Market Overview

The Vietnam Electrical Equipment Market is valued at USD 4.2 billion in 2025 with an approximated compound annual growth rate (CAGR) of 3.35% from 2025-2030, based on a comprehensive analysis of industry trends, including government initiatives aimed at enhancing energy infrastructure and fostering renewable energy solutions. Market growth is primarily driven by increasing urbanization and a growing demand for electrical infrastructure to support new residential and industrial projects throughout the country. Additionally, the push toward energy efficiency and modernization of existing electrical systems is further propelling the market forward.

Key cities dominating the Vietnam Electrical Equipment Market include Ho Chi Minh City, Hanoi, and Da Nang. Ho Chi Minh City stands out due to its rapid industrialization and vibrant commercial activities, making it a significant consumer of electrical equipment. Hanoi, as the capital, is also a central hub for large governmental and infrastructural developments, while Da Nang’s growing tourism sector necessitates a robust electrical framework. These cities collectively drive demand for high-quality electrical equipment to meet the needs of both residential and commercial sectors.

Market Segmentation

By Product Type

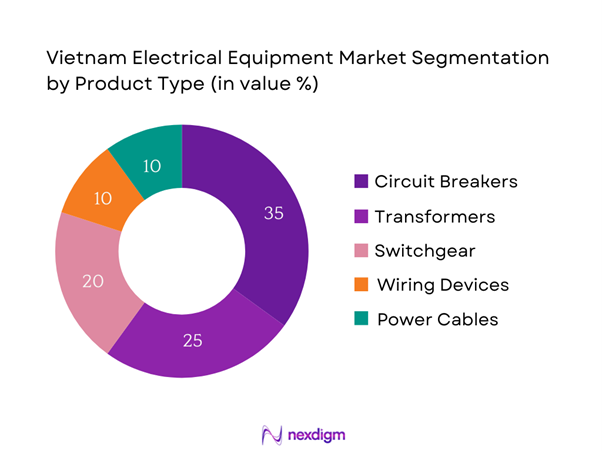

The Vietnam Electrical Equipment Market is segmented by product type into circuit breakers, transformers, switchgear, wiring devices, and power cables. Among these, smart circuit breakers hold a dominant market share as they are crucial for ensuring the safety and reliability of electrical systems. Their widespread application across residential, commercial, and industrial sectors is driven by stringent safety regulations and the growing necessity for reliable electrical distribution. Furthermore, advancements in technology are leading to the development of smarter, more efficient circuit breakers, enhancing their appeal and market presence.

By Application

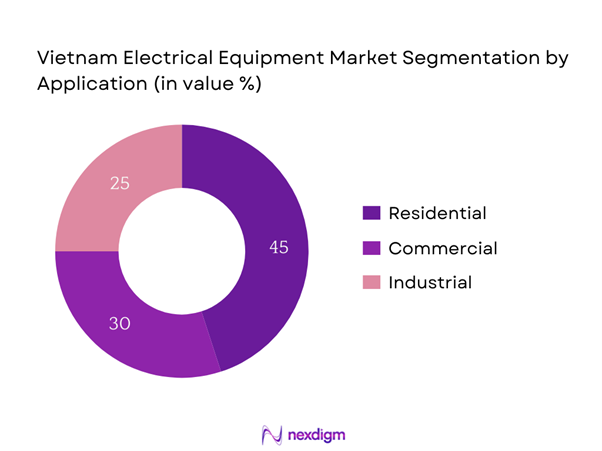

The market is further segmented by application into residential, commercial, and industrial segments. The residential segment dominates the market share, primarily due to the increasing number of households and government incentives aimed at enhancing home electrical systems. As urbanization continues to rise, the demand for electrical installations and upgrades in homes has surged, prompting homeowners to invest in quality electrical equipment to ensure safety and efficiency. Government initiatives promoting energy-efficient appliances are also bolstering this segment’s growth.

Competitive Landscape

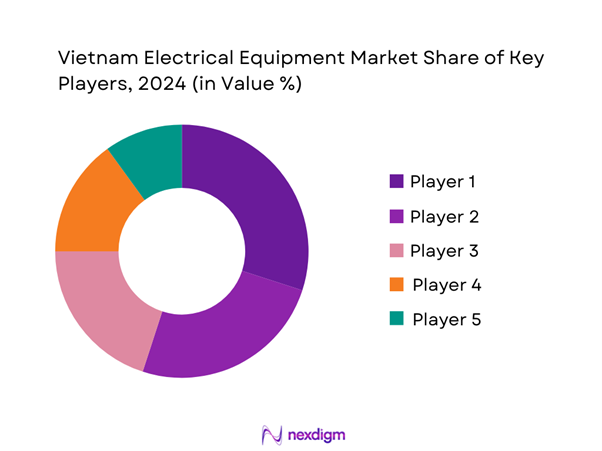

The Vietnam Electrical Equipment Market is dominated by several major players, highlighting a competitive landscape characterized by innovation and market consolidation. Key manufacturers include Siemens AG, Schneider Electric, and ABB Ltd., all of which leverage their technological expertise and established brand reputation to secure market presence. This consolidation indicates the significant influence these key companies have, not only on the market’s direction but also on technological advancements within the sector.

| Company | Establishment Year | Headquarters | Product Range | Market Focus | Innovative Technologies |

| Siemens AG | 1847 | Munich, Germany | – | – | – |

| Schneider Electric | 1836 | Rueil-Malmaison, France | – | – | – |

| ABB Ltd. | 1988 | Zurich, Switzerland | – | – | – |

| General Electric | 1892 | Boston, MA, USA | – | – | – |

| Mitsubishi Electric | 1921 | Tokyo, Japan | – | – | – |

Vietnam Electrical Equipment Market Analysis

Growth Drivers

Urbanization and Infrastructure Development

Urbanization is a significant driving force in Vietnam’s electrical equipment market, with more than 38% of the population now residing in urban areas, compared to just 30% a decade earlier. The government’s commitment to infrastructure projects, including the National Target Program for Socio-Economic Development, has earmarked over USD 10 billion for energy infrastructure investments by end of 2025. The rapid development in cities like Ho Chi Minh City and Hanoi is leading to increased demand for reliable electrical systems to support both residential and commercial growth. As urban infrastructure expands, so does the need for advanced electrical equipment solutions to meet the rising energy demands of urban living.

Energy Efficiency Regulations

Vietnam’s commitment to energy efficiency has led to the establishment of regulations aiming to reduce energy consumption by 5% annually, outlined in the National Energy Efficiency Program. With the anticipated energy consumption reaching 388 billion kWh by end of 2025, strict energy efficiency standards will drive the adoption of energy-efficient electrical devices. Additionally, the government plans to invest approximately USD 1 billion in energy-saving projects, promoting the importance of adopting technologies that reduce electrical waste. This regulatory framework positions the electrical equipment market for growth in energy-efficient solutions in response to these initiatives.

Market Challenges

Import Dependency

The electrical equipment market in Vietnam faces challenges due to a high dependency on imports, with approximately 70% of electrical components currently imported, primarily from China, Japan, and South Korea. This dependency creates vulnerabilities in supply chains, especially amid global disruptions or trade tensions which can lead to increased costs and supply shortages. The Vietnamese government is actively seeking to promote domestic manufacturing through incentives, but current levels indicate a continued reliance on imports, which can impede potential market growth.

Technological Advancement Gaps

Vietnam’s electrical equipment market is experiencing gaps in technological advancements, with many domestic manufacturers still reliant on outdated technologies. For instance, the World Economic Forum ranks Vietnam 116th in the Global Competitiveness Index for technology adoption, highlighting the need for modernization. As the global market for electrical equipment evolves significantly due to Industry 4.0 innovations, Vietnam’s lag may hinder the adoption of advanced manufacturing processes, impacting innovation and competitiveness in the electrical equipment landscape. To overcome these challenges, investment in R&D and training in modern technologies is essential.

Opportunities

Smart Grid Development

The rise in smart grid solutions presents a substantial opportunity for the electrical equipment market in Vietnam, especially with the government’s vision to develop smart cities. Currently, only 11% of Vietnam’s power distribution networks are equipped with smart technologies, indicating vast potential for growth. With an expected annual investment of USD 6 billion in smart grid infrastructure to enhance energy efficiency and reliability, market players have opportunities to capitalize on this trend by developing and providing innovative electrical solutions that align with modernization efforts. The increasing demand for real-time energy management systems will further propel this segment’s expansion.

Investment in Renewable Projects

With the Vietnamese government pledging to increase its capacity for renewable energy, there exists a lucrative opportunity for companies involved in electrical equipment. Notably, over 1,100 solar projects are confirmed to be operational or under construction, translating to approximately 20,000 MW of electricity production capacity. This exponential growth in renewable projects implies a vibrant market for electrical solutions tailored to renewable energy needs, including inverters and energy storage systems, which are essential components in integrating renewable energy into the national grid. These investments in sustainable energy will provide vast opportunities for businesses to engage in the supply chain for innovative technologies.

