Market Overview

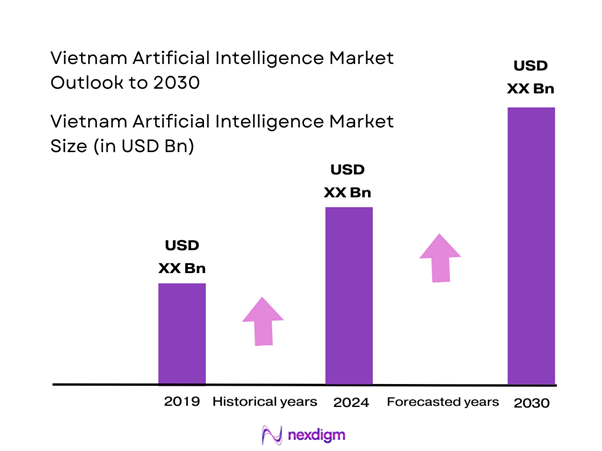

The Vietnam Artificial Intelligence market is valued at USD 753.4 million in 2024 with a Compound Annual Growth Rate of 14.96% from 2024-2030, driven by substantial investments from both government and private sectors in AI technologies and applications. This growth is attributed to the rapid digital transformation occurring across various industries, such as healthcare, finance, and retail, leading to an increased demand for AI solutions. Additionally, initiatives to cultivate a robust AI ecosystem have been implemented, promoting research and development, which helps to solidify the market’s growth trajectory.

Significant cities driving the growth of the Vietnam Artificial Intelligence market include Ho Chi Minh City and Hanoi. Ho Chi Minh City serves as the economic center, fostering a vibrant startup culture supported by technological investment. Hanoi, being the political hub, is also focused on advancing digital transformation through government-backed initiatives, making both cities attractive for AI development. These urban centers are home to numerous tech companies and research institutions, bolstering the local demand and innovation necessary for a thriving AI ecosystem.

The Vietnamese government has prioritized technological advancements through policies designed to foster the growth of the AI sector. As part of its National Strategy for Artificial Intelligence Development, which aims for a significant increase in national AI capabilities by end of 2025, the government plans to allocate USD 1 billion to support AI initiatives, enhance infrastructure, and promote research and development.

Market Segmentation

By Technology

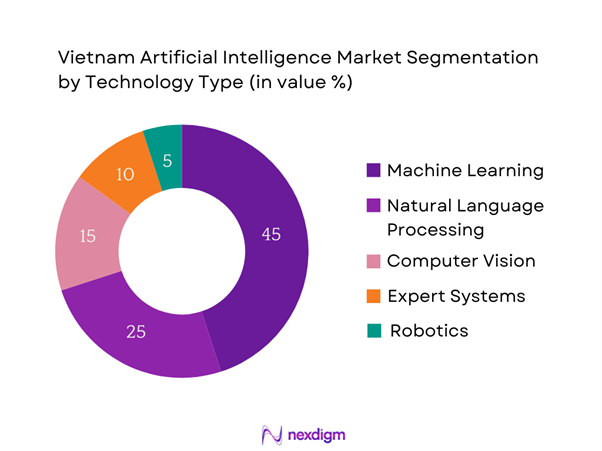

The Vietnam Artificial Intelligence market is segmented by technology into machine learning, natural language processing (NLP), computer vision, expert systems, and robotics. Among these, machine learning holds a dominant market share due to its versatility and applicability across various sectors. Its ability to automate processes, analyze large datasets, and generate predictive insights makes it indispensable for businesses looking to enhance operational efficiencies. Companies in finance and customer service rely heavily on machine learning algorithms to improve decision-making and user experience. The rapid increase in data generation has also propelled the need for machine learning solutions, as organizations seek to harness data for strategic advantages.

