Market Overview

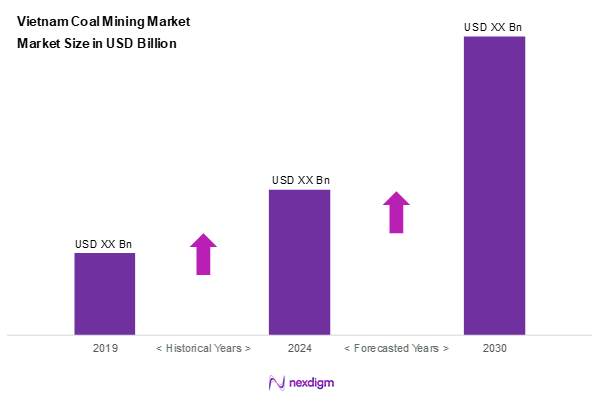

As of 2024, the Vietnam coal mining market is valued at USD 15.8 billion, with a growing CAGR of 2.1% from 2024 to 2030. It is primarily driven by increasing energy demands and significant investments in infrastructure development. These factors create a strong need for coal to power industries, infrastructure projects, and residential areas as the country continues its rapid industrialization. The growing population also contributes to the heightened demand for energy sources such as coal, solidifying the market’s essential role within the economy.

Key cities dominating the Vietnam coal mining market include Quang Ninh, Ha Noi, and Ho Chi Minh City. Quang Ninh is the largest coal-producing region in the country, hosting numerous coal mines and significant infrastructure for coal transport. Ha Noi and Ho Chi Minh City serve as major consumption hubs, given their extensive industrial sectors and energy requirements. The concentration of these cities facilitates local coal supply chains and strengthens their positions within the market.

Market Segmentation

By Coal Type

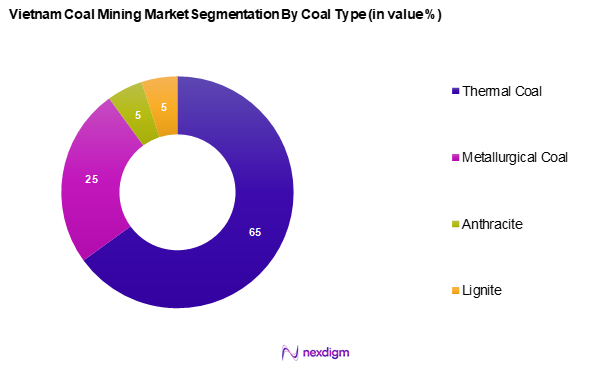

The Vietnam coal mining market is segmented into thermal coal, metallurgical coal, anthracite, and lignite. Among these, thermal coal holds the dominant market share due to its extensive use in power generation. As Vietnam works towards increasing its electricity production to meet growing demand, thermal coal remains a crucial energy source. The country’s commitment to coal as part of its energy mix ensures that thermal coal is favored over other types, despite environmental concerns.

By Mine Type

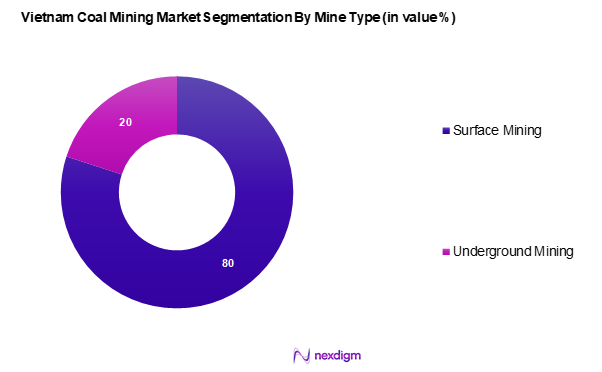

The Vietnam coal mining market is segmented into surface mining and underground mining. Surface mining has a dominant market share, primarily due to its cost-effectiveness and the ability to extract large quantities of coal efficiently. In Vietnam, surface mining techniques such as open-pit mining are widely applied, and the operational costs are lower compared to underground mining. This adaptability is essential in meeting the increasing energy demands of various industries and helps leverage the extensive coal reserves available.

Competitive Landscape

The Vietnam coal mining market is dominated by a few major players, with a mix of state-owned enterprises and private companies. This consolidation indicates a significant influence of these key companies on the market.

| Major Player | Establishment Year | Headquarters | Annual Revenue (USD) | Key Coal Types Produced | Market Innovation |

| Vinacomin | 2008 | Ha Noi | – | – | – |

| Nui Beo Coal Joint Stock Company | 2005 | Quang Ninh | – | – | – |

| Hong Ha Coal JSC | 1996 | Quang Ninh | – | – | – |

| Quang Ninh Coal JSC | 1971 | Quang Ninh | – | – | – |

| Vietnam National Coal – Mineral Industries Holding Corporation Limited | 1995 | Ha Noi | – | – | – |

Vietnam Coal Mining Market Analysis

Growth Drivers

Increasing Energy Demand

Vietnam’s energy consumption is witnessing steady growth, fuelled by rapid urban development and a booming industrial sector. As the country pursues consistent economic expansion, the demand for electricity continues to surge. Coal remains a key energy source in the national power mix, with government plans reinforcing its role in power generation. This increasing energy appetite is expected to keep coal mining activities active and essential.

Infrastructure Development Projects

Major infrastructure developments are underway across Vietnam, including upgrades to transport networks and energy systems. These projects are crucial to sustaining the country’s economic progress and include the construction of new highways and power plants. The reliance on coal-powered machinery and the need for energy-intensive construction support the continued relevance of coal in meeting infrastructure demands. Improved logistics networks also create a more efficient coal supply chain, further benefiting mining operations.

Market Challenges

Regulatory Compliance Issues

Coal mining companies in Vietnam face increasing pressure to comply with stringent regulations concerning operational safety and environmental standards. While these regulations aim to enhance sustainability and protect worker welfare, they also result in higher operational costs. Balancing regulatory compliance with profitability is becoming an ongoing concern for industry players.

Environmental Concerns

Environmental degradation caused by coal mining has become a focal issue, attracting scrutiny from both authorities and the public. Companies are being required to invest in better waste management practices and minimize ecological impact, which adds to operational complexity. Addressing environmental issues is critical for the industry’s long-term viability but presents a significant challenge in the current landscape.

Opportunities

Technological Advancements in Mining

The adoption of modern mining technologies is transforming the coal sector in Vietnam. Automation and mechanization are enhancing both safety and efficiency, allowing for more sustainable extraction processes. These advancements present opportunities for coal companies to increase productivity and reduce operational risks, supporting future growth.

Expansion into New Markets

Vietnam’s coal industry is exploring export opportunities in nearby regions where demand for thermal coal is rising. Strengthening trade relationships with neighbouring countries positions Vietnam as a competitive coal supplier in Southeast Asia. Diversifying export markets not only enhances revenue streams but also reduces dependence on domestic consumption alone.

Future Outlook

Over the next five years, the Vietnam coal mining market is expected to experience significant growth, driven by robust energy demand and government initiatives to expand coal production. The government’s focus on infrastructure development and energy security supports the market’s continued reliance on coal as an energy source. Additionally, advancements in mining technologies and practices will enable more environmentally sustainable operations while meeting the increasing needs of the industry.

Major Players

- Vinacomin

- Nui Beo Coal Joint Stock Company

- Hong Ha Coal JSC

- Quang Ninh Coal JSC

- Vietnam National Coal – Mineral Industries Holding Corporation Limited

- Ha Lam Coal JSC

- Southern Coal Trade JSC

- Northern Coal Industry Corporation

- Dong Bac Corporation

- Vietnam Machinery Erection Corporation

- General Department of Geology and Minerals of Vietnam

- Vinacomin – Power Holding Corporation

- Vietnam Coal Industry Group

- Quang Ninh Construction Investment JSC

- Joint Stock Company of Minerals and Ha Tinh Coal

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Industry and Trade)

