Market Overview

As of 2024, the Vietnam fuel cell market is valued at USD 190.4 million, with a growing CAGR of 3.4% from 2024 to 2030, reflecting a steady increase driven by government support for clean energy initiatives and the growing demand for sustainable power sources. This market growth is further enhanced by technological advancements in fuel cell technologies, which are increasingly considered a viable alternative to traditional energy systems.

Key cities that dominate the Vietnam fuel cell market include Ho Chi Minh City, Hanoi, and Da Nang. These urban centers are pivotal due to their concentration of industrial activities and government policies promoting clean technologies. Additionally, their infrastructure development and higher energy consumption rates position them as prime locations for fuel cell adoption, thereby fostering market growth.

Market Segmentation

By Technology

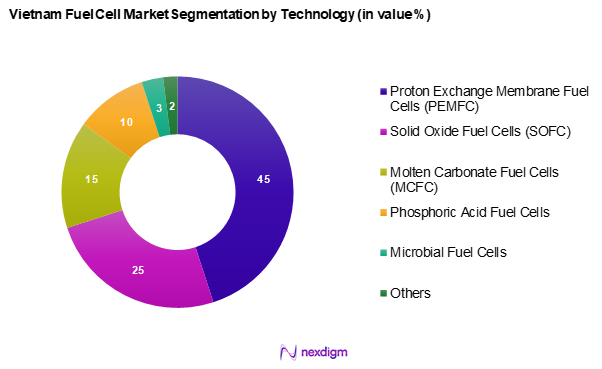

The Vietnam fuel cell market is segmented into Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Molten Carbonate Fuel Cells (MCFC), Phosphoric Acid Fuel Cells, Microbial Fuel Cells, and Others. The Proton Exchange Membrane Fuel Cells (PEMFC) currently holds a dominant market share, largely due to their high efficiency, lower operating temperatures, and suitability for transport applications. As government and private sectors increase investments in hydrogen technologies, PEMFCs have become the preferred choice for various applications from transportation to stationary power generation, reflecting significant growth in consumer interest and commercial adoption.

By Application

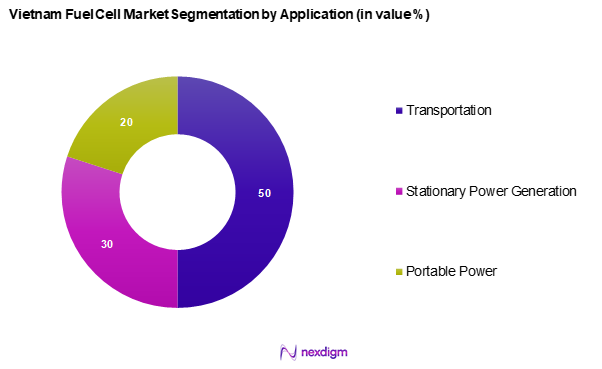

The Vietnam fuel cell market is segmented into transportation, stationary power generation, and portable power applications. The Transportation segment leads the market share, largely driven by the growing urban population’s demand for cleaner alternatives to fossil fuel-driven vehicles. Fuel cells are seen as a promising solution to reduce emissions, and with the government’s strong push towards electrification of transport, this segment is gaining substantial traction. The integration of fuel cell technology into electric vehicles promotes sustainability and aligns with national energy strategies, making transportation applications a focal point for market developments.

Competitive Landscape

The Vietnam fuel cell market is dominated by a few major players, including global leaders and local innovators. This consolidation highlights the significant influence of companies such as Ballard Power Systems and Toyota, known for their advanced fuel cell technologies and established market presence, fostering competitive growth within the sector.

| Major Players | Establishment Year | Headquarters | Market Focus | Revenue (USD) | Unique Offering |

| Ballard Power Systems | 1979 | Burnaby, Canada | – | – | – |

| Plug Power | 1997 | New York, USA | – | – | – |

| VinFast | 2017 | Haiphong, Vietnam | – | – | – |

| Toshiba Energy Systems | 1939 | Tokyo, Japan | – | – | – |

| Doosan Fuel Cell Co., Ltd | 2014 | Seoul, South Korea | – | – | – |

Vietnam Fuel Cell Market Analysis

Growth Drivers

Government Policies and Initiatives

The Vietnamese government is actively promoting the adoption of clean energy solutions through various policies and initiatives. In 2022, the government allocated approximately USD 2 billion to develop renewable energy projects, which include fuel cell technology. The implementation of the Vietnam National Strategy on Green Growth emphasizes sustainable development and encourages investments in clean technologies, including fuel cells, reflecting an ambitious plan to enhance energy security and environmental sustainability.

Increasing Demand for Clean Energy

The demand for clean energy in Vietnam continues to rise, driven by a growing population and urbanization. Vietnam’s energy consumption reached 251.5 billion kWh, which is expectations to rise at 10-12 % annually through 2030, as reported by the International Trade Administration. This surge necessitates alternative energy solutions such as fuel cells, which can offer cleaner and more efficient power generation. Additionally, the commitment to reduce greenhouse gas emissions by 20% by 2030 under the Paris Agreement adds further momentum to the development and adoption of clean energy technologies like fuel cells.

Market Challenges

High Initial Investment

One of the key challenges facing the Vietnam fuel cell market is the high initial investment required for infrastructure and technology development. The cost of establishing a fuel cell power generation facility can exceed USD 10 million per megawatt. Moreover, the upfront costs associated with fuel cell vehicles and their supporting infrastructure, such as hydrogen refuelling stations, significantly hinder widespread adoption. With the current investment climate, where the average capital investment in renewable energy infrastructure stands at USD 1.7 billion as of 2023, stakeholders are often hesitant to allocate resources to fuel cell technology, limiting growth potential.

