Market Overview

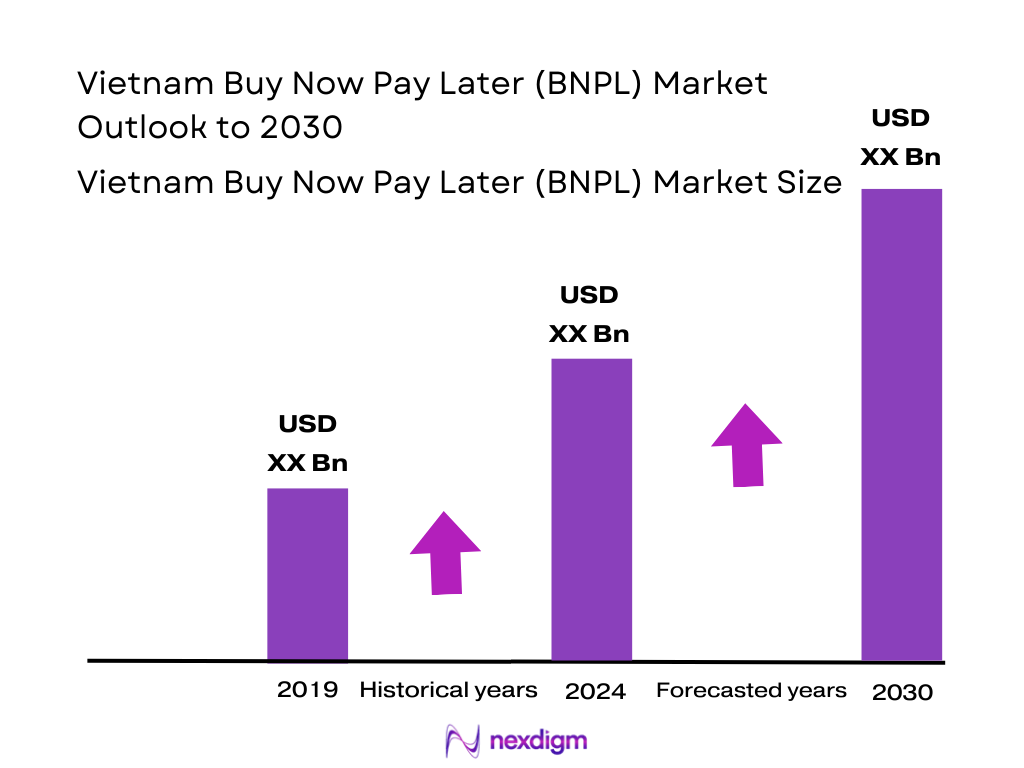

The Vietnam BNPL market is valued at USD 1.91 billion, based on a five‑year historical analysis, reflecting performance through early 2024. This scale is driven by Vietnam’s booming e‑commerce sector (with BNPL GMV reaching USD 3.33 billion in e‑commerce alone) and limited credit‑card penetration, pushing both consumers and merchants toward flexible financing options and digital wallets like MoMo, Grab and ZaloPay.

Urban centers—such as Ho Chi Minh City, Hanoi, and Da Nang—are at the heart of BNPL activity. This concentration stems from high smartphone and internet access, dense merchant networks, and rapid fintech adoption in these metros. Their digital infrastructure and elevated discretionary spending foster seamless BNPL integrations at checkout, both online and offline.

