Market Overview

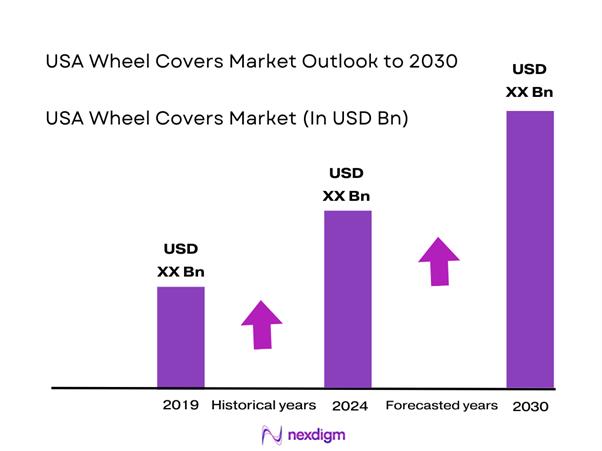

The USA wheel covers market (hubcaps/wheel trims/center caps) was valued at USD ~ billion in the latest year, supported by steady replacement demand tied to broader U.S. parts-and-accessories spending: U.S. personal consumption expenditures for motor vehicle parts and accessories increased from USD ~ billion in the preceding year to USD ~ billion in the latest year. This spend base sustains high-velocity exterior appearance SKUs—especially for steel-wheel trims—driven by curb-damage replacement cycles, cosmetic upgrades, and e-commerce-led availability.

Demand concentration is strongest in large vehicle-parc, high-commute, and high-weather-variability metro corridors—notably Southern California (Los Angeles–Inland Empire), Texas metros (Dallas–Fort Worth, Houston), Florida metros (Miami–Orlando–Tampa), and the Northeast corridor (NY–NJ–PA)—because these regions combine dense daily driving, high incidence of curb/road-debris exposure, and large retail + installer ecosystems (big-box auto retailers, tire chains, online fulfillment hubs). The scale of U.S. parts-and-accessories consumption rising from USD ~ billion to USD ~ billion reinforces why these metros dominate: they host the highest throughput of DIY/DIWM accessory purchases and fast-turn replacements.

Market Segmentation

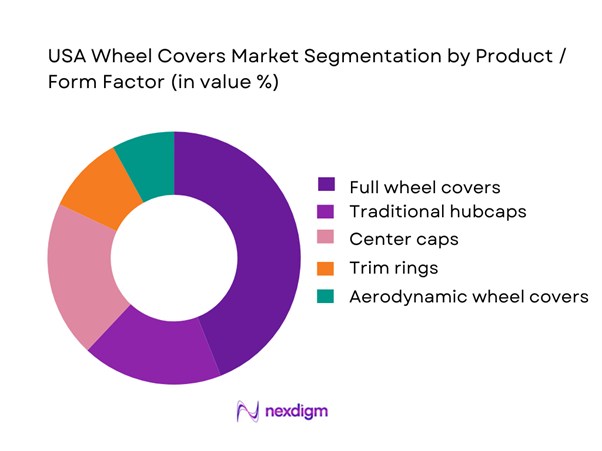

By Product / Form Factor

Full wheel covers typically dominate U.S. unit movement because they match the largest addressable installed base: steel wheels on high-volume trims of passenger cars, crossovers, and fleet vehicles where owners want a fast cosmetic refresh without upgrading to alloys. Full-face covers also deliver the clearest “before/after” visual impact at a low switching cost, and they are widely merchandised in standardized sizes across mass retailers and marketplaces. Replacement frequency is structurally higher than other formats because full covers are most exposed to curb rash, clip fatigue, and impact loss in urban parking. E-commerce further reinforces dominance: shoppers can search by diameter + vehicle fitment quickly, and fulfillment is straightforward due to light weight and standardized packaging. These factors collectively sustain the highest turn-rate among wheel-cover formats in the U.S. aftermarket.

