Market Overview

The Vietnam heat pump machine market is valued at USD 1.49 billion in 2024 with an approximated compound annual growth rate of 3.64% from 2024-2030, driven by significant growth in energy-efficient heating solutions and government initiatives promoting renewable energy usage. The demand is fueled by rising awareness of environmental sustainability and increasing investments in residential and commercial infrastructure.

Major cities such as Ho Chi Minh City, Hanoi, and Da Nang dominate the heat pump market due to their rapid urbanization, population growth, and significant industrial activities. Ho Chi Minh City leads this trend with its extensive construction and real estate developments focused on energy-efficient technologies. Additionally, Hanoi, being the political and educational hub, intensifies the demand for sustainable heating solutions across residential and commercial sectors.

The Vietnamese government has implemented various policies to promote the use of renewable energy and sustainable technology, significantly impacting the heat pump market. In 2022, the government allocated over USD 400 million for renewable energy projects under its Renewable Energy Development Strategy, aiming for 20% of the country’s total energy supply to come from renewable sources by 2030. This includes specific incentives for residential and commercial installations of technologies that conserve energy, including heat pumps.

Market Segmentation

By Product Type

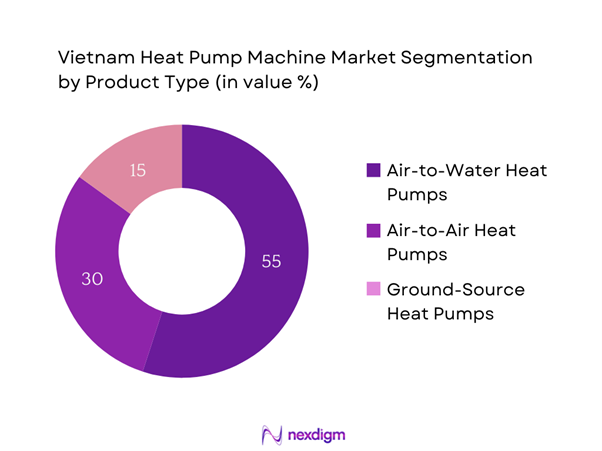

The Vietnam heat pump machine market is segmented by product type into air-to-water heat pumps, air-to-air heat pumps, and ground-source heat pumps. The air-to-water heat pumps account for the largest market share, with a projected share of 55% in 2024. This dominance is attributed to their versatility and efficiency in providing both heating and cooling solutions, making them particularly appealing for residential applications. These heat pumps are highly utilized in both existing homes and new constructions as part of the shift towards energy-efficient designs.

By Application

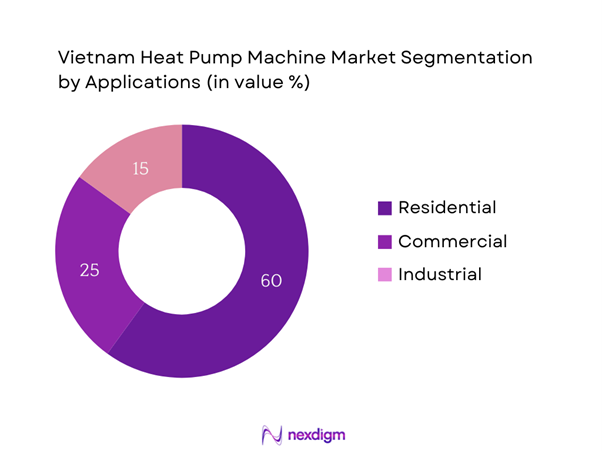

The market is also segmented by application into residential, commercial, and industrial uses. The residential segment is expected to dominate with a market share of 60% in 2024. This segment’s growth is propelled by increasing consumer awareness of energy conservation and rising electricity costs. Homeowners are investing in heat pump technology as an efficient alternative to traditional heating systems, especially in urban areas where energy efficiency is a growing priority.

Competitive Landscape

The Vietnam heat pump machine market is dominated by several key players, including major global manufacturers and local companies. This competitive landscape is characterized by strong brand presences and innovative product offerings, highlighting the significance of established companies in shaping market dynamics.

| Company | Establishment Year | Headquarters | Market Presence | Technology Developed | Key Products | Partnerships and Collaborations |

| Daikin Industries, Ltd. | 1924 | Osaka, Japan | – | – | – | – |

| Mitsubishi Electric Corp. | 1921 | Tokyo, Japan | – | – | – | – |

| Panasonic Corporation | 1918 | Osaka, Japan | – | – | – | – |

| Carrier Corporation | 1902 | Palm Beach, USA | – | – | – | – |

| LG Electronics Inc. | 1958 | Seoul, South Korea | – | – | – | – |

Vietnam Heat Pump Machine Market Analysis

Growth Drivers

Rising Energy Efficiency Demand

The demand for energy-efficient solutions in Vietnam is rapidly increasing, largely driven by escalating energy costs and a national commitment to reducing carbon emissions. In 2022, Vietnam’s total primary energy supply reached 115 million tons of oil equivalent (Mtoe), reflecting a steady rise in energy consumption influenced by economic growth at 8% in 2022. The Vietnamese government has set a target for energy efficiency to be improved by 20% by 2030, which encourages the adoption of efficient technologies such as heat pumps. This growing focus on energy conservation is critical as Vietnam aims to enhance productivity without compromising environmental sustainability.

Shift Towards Renewable Energy

Vietnam is experiencing a substantial transition towards renewable energy sources, with wind and solar energy growing rapidly. The share of renewables in Vietnam’s total energy generation increased to approximately 15% in 2022, signaling a clear intention to reduce reliance on fossil fuels. As part of this transition, the National Power Development Plan targets an additional 100 GW of renewable energy capacity by 2030, which naturally promotes the adoption of heat pump technology as they align with energy generation strategies that prioritize sustainability and efficiency in residential and industrial heating systems.

Market Challenges

Initial Installation Costs

The upfront costs associated with heat pump installations remain a significant barrier for many potential users in Vietnam. As of 2022, the average installation cost for residential heat pumps is estimated to range between USD 4,500 – USD 7,500. This cost can deter consumers, especially in a country where the GDP per capita was approximately USD 3,500 in 2022. The perception of high initial investment, despite long-term savings on energy bills, limits wider adoption and presents a challenge to constant growth in the market. Addressing these cost concerns through financing options or enhanced consumer education could be essential for market expansion.

Lack of Awareness Among Consumers

Despite the advantages, consumer awareness regarding heat pump technology remains relatively low in Vietnam. A government survey in 2022 indicated that only 35% of the population is aware of the operational benefits and energy savings that heat pumps could deliver. The lack of comprehensive education and marketing strategies promotes misconceptions about these technologies, hindering their adoption. Initiatives aimed at consumer outreach, showcasing successful case studies, and highlighting the benefits of heat pumps can significantly influence public perception and interest, driving market growth.

Opportunities

Advances in Technology

The rapid advancement in heat pump technology presents significant opportunities for market growth in Vietnam. Innovations, such as variable refrigerant flow systems and improved inverter technologies, are enhancing the efficiency and reliability of heat pumps. In 2022, technological advancements allowed for heat pump systems to achieve a coefficient of performance (COP) of more than 3.5, providing substantial energy savings and lowering operational costs. With local manufacturers increasingly investing in research and development, the market can expect a broader range of innovative products tailored specifically for the Vietnamese climate, enabling more consumers to adopt heat pump systems looking for energy-efficient solutions.

Market Expansion in Rural Areas

As Vietnam’s rural population continues to grow, there is an emerging demand for modern heating technologies in these underserved regions. In 2022, approximately 60% of Vietnam’s population still resided in rural areas, where traditional heating methods are prevalent. The rural electrification rate reached 99% in 2022, enabling greater access to electricity and creating an opportunity for heat pump adoption. Public and private partnerships aimed at promoting renewable energy technologies in rural communities can spark substantial market growth as more rural households adopt efficient heating solutions for improved living conditions and energy sustainability.

Future Outlook

Over the next five years, the Vietnam heat pump machine market is expected to show significant growth driven by continuous government support for renewable energy adoption, advancements in heat pump technology, and increasing consumer demand for energy-efficient heating solutions. As urbanization accelerates and the construction sector expands, heat pump systems are anticipated to become a standard for residential and commercial heating needs, further enhancing market potential.

Major Players

- Daikin Industries, Ltd.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Carrier Corporation

- LG Electronics Inc.

- Trane Technologies

- Rheem Manufacturing Company

- Bosch Thermotechnology

- Fujitsu General Limited

- Hitachi Ltd.

- Glen Dimplex Group

- Aermec S.p.A

- Dimplex North America

- ThermoKing Corporation

- Toshiba Carrier Corporation

Key Target Audience

- Government Agencies (Ministry of Industry and Trade, Vietnam)

- Energy Efficiency Authorities (Vietnam Energy Efficiency Center)

- Investors and Venture Capitalist Firms

- Real Estate Developers

- HVAC Contractors

- Environmental Consultants

- Energy Auditing Firms

- Renewable Energy Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all significant stakeholders within the Vietnam heat pump machine market. This phase is supported by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The main objective is to identify and define crucial variables influencing market dynamics, thereby establishing a solid foundation for further analysis.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Vietnam heat pump machine market is compiled and analyzed. This includes evaluating market penetration rates, the ratio of various product types to service providers, and resulting revenue generation. Additionally, a detailed assessment of service quality metrics will be conducted to ensure reliability and accuracy in the proposed revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse range of companies. Inputs from these consultations will provide valuable operational and financial insights directly from practitioners in the field, playing a critical role in refining and corroborating the collected market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with various manufacturers and stakeholders to acquire detailed insights regarding product segments, sales performance, consumer preferences, and other essential factors. This interaction will confirm and supplement data derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam heat pump machine market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Revenue Model

- Growth Drivers

Increasing Energy Costs

Growing Awareness about Energy Efficiency

Supportive Government Policies - Market Challenges

High Initial Costs

Limited Consumer Awareness - Opportunities

Technological Advancements

Rising Adoption in Urban Areas - Trends

Shift Toward Renewable Energy Solutions

Increase in Integrated Heating Solutions - Government Regulation

Energy Efficiency Standards

Import Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Air-to-Air Heat Pumps

– Split-Type Heat Pumps

– Ducted Systems

– Multi-Split Systems

– Reversible Units

Air-to-Water Heat Pumps

– Domestic Hot Water (DHW) Systems

– Space Heating via Radiators or Underfloor Heating

– Hybrid Water Heaters

– Integrated Tank Systems

Ground-Source Heat Pumps (Geothermal)

– Vertical Loop Systems

– Horizontal Loop Systems

– Open-Loop Systems

– Direct Exchange Systems - By Application (In Value %)

Residential

– Single-Family Homes

– Villas & Row Houses

– High-Rise Apartments

– Gated Housing Societies

Commercial

– Hotels & Resorts (DHW and heating)

– Office Complexes

– Educational Institutions

– Hospitals and Healthcare Centers

Industrial

– Textile and Garment Factories

– Food Processing Plants

– Chemical and Pharma Plants

– Warehouses - By Technology (In Value %)

Inverter Technology

Non-Inverter Technology - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam - By Capacity (In Value %)

Less than 10 kW

10–20 kW

20–50 kW

Above 50 kW

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Heat Pump Machine Segment, 2024 - Cross Comparison Parameters (Company Overview, Inception Year, Business Strategies, Organizational Structure, Revenues, Number of Product Offerings, Customer Satisfaction Index, Average Selling Price, Warranty Options, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plants and Capacity, Unique Value Offering, Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Daikin

Mitsubishi Electric

LG Electronics

Bosch Thermotechnology

Panasonic

Fujitsu General

Rinnai Corporation

Carrier Global Corporation

Trane Technologies

Gree Electric Appliances

Toshiba

Midea Group

Rheem Manufacturing Company

Hoval Group

Swegon

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030