Market Overview

The Vietnam healthcare market is valued at approximately USD 9.91 billion, reflecting hospital-sector revenue for 2024, and aligned with broader healthcare expenditure estimates near USD 17 billion by 2022–2023. This growth is driven by rising inpatient/outpatient volumes, expanding pharmaceutical and medical device sales, and increased public and private investment in healthcare infrastructure. Demand is particularly fueled by expanding insurance coverage, aging demographics, and a fast-growing middle‑income population seeking quality care.

Major urban centers like Hanoi and Ho Chi Minh City dominate the market due to their concentration of tertiary and specialty hospitals, modern private-sector facilities, and foreign‑invested chains. These cities host most private hospitals, advanced medical device imports, and international clinical laboratories, drawing high patient flows regionally. They benefit from dense population, higher incomes, and easier regulatory facilitation, compared to other regions.

Market Segmentation

By service type

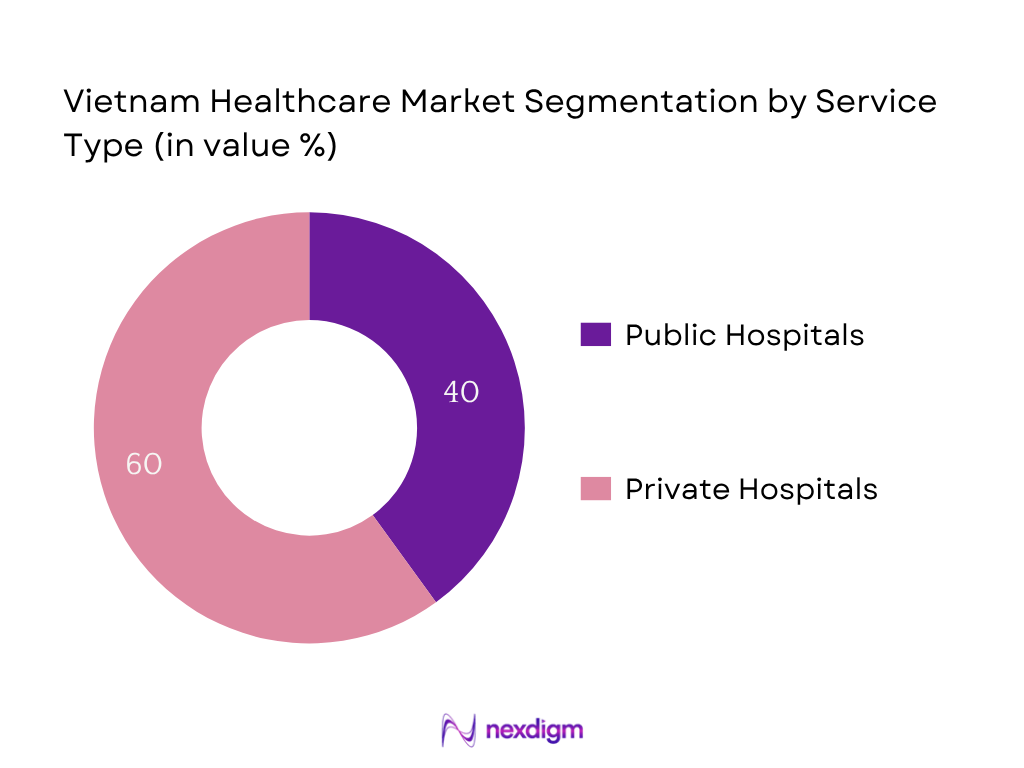

The Vietnam healthcare market is segmented into public and private hospitals. Currently, public hospitals comprise approximately 86% of the total number of facilities, yet private hospitals dominate revenue growth due to superior infrastructure, service quality, and preferential investment incentives. The government encourages private healthcare expansion to ease overcapacity in public hospitals. Enhanced middle-income demand and strategic M&A activity further elevate private sector prominence.

By product type

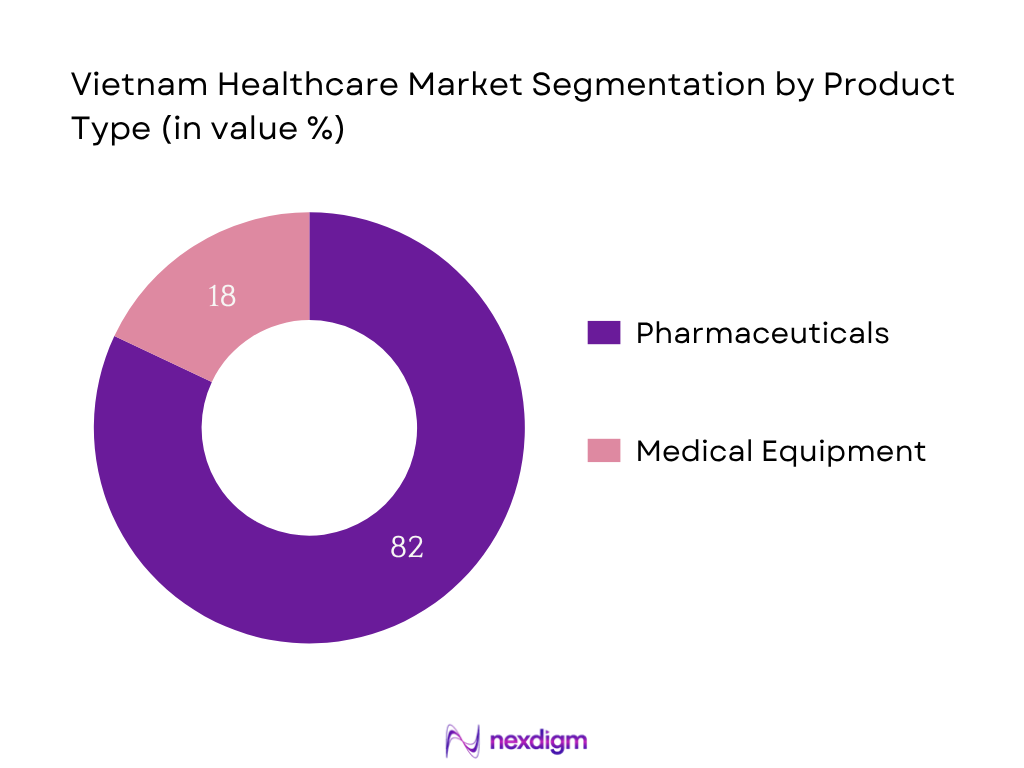

The market is divided into pharmaceuticals and medical equipment. Pharmaceuticals lead in value terms—at USD 7.6 billion in 2024—driven by rising chronic disease needs and robust import trends. Medical equipment, by contrast, is estimated at USD 1.7 billion, with demand concentrated in urban hospitals. Pharmaceuticals command higher revenue mainly due to volume-driven use and domestic & foreign investments in drug procurement.

Competitive Landscape

The Vietnam healthcare market features a mix of domestic private hospital chains, public institutions, major medical device importers, and digital health providers. The landscape is increasingly shaped by foreign investment and consolidation. Public providers like Viet Duc Hospital and Cho Ray Hospital also play a critical role but are not listed in this table as the focus is on major organizational competitors in private and device/import/digital spaces.

| Player | Establishment Year | Headquarters | Service Portfolio | Technology Adoption | Regional Presence | Accreditation / Standards |

| Vinmec Healthcare | — | Hanoi/Vingroup | – | – | – | – |

| Hoan My Medical Corporation | 1997 | Ho Chi Minh City | – | – | – | – |

| FV Hospital (Thomson Medical) | — | Ho Chi Minh City | – | – | – | – |

| Tam Duc Heart Hospital | — | Ho Chi Minh City | – | – | – | – |

| Bach Mai Hospital | — | Hanoi | – | – | – | – |

Vietnam Healthcare Market Analysis

Growth Drivers

Increasing Coverage under Social Health Insurance

Vietnam’s social health insurance system, administered by Vietnam Social Security, funded 186.2 million outpatient and inpatient visits, with fund disbursements amounting to VND 142.9 trillion (~US$ 5.63 billion) in medical examination and treatment services in 2024. Health insurance coverage reached 94.2% of the population by late 2024, up from 93.3% in 2023, enabling expanded access to care. This robust coverage supports large patient flows through insured facilities, reducing financial barriers and increasing utilization across both public hospitals and private accredited providers.