Market Segmentation

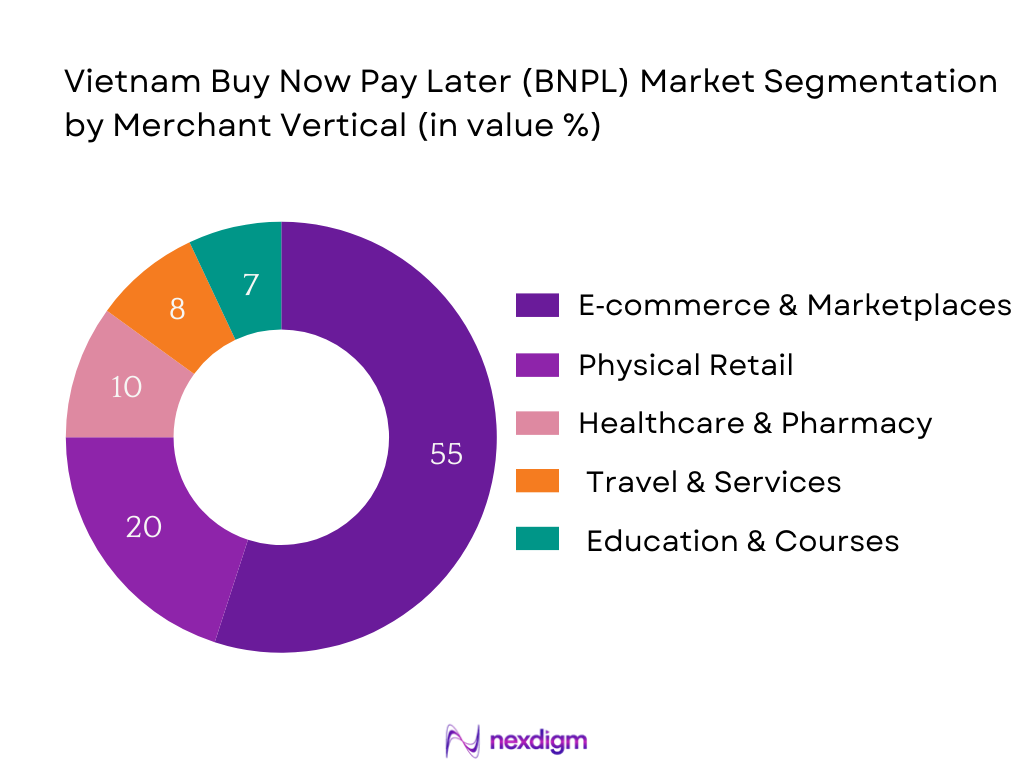

By Merchant Vertical

The Vietnam BNPL market is segmented into e‑commerce & marketplaces, physical retail, healthcare & pharmacy, travel & services, and education. The e‑commerce & marketplaces sub‑segment commands the dominant share—about 55 %, due to its frictionless integration, high transaction frequency, and broad user base. Key players like MoMo, Fundiin, and Atome partner with leading platforms, catalyzing adoption across product categories and urban and peri‑urban consumers.