By Application

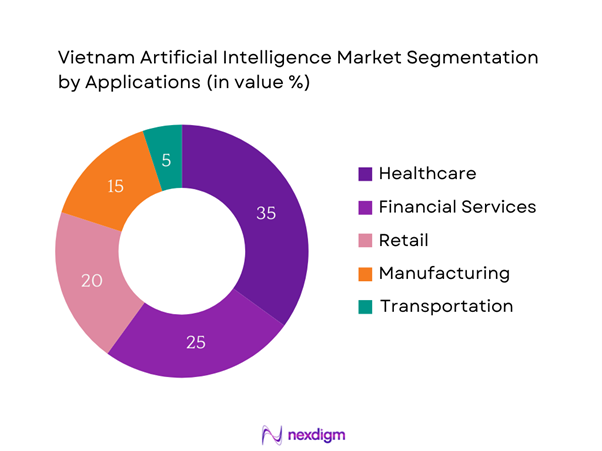

The market is also segmented by application, including healthcare, financial services, retail, manufacturing, and transportation. The healthcare segment is currently dominating the market share, primarily due to the increasing integration of AI technologies in diagnostics labs, patient care, and administrative tasks. By utilizing AI for predictive analytics, diagnosis assistance, and personalized medicine, the healthcare sector significantly enhances patient outcomes while optimizing operational efficiency. The demand for AI in healthcare has surged, particularly post-pandemic, as the industry strives for innovative solutions to improve healthcare delivery and accessibility.

Competitive Landscape

The Vietnam Artificial Intelligence market is characterized by the presence of several major players including local firms and global technology leaders. The competitive environment features a variety of innovative companies that significantly shape the market landscape. Noteworthy players include FPT Corporation, Viettel Group, and VNG Corporation, who capitalize on their expertise and localized knowledge to offer tailored AI solutions. This concentration of both local and international capabilities facilitates significant advancements across industries, reinforcing the overall growth of the market.

| Company | Establishment Year | Headquarters | Key Technology Focus | Key Application Areas | Employee Count |

| FPT Corporation | 1988 | Hanoi, Vietnam | – | – | – |

| Viettel Group | 2004 | Hanoi, Vietnam | – | – | – |

| VNG Corporation | 2004 | Ho Chi Minh City | – | – | – |

| TMA Solutions | 2000 | Ho Chi Minh City | – | – | – |

| CMC Corporation | 1993 | Hanoi, Vietnam | – | – | – |

Vietnam Artificial Intelligence Market Analysis

Growth Drivers

Increasing Investment in Technology

In 2023, Vietnam’s overall technology sector saw an influx of USD 1.5 billion in foreign direct investment (FDI) specifically targeting AI startups and technology innovation. This upsurge in investment can be attributed to foreign investors recognizing the potential of Vietnam as an emerging technology hub in Southeast Asia. With a rapidly growing digital economy valued at USD 14 billion, further investments are anticipated as companies seek to harness AI for competitive advantage.

Enhancements in Data Processing Capabilities

Vietnam’s data processing capabilities are evolving rapidly, fueled by investments in cloud computing and big data technologies. As of 2023, the adoption of cloud services in Vietnam is projected to exceed USD 6 billion, highlighting the shift towards efficient data management practices. This progress is critical for AI deployment, as AI models require access to vast data sets for training and forecasting. Enhanced internet connectivity, with over 72 million internet users, facilitates faster data access and processing capabilities, thereby reinforcing the AI ecosystem as organizations seek to optimize operations and decision-making processes.

Market Challenges

Data Privacy Concerns

As the use of AI expands, so do concerns surrounding data privacy and security. In 2023, Vietnam’s Ministry of Information and Communications reported that over 79% of Vietnamese internet users expressed worries about data misuse and breaches, particularly around personal information handled by AI technologies. Regulatory frameworks focusing on data protection are still in their nascent stages, which adds skepticism among businesses about compliance and trust. Addressing these concerns is critical for fostering consumer confidence as the AI market progresses.

Limited Infrastructure in Rural Areas

Infrastructure disparities present a significant challenge for AI implementation, particularly in rural Vietnam, where only 37% of households have internet access. This gap limits the reach of AI solutions and hinders the ability of rural businesses to adopt technological advancements. With rural areas contributing to about 65% of the population, addressing these infrastructural inadequacies is crucial for ensuring equitable AI development and access across the country. Efforts to enhance broadband connectivity in these regions are essential for market-wide integration of artificial intelligence

Opportunities

Expansion of Startups

The startup ecosystem in Vietnam is flourishing, with more than 3,000 startups operating in the technology sector, 30% of which focus on AI solutions. This robust environment fosters innovation and competition, appealing to venture capitalists and global investors. In 2023, Vietnam attracted USD 1 billion in investments for technology startups, with a significant portion aimed at those developing AI applications. The government is actively providing support through funding and mentorship programs to nurture these startups, recognizing their role as key drivers of economic growth. As more entrepreneurs enter the AI space, the potential for groundbreaking solutions that address local and global challenges expands, positioning Vietnam as a significant player in the AI landscape. Furthermore, the proliferation of incubators and accelerators is expected to create a supportive ecosystem for the next generation of AI innovators.

Collaboration with Global Tech Giants

Vietnam’s strategic partnerships with global technology leaders provide ample opportunities for market growth. Collaborations with companies such as Microsoft and Google foster knowledge transfer and technology sharing critical for local companies. In recent years, major tech firms have expanded their presence in Vietnam, launching programs that support AI research and development, as well as local talent training initiatives. Such partnerships allow Vietnamese firms to leverage advanced technologies and expertise while creating a more robust AI landscape, ultimately enhancing competitiveness regionally and globally. The trend is expected to accelerate growth in both the public and private sectors.

Future Outlook

Over the next five years, the Vietnam Artificial Intelligence market is expected to align with the global trend towards digital transformation, anticipated to witness substantial growth driven by continuous government promotion of technology adoption, advancements in AI capabilities, and a booming startup ecosystem. The focus on AI as a core component of national strategy enhances collaborative efforts between government bodies and private enterprises, fostering innovation and increasing competitiveness. As the demand for AI solutions grows across various sectors, investment in research and development will play a pivotal role in the growth trajectory of the market. This synergy between public and private sectors will not only create job opportunities but also establish Vietnam as a regional hub for AI innovation.

Major Players

- FPT Corporation

- Viettel Group

- VNG Corporation

- TMA Solutions

- CMC Corporation

- G-Group

- NovaGroup

- Be Group

- vn

- Momo

- VinGroup

- Global CyberSoft

- AIT (Artificial Intelligence Technology)

- Tinhvan Group

- HPT Vietnam

Key Target Audience

- Technology Companies

- Healthcare Providers

- Financial Institutions

- Retail Chains

- Transportation and Logistics Firms

- Government and Regulatory Bodies (Ministry of Science and Technology, Ministry of Information and Communications)

- Investments and Venture Capitalist Firms

- Research and Development Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the Vietnam Artificial Intelligence Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

This phase includes compiling and analyzing historical data pertaining to the Vietnam Artificial Intelligence Market. Detailed assessments of market penetration, leading technology applications, and significant player contributions will be evaluated to ensure accuracy in market sizing and forecasting. Additionally, an exploration of technological advancements informs the projections of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through comprehensive interviews with industry experts representing various segments of the AI space. These consultations provide valuable operational, technological, and financial insights directly from practitioners, which help in enhancing and corroborating the market data collected through initial research processes.

