Market Overview

As of 2024, the Vietnam HVAC control systems market is valued at USD 759.4 million, with a growing CAGR of 5.5% from 2024 to 2030, driven by the rapid urbanization and increasing construction activities in the region. The ongoing demand for energy efficiency and smart control solutions further propels this market, providing substantial growth opportunities for businesses involved in HVAC technologies. The market’s expansion reflects a growing focus on optimizing indoor environments and reducing energy expenses.

Key cities such as Ho Chi Minh City and Hanoi dominate the HVAC control systems market in Vietnam due to their significant economic activities and high population density. These urban centres are experiencing substantial real estate development, leading to heightened demand for advanced HVAC solutions. The emphasis on innovation and sustainability within these metropolitan areas supports the increasing adoption of smart technologies in HVAC applications.

Market Segmentation

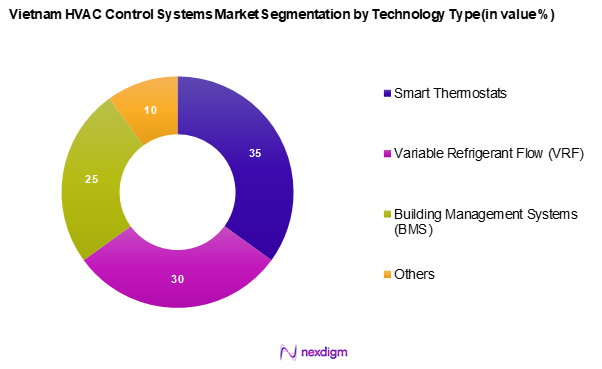

By Technology Type

The Vietnam HVAC control systems market is segmented into smart thermostats, Variable Refrigerant Flow (VRF) systems, Building Management Systems (BMS), and others. Among these, the smart thermostats segment is witnessing robust growth due to the escalating consumer preference for convenience and energy efficiency. Smart thermostats offer features such as remote access and automated programming, making them appealing to homeowners and businesses aiming to optimize energy consumption while enhancing comfort levels.

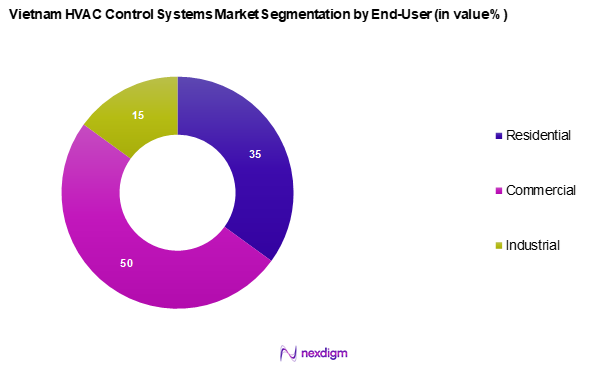

By End-User

The Vietnam HVAC control systems market is segmented into residential, commercial, and industrial. The commercial segment dominates the market share due to the substantial investments in commercial infrastructure and the need for efficient heating, ventilation, and air conditioning solutions in office buildings, retail spaces, and hotels. The increasing focus on energy management and occupancy comfort within commercial environments propels the demand for sophisticated HVAC control systems.

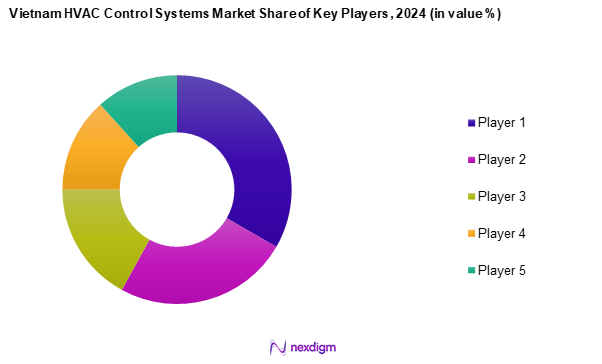

Competitive Landscape

The Vietnam HVAC control systems market is dominated by a few major players, including global brands like Honeywell, Siemens, and Daikin, along with local manufacturers. This consolidation highlights the significant influence of these key companies in shaping the market dynamics through innovation and customer-centric solutions.

| Company Name | Establishment Year | Headquarters | Market Focus | Revenue | Business Segment Revenue | Market Strategy |

| Honeywell | 1885 | Morris Plains, USA | – | – | – | – |

| Siemens | 1847 | Munich, Germany | – | – | – | – |

| Daikin | 1924 | Osaka, Japan | – | – | – | – |

| Trane | 1913 | Swords, Ireland | – | – | – | – |

| LG Electronics | 1958 | Seoul, South Korea | – | – | – | – |

Vietnam HVAC Control Systems Market Analysis

Growth Drivers

Urbanization and Population Growth

Vietnam’s rapid urbanization is a significant driver for the HVAC control systems market, with urban populations reaching over 48% in 2024, increasing from 34% in 2020, according to the General Statistics Office of Vietnam. As more people migrate to cities, there is a corresponding rise in the demand for modern living standards that include advanced HVAC solutions for comfort and energy efficiency. This urban shift translates to a projected annual increase of 1.3 million in urban residents, necessitating upgraded building solutions, thus boosting the HVAC sector.

Government Initiatives and Infrastructure Development

The Vietnamese government has invested significantly in infrastructure development, allocating approximately USD 51.0 billion for projects under the National Target Program for socio-economic development from 2022 to 2025. This investment is expected to facilitate the construction of residential and commercial buildings, directly impacting the HVAC control systems market. Moreover, the government’s push for energy efficiency through policies aims to decrease power consumption by 20% by 2025, enhancing the demand for smart HVAC solutions capable of optimizing energy use.

Market Challenges

High Initial Installation Costs

One of the main challenges facing the HVAC control systems market is the high upfront costs associated with installation, which can range from USD 5,000.0 to USD 10,000.0 for commercial systems. This financial barrier limits accessibility for many small businesses and homeowners. Additionally, with an average disposable income of approximately USD 3,500.0 in 2024, many potential buyers consider the investment prohibitive. These factors create a reluctance to adopt advanced HVAC technology, which could slow market growth despite its long-term economic benefits.

Lack of Skilled Workforce

The HVAC industry struggles with a shortage of skilled technicians. As of 2023, it is reported that about 50% of HVAC technician positions in Vietnam remained unfilled due to inadequate training programs and education in technical fields. The lack of a skilled workforce hampers the installation and maintenance of advanced HVAC systems, leading to subpar implementation and customer dissatisfaction. Vietnam’s labour force participation rate is around 76%, and the emphasis on skills training remains critical to addressing industry requirements.

Opportunities

Expansion of Smart Cities

The concept of smart cities is gaining momentum in Vietnam, evidenced by initiatives like the Ho Chi Minh City Smart City Project that aims to implement advanced technologies to improve urban infrastructure. As the government prioritizes smart city development, there is immense potential for HVAC control systems that integrate with city-wide automation systems. In 2023, it was noted that 70% of urban projects included components aimed at boosting energy efficiency, indicating a clear alignment of HVAC technology with future urban planning.

Adoption of Green Building Practices

Vietnam is increasingly embracing green building practices, with over 300 green projects registered for certification under the Vietnam Green Building Council. The push for sustainable development is invigorating the HVAC industry, as energy-efficient and environmentally friendly systems become critical. By promoting the use of renewable energy tasks, such as solar-powered HVAC installations, the market opportunity for advanced systems is expanding. This transition is set to create robust growth, surging demand for solutions that meet environmental standards.

Future Outlook

Over the next five years, the Vietnam HVAC control systems market is expected to show significant growth driven by continuous urbanization, advancements in HVAC technology, and increasing consumer demand for smart and energy-efficient systems. The government’s emphasis on sustainable building practices and energy conservation will further enhance market prospects, creating an environment conducive for innovation and investment in HVAC solutions.

Major Players

- Honeywell

- Siemens

- Daikin

- Trane

- LG Electronics

- Mitsubishi Electric

- Johnson Controls

- Carrier

- Rheem Manufacturing

- Lennox International

- Bosch Thermotechnik

- ABB

- Emerson Electric

- Resideo Technologies

- Schneider Electric

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Construction, Ministry of Industry and Trade)

- HVAC Manufacturers

- Energy Management Companies

- Real Estate Developers

- Builders and Contractors

- Facility Management Companies

- End-users (Commercial and Residential Consumers)