Rising Burden of Non‑Communicable Diseases (NCDs)

NCDs account for 84% of total deaths in Vietnam in 2024, according to the official Deputy Minister of Health, up from approximately 74% in 2022. Within this, cardiovascular disease leads at ~20.5%, cancer at ~13.3%, chronic respiratory disease ~4%, and diabetes ~3.9%. Between early 2023 and early 2024, visits for hypertension nearly doubled and diabetes visits increased nearly four-fold at commune health stations, reflecting escalating care demand for chronic conditions.

Market Challenges

Public Hospital Overcrowding

Public hospitals manage the majority of insured patient volume under social health insurance—186 million visits in 2024—placing severe strain on facilities. Many tertiary hospitals operate beyond capacity, especially in urban centers, where facility occupancy often exceeds 120‑130% due to large outpatient and emergency flows. Infrastructure in district-level units remains outdated, reflecting underinvestment relative to demand. Support funds of VND 142.9 trillion were disbursed to support these volumes.

Shortage of Skilled Healthcare Workforce

While Vietnam’s life expectancy climbed to approximately 74.5 years in 2023, medical workforce ratios lag regional peers. Public data indicates suboptimal physician-to-population ratios in specialist disciplines such as oncology, cardiology, and imaging. Training pipeline capacity is limited, leading to uneven specialist availability between Hanoi and peripheral provinces, constraining adoption of advanced services and burdening existing hospital staff.

Opportunities

Investment in Tier‑2 & Rural Healthcare Infrastructure

Vietnam’s expansion of social health insurance beneficiaries to 94.2% coverage supports infrastructure growth outside metros. As 186 million visits in 2024 are largely concentrated in major provinces, Tier‑2 cities and rural districts remain underserved. Commune health stations are now treating 80% of mild to moderate NCD patients, having nearly doubled hypertension visits and quadrupled diabetes visits between early 2023 and 2024. This presents opportunity for private hospital and clinic investment in secondary cities.

Growth in Home Healthcare & Telemedicine

The telemedicine market reached US$ 242 million in 2023, signaling rising patient acceptance of remote care. Coupled with broader digital market value of US$ 926 million, there is strong foundation for scaling home-based care. With digital mature systems in public hospitals and regulatory changes allowing telehealth under insurance, expansion of remote monitoring, home nursing, and virtual consultations represents a growing opportunity to capture care demand beyond facility walls.

Future Outlook

Over the coming years, Vietnam’s healthcare market is positioned for robust expansion, led by continued growth in private hospital delivery, diagnostics, medical devices, and digital health. Public policy will further drive private sector participation and telemedicine adoption, while demographic factors such as aging and non-communicable disease prevalence will sustain demand. Ongoing foreign direct investment and PPP initiatives will enhance infrastructure, specialty services, and technological integration, delivering new opportunities across value chains.

Major Players

- Hoàn Mỹ Medical Corporation

- Vinmec Healthcare System

- FV Hospital

- City International Hospital (CIH)

- Hồng Ngọc Hospital Group

- Phương Châu Hospital

- Viet Duc Hospital

- Cho Ray Hospital

- Roche Vietnam

- Siemens Healthineers Vietnam

- Abbott Laboratories Vietnam

- Medtronic Vietnam

- Viet A Corporation

- Pharmacity chain

- Long Châu pharmacy chain

Key Target Audience

- Hospital groups & private healthcare providers

- Medical device distributors & equipment importers

- Pharmaceutical manufacturers & suppliers

- Retail pharmacy chains & operators

- Investment & venture capital firms

- Government & regulatory bodies (Ministry of Health; Vietnam Social Security)

- Health insurers & corporate wellness programme managers

- Telemedicine & e‑health platform providers

Research Methodology

Step 1: Identification of Key Variables

We built an ecosystem map covering hospitals, clinics, diagnostics labs, device importers, pharmaceutical players, insurers, and government agencies. Secondary sources and official MOH publications were used to define market variables including expenditure, import dependency, insurance coverage, and demographic drivers.

Step 2: Market Analysis and Construction

Historical data from 2019 through 2023 was collated for hospital revenue, pharma sales, device imports, and private sector volumes. We quantified hospital capacity, SHI‐reimbursed visits, number of private beds, and diagnostic volumes to estimate segment revenues. Pricing tariff data (services and devices) from tender circulars and CPI indexes were used to validate value estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were vetted through computer-assisted telecom interviews with executives from private hospital chains, diagnostics firms, and device distributors. These interviews furnished real‑world insights on pricing, capacity utilisation, patient sourcing, and investment activity.

Step 4: Research Synthesis and Final Output

We conducted direct outreach to selected healthcare providers and device importers to validate bottom‑up revenue estimates, service mix, and digital readiness. Market forecast models were formulated using Nexdigm’s CAGR projections and segment‐specific growth curves, ensuring triangulation from multiple sources.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Developments

- Healthcare Service Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Coverage under Social Health Insurance

Rising Burden of Non‑Communicable Diseases (NCDs)

Growing Middle‑Class Population & Private Healthcare Demand

Medical Tourism Potential (Ho Chi Minh City, Hanoi)

Digital Transformation in Healthcare - Market Challenges

Public Hospital Overcrowding

Shortage of Skilled Healthcare Workforce

Rural‑Urban Access Disparities

Dependence on Imported Medical Devices & Medicines

Regulatory Approval Delays for Devices & Drugs - Opportunities

Investment in Tier‑2 & Rural Healthcare Infrastructure

Growth in Home Healthcare & Telemedicine

Expansion of Diagnostic Chains

Public‑Private Partnership (PPP) in Specialty Care - Trends

Consolidation in Private Hospital Sector

Chain Pharmacy Expansion

Integration of AI & Big Data in Diagnostics - Government Regulations

Social Health Insurance Reimbursement Rules

FDI & Private Hospital Investment Policies

Medical Device Import Regulations - SWOT Analysis

- Stakeholder Ecosystem (Regulators, Providers, Payers, Distributors, Tech Vendors)

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Service Tariff, 2019-2024

- By Provider Type (In Value %)

Public Hospitals

Private Hospitals

Specialty Clinics

Diagnostic Laboratories

Home‑Care & Telemedicine Providers - By Payer Type (In Value %)

Social Health Insurance

Private Health Insurance

Out‑of‑Pocket / Self‑Pay

Employer‑Funded / Corporate Schemes - By Service Type (In Value %)

General Medicine

Diagnostics & Imaging

Surgical & Interventional Services

Elderly & Long‑Term Care

Telehealth & Digital Care - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam

Mekong Delta

Urban vs Rural - By Technology & Product Type (In Value %)

Electronic Health Records (EHR) Systems

Molecular Diagnostics

Point‑of‑Care Testing (POCT) Devices

Imaging Modalities (MRI, CT, Ultrasound)

Remote Patient Monitoring Devices

- Market Share of Major Players (By Provider Type, By Service Type)

- Cross Comparison Parameters (Company Overview, Bed Capacity / Facility Count, Service Portfolio Coverage, Accreditation & Insurance Tie‑Ups, Geographic Presence, Digital Health Adoption Level, Tariff Range for Key Services, Ownership of Pharmacy / Diagnostic Network)

- SWOT Analysis of Major Players

- Pricing Analysis (Service Tariffs, Drug Prices)

- Detailed Profiles of 15 Major Companies

Hoàn Mỹ Medical Corporation

Vinmec Healthcare System

FV Hospital

City International Hospital

Hồng Ngọc Hospital

Phương Châu Hospital

Viet Duc Hospital

Cho Ray Hospital

Roche Vietnam

Siemens Healthineers Vietnam

Abbott Laboratories Vietnam

Medtronic Vietnam

Viet A Corporation

Pharmacity

Long Châu Pharmacy Chain

- Patient Utilization Patterns (Public vs Private)

- Purchasing Power & Affordability

- Regulatory & Compliance Requirements for Providers

- Needs, Desires, and Pain Points of Patients

- Decision‑Making Process in Provider Selection

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Service Tariff, 2025-2030