Market Overview

As of 2024, the Vietnam dietary food supplements market is valued at USD 325.4 million, with a growing CAGR of 5.6% from 2024 to 2030. Fuelled by an increasing focus on health and wellness among consumers, this market is propelled by rising disposable incomes, urbanization, and a growing aging population. The demand for dietary supplements, particularly vitamins and herbal products, highlights a shift toward preventive healthcare and healthier lifestyles.

Major cities such as Ho Chi Minh City and Hanoi dominate the market due to their large populations, economic growth, and increasing health awareness among residents. These urban areas benefit from higher purchasing power and access to a range of retail channels, including supermarkets and online platforms, making them key players in the dietary food supplements market.

Market Segmentation

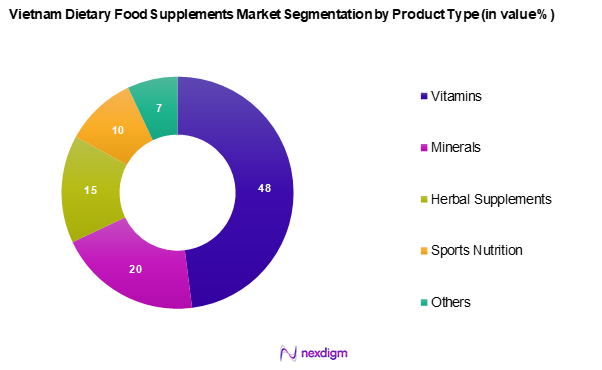

By Product Type

The Vietnam dietary food supplements market is segmented into vitamins, minerals, herbal supplements, sports nutrition, and others. Vitamins currently hold a dominant market share in this segment, driven by widespread consumer recognition of their health benefits and the increasing prevalence of deficiencies among the population. Additionally, various brands offer a broad array of vitamin products, establishing strong customer loyalty through targeted marketing and effective distribution channels.

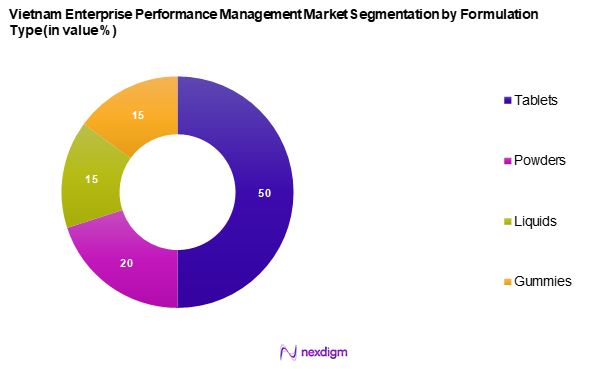

By Formulation Type

The Vietnam dietary food supplements market is segmented into tablets, powders, liquids, and gummies. Tablets segment dominate the market due to their convenience, established consumer preference, and widespread availability. The familiarity and effectiveness of tablet supplements contribute to their popularity among consumers seeking nutritional support. Furthermore, well-known brands actively promote tablet formulations, bolstering their presence in the competitive landscape.

Competitive Landscape

The Vietnam dietary food supplements market is dominated by several key players, including both local manufacturers and international brands. Leading companies in the market recognize the growing demand for dietary health products, which shapes their strategic initiatives aimed at enhancing product innovation and expanding distribution networks.

| Company Name | Establishment Year | Headquarters | Market Focus | Product Range | Revenue | Strength | Weakness |

| Herbalife | 1980 | Los Angeles, USA | – | – | – | – | – |

| Nutrilite | 1934 | Ada, USA | – | – | – | – | – |

| Blackmores | 1932 | Sydney, Australia | – | – | – | – | – |

| Amway | 1959 | Ada, USA | – | – | – | – | – |

| MegaLife | 1998 | Ho Chi Minh City, Vietnam | – | – | – | – | – |

Vietnam Dietary Food Supplements Market Analysis

Growth Drivers

Increasing Health Awareness

The rising health awareness among the population is a key driver of the Vietnam dietary food supplements market. In recent years, an increasing number of Vietnamese individuals are prioritizing their health, leading to a surge in the consumption of dietary supplements. According to the General Statistics Office of Vietnam, over 75% of the population has expressed a desire to improve their health in 2023, reflecting a significant societal shift towards wellness. This growing health consciousness is largely attributed to increased access to health information through the internet and social media platforms, enabling consumers to make informed dietary choices. Moreover, the World Health Organization indicates that nearly 90% of Vietnam’s healthcare spending can be linked to preventive health measures, supporting the trend toward dietary supplementation.