Step 4: Research Synthesis and Final Output

This final phase involves integrating insights from multiple AI-focused companies to acquire detailed perspectives on product offerings, consumer preferences, and competitive dynamics. Interactions will verify data obtained from various sources and serve to complement the overall analysis, ensuring a robust and authoritative examination of the Vietnam Artificial Intelligence Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics and Trends

- Timeline of Major Players

- Business Cycle

- Revenue Model

- Growth Drivers

Increasing Investments in AI Startups

Rising Demand for Automation

Government Initiatives and Public Policy - Market Challenges

Skills Gap in Workforce

Data Privacy Concerns - Opportunities

Advancements in AI Technologies

Rising Adoption of AI Across Various Industries - Trends

Increasing AI Adoption in SMEs

Growth of AI Ethics and Governance - Government Regulation

AI Policy Frameworks

Data Protection Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019–2024

- By Component, 2019-2024

- By Technology Type, 2019-2024

- By Technology Type (In Value %)

Machine Learning

– Supervised Learning

– Unsupervised Learning

– Reinforcement Learning

– Predictive Analytics (e.g., forecasting models in finance and agriculture)

Natural Language Processing (NLP)

– Speech Recognition

– Text Analytics & Sentiment Analysis

– Chatbots & Virtual Assistants

– Machine Translation

Computer Vision

– Facial Recognition

– Image Processing in Healthcare

– Object Detection in Retail and Traffic Monitoring

– Optical Character Recognition (OCR)

Expert Systems

– Decision Support Systems

– Diagnostic Systems in Healthcare

– Fraud Detection Engines in Banking

– Maintenance Advisory Tools in Manufacturing

Robotics

– Industrial Robots

– Service Robots

– Educational Robots

– Autonomous Mobile Robots (AMRs) for warehouses - By Application Sector (In Value %)

Healthcare

– AI-Assisted Diagnostics

– Patient Monitoring Systems

– Hospital Chatbots & Appointment Scheduling

– Radiology Image Analysis

Financial Services

– Credit Scoring & Risk Assessment

– Fraud Detection

– Robo-Advisors for Wealth Management

– Customer Service Automation (AI Chatbots)

Retail

– Demand Forecasting

– Visual Search & Image Recognition

– Personalized Recommendations

– Inventory Automation & Dynamic Pricing

Manufacturing

– Predictive Maintenance

– Quality Control via Computer Vision

– Smart Automation & Assembly Line Robotics

– AI-Driven Supply Chain Optimization

Transportation

– Intelligent Traffic Management Systems

– AI-Based Route Optimization

– Autonomous or Semi-Autonomous Vehicles

– Predictive Maintenance for Public Transport - By Deployment Model (In Value %)

Cloud

– Public Cloud AI Platforms

– SaaS AI Tools

– Hybrid Cloud Models

On-Premises

– AI Infrastructure in Government Agencies & Large Enterprises

– On-prem Machine Learning Engines (for compliance-sensitive sectors)

– Edge AI Deployment in Manufacturing - By End User Type (In Value %)

Large Enterprises

– Multinational Corporations

– State-Owned Enterprises in Telecom, Banking, and Energy

– Large Tech Conglomerates

– Enterprises with Dedicated AI/ML Teams

SMEs

– AI Startups

– Mid-sized E-commerce Retailers

– Local Healthcare Clinics & Diagnostic Centers

– Small Manufacturers deploying affordable AI tools - By Region (In Value %)

Northern Vietnam

Southern Vietnam

Central Vietnam

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Artificial Technology Segment, 2024 - Cross Comparison Parameters (Company Overview, Year Established, Product & Solution Offerings, Business Strategies, Recent Developments, Organizational Structure, Revenue, Client Segments, R&D Investment, Partnership Networks, Market Penetration, Unique Value Proposition)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

FPT Corporation

Viettel Group

Bkav Corporation

MobiFone

VNEDU

VinAI Research

CMC Corporation

TMA Solutions

Thang Long Data Center

ECM Technologies

VNG Corporation

Lotus AI

DTT Technology Group

MLL Technology

Techfest Vietnam

- Market Demand and Utilization

- Purchasing Power and Budget Allocation

- Regulatory and Compliance Requirements

- Needs and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Component, 2025-2030

- By Technology Type, 2025-2030