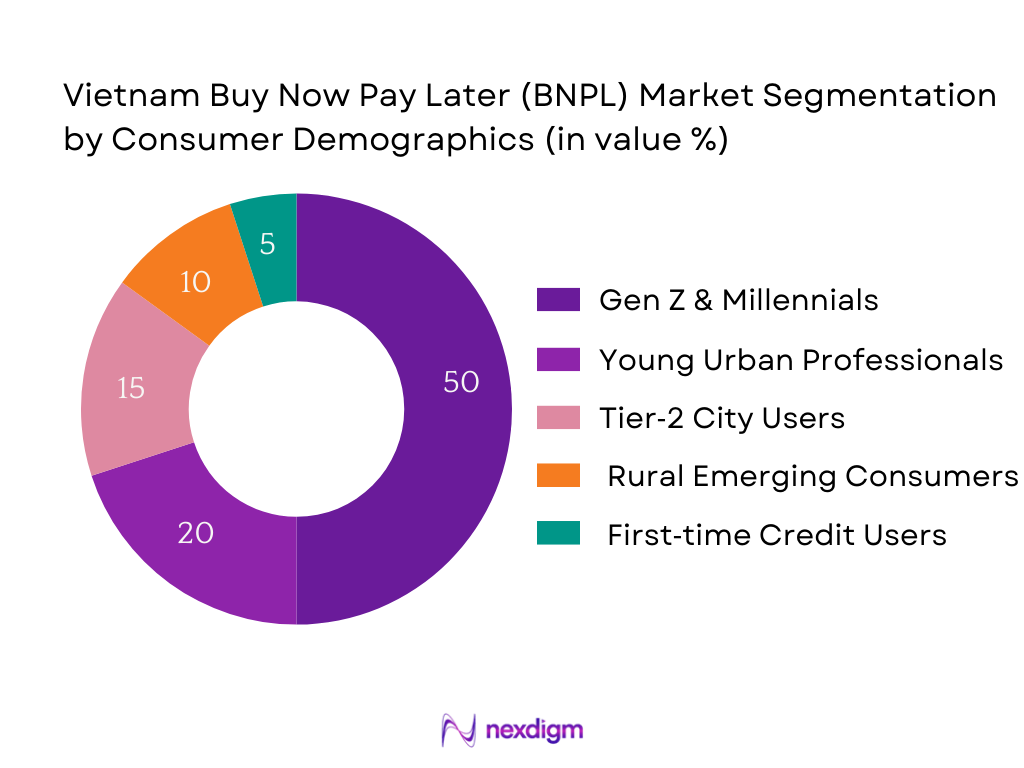

By Consumer Demographic

The BNPL ecosystem segments the user base into Gen Z & Millennials, young urban professionals, Tier‑2 city users, rural emerging consumers, and first‑time credit users. Gen Z & Millennials hold about 50 % of 2024 BNPL volume, driven by their digital savviness, comfort with mobile payments, and preference for flexible purchasing. They are active across e‑commerce, travel bookings, and lifestyle segments, often using embedded BNPL in apps like Shopee and MoMo.

Competitive Landscape

Vietnam’s BNPL market is shaped by both ambitious local fintechs and regional players integrating with digital platforms and brick‑and‑mortar retail. Leaders such as MoMo BNPL, ZaloPay BNPL, Shopee PayLater, and Atome (in partnership with pharmacy chains) are redefining consumer credit access. The competitive environment reflects an ecosystem where digital wallets, e‑commerce operators, and financial services converge to deliver accessible, flexible credit solutions.

| Player | Established | Headquarters | Regulatory Partnership | Merchant Coverage | Underwriting Model | Average Tenor | Fee Structure | Digital Integration |

| MoMo BNPL | 2010 | Ho Chi Minh City | – | – | – | – | – | – |

| ZaloPay BNPL | 2012 | Hanoi | – | – | – | – | – | – |

| Shopee PayLater | 2015 | Singapore (VN ops) | – | – | – | – | – | – |

| Atome (with Kredivo) | 2018 | Singapore (VN ops) | – | – | – | – | – | – |

| Home Credit BNPL | 1997 | Ho Chi Minh City | – | – | – | – | – | – |

Vietnam BNPL Market Analysis

Growth Drivers

Smartphone Adoption

Vietnam’s digital ecosystem is buoyed by remarkable smartphone penetration: there were 169.8 mobile phone subscriptions per 100 inhabitants in 2024, up from 148 in 2022—indicative of widespread access to digital connectivity and multiple SIM usage. The population was approximately 99.19 million in early 2024. This means there were roughly 168.5 million active cellular mobile connections, aligning closely with total subscriptions and further emphasizing mobile-first outreach and digital wallet usage, critical to BNPL adoption in both urban and semi-urban centers. Such saturation indicates that the majority of consumers carry at least one smartphone, enabling effortless access to fintech and BNPL services, underpinning the viability of app-based, on-the-go BNPL offerings.

E‑commerce Expansion

Vietnam’s e‑commerce momentum is evident: the market value surpassed USD 25 billion in 2024, marking a 20 percent increase versus the prior year. Mobile devices accounted for 70 percent of e‑commerce transaction volume, underscoring mobile’s dominance in digital purchasing. Concurrently, approximately 57 million Vietnamese were shopping online in 2024, with Gen Z comprising 43 percent of those consumers. This digital commerce surge, primarily driven by a youthful, mobile-native populace using platforms such as Shopee, Lazada, Tiki, and TikTok Shop, has naturally accelerated demand for flexible payment alternatives like BNPL, particularly as mobile-based checkout becomes ubiquitous.

Market Challenges

Regulatory Uncertainty

While BNPL growth is sparking interest, regulation remains in flux. As of early 2025, a formal BNPL-specific regulatory framework was anticipated by 2025–26, to emerge from the State Bank of Vietnam’s broader fintech oversight strategies, including mandatory disclosures, late-fee caps, and eligibility checks. Moreover, Vietnam currently lacks open banking or digital-lending-specific regulations, as its domestic payment infrastructure and governance regimes remain legacy-based—even though modernization is under consideration in the near term. The uncertainty surrounding timeline, licensing requirements, and compliance standards poses a structural risk for BNPL providers, who must navigate evolving expectations around consumer protection, licensing, and fintech governance.

Delinquency Risks

Credit quality remains a concern. Vietnam’s overall banking non‑performing loan (NPL) ratio narrowed modestly to 2.25 percent in 2024—down a few basis points year-on-year—but this statistic masks potential risk pockets, particularly within unsecured consumer lending. Conversely, earlier in 2024, the broader banking system’s bad debts had risen to 4.94 percent as of May, up from 4.55 percent at end‑2023. Meanwhile, consumer finance lenders experienced a ‑9.1 percent year-on-year decline in loan book growth during 2023, indicating tightening credit demand and worsening asset quality. These signs highlight elevated delinquency and provisioning pressures for BNPL portfolios—especially if underwriting and recovery frameworks lag behind.

Opportunities

Tier‑2 & Tier‑3 City Expansion

Vietnam’s e‑commerce landscape is evolving beyond the traditional metropolis boundaries. While Ho Chi Minh City and Hanoi remain dominant in transaction value, rapid infrastructure growth has opened corridors in Da Nang, Can Tho, Hai Phong, and Nha Trang. Urban household e‑commerce adoption reached 60 percent in metropolitan areas in 2024, compared to just 29 percent in rural zones—though government‑backed rural fiber programs are narrowing this gap. These emerging digital pockets in secondary cities represent a fertile expansion path for BNPL providers, who can tap underserved populations through mobile-first solutions aligned with improving broadband and digital infrastructure.

Healthcare & Education BNPL

Vietnam’s public investment in education was estimated at VND 380,561 billion (approx. USD 14.5 billion) in 2024, equivalent to around 6 percent of GDP. Lower-secondary enrollment achieved 95 percent, and upper-secondary 80 percent. These figures underscore both strong institutional investment and consumer demand in education, while healthcare spending and related services continue growing. Embedding BNPL into tuition and medical services payments can lower upfront financial burdens for households. Given the volume of spend and consistent demand, these verticals offer scalable opportunities for BNPL rollouts—particularly in facilitating access to quality education and healthcare in urban and peri-urban areas.

Future Outlook

Over the next several years, the Vietnam BNPL market is expected to grow significantly, supported by expanding e‑commerce, rising digital wallet use, and demand from underserved credit segments. The transition from metro to Tier‑2/3 cities, increased regulatory clarity, and partnerships with retailers and utilities will drive broader adoption. Technological innovations like credit scoring via alternative data and embedded BNPL at points of sale will deepen market penetration.

Major Players

- MoMo BNPL

- ZaloPay BNPL

- Shopee PayLater

- Tiki Nguyen BNPL

- GrabPay Later

- VPBank PayLater

- FE Credit BNPL

- VietCredit BNPL

- Home Credit BNPL

- Samsung Finance Plus (BNPL)

- Moca PayLater

- Lazada PayLater

- OnePay Installment

- Atome (via non‑bank JV)

- Kredivo (Vietnam JV)

Key Target Audience

- Chief Investment Officers & Portfolio Heads at Investment and Venture Capitalist Firms

- Heads of Digital Strategy / Product at Major Retail Chains

- CTOs/Product Directors at Leading E‑commerce Platforms

- Heads of Payment Innovation at Mobile Wallet Providers

- Directors of Retail Banking & Consumer Finance at Commercial Banks

- Heads of Digital Lending – Microfinance Institutions

- Policy Leads at State Bank of Vietnam (Regulation of BNPL)

- Consumer Protection Directors at Ministry of Industry and Trade (online credit oversight)

Research Methodology

Step 1: Identification of Key Variables

We mapped Vietnam’s BNPL ecosystem—covering fintechs, digital wallets, e‑commerce platforms, banks, regulators—via tier‑1/2 desk research and proprietary databases, defining core metrics like GMV, user segments, underwriting models.