Competition from Batteries

The Vietnam fuel cell market faces significant competition from battery technologies, particularly in the transportation sector. As electric vehicle (EV) adoption increases, battery manufacturers are capitalizing on economies of scale, reducing costs and improving performance. The number of registered electric vehicles in Vietnam rose to 20,000 electric cars and around 1,500 buses in 2022, showcasing the growing preference for battery-powered solutions. Furthermore, as lithium-ion battery technology continues to evolve, with an expected 25% reduction in costs by 2025, the attractiveness of batteries as an alternative energy source for both personal and commercial use poses a substantial challenge to the fuel cell market.

Opportunities

Expansion of Hydrogen Infrastructure

The development of hydrogen production and distribution networks presents a significant opportunity for the Vietnam fuel cell market players. Increasing investments in hydrogen refuelling stations and supply chains will enhance accessibility and support adoption across transportation and energy sectors. Government initiatives aimed at scaling hydrogen infrastructure further strengthen market prospects, driving long-term growth potential for fuel cell applications.

Collaborations and Partnerships

Strategic collaborations and partnerships can drive innovation and market expansion in the Vietnam fuel cell sector. With over 50 research institutions currently engaged in clean energy development, the potential for joint ventures between academia, government, and industry is significant. For instance, collaborations focused on R&D in fuel cell technology can accelerate advancements in efficiency and cost reduction. The establishment of public-private partnerships is also critical, ensuring that the government supports major players in the industry, allowing companies to share resources and expertise, ultimately strengthening the fuel cell ecosystem in Vietnam.

Future Outlook

Over the next five years, the Vietnam fuel cell market is expected to experience robust growth driven by continuous government support, advancements in fuel cell technology, and increasing demand for clean energy solutions. The commitment to reducing carbon emissions and the expansion of hydrogen infrastructure will further propel market expansion, positioning Vietnam as a regional hub for fuel cell development and use.

Major Players

- Ballard Power Systems

- Plug Power

- VinFast

- Toyota Motor Corporation

- Hyundai Motor Company

- General Motors

- Honda Motor Co., Ltd

- Siemens Energy AG

- Toshiba Energy Systems

- AFC Energy PLC

- Ceres Power Holdings PLC

- Horizon Fuel Cell Technologies

- Doosan Fuel Cell Co., Ltd

- Panasonic Corporation

- Bloom Energy

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Industry and Trade, Ministry of Natural Resources and Environment)

- Energy Utilities and Providers

- Automotive Manufacturers

- Industrial Equipment Manufacturers

- Research Institutions and Think Tanks

- Technology Development Agencies

- Environmental NGOs and Advocacy Groups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam fuel cell market. This step is underpinned by extensive desk research, utilizing both secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including technological advancements, regulatory frameworks, and consumer preferences.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Vietnam fuel cell market. This includes assessing market penetration, revenue generation from various segments, and the value chain dynamics. Furthermore, an evaluation of service quality indicators will be conducted to ensure the reliability and accuracy of the revenue estimates. This analysis will provide a robust framework for understanding market trends and opportunities.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts spanning various sectors of the fuel cell market. These consultations aim to gather operational and financial insights directly from practitioners, thereby corroborating market data and refining the accuracy of our market projections. Input from diverse stakeholders will enhance the overall understanding of market behaviours.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagements with fuel cell manufacturers and key players to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent market factors. This interaction will serve to validate and complement the statistics derived from the bottom-up approach, ensuring a comprehensive and accurate analysis of the Vietnam fuel cell market. The synthesis of all data will culminate in a polished final report.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain & Value Chain Analysis

- Growth Drivers

Government Policies and Initiatives

Increasing Demand for Clean Energy - Market Challenges

High Initial Investment

Competition from Batteries - Opportunities

Expansion of Hydrogen Infrastructure

Collaborations and Partnerships - Trends

Growth in Renewable Energy Adoption

Increase in Fuel Cell Vehicles - Government Regulation

Emissions Standards

Incentives for Clean Energy Projects - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Technology (In Value %)

Proton Exchange Membrane Fuel Cells (PEMFC)

Solid Oxide Fuel Cells (SOFC)

Molten Carbonate Fuel Cells (MCFC)

Phosphoric Acid Fuel Cells

Microbial Fuel Cells

Others - By Application (In Value %)

Transportation

– Fuel Cell Mobility

– Drones & UAVs

Stationary Power Generation

– Primary

– Backup

– Combined Heat & Power (CHP)

Portable Power

– Consumer Electronics

– Military Devices - By Region (In Value %)

Northern Vietnam

Southern Vietnam

Central Vietnam

Major Urban Areas - By End User (In Value %)

Industrial

Commercial

Automotive

Consumer Electronics

Data Centre

Military & Defense

Others - By Size (In Value %)

Small

Large

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Type of Technology Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Number of Dealers, Unique Value Offerings, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Ballard Power Systems

Plug Power

VinFast

Toshiba Energy Systems

Doosan Fuel Cell Co., Ltd

Bloom Energy

Hyundai Motor Company

Panasonic Corporation

Siemens Energy AG

Honda Motor Co., Ltd

General Motors

Toyota Motor Corporation

AFC Energy PLC

Ceres Power Holdings PLC

Horizon Fuel Cell Technologies

HORIBA Vietnam Company Limited

Elcogens

Nikkei Asia

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030