- Energy Sector Stakeholders

- Utility Companies

- Environmental Agencies

- Coal Exporting Companies

- Heavy Machinery Manufacturers

- Industrial Energy Consumers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam coal mining market. This step is underpinned by an extensive desk research methodology, utilizing a combination of secondary data from industry reports, government publications, and proprietary databases to gather comprehensive information. The primary objective is to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase compiles and analyzes historical data related to the Vietnam coal mining market. It involves assessing market penetration, coal production statistics, and consumption ratios across various industries. Furthermore, an evaluation of geographical distribution and resource accessibility is conducted to ensure the reliability and accuracy of the revenue generation estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through consultations with industry experts. Computer-assisted telephone interviews (CATIs) with professionals from various companies within the coal sector provide valuable operational and financial insights that are instrumental in refining and corroborating market data. This method allows for real-time feedback and validation of the assumptions made during the analysis.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple coal mining operators to acquire detailed insights into production capabilities, market trends, and consumer preferences. This interaction ensures the integration of practical knowledge with statistical data gathered from the previous steps, resulting in a comprehensive, accurate, and validated analysis of the Vietnam coal mining market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Energy Demand

Infrastructure Development Projects

Government Initiatives for Coal Production - Market Challenges

Regulatory Compliance Issues

Environmental Concerns

Competition from Renewable Energy Sources - Opportunities

Technological Advancements in Mining

Expansion into New Markets - Trends

Shift Towards Clean Coal Technologies

Increasing Investments in Coal Mining - Government Regulations

Mining Safety Regulations

Emission Standards

Import/Export Policies - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Coal Type

Thermal Coal

– Sub-bituminous Thermal Coal

– Pulverized Coal for Power Plants

– Low Ash Thermal Coal

Metallurgical Coal

– Coking Coal

– Semi-soft Coking Coal

– PCI (Pulverized Coal Injection) Coal

Anthracite

– High-Grade Anthracite

– Medium-Grade Anthracite

– Washed Anthracite

Lignite

– Low Moisture Lignite

– High Moisture Lignite - By Mine Type

Surface Mining

– Open-Cast Mining

– Strip Mining

Underground Mining

– Room and Pillar Mining

– Longwall Mining

– Drift Mining - By Region

Northern Vietnam

Central Vietnam

Southern Vietnam - By End-Use Industry

Power Generation

– State-Owned Thermal Plants

– Independent Power Producers (IPPs)

Steel Production

– Integrated Steel Mills

– Mini Steel Plants

Cement Manufacturing

– Rotary Kiln Cement Plants

– Clinker Units

Others

– Ceramic and Brick Manufacturing

– Paper and Pulp Industry

– Industrial Boilers - By Market Structure

Organized Sector

– Vinacomin (Vietnam National Coal and Mineral Industries Group)

– TKV Subsidiaries

– Licensed Private Enterprises

Unorganized Sector

– Informal Small-Scale Mines

– Local Cooperative-Based Mining - By Mining Technology

Surface Mining

– Dragline and Shovel-Based Mining

– Truck-and-Loader Based Mining

Strip Mining

– Area Strip Mining

– Contour Strip Mining

Auger Mining

– Single Head Auger

– Twin Head Auger

Open-Pit Mining

– Multi-Bench Operations

– Highwall Operations

Mountain Removal Mining

Underground Mining

– Shaft Mining

– Drift Mining

Room and Pillar

– Manual Cutting with Support

– Semi-Mechanized Techniques

Longwall Mining

– Fully Mechanized Longwall

– Semi-Automated Longwall - By Grade

Bituminous Coal

– Low-Volatile Bituminous

– Medium-Volatile Bituminous

– High-Volatile Bituminous

Sub-Bituminous Coal

– Low-Rank Sub-Bituminous

– Medium-Rank Sub-Bituminous

Lignite

– Brown Lignite

– Grey Lignite

Anthracite

– Ultra-High Grade

– Semi-Anthracite

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Coal Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Production Capacity, and Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Coal Grade for Major Players

- Detailed Profiles of Major Companies

Vinacomin

Nui Beo Coal Joint Stock Company

Hong Ha Coal JSC

Quang Ninh Coal JSC

Ha Lam Coal JSC

Southern Coal Trade JSC

Northern Coal Industry Corporation

Vietnam National Coal – Mineral Industries Holding Corporation Limited

Dong Bac Corporation

Vietnam Machinery Erection Corporation

General Department of Geology and Minerals of Vietnam

Vinacomin – Power Holding Corporation

Vietnam Coal Industry Group

Quang Ninh Construction Investment JSC

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030