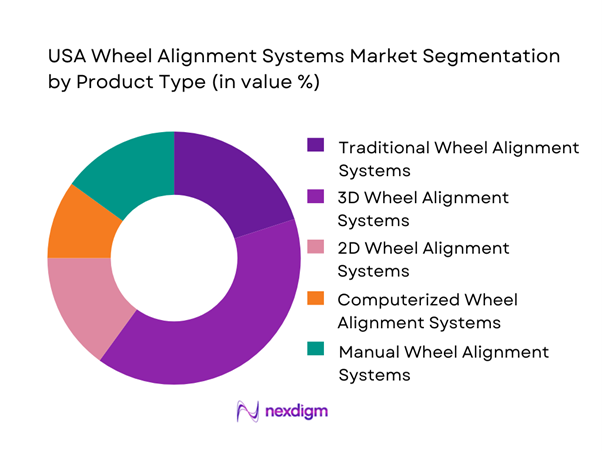

By Product Type

In the USA Wheel Alignment Systems market, the 3D wheel alignment systems segment is the most dominant due to their superior accuracy, speed, and ability to perform alignment with minimal human intervention. These systems provide highly precise measurements, which is crucial for automotive repair shops and fleet services that require frequent, accurate alignment services to maintain vehicle safety and performance. The preference for 3D systems is also supported by their ability to provide real-time data analysis and immediate corrective actions, which are highly valued in the competitive automotive service industry.

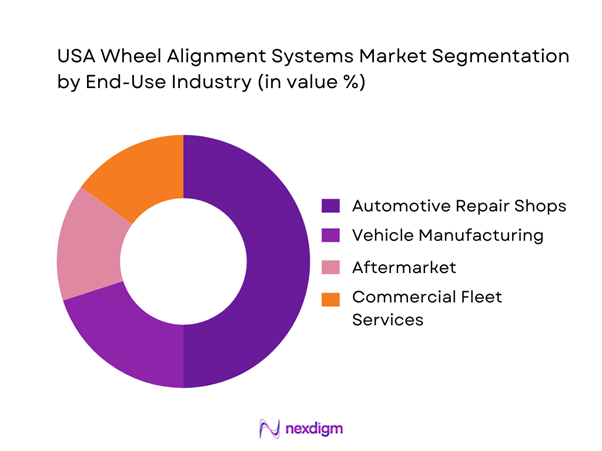

By End-Use Industry

The automotive repair shop sector dominates the USA Wheel Alignment Systems market, driven by the high demand for regular alignment services in light of increasing vehicle ownership and longer vehicle lifespans. This sector represents the largest application area for wheel alignment systems, with both independent repair shops and large franchises investing in advanced alignment systems to meet customer demands. Additionally, the growth of the aftermarket sector has further boosted the demand for wheel alignment systems, as more vehicle owners seek quality service options beyond dealerships.

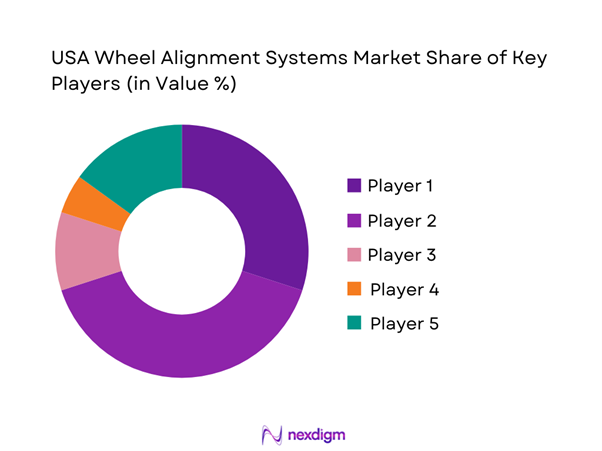

Competitive Landscape

The USA Wheel Alignment Systems market is dominated by a few major players, including Hunter Engineering and global brands like Snap-on Inc., Beissbarth, and Bosch Automotive Service Solutions. This consolidation highlights the significant influence of these key companies, who drive technological advancements and set high industry standards for precision, automation, and service capabilities.

| Company | Establishment Year | Headquarters | Product Features | Market Reach | Service Capabilities | Customer Base | Innovation Focus | Revenue Streams | Market Leadership |

| Hunter Engineering | 1946 | Bridgeton, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Snap-on Inc. | 1920 | Kenosha, USA | ~ | ~ | ~ | ` | ~ | ~ | ~ |

| Hella Gutmann Solutions | 1990 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Beissbarth | 1905 | Munich, Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Bosch Automotive Service | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

USA Wheel Alignment Systems Market Analysis

Growth Drivers

Technological Advancements in Wheel Alignment Systems

The continued evolution of wheel alignment technology has been a significant growth driver in the market. Innovations such as 3D and computerized wheel alignment systems have revolutionized the accuracy and speed of alignments. These systems enable precise adjustments with minimal human intervention, reducing errors and increasing service efficiency. As repair shops adopt these high-tech solutions, they can offer faster turnaround times and a better customer experience, which boosts demand for such systems. Additionally, advancements in AI and machine learning are enhancing system capabilities, allowing for automated diagnostics and even predictive maintenance.

Increasing Vehicle Fleet Size

The growing number of vehicles on the road has directly increased the need for wheel alignment services. With more vehicles requiring regular maintenance, especially those that experience frequent tire wear or handling issues, the demand for wheel alignment systems continues to rise. Fleets of vehicles used by businesses, including delivery trucks, taxis, and commercial fleets, also require ongoing alignment checks to ensure efficiency and safety. As the global vehicle fleet grows, both in personal and commercial sectors, the demand for reliable and efficient wheel alignment systems will continue to expand, contributing to market growth.

Market Challenges

High Capital Investment for Advanced Systems

One of the primary challenges faced by businesses in adopting advanced wheel alignment systems is the high upfront investment required. The latest alignment technologies, such as 3D and computerized systems, can be costly for small and mid-sized repair shops to implement. The high initial purchase price, combined with installation and training costs, can create a financial barrier for some businesses. For many repair centers, the need to secure financing options or wait for returns on investment can delay the adoption of these systems, limiting their ability to compete with larger companies that can afford such investments.

Complex Calibration and Maintenance Requirements

While modern wheel alignment systems offer exceptional accuracy, they also come with complex calibration and maintenance requirements. These systems often involve advanced sensors, cameras, and software that need to be calibrated regularly to maintain precision. If calibration is not properly managed, it can result in inaccurate alignments and negatively affect service quality. Additionally, advanced systems may require specialized knowledge and expertise for repairs, which can strain resources for smaller repair shops. The need for ongoing maintenance, specialized staff training, and costly parts replacements can be a significant hurdle for businesses looking to optimize their operations.

Opportunities

Rising Demand for Advanced and Automated Alignment Systems

As the automotive repair industry grows, the demand for advanced, automated wheel alignment systems is expected to rise. Consumers and businesses alike are increasingly seeking high-efficiency, high-precision services that can minimize downtime and improve the accuracy of wheel alignments. These advanced systems offer faster service times, reduce human error, and often include diagnostic features that can identify underlying issues, which are crucial for providing value-added services. Repair shops that invest in these automated systems can improve their competitive edge, boost customer satisfaction, and cater to the increasing demand for high-tech solutions in the automotive service market.

Increasing Popularity of Electric and Autonomous Vehicles

The growing adoption of electric and autonomous vehicles presents a significant opportunity for the wheel alignment systems market. Electric vehicles (EVs) often require specialized maintenance, including precise wheel alignments, due to their unique weight distribution and tire characteristics. Autonomous vehicles, which rely on precise sensor technology, also require high-precision alignments to ensure safety and operational efficiency. As the number of EVs and autonomous vehicles on the road increases, the demand for alignment systems that can support these advanced technologies is expected to rise. This creates an opportunity for manufacturers to develop alignment systems tailored to the needs of these emerging vehicle types.