Aging Population

The demographic shift towards an aging population significantly contributes to the demand for dietary food supplements in Vietnam. The United Nations estimates that the percentage of individuals aged 60 and older will surpass 20% of the total population by 2025. This demographic change creates an increased need for health products aimed at improving vitality and managing age-related health conditions. Additionally, the Vietnam Ministry of Health reports a projected increase in chronic diseases among older adults, which fuels the demand for supplements that support immune function, bone health, and overall wellness. The growing recognition of preventive health measures among the elderly indicates a lucrative market opportunity for supplement manufacturers catering to this demographic.

Market Challenges

Regulatory Compliance

Regulatory compliance remains a significant challenge for players in the Vietnam dietary food supplements market. Strict regulations set by the Vietnamese Ministry of Health require manufacturers to adhere to stringent safety, efficacy, and labelling standards to ensure consumer protection. In 2023, regulatory bodies issued more than 1,200 penalties related to non-compliance with health regulations, underscoring the stringent oversight present in the market. These challenges make it imperative for companies to invest in quality assurance processes and regulatory expertise to navigate complex approval protocols. Additionally, the evolving nature of regulations presents ongoing challenges for market participants who must keep pace with changes in legal requirements.

Counterfeit Products

The prevalence of counterfeit products poses a formidable challenge within the Vietnam dietary food supplements market. Approximately 20% of dietary supplements sold in Vietnam are reported to be counterfeit, as highlighted by the Ministry of Industry and Trade. This pervasive issue not only undermines consumer trust but also threatens public health due to safety concerns regarding unverified products. In response to this challenge, authorities have intensified efforts to crack down on counterfeit goods through heightened inspections and public awareness campaigns. However, manufacturers must remain vigilant and implement robust verification processes to assure quality and authenticity in their product offerings to maintain their reputations.

Opportunities

Expansion of E-commerce Channels

With the rise of digital technology, there is significant potential for expanding e-commerce channels for dietary food supplements in Vietnam. In 2023, approximately 80% of urban consumers reported purchasing health products online, reflecting a dramatic increase in online shopping behaviour. The Vietnam Internet Network Information Centre has indicated that internet penetration reached approximately 75% in late 2022, providing companies with a substantial platform to engage with consumers. This surge in digital engagement allows brands to reach a broader audience, particularly younger consumers who prefer online shopping. As logistics and payment infrastructure continue to improve, companies can leverage e-commerce to drive market growth effectively.

Growing Demand for Organic Products

The rising demand for organic ingredients offers a promising opportunity for the dietary food supplements market in Vietnam. Current trends indicate that over 45% of consumers are increasingly interested in organic and natural products, as indicated by surveys conducted by the Ministry of Agriculture and Rural Development. The notion of healthier and more sustainable diets is gaining traction among consumers, which drives the shift toward products made with organic ingredients. This change in consumer preferences encourages manufacturers to invest in sourcing organic materials and developing innovative products that appeal to health-conscious buyers, positioning them for success in this burgeoning market.

Future Outlook

Over the next five years, the Vietnam dietary food supplements market is expected to experience significant growth due to rising health consciousness, increased disposable income, and a burgeoning demand for natural and organic products. An expanding e-commerce landscape also offers opportunities for brands to reach untapped consumer segments, further driving market progression.

