Market Overview

As of 2024, the Vietnam enterprise performance management market is valued at USD 6.9 billion, with a growing CAGR of 8.8% from 2024 to 2030. This growth is driven by the increasing adoption of digital transformation strategies among businesses, as organizations seek to enhance efficiency and decision-making processes through intelligent performance management solutions. The demand for real-time analytics and business intelligence tools has contributed significantly to this value.

Key cities such as Ho Chi Minh City and Hanoi dominate the Vietnam Enterprise Performance Management landscape. Ho Chi Minh City, as the economic hub, houses several multinational corporations and thriving tech start-ups, fostering a conducive environment for enterprise solutions. Similarly, Hanoi’s status as the political and administrative centre drives demand for performance management tools in government agencies and public sector enterprises.

Market Segmentation

By Application

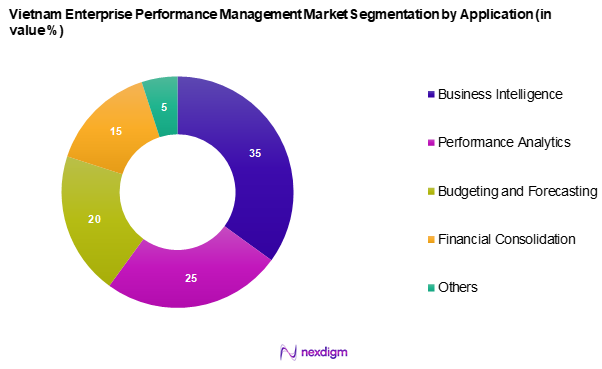

The Vietnam enterprise performance management market is segmented into business intelligence, performance analytics, budgeting and forecasting, financial consolidation, and others. Business intelligence holds a dominant market share due to the increasing need for data-driven decision-making. Organizations are increasingly recognizing the value of leveraging data to improve operational efficiency, enhance customer satisfaction, and drive revenue growth. Popular BI tools allow stakeholders to analyse large datasets and generate insights that inform strategic initiatives.

By Deployment Model

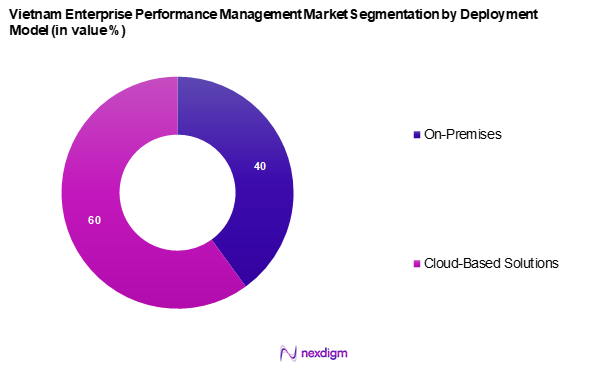

The Vietnam enterprise performance management market is segmented into on-premises and cloud-based solutions. Cloud-Based deployment is experiencing a surge in market share, driven by the flexibility, scalability, and cost-effectiveness offered by cloud solutions. As Vietnamese enterprises increasingly transition to online infrastructures, cloud-based performance management enables quick access to real-time data and collaboration among teams, thus supporting business agility and continuity.

Competitive Landscape

The Vietnam enterprise performance management market is dominated by several major players, including global and local firms. Notable players such as SAP, Oracle, and IBM, along with emerging tech companies, drive the competitive landscape, highlighting their significant influence on market dynamics.