Future Outlook

The USA Wheel Alignment Systems market is expected to experience steady growth over the next few years, driven by continued advancements in alignment technologies and the increasing adoption of automated systems across repair shops and fleet service providers. The demand for high-precision systems will likely rise with the expanding automotive fleet and the shift toward electric vehicles, which require specialized alignment services. Additionally, innovations in artificial intelligence and machine learning will enable further enhancements in alignment accuracy and service speed.

Major Players

- Hunter Engineering

- Snap-on Inc.

- Hella Gutmann Solutions

- Beissbarth

- Bosch Automotive Service Solutions

- John Bean Technologies

- CEMB USA

- MAHA USA

- Friedrich Lütjen GmbH

- Car-O-Liner

- Ranger Products

- HawkEye Elite

- Wheel Alignment Systems Inc.

- AutoEnginuity

- ASE Group

Key Target Audience

- Automotive Repair Shop Owners

- Vehicle Fleet Managers

- Automotive Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Parts Distributors

- Automotive Equipment Resellers

- Commercial Fleet Service Providers

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying and analyzing the key factors that impact the wheel alignment systems market, including technological developments, consumer preferences, and regional market conditions.

Step 2: Market Analysis and Construction

This phase involves collecting and analyzing historical data, identifying major trends, and constructing a comprehensive market model that incorporates all relevant factors impacting growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts and key stakeholders to refine assumptions and ensure the reliability of the data gathered.

Step 4: Research Synthesis and Final Output

The final step synthesizes all research findings, ensuring a complete and accurate representation of the USA Wheel Alignment Systems market, backed by expert validation and comprehensive analysis.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Wheel Alignment Systems Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- USA Industry / Service / Delivery Architecture

- Growth Drivers

Technological Advancements in Wheel Alignment Systems

Increasing Vehicle Fleet Size

Advancements in Aftermarket Services - Market Challenges

High Capital Investment for Advanced Systems

Complex Calibration and Maintenance Requirements - Opportunities

Rising Demand for Advanced and Automated Alignment Systems

Increasing Popularity of Electric and Autonomous Vehicles - Trends

Integration of Artificial Intelligence in Wheel Alignment Systems

Rise in Demand for High-Precision Alignment Equipment - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base / Active Usage Metric, 2019–2024

- Service / Revenue Mix, 2019–2024

- By Product Type (in Value %)

Traditional Wheel Alignment Systems

3D Wheel Alignment Systems

2D Wheel Alignment Systems

Computerized Wheel Alignment Systems

Manual Wheel Alignment Systems - By End-Use Industry (in Value %)

Automotive Repair Shops

Vehicle Manufacturing

Aftermarket

Commercial Fleet Services - By Technology / Product / Platform Type (in Value %)

Optical Technology

Laser Technology

CCD (Charge-Coupled Device) Technology - By Deployment / Delivery / Distribution Model (in Value %)

Direct Sales

Online Retailers

Authorized Distributors - By Region (in Value %)

Northeast Region

Midwest Region

South Region

West Region

- Competition ecosystem overview

- Cross Comparison Parameters (Product Features, Market Reach, Service Capabilities, Customer Base, Innovation Focus, Revenue Streams, Market Leadership, Competitive Strategy)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Hunter Engineering

Snap-on Inc.

Hella Gutmann Solutions

Beissbarth

Bosch Automotive Service Solutions

John Bean Technologies

CEMB USA

MAHA USA

Friedrich Lütjen GmbH

Car-O-Liner

Ranger Products

HawkEye Elite

Wheel Alignment Systems Inc.

AutoEnginuity

ASE Group

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- Installed Base / Active Usage Metric, 2025–2030

- Service / Revenue Mix, 2025–2030