Research Methodology

Step 1: Identification of Key Variables

This step involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam HVAC control systems market. Comprehensive industry-level information is gathered through secondary and proprietary databases to identify and define critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data pertaining to the Vietnam HVAC control systems market is compiled and analyzed in this phase. This includes assessing market penetration rates, the ratio of various technology types to service providers, and resulting revenue generation. Further evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates, which contribute to a well-rounded market picture.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts across different companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are crucial for refining and corroborating the market data obtained in earlier phases.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with multiple HVAC control systems manufacturers occurs to gather detailed insights regarding product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam HVAC control systems market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Trends and Dynamics

- Competitive Landscape

- Technological Advancements

- Regulatory Framework and Standards

- Supply Chain and Value Chain Analysis

- Growth Drivers

Urbanization and Population Growth

Government Initiatives and Infrastructure Development - Market Challenges

High Initial Installation Costs

Lack of Skilled Workforce

Competition from Alternative Solutions - Opportunities

Expansion of Smart Cities

Adoption of Green Building Practices - Market Trends

Digitization of HVAC Control Systems

Integration with IoT Devices - Regulatory Analysis

Energy Efficiency Standards

Environmental Regulations - SWOT Analysis

- Porter’s Five Forces

- By Revenue, 2019-2024

- By Volume, 2019-2024

- By Installation Type, 2019-2024

- By Technology Type (In Value %)

Smart Thermostats

– Programmable Thermostats

– Learning Thermostats

– Zonal Temperature Controllers

Variable Refrigerant Flow (VRF) Systems

– Heat Recovery Systems

– Heat Pump Systems

– Inverter-Based Controllers

Building Management Systems (BMS)

– HVAC-Centric BMS

– Integrated BMS (Lighting, Fire Safety, etc.)

– Cloud-Based BMS Platforms

Others

– Occupancy Sensors

– Smart Vents

– Energy Monitoring Devices - By End User (In Value %)

Residential

– Single-Family Homes

– Apartments and Condominiums

– Villas

Commercial

– Offices and Business Complexes

– Retail Outlets and Shopping Malls

– Hotels and Hospitality

Industrial

– Manufacturing Plants

– Warehouses

– Data Centers - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer to Contractor

– Manufacturer to End User

Online Sales

– E-Commerce Platforms

– OEM Brand Stores

Distributors/Agents

– Regional HVAC Distributors

– Authorized Sales Agents - By Type of Control System (In Value %)

Wired Control Systems

– Centralized Wired Networks

– Hardwired Sensors and Panels

Wireless Control Systems

– Wi-Fi Based Controllers

– Zigbee/Z-Wave Protocol Systems

– Bluetooth-Enabled Thermostats - By Type (In Value %)

Centralized HVAC Control Systems

– Integrated Building-Wide Systems

– Central Monitoring Dashboards

Decentralized HVAC Control Systems

– Room-Based Units

– Independent System Controllers

Smart HVAC Control Systems

– AI-Powered Optimization

– App-Controlled Interfaces

– Remote and Voice-Controlled Systems - By Implementation Type (In Value %)

New Constructions

– Residential and Commercial Developments

– Government and Infrastructure Projects

Retrofits

– System Upgrades

– Energy Efficiency Replacements - By Offering (In Value %)

Equipment

– Sensors and Actuators

– Thermostats and Controllers

– Communication Devices

Service

– Installation and Commissioning

– Repair and Maintenance

– System Integration - By System (In Value %)

Temperature

– Heating Control

– Cooling Control

Ventilation

– Air Quality Control

– Air Flow Regulation

Humidity

– Humidifiers/Dehumidifiers

– Humidity Control Sensors

Integrated

– All-in-One Environmental Control

– Multi-Parameter Automation - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam

- Market Share of Key Players on the Basis of Value Volume 2024

- Market Share of Major Players by Type Segment 2024

- Cross Comparison Parameters (Company Overview, Product Portfolio, Recent Innovations, Revenue, Customer Base, Strength, Weakness, Organizational Structure, Distribution Networks, Market Strategy, Business Segment Revenue)

- SWOT Analysis of Major Competitors

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Daikin Industries

Carrier Global Corporation

Trane Technologies

Johnson Controls

LG Electronics

Mitsubishi Electric

Honeywell International

KMC Controls

Siemens AG

Emerson Electric Co

York International

Schneider Electric

Panasonic Corporation

Rheem Manufacturing Company

Viet Hung Group

Others

- Demand Forecast and Utilization Patterns

- Consumer Behaviour and Budget Considerations

- Awareness and Adoption Trends

- By Value 2025–2030

- By Volume 2025–2030

- By Average Pricing 2025–2030