Major Players

- Herbalife

- Amway

- GNC Holdings

- Abbott Laboratories

- Blackmores

- Nature’s Way

- Otsuka Pharmaceutical

- DSM Nutritional Products

- Danone

- Yakult Honsha

- Sunrider

- Usana Health Sciences

- Swisse

- Shaklee Corporation

- Nestle Health Science

- DHG Pharmaceuticals Joint Stock Company

- Tiens Group Co. Ltd.

- Life Extension Vietnam

- Nu Skin

- Mega Lifesciences Public Company Limited

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Health)

- Health and Wellness Retailers

- Pharmacies and Health Stores

- Fitness Centres and Gyms

- Health Food Manufacturers

- Nutritionists and Dieticians

- E-commerce Platforms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam dietary food supplements market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data pertaining to the Vietnam dietary food supplements market. This includes assessing market penetration rates, the ratio of product types to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates, reinforcing the validity of our analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data, ensuring an accurate representation of industry trends.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple dietary supplement manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam dietary food supplements market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Health Awareness

Aging Population - Market Challenges

Regulatory Compliance

Counterfeit Products - Opportunities

Expansion of E-commerce Channels

Growing Demand for Organic Products - Trends

Personalized Nutrition

Increasing Popularity of Functional Foods

Rise in Lifestyle Diseases - Government Regulation

Health Claims Regulations

Quality Standards

Labelling Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Vitamins

– Vitamin A

– Vitamin B Complex

– Vitamin C

– Vitamin D

– Multivitamins

Minerals

– Calcium

– Iron

– Magnesium

– Zinc

– Potassium

Herbal Supplements

– Ginseng

– Turmeric

– Green Tea Extract

– Garlic Extract

– Aloe Vera

Sports Nutrition

– Protein Supplements

– BCAAs (Branched-Chain Amino Acids)

– Creatine

– Energy Bars

– Electrolytes

Others

– Omega Fatty Acids (Omega-3, Omega-6)

– Probiotics & Prebiotics

– Digestive Enzymes

– Fiber Supplements - By Customer Demographics (In Value %)

Age Group

– Children (0–12 years)

– Adolescents (13–19 years)

– Adults (20–59 years)

– Seniors (60+ years)

Gender

– Male

– Female

– Unisex/Neutral

Income Level

– Low-Income

– Middle-Income

– High-Income - By Formulation Type (In Value %)

Tablets

– Coated Tablets

– Chewable Tablets

– Effervescent Tablets

Powders

– Sachets

– Protein Powders

– Energy Drink Mixes

Liquids

– Syrups

– Tinctures

– Drops

Gummies

– Vitamin Gummies for Adults

– Vitamin Gummies for Children

– Multivitamin Gummies - By Distribution Channel (In Value %)

Online Retail

– Brand Websites

– E-commerce Platforms

Offline Retail

– Health & Wellness Stores

– Departmental Stores

– Independent Supplement Stores

Pharmacies

– Chain Pharmacies

– Independent Pharmacies - By Application (In Value %)

Energy and Weight Management

– Fat Burners

– Meal Replacements

– Metabolism Boosters

General Health

– Multivitamins

– Essential Nutrients

– Daily Wellness

Bone and Joint Health

– Calcium & Vitamin D

– Glucosamine

– Chondroitin

Immunity

– Vitamin C

– Zinc Supplements

– Echinacea

Others

– Heart Health

– Digestive Health

– Mental Health & Cognitive Support - By Region (In Value %)

Northern Region

Central Region

Southern Region

- Market Share of Major Players on the Basis of Value and Volume 2024

Market Share of Major Players by Type of Product Segment 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Market Reach, Product Range, R&D Investments, Partnerships)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

Herbalife

Amway

GNC Holdings

Abbott Laboratories

Blackmores

Nature’s Way

Otsuka Pharmaceutical

DSM Nutritional Products

Danone

Yakult Honsha

Sunrider

Usana Health Sciences

Swisse

Shaklee Corporation

Nestle Health Science

DHG Pharmaceuticals Joint Stock Company

Tiens Group Co Ltd

Life Extension Vietnam

Nu Skin

Mega Lifesciences Public Company Limited

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs Desires and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030