Step 2: Market Analysis and Construction

Historical data (2021–2024) on BNPL volumes, values, transaction counts, ARPU, and merchant categories were compiled and analyzed to validate revenue patterns and establish segment share bases.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on growth drivers and demographic adoption were vetted through structured interviews (via CATI) with fintech executives, digital wallet leads, merchant consortiums, and compliance officers.

Step 4: Research Synthesis and Final Output

We cross‑validated insights with BNPL providers and regulatory feedback to ensure accuracy, then synthesized findings into actionable strategic insights tailored for business professionals.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In-depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major BNPL Introductions in Vietnam

- Regulatory & Licensing Framework (State Bank of Vietnam oversight, Consumer Finance guidelines)

- Supply Chain and Value Chain Analysis (BNPL Provider–Merchant–Consumer–Bank/E-wallet–Regulator)

- Growth Drivers (Smartphone adoption, E-commerce expansion, Low credit penetration, Digital wallet usage)

- Market Challenges (Regulatory uncertainty, Delinquency risks, Merchant reluctance, Limited consumer awareness outside cities)

- Opportunities (Tier-2 & Tier-3 city expansion, Healthcare/Education BNPL, Embedded finance with e-wallets)

- Trends (Integration with super-apps, Loyalty-linked BNPL, Cross-border BNPL for outbound tourism)

- Government Regulation (Consumer protection framework, State Bank sandbox initiatives, Data privacy rules)

- SWOT Analysis

- Stake Ecosystem (Consumers, Merchants, BNPL providers, Banks, Regulators, Tech enablers)

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Revenue per User (ARPU), 2019-2024

- By Merchant Vertical (In Value %)

E-commerce Marketplace

Physical Retail (Electronics, Fashion, F&B)

Travel & Hospitality

Healthcare & Wellness

Education & Courses - By Consumer Demographic (In Value %)

Millennials & Gen Z

Urban Affluent Consumers

Tier-2 City Consumers

Rural Emerging Users

First-time Credit Users - By BNPL Duration & Payment Terms (In Value %)

Pay-in-4 Instalments

Monthly Instalments (3–12 months)

At-checkout Deferred Payment (15–30 days) - By Channel (In Value %)

Online/M-commerce

In-store QR-based BNPL

App-integrated E-wallet BNPL - By Platform Type (In Value %)

Pure-play Fintech BNPL Providers

Bank-affiliated BNPL Offerings

E-wallet / Super-app BNPL Modules

- Market Share of Major Players by Value/Volume

- Cross Comparison Parameters: (Company Overview, Regulatory Partnerships, Merchant Acquisition Strategy, Underwriting & Risk Analytics Model, Delinquency Rate, Average Tenor & Ticket Size, Consumer Segmentation & Reach, Tech Stack & Digital Capabilities)

- SWOT Analysis of Major Players

- Pricing & Fee Structure Benchmarking

- Detailed Profiles of 15 Competitors:

MoMo BNPL

ZaloPay BNPL

Shopee PayLater

Tiki Nguyen BNPL

GrabPay Later

VPBank PayLater

FE Credit BNPL

VietCredit BNPL

Home Credit BNPL

Samsung Finance Plus (BNPL)

Moca PayLater

Lazada PayLater

OnePay Installment

Afterpay (Vietnam JV)

Klarna (Vietnam expansion)

- Adoption Drivers & Purchase Behavior

- Purchasing Power & Spending Pattern

- Regulatory & Compliance Awareness

- Needs, Desires, and Pain Points (late fees, credit transparency, merchant coverage)

- Decision-Making Journey (from awareness to repayment behavior)

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Revenue per User, 2025-2030