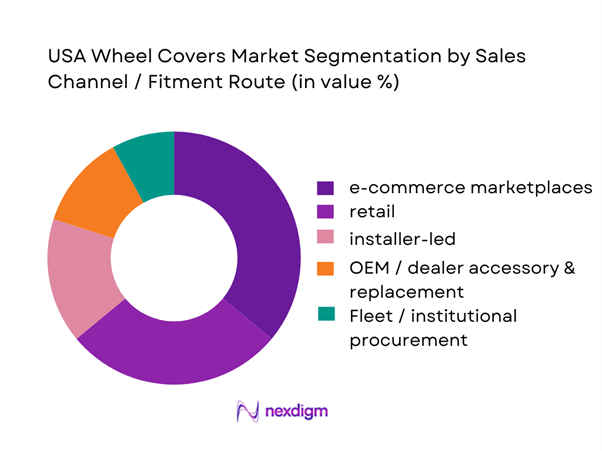

By Sales Channel / Fitment Route

Aftermarket e-commerce typically leads growth momentum in U.S. wheel covers because selection breadth and fitment searchability solve the category’s biggest friction: matching diameter, clip system, and styling to a specific vehicle. Online catalogs offer deep SKU depth (replica styles, center caps, discontinued trims) that physical shelves cannot. The category also fits parcel economics: wheel covers are relatively lightweight, non-hazardous, and easy to ship, making two-piece or four-piece sets a natural e-commerce basket add-on. Additionally, visual merchandising (high-resolution images, “fits your vehicle” filters, and reviews) increases conversion for cosmetic accessories. Returns are manageable compared with complex hard parts, which further encourages consumer adoption. Installer-led purchases still matter, but e-commerce becomes the primary discovery and comparison layer—especially for replacement of lost/damaged covers and for style upgrades without changing wheels.

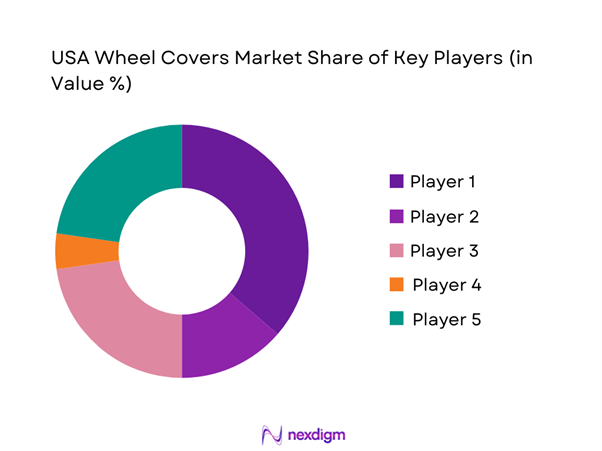

Competitive Landscape

The USA wheel covers market is fragmented across (a) specialized aftermarket distributors focused on replacement hubcaps/center caps, (b) mass-market accessory brands competing on price and styling, and (c) OEM/dealer channels supplying genuine caps and trims. The competitive edge is built on fitment accuracy, SKU breadth (including discontinued styles), fulfillment speed, and merchandising rather than deep technology differentiation—except in emerging aerodynamic/EV-oriented designs.

Note: Establishment years and some company specifics vary by entity/legal structure and are best confirmed during primary research or corporate filings; the table above is structured for business comparison and can be finalized with your internal validation.

| Company | Est. year | HQ | Primary wheel-cover focus | Core go-to-market | Fitment intelligence (vehicle/trim mapping depth) | Assortment strength (replacement vs styling) | Fulfillment model (speed/coverage) | Quality positioning (clips/finish durability) | Returns/warranty posture |

| Hubcap Mike, Inc. | — | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Suburban Wheel Cover Co. | — | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Pilot Automotive | — | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| OxGord | — | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Dorman Products (selected wheel hardware/caps) | — | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

