Market Overview

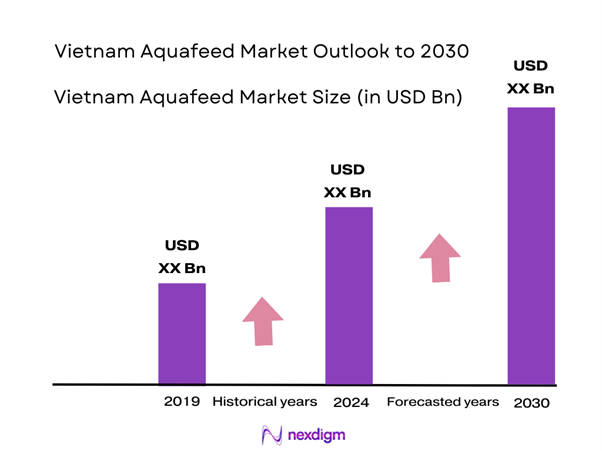

The Vietnam Aquafeed market is valued at USD 3.46 Billion in 2025 with an approximated compound annual growth rate of 5.23% from 2025-2030, based on a five-year historical analysis. The market is driven by the growing aquaculture sector, which is increasingly catering to both domestic consumption and export demand. With a rising population and growing health consciousness regarding protein sources, the demand for aquaculture products continues to climb, thus boosting the aquafeed market significantly.

Vietnam stands out as a key player in the aquafeed market, particularly due to its strategic coastal location and favorable climatic conditions that support aquaculture activities, specifically in the Mekong Delta region. Major cities like Ho Chi Minh City and Hanoi act as significant processing and distribution hubs, enhancing accessibility to global markets. The government’s support for aquaculture development, coupled with an increase in international trade, underscores Vietnam’s dominance in the aquafeed industry.

The Vietnam government has established comprehensive standards and regulations to govern aquaculture practices, ensuring food safety and environmental protection. With new guidelines implemented in 2023, producers must comply with stringent quality control measures to meet the requirements set by the Vietnam Ministry of Agriculture and Rural Development along with international standards. These regulations aim to ensure that aquafauna is raised in environments that minimize disease and maximize health, promoting both consumer confidence and export potential.

Market Segmentation

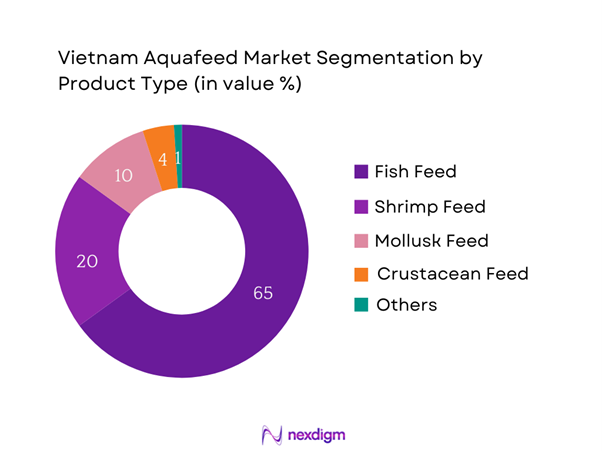

By Product Type

The Vietnam Aquafeed market is segmented by product type into fish feed, shrimp feed, mollusk feed, crustacean feed, and others. Fish feed dominates the market, owing to the prevalent aquaculture practices that heavily focus on species like pangasius and tilapia. This segment captures a major portion of the aquaculture production volume, supported by rising consumer demand for fish as a vital protein source. Established companies have created specialized formulations that enhance growth rates and feed efficiency, further solidifying fish feed’s prominence within the sector.

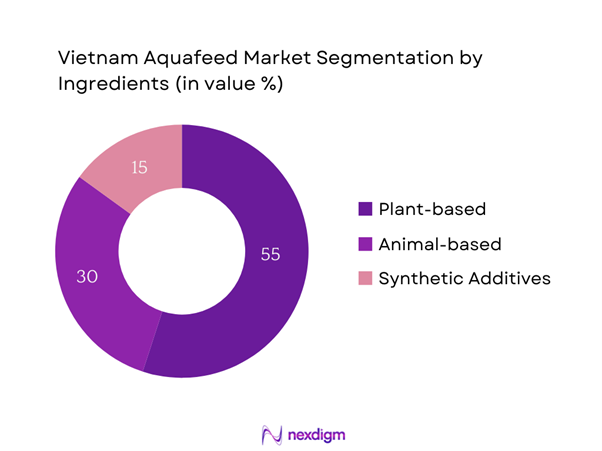

By Ingredient Type

The market is also segmented by ingredient type into plant-based, animal-based, and synthetic additives. The plant-based segment dominates, primarily due to its cost-effectiveness and the increasing demand for sustainable aquafeed options. Numerous manufacturers are focusing on incorporating plant-based proteins and nutrients in their formulations, such as soybean meal and corn, to address sustainability concerns and meet regulations regarding fishmeal usage. Furthermore, the growing awareness about the health benefits of plant-based ingredients among consumers is propelling this segment forward.