| Company Name | Establishment Year | Headquarters | Revenue | Product Offerings | Strengths | Weaknesses | Business Segment Revenue |

| SAP | 1972 | Germany | – | – | – | – | – |

| Oracle | 1977 | USA | – | – | – | – | – |

| IBM | 1911 | USA | – | – | – | – | – |

| Microsoft | 1975 | USA | – | – | – | – | – |

| Salesforce | 1999 | USA | – | – | – | – | – |

Vietnam Enterprise Performance Management Market Analysis

Growth Drivers

Adoption of Digital Transformation

The rapid adoption of digital transformation is a key driver for the Vietnam enterprise performance management market. In 2023, Vietnam’s digital economy is projected to reach USD 30.0 billion, with the government implementing initiatives to promote digitalization across various industries. This shift is evidenced by a 25% rise in digital technology investments compared to 2022, according to the Ministry of Information and Communications. Businesses are increasingly adopting enterprise performance management solutions to ensure operational efficiency, streamline processes, and enhance data-driven decision making, fueled by the national agenda to transform Vietnam into a digital nation.

Increasing Demand for Real-Time Analytics

The increasing demand for real-time analytics is significantly influencing the Vietnam enterprise performance management market. In 2023, approximately 65% of organizations in Vietnam reported a strong need for real-time data capabilities to make informed decisions. The global business analytics market, which includes real-time analytics, is expected to exceed USD 300.0 billion by 2025. This growing appetite for analytics solutions stems from businesses striving to remain competitive and agile in a dynamic market environment. As companies across sectors such as finance, retail, and manufacturing garner insights from real-time data, the relevance of performance management tools becomes even more pronounced.

Market Challenges

Integration Issues with Existing Systems

Integration issues with existing systems remain a considerable challenge for the Vietnam enterprise performance management market. A significant 48% of Vietnamese organizations reported facing difficulties in integrating new performance management solutions with legacy systems in 2023. Additionally, the complex IT landscape contributes to slower adoption rates, putting pressure on organizations to ensure seamless interoperability. As the market evolves, overcoming these integration hurdles will be crucial for firms seeking to leverage enterprise performance management tools effectively, ensuring that they can capture and utilize comprehensive data across all functions.

Security and Data Privacy Concerns

Security and data privacy concerns are increasingly affecting the Vietnam enterprise performance management market. With the rise of digital transformation, businesses are exposed to a growing number of cyber threats. In 2023, reports indicated that approximately 60% of enterprises in Vietnam experienced at least one cybersecurity incident. This alarming statistic has prompted companies to approach performance management solutions with caution, prioritizing data protection measures. Furthermore, regulations governing data privacy are becoming stricter, compelling organizations to ensure compliance, which can complicate the deployment of new performance management systems and hinder market growth.

Opportunities

Growth in Cloud Computing

The burgeoning growth of cloud computing represents a significant opportunity for the Vietnam enterprise performance management market. In 2023, the cloud services market in Vietnam was valued at approximately USD 2.3 billion, marking a 35% increase from the previous year. This expansion is driven by businesses transitioning to cloud-based platforms for improved scalability and flexibility. As more organizations recognize the advantages of cloud solutions, including their cost-effectiveness and enhanced collaboration capabilities, the integration of cloud computing with enterprise performance management tools presents a promising avenue for future growth.

Rising Investments in AI and Machine Learning

The surge in investments in artificial intelligence (AI) and machine learning (ML) technologies is a transformative opportunity for the Vietnam enterprise performance management market. In 2023, Vietnam’s AI and ML market was valued at USD 600.0 million, reflecting a year-on-year growth of 20%. This growth is propelled by increased funding from both government initiatives and private sector ventures. As businesses harness AI and machine learning capabilities to enhance analytics and automate processes, integrating these technologies with enterprise performance management solutions will likely revolutionize decision-making effectiveness and operational performance across various sectors.

Future Outlook

Over the next five years, the Vietnam enterprise performance management market is expected to exhibit significant growth, driven by continuous advancements in cloud computing, increasing demand for real-time data analytics, and heightened investments in artificial intelligence. As businesses increasingly recognize the importance of performance management tools for strategic decision-making and operational efficiency, the market will continue to evolve and expand.