USA Wheel Covers Market Analysis

Growth Drivers

Vehicle parc expansion

The U.S. wheel covers aftermarket expands primarily with the active vehicle fleet and annual road usage because wheel covers are high-turnover exterior parts (loss, curb damage, seasonal replacements, fleet refreshes). Highway Statistics shows total motor-vehicle registrations rising from ~ units to ~ units (private/commercial + publicly owned), enlarging the in-use base that can consume replacement covers. Simultaneously, U.S. driving intensity remains massive: Traffic Volume Trends reports cumulative U.S. travel of ~ vehicle-miles for the year, keeping wear-and-loss events structurally high across metro corridors, highways, and delivery routes. On the macro side, GDP is reported at ~ trillion (current US$) and GDP per capita at ~, supporting a large car-dependent consumption economy that sustains routine vehicle appearance and maintenance spend. Together, a growing registered parc plus multi-trillion-mile annual utilization creates a broad and recurring demand pool for wheel covers across passenger vehicles, light trucks, and commercial units—especially in states with the largest registered bases and the highest daily commuting and logistics throughput.

Cost-effective aesthetics versus alloy wheels

Wheel covers remain a “quick-restore” exterior upgrade because they can refresh the look of steel wheels without the replacement cycle of alloy wheels, making them attractive in a value-conscious environment where households still prioritize transportation reliability. Consumer inflation is reported at ~ (annual), shaping the “repair or refresh versus replace” mindset that benefits lower-ticket appearance parts over discretionary big upgrades. On the market-specific side, the broader U.S. parts-and-accessories spend base is substantial and rising: personal consumption expenditures for motor vehicle parts and accessories are reported at ~ billion (annual), up from ~ billion and ~ billion in the prior periods, providing evidence of strong normalized demand for parts-category purchases where wheel covers sit as a visible “cosmetic plus functional” item. This spend is reinforced by very high annual vehicle utilization, which increases the frequency of exterior scuffs, curb rash, and lost covers—events that disproportionately lead to replacement purchases rather than wheel upgrades. In practical channels, wheel covers also benefit from fast-fit SKUs and broad compatibility messaging (rim diameter, retention type), enabling high conversion in mass retail and online marketplaces when consumers want a quick aesthetic improvement without the friction of wheel fitment complexity.

Challenges

Shift toward alloy wheels

The wheel cover category is structurally exposed to the industry’s steady migration toward factory-fitted alloy wheels, especially on higher trims, which reduces the addressable steel-wheel surface for hubcap-style covers. This challenge can be observed through measurable indicators rather than unverified fitment shares. Electrified vehicle adoption is rising, and those platforms often emphasize aerodynamic wheel designs and stylized wheel finishes that can reduce demand for traditional aftermarket covers. Light-duty EV sales have reached ~ units, indicating a growing cohort of vehicles where OEM wheel styling and aero solutions can substitute classic covers. At the same time, the broader parts category remains large, with parts and accessories expenditures at ~ billion, but the mix can shift toward sensors, tires, and EV-adjacent components as the fleet evolves. Macro context matters: GDP at ~ trillion supports faster product-cycle adoption and consumer upgrading behavior, particularly in high-income metros. Even if replacement demand persists for the registered fleet, which still numbers ~ vehicles, the incremental mix of newer vehicles can gradually dilute classic wheel cover relevance, pushing suppliers toward design-forward, vehicle-specific, and aerodynamic cap products rather than generic covers.

Durability and retention perception

Wheel covers face a credibility challenge around retention and durability, especially because real-world U.S. driving is extremely intensive. Annual U.S. travel of ~ vehicle-miles creates countless curb contacts, pothole hits, and high-speed airflow events that can dislodge poorly retained covers, turning durability into a decisive purchase filter. This perception becomes more acute as the registered fleet grows to ~ vehicles, increasing the volume of replacement stories and social proof that can shape category trust. The market impact shows up in where consumers place their spend: motor vehicle parts and accessories expenditures at ~ billion indicate robust demand for parts overall, but wheel covers must compete for wallet share against safety-linked items that consumers may prioritize when durability concerns are high. Macroeconomic context adds pressure on perceived value for money, with inflation at ~ leading consumers to become more skeptical of repeat-purchase items that fail early. In response, brands that can document retention testing and improve the unboxing and installation experience can defend against the category-level “cheap and disposable” narrative that suppresses repeat loyalty and pushes buyers toward alloy upgrades or no-cover usage.