Competitive Landscape

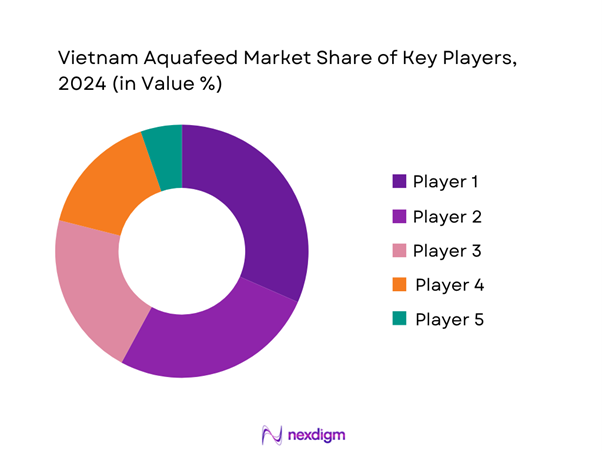

The Vietnam Aquafeed market is dominated by a few major players, including local manufacturers like Cargill Vietnam, Grobest, and Tackle, alongside global entities such as Nutreco and BioMar. The consolidation of large players illustrates the significant influence these companies have in shaping industry trends, driving innovation, and offering comprehensive distribution networks to meet growing demand.

| Company Name | Establishment Year | Headquarters | Market Segment Focus | R&D Investment | Distribution Channels | Sustainability Practices |

| Cargill | 1865 | Ho Chi Minh City | – | – | – | – |

| Grobest | 1998 | Ho Chi Minh City | – | – | – | – |

| Nutreco | 1994 | Ho Chi Minh City | – | – | – | – |

| BioMar | 1984 | Hanoi | – | – | – | – |

| Tackle | 2005 | Da Nang | – | – | – | – |

Vietnam Aquafeed Market Analysis

Growth Drivers

Increasing Seafood Demand

The demand for seafood in Vietnam has surged, reaching approximately 5.4 million tons in recent years, as more consumers recognize seafood as a healthy protein source. The country’s per capita seafood consumption has increased to about 56 kg, driven by population growth and rising disposable income, leading to a higher dietary shift toward protein-rich foods. As the global seafood market is projected to grow significantly, Vietnam aims to position itself as a leading aquaculture exporter, which will further amplify demand for aquafeed. This demand surge is crucial as seafood exports contribute significantly to Vietnam’s GDP, accounting for approximately USD 8 billion annually.

Advancements in Aquaculture Technologies

Technological advancements have significantly impacted the aquaculture sector, with innovations in feed formulation and farming practices leading to improved productivity. In 2022, the adoption of responsible aquaculture practices and next-gen feeding technologies propelled growth, yielding improved feed conversion ratios from approximately 1.2 to 1.5 in many species. Furthermore, investments in R&D for new feed ingredients, such as algae and insect protein, are becoming more prevalent, addressing concerns related to sustainability and environmental impact. The government’s support for innovative technologies has been pivotal, with underlining policies promoting sustainable aquaculture development.

Market Challenges

Regulatory Compliance

Regulatory compliance remains a significant challenge for the Vietnam aquafeed market, especially with increasingly stringent food safety and environmental regulations. Compliance with international standards requires substantial investment in quality assurance practices to ensure the safety and sustainability of aquafeed. The Vietnamese government has enacted regulations that necessitate aquafarmers and feed manufacturers to adhere to standards set by bodies like the Vietnam Ministry of Agriculture and Rural Development, which emphasizes the need for rigorous inspections.

Price Volatility of Raw Materials

The aquafeed industry is grappling with price volatility in raw materials essential for feed production. The prices of vital ingredients such as fishmeal and soybean meal have risen sharply, attributed to global supply chain disruptions and climate change impacts affecting crop yields. In the recent year, fishmeal prices soared to approximately USD 1,270 per ton, representing a significant increase from USD 1,150 in 2022. These fluctuations challenge profit margins for feed manufacturers and aquaculture producers alike, pressuring them to seek cost-effective alternatives without sacrificing quality.

Opportunities

Technological Innovations in Feed Production

The current landscape is ripe for technological innovations in feed production, which can significantly bolster the efficiency and sustainability of the aquafeed market. The rise of precision aquaculture techniques has improved feed utilization and reduced waste, with companies developing smarter feed formulations incorporating nutrients tailored to aquatic species’ specific needs. These innovations are crucial for responding to global demand trends, as the international aquaculture industry seeks sustainable practices. Investments in automation and data analytics are already reshaping production processes, enabling manufacturers to improve their offerings and expand market share.