Future Outlook

Over the next five years, the Vietnam Electrical Equipment Market is projected to experience significant growth driven by continuous government support for infrastructure development, advancements in electrical technology, and rising consumer demand for efficient energy solutions. The growing emphasis on renewable energy sources will lead to enhanced investments across sectors, resulting in increased adoption of innovative electrical equipment. Additionally, the market is expected to benefit from initiatives targeting energy conservation and modernization of legacy systems, setting the stage for sustainable growth.

Major Players

- Siemens AG

- Schneider Electric

- ABB Ltd.

- General Electric

- Mitsubishi Electric

- Rockwell Automation

- Honeywell International

- Eaton Corporation

- LS Electric

- Panasonic Corporation

- Toshiba Corporation

- Legrand SA

- Emerson Electric Co.

- NHP Electrical Engineering Products

- Delta Electronics

Key Target Audience

- Electrical Engineers and Technicians

- Electrical Contractors

- Manufacturing Companies

- Real Estate Developers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Industry and Trade)

- Research and Development Institutions

- Utility Companies

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the Vietnam Electrical Equipment Market. Through extensive desk research, we utilize a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as regulatory frameworks, technological advancements, and consumer trends.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the Vietnam Electrical Equipment Market. This includes assessing market penetration rates, the ratio of electrical equipment demand between various sectors (residential, commercial, industrial), and the resultant revenue generation. Additionally, an evaluation of service quality metrics will be conducted to confirm the reliability and accuracy of the revenue estimates, ensuring a holistic understanding of market performance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies within the electrical equipment sector. These consultations provide invaluable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data gathered in earlier steps.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with multiple electrical equipment manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors influencing the market. This interaction serves to verify and complement the statistics derived from a bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam Electrical Equipment Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Market Genesis

- Key Milestones and Regulatory Timeline

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Urbanization and Infrastructure Development

Energy Efficiency Regulations

Rise in Renewable Energy Adoption - Market Challenges

Import Dependency

Technological Advancement Gaps - Opportunities

Smart Grid Development

Investment in Renewable Projects - Trends

Shift Towards Sustainable Electrical Technologies

Increase in Automation Solutions - Government Regulations

Energy Standards and Codes

Trade Policies and Tariffs - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Circuit Breakers

– Miniature Circuit Breakers (MCB)

– Molded Case Circuit Breakers (MCCB)

– Residual Current Circuit Breakers (RCCB)

– Air Circuit Breakers (ACB)

Transformers

– Distribution Transformers

– Power Transformers

– Instrument Transformers

– Dry-Type Transformers

Switchgear

– Low Voltage (LV) Switchgear

– Medium Voltage (MV) Switchgear

– High Voltage (HV) Switchgear

– Gas-Insulated Switchgear (GIS)

Wiring Devices

– Switches and Sockets

– Dimmers and Fan Regulators

– Modular Plates

– USB Charging Ports

Power Cables

– Low Voltage Cables

– Medium Voltage Cables

– High Voltage Cables

– Underground and Aerial Cables - By Application (In Value %)

Residential

– Individual Houses

– Apartments and Condominiums

– Gated Communities

Commercial

– Offices and Co-working Spaces

– Hotels and Retail Spaces

– Data Centers

Industrial

– Manufacturing Units

– Oil & Gas Facilities

– Warehouses & Logistics Parks - By Distribution Channel (In Value %)

Online Retail

– E-commerce Platforms

– OEM Online Stores

Direct Sales

– Corporate B2B Orders

– Government and Utility Contracts

Distributors and Wholesalers

– Authorized Channel Partners

– Electrical Trade Markets - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam - By Technology (In Value %)

Traditional Technology

– Manual Operation Devices

– Conventional Wiring Systems

Smart Technology

– IoT-enabled Switches

– Smart Meters and Energy Monitoring

– Home Automation-compatible Devices

- Market Share of Major Players Based on Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Distribution Network Reach, Number and type of distribution channels, Production Capacities, Total manufacturing capacity by product, Unique Selling Propositions, Technology Integration, Quality Certifications, R&D Spend and Innovation Index, After-Sales Support and Service Network, Export Contribution / Global Footprint, OEM Partnerships, Market Recommendations)

- SWOT Analysis of Major Players

- Pricing Strategy Analysis Across Major Players

- Detailed Profiles of Key Companies

Siemens AG

Schneider Electric

General Electric Company

ABB Ltd.

Mitsubishi Electric

Rockwell Automation

Honeywell International

Eaton Corporation

LS Electric

Panasonic Corporation

Toshiba Corporation

Legrand SA

Emerson Electric Co.

NHP Electrical Engineering Products

Delta Electronics

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory Compliance Impact

- Customer Needs, Preferences, and Pain Points

- Decision-Making Dynamics

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030