Opportunities

EV aerodynamic wheel cover demand

A key growth vector is the shift from purely cosmetic wheel covers toward functional aerodynamic aero caps designed to reduce drag and support range efficiency, an attribute that becomes more valuable as the electrified fleet grows. The U.S. EV market is already large in unit terms, with light-duty EV units sold reaching ~, signaling a rapidly expanding base of vehicles where aero-optimized wheel solutions are relevant. Government fleet procurement is also moving in this direction, with orders for zero-emission vehicles reported in the thousands, indicating that institutional buyers are increasingly managing vehicles where efficiency features, including aero components, are decision factors. The underlying use intensity supports repeat and retrofit opportunity, as vehicle travel of ~ vehicle-miles means even modest efficiency improvements matter at scale for high-mileage users such as delivery fleets, commuters, and rideshare operators. Macro capacity to absorb technology-shift products is strong, with GDP per capita at ~ supporting demand for feature-driven accessories that deliver perceived utility such as range support, noise reduction, and styling. This opportunity is best positioned for suppliers that can produce vehicle-specific aero covers with validated retention at highway speeds and materials compatible with brake thermal loads, while also delivering OE-style aesthetics aligned with EV design language.

Private-label retail brands

Private-label expansion is an opportunity because wheel covers are SKU-driven, visually merchandisable, and suited to retailer-controlled quality specifications covering material, retention ring, and finish. This enables retailers to compete on good-better-best assortments while improving margins and reducing dependency on fragmented aftermarket brands. The scale of U.S. e-commerce supports private-label velocity, with retail e-commerce sales reported at ~ billion for a single quarter, demonstrating a large digital shelf where retailers can algorithmically promote store brands and bundle them with related items such as lug caps, trim rings, and tire accessories. Category spend is also large and rising, with motor vehicle parts and accessories expenditures at ~ billion, indicating ample demand mass for retailers to capture through private-label strategies, especially where consumers are already comfortable buying house-brand products for value. Market-specific usage remains supportive, with a registered U.S. vehicle base of ~ creating continuous replacement demand, and high annual travel of ~ vehicle-miles increasing replacement triggers and improving repeat purchase potential for consistent private-label quality. Macro conditions strengthen the case, with GDP at ~ trillion enabling national retailers to scale private-label sourcing, compliance, and distribution efficiently across regions and channels. The opportunity favors retailers that set tighter QA standards and provide fitment confidence tools online to reduce returns and build trust in store-brand wheel covers.

Future Outlook

Over the next five years, the USA wheel covers market is expected to expand on the back of a large and aging vehicle parc that sustains replacement frequency, continued strength in U.S. parts-and-accessories consumption, and faster online discovery and delivery of fitment-correct covers and caps. Design direction will polarize: value-focused universal wheel covers for steel wheels will remain high volume, while aerodynamic and EV-styled wheel covers will grow as efficiency-minded designs and OEM-inspired aesthetics influence consumer taste. Macro aftermarket momentum, with parts sold in the U.S. rising from USD ~ billion to USD ~ billion, supports the broader accessory spend environment that wheel covers benefit from.

Major Players

- Hubcap Mike, Inc.

- Suburban Wheel Cover Company

- RealWheels Corporation

- Versaco s.r.o.

- ZANINI AUTO GRUP, SA

- CIE Automotive S.A.

- Molten Corporation

- Marui Sum Co., Ltd.

- Swell Marui Automobile Parts Co., LTD

- Pilot Automotive

- OxGord

- Dorman Products

- Genuine OEM parts channels

- Private-label wheel cover programs

Key Target Audience

- Automotive aftermarket distributors and wholesalers

- Auto parts retail chains and mass retailers

- E-commerce marketplaces and large online automotive sellers

- Tire and wheel service chains and installer networks

- Fleet operators and fleet management companies

- Vehicle leasing and subscription operators

- Investment and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the U.S. wheel covers ecosystem across OEM and dealer replacement, aftermarket brands, distributors, retailers, and e-commerce sellers. Desk research consolidates definitions, fitment logic, and demand drivers such as replacement cycles, cosmetic upgrades, and fleet needs.