Growing Organic Aquafeed Market

The organic aquafeed market is witnessing tremendous growth driven by consumer demand for sustainably sourced food products. Increasing awareness surrounding health and environmental impacts has led to a shift toward organic practices within the aquaculture sector. As of now, around 20% of aquafarms are exploring organic certifications, with many shifting their feed sourcing towards organic ingredients. The total organic aquafeed production in Vietnam has seen a notable uptick, with expectations that this segment will expand rapidly, bolstered by government incentives and consumer preferences for organic seafood.

Future Outlook

Over the next five years, the Vietnam Aquafeed market is expected to show significant growth due to a combination of factors, including governmental support for aquaculture, advancements in feed technology, and an increased focus on sustainability in aquaculture practices. The demand for high-quality aquafeed is projected to escalate as consumer preferences shift towards healthier protein options, driving manufacturers to innovate and adapt to meet market needs effectively.

Major Players

- Cargill

- Grobest

- Nutreco

- BioMar

- Tackle

- Alltech

- Uwatec

- Cermaq

- ADM Animal Nutrition

- Beneo

- Novus International

- INVE Aquaculture

- Skrett

- HM Clause

- Aker BioMarine

Key Target Audience

- Aquaculture Producers

- Aquafeed Manufacturers

- Distributors and Retailers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Vietnam Ministry of Agriculture and Rural Development, Ministry of Natural Resources and Environment)

- Fisheries Associations

- Exporters of Seafood Products

- Sustainable Development Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Aquafeed market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Vietnam Aquafeed market will be compiled and analyzed. This includes assessing market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. Additionally, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple aquafeed manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam Aquafeed market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Seafood Demand

Export Opportunities

Advancements in Aquaculture Technologies - Market Challenges

Regulatory Compliance

Price Volatility of Raw Materials - Opportunities

Technological Innovations in Feed Production

Growing Organic Aquafeed Market - Trends

Sustainable Practices in Feed Production

Increasing Use of Probiotics and Prebiotics - Government Regulation

Aquaculture Standards and Regulations

Environmental Impact Protocols - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Fish Feed

– Tilapia Feed

– Pangasius (Basa) Feed

– Catfish Feed

– Carp Feed

Shrimp Feed

– Whiteleg Shrimp Feed

– Black Tiger Shrimp Feed

– Hatchery Feed

Mollusk Feed

– Clam Feed

– Mussel Feed

– Oyster Feed

Crustacean Feed

– Crab Feed

– Lobster Feed

– Mixed Crustacean Feed

Others

– Eel Feed

– Frog Feed

– Specialty Species Feed - By Ingredient Type (In Value %)

Plant-Based

– Soybean Meal

– Corn Gluten Meal

– Rice Bran

– Wheat Middlings

Animal-Based

– Fish Meal

– Shrimp Meal

– Poultry By-Product Meal

– Blood Meal

Synthetic Additives

– Vitamin and Mineral Premixes

– Enzymes

– Antioxidants

– Probiotics & Growth Promoters - By Application Area (In Value %)

Commercial Aquaculture

– Industrial Fish Farms

– Intensive Shrimp Farming

– Export-Oriented Aquaculture

Subsistence Aquaculture

– Smallholder Ponds

– Community-Based Aquaculture

– Backyard Systems

Research and Development

– University Hatcheries

– Government Research Projects

– Feed Formulation Trials - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer-to-Farm

– Feed Mill Onsite Retail

Distributors

– Regional Wholesalers

– Local Feed Agents

– Franchise-Based Distribution

Online Sales

– Company E-Commerce Platforms

– Agricultural E-Marketplaces (e.g., Tiki Agri, Shopee Agri) - By Region (In Value %)

Northern Region

Central Region

Southern Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Aquafeed Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenue by Species Type, Production Capacity, Number of Feed Mills / Production Plants, Distribution Channels, Product Portfolio Breadth, Unique Value Offering, R&D Investment and Innovation Pipeline, Sustainability Certifications, Raw Material Sourcing Strategy, Customer Segments, Profit Margins, Strategic Partnerships)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

Cargill

BASF SE

DSM

Evonik Industries

Novozymes

Alltech

Adisseo

Kemin Industries

DuPont

Archer Daniels Midland (ADM)

Charoen Pokphand Foods

Trouw Nutrition

Sumitomo Chemical

Nutreco

Zinpro Corporation

- Market Demand and Utilization

- Purchasing Power Trends

- Regulatory and Compliance Forces

- Needs and Pain Point Analysis

- Decision-Making Process

By Value, 2025-2030

By Volume, 2025-2030

By Average Price, 2025-2030