Major Players

- SAP

- Oracle

- IBM

- Microsoft

- Salesforce

- SAS Institute

- Domo

- Tableau

- Qlik

- Adaptive Insights

- Zoho Corporation

- Sisense

- MicroStrategy

- Infor

- Workday

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Planning and Investment, Ministry of Information and Communications)

- Large Enterprises

- Medium Enterprises

- Public Sector Organizations

- Technology Providers

- Consulting Firms

- Industry Associations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map of stakeholders in the Vietnam enterprise performance management market. This identifies the critical variables influencing market dynamics, supported by comprehensive desk research and secondary data analysis.

Step 2: Market Analysis and Construction

This phase compiles historical data on market penetration and revenue generation, assessing the ratio of enterprises utilizing performance management solutions and the quality statistics of services rendered.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through direct consultations with industry experts via Computer-Assisted Telephone Interviews (CATIs). These consultations will gather insights from practitioners representing a diverse range of companies, providing essential operational and financial data that refine and corroborate market data.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with leading enterprise performance management solution providers will take place. This will involve obtaining detailed insights into product segments, sales performance, and consumer trends. The interaction with these key players will serve to verify and complement statistics derived from both top-down and bottom-up approaches, ensuring a comprehensive, accurate, and validated analysis of the Vietnam enterprise performance management market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Adoption of Digital Transformation

Increasing Demand for Real-Time Analytics - Market Challenges

Integration Issues with Existing Systems

Security and Data Privacy Concerns - Opportunities

Growth in Cloud Computing

Rising Investments in AI and Machine Learning - Trends

Shift Towards Predictive Analytics

Increased Focus on Sustainability Metrics - Government Regulation

Data Protection Regulations

Compliance Standards for Financial Reporting - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Number of Users, 2019-2024

- By Average Price, 2019-2024

- By Application (In Value %)

Business Intelligence

– Data Visualization Tools

– KPI Dashboards

– Real-Time Data Monitoring

Performance Analytics

– Financial Performance

– Operational Efficiency

– Strategic KPI Analysis

Budgeting and Forecasting

– Rolling Forecasts

– Zero-Based Budgeting

– Predictive Budgeting (AI-driven)

Financial Consolidation

– Intercompany Eliminations

– Regulatory Reporting

– Multi-Entity Reporting

Others

– Risk Management

– ESG & Sustainability Reporting

– Tax and Statutory Compliance - By Deployment Model (In Value %)

On-Premises

Cloud-Based

– Public Cloud (e.g., AWS, Azure, GCP)

– Hybrid Cloud

– SaaS Platforms - By Industry Vertical (In Value %)

Manufacturing

– Discrete Manufacturing

– Process Manufacturing

Healthcare

– Hospitals & Clinics

– Pharma & Life Sciences

Government & Public Sector

– State-Owned Enterprises

– Government Budgeting & Auditing

BFSI

– Banking

– Insurance

– Investment & Wealth Management

Telecommunications

– Network Operators

– Digital Service Providers

Others

– Retail

– Energy & Utilities

– Education - By Organization Size (In Value %)

Small Enterprises (1–100 Employees)

Medium Enterprises (101–500 Employees)

Large Enterprises (500+ Employees) - By Component (In Value %)

Service

– Consulting Services

– Implementation & Integration

– Support & Maintenance

– Training & Development

Solutions

– Core EPM Software

– Add-on Modules

– Custom Analytical Tools - By Region (In Value %)

Northern Vietnam

Southern Vietnam

Central Vietnam

- Market Share of Major Players on the Basis of Value 2024

Market Share of Major Players by Type of Component Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths & Weaknesses, Organizational Structure, Revenues, Product Offering Breakdown, Customer Reach, Pricing Strategy, Deployment Models Supported, Integration Capabilities, Technology Stack / Innovation, Partner Ecosystem, Customer Satisfaction & Support, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

SAP

Oracle

IBM

Microsoft

Salesforce

SAS Institute

Domo

Tableau

Qlik

Adaptive Insights

Zoho Corporation

Sisense

MicroStrategy

Infor

Workday

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Number of Users, 2025-2030

- By Average Price, 2025-2030