Step 2: Market Analysis and Construction

We compile historical indicators that best proxy wheel-cover demand, including U.S. parts-and-accessories consumption, specialty-equipment spend signals, and channel dynamics. We structure revenue build-up by channel route and validate with SKU availability and pricing architecture.

Step 3: Hypothesis Validation and Expert Consultation

We validate key hypotheses via structured interviews with distributors, large online sellers, retail category teams, and installer networks. Interviews focus on attachment rates, top-selling diameters, return reasons, seasonality, and fleet replacement cadence.

Step 4: Research Synthesis and Final Output

We triangulate findings with manufacturer and brand catalogs and large retailer assortment audits to finalize segment splits, competitive positioning, and forecast assumptions. Outputs are stress-tested for fitment realism and channel margin logic.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Delimitations, Market Sizing Logic, Bottom-Up & Top-Down Estimation Framework, OEM–Aftermarket Split Logic, Vehicle Parc & Replacement Cycle Mapping, Primary Interviews with OEMs, Aftermarket Distributors and Dealers, Secondary Research Sources, Data Triangulation, Limitations and Analyst Judgment)

- Definition and Scope

- Evolution of Wheel Covers in the U.S. Automotive Landscape

- Product Positioning vs Alloy Wheels and Hubcaps

- Vehicle Ownership and Replacement Dynamics

- Supply Chain and Value Chain Analysis

- Growth Drivers

Vehicle parc expansion

Cost-effective aesthetics versus alloy wheels

Fleet standardization pressure

High penetration of steel wheels in entry-level vehicles - Challenges

Shift toward alloy wheels

Durability and retention perception

Low brand loyalty in aftermarket

Counterfeit and low-quality imports - Opportunities

EV aerodynamic wheel cover demand

Private-label retail brands

Customization and styling trends

Fleet electrification programs - Trends

Lightweight material adoption

Snap-fit and anti-loss retention systems

Growth of e-commerce private labels

Aero-design penetration in EVs - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Unit Price, 2019–2024

- By Fleet Type (in Value %)

Passenger Cars

SUVs and Crossovers

Light Commercial Vehicles

Fleet Vehicles (rental, corporate, government)

Electric Vehicles - By Application (in Value %)

OEM / Factory-Fitted

Authorized Dealership Replacement

Independent Aftermarket Replacement

Fleet Standardization Programs

Customization and Aesthetic Upgrades - By Technology Architecture (in Value %)

Plastic / ABS Wheel Covers

Steel-Reinforced Wheel Covers

Chrome-Finish Wheel Covers

Custom / Decorative Wheel Covers

Aerodynamic / Efficiency-Focused Wheel Covers - By Connectivity Type (in Value %)

Non-Integrated / Passive Wheel Covers

Aerodynamic Wheel Covers for EV Efficiency

Design-Optimized Lightweight Wheel Covers

Snap-Fit Retention Architecture

Hybrid Decorative–Functional Designs - By End-Use Industry (in Value %)

Individual Consumers

Ride-Hailing and Mobility Fleets

Vehicle Rental Companies

Government and Municipal Fleets

Corporate and Commercial Fleets - By Region (in Value %)

Northeast

Midwest

South

West

- Market Share Analysis by Value and Volume

- Cross Comparison Parameters (Product Portfolio Breadth, Material Technology, Rim Size Coverage, OE Approval Status, Aftermarket Penetration, Average Price Positioning, Distribution Footprint, Fleet Contract Presence)

- SWOT Analysis of Key Players

Pricing Analysis by Rim Size and Finish Category - Company Profiles

Pilot Automotive

OxGord

Custom Accessories, Inc.

Plasticolor

AutoDrive

Bell Automotive

Coast to Coast International

Versaco

American Eagle Wheel Corp.

Speedway Motors

Gorilla Automotive

Automotive Gold

Wheel Pros

Marui Sum Co., Ltd.

- Demand Drivers by End-User Category

- Purchasing Criteria and Decision Metrics

- Replacement Cycles and Wear-Out Triggers

- Customization versus Standardization Preferences

- Procurement and Buying Journey Analysis

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Unit Price, 2025–2030