Market Overview

The Vietnam IT Security market is valued at approximately USD 2.4 billion in 2024 with an approximated compound annual growth rate (CAGR) of 15% from 2024-20230, based on a five-year historical analysis. This growth is driven by a surge in cyber threats, increased digital transformation, and a growing awareness of the need for comprehensive cybersecurity solutions among businesses and organizations. Additionally, substantial government investment in enhancing national cybersecurity infrastructure is helping to create a supportive environment for the market’s expansion.

Major cities such as Ho Chi Minh City and Hanoi dominate the Vietnam IT Security market due to their concentration of business activities and rapid urbanization. These cities host numerous tech startups and a growing number of multinational corporations, which increases the demand for advanced IT security solutions.

The Vietnamese government is actively promoting cybersecurity through legislative and strategic frameworks. The National Cybersecurity Strategy aims to position Vietnam among the top ASEAN nations for cybersecurity by end of 2025. In 2022, the Ministry of Information and Communications allocated VND 3 trillion (approximately USD 130 million) to enhance the nation’s cybersecurity capabilities. This funding will bolster public awareness campaigns, training programs, and technological advancements in cybersecurity, thereby driving market growth as public and private sectors align their initiatives with national strategies.

Market Segmentation

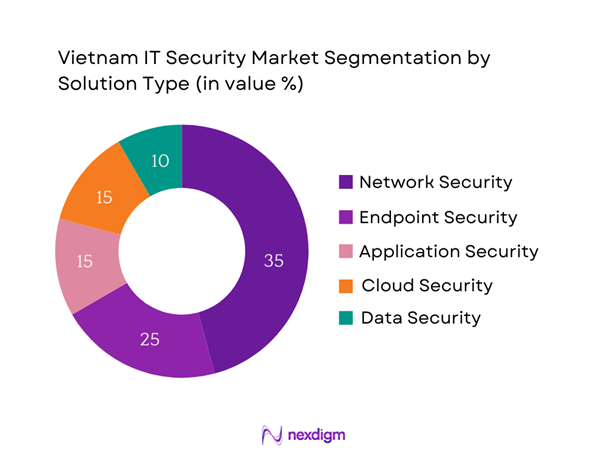

By Solution Type

The Vietnam IT Security market is segmented by solution type into network security, endpoint security, application security, cloud security, and data security. In this segmentation, network security currently holds a dominant market share. This is primarily due to the escalating frequency and sophistication of cyberattacks targeting networks and infrastructure within organizations. As networked environments expand, businesses see network security as a critical investment to safeguard sensitive information and maintain operational integrity, making it a funding priority.

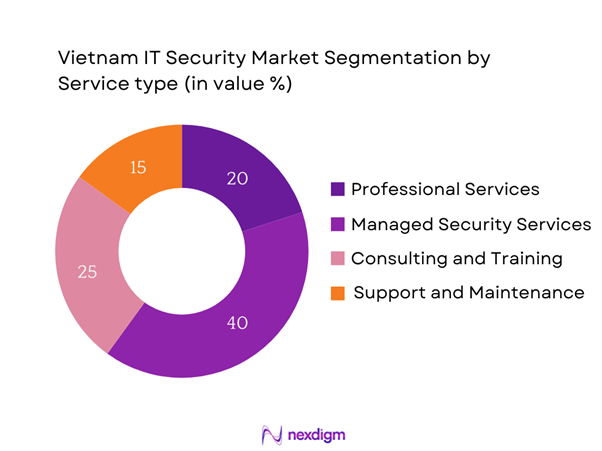

By Service Type

The market is also segmented by service type into professional services, managed security services, consulting and training, and support and maintenance. Managed security services represent a leading segment due to the increasing complexity of cyber threats and the lack of in-house expertise within organizations. Companies increasingly prefer outsourcing their IT security functions to specialized providers, allowing them to focus on core business activities while ensuring robust cybersecurity measures are in place. This trend is significantly enhancing the growth of managed security services in Vietnam.

Competitive Landscape

The Vietnam IT Security market is dominated by a few key players, including local companies and international players offering a range of services. Major players include FPT Corporation, Viettel Cybersecurity, and BKAV. These companies have established themselves through innovative solutions, robust networks, and strategic partnerships. Their prominence indicates significant operational influence and commitment to enhancing the cybersecurity landscape in Vietnam.

| Company | Establishment Year | Headquarters | Market Segment | Key Offerings | Employee Count | Revenue |

| FPT Corporation | 1988 | Hanoi, Vietnam | – | – | – | – |

| Viettel Cybersecurity | 2007 | Hanoi, Vietnam | – | – | – | – |

| BKAV | 1998 | Hanoi, Vietnam | – | – | – | – |

| CyRadar | 2015 | Ho Chi Minh City | – | – | – | – |

| CMC Corporation | 1993 | Hanoi, Vietnam | – | – | – | – |

Vietnam IT Security Market Analysis

Growth Drivers

Increasing Cyber Threats and Data Breaches

Vietnam has witnessed a sharp increase in cyber threats, with the Cyber Security Assurance Center reporting that 4,545 cyberattacks were recorded in 2022 alone. The rapid digitalization of businesses, in conjunction with inadequate security measures, has made organizations susceptible to data breaches. In 2023, the Vietnam Ministry of Information and Communications highlighted that 80% of enterprises experienced at least one cyber incident, emphasizing the urgency for enhanced security measures. This escalating threat landscape is prompting companies to invest heavily in IT security solutions to protect sensitive data and ensure compliance with regulations.

Rising Demand for Cloud-Based Cybersecurity Solutions

In 2022, Vietnam’s cloud services market was valued at USD 580 million, demonstrating a 30% growth compared to the previous year. The increasing reliance on digital platforms and remote work has driven organizations to adopt cloud technologies, laying the foundation for the growth of cloud-based cybersecurity services. A report from the Vietnam Cloud Computing Association indicates that 65% of Vietnamese enterprises plan to migrate to cloud environments, creating significant demand for tailored cybersecurity solutions to mitigate potential risks associated with cloud storage and applications.

Market Challenges

High Initial Costs and Complexities

The implementation of advanced cybersecurity solutions entails substantial upfront investments, often deterring smaller enterprises from adopting necessary technologies. In 2022, the average cost for deploying comprehensive IT security infrastructure in Vietnam was reported to be around USD 60,000. Additionally, complex software solutions require regular updates and maintenance, contributing to ongoing expenditure. The financial burden can be a significant barrier, particularly for small and medium-sized enterprises (SMEs) that may lack the resources to invest in robust cybersecurity measures.

Lack of Skilled IT Security Professionals

Despite the increasing demand for cybersecurity expertise, Vietnam faces a shortage of skilled IT security professionals. According to a report by the Vietnam Information Technology Association, the country currently has a deficit of approximately 70,000 cybersecurity professionals needed to meet market demands. This skills gap hampers the effective implementation of security protocols and leaves organizations vulnerable to attacks. The government and educational institutions must prioritize skills development in IT security to address this critical challenge, as the demand for professionals is anticipated to continue rising.

Opportunities

Growing Adoption of IoT and BYOD Policies

The increasing integration of the Internet of Things (IoT) into various sectors presents a substantial growth opportunity for the IT security market. As of 2023, Vietnam is estimated to have around 122 million connected devices, with projections suggesting this figure will rise significantly in the coming years. Alongside this trend, the Bring Your Own Device (BYOD) policy is gaining traction, emphasizing the need for enhanced security measures to protect the organization’s data against potential vulnerabilities introduced by personal devices. Companies that invest in tailored security solutions can effectively capitalize on this rapidly evolving technological landscape.

Emergence of AI and Machine Learning in Cybersecurity

The adoption of artificial intelligence (AI) and machine learning (ML) technologies is set to revolutionize cybersecurity efforts in Vietnam. This is evident as 90% of Vietnamese businesses recognize that AI can significantly improve their cybersecurity posture. The AI cybersecurity market is experiencing rapid growth, with investments in this domain expected to soar as organizations seek to automate threat detection and response mechanisms. By leveraging AI and ML, companies can not only streamline their security protocols but also enhance their ability to prevent and respond to sophisticated cyber threats.

Future Outlook

Over the next five years, the Vietnam IT Security market is anticipated to see substantial growth driven by an increased focus on cybersecurity due to the rising number of cyber threats, the digital transformation of businesses, and government initiatives promoting cybersecurity awareness. As organizations in Vietnam continue to integrate technology into their operations, the demand for various IT security solutions will likely increase, fostering a robust market environment.

Major Players in the Market

- FPT Corporation

- Viettel Cybersecurity

- BKAV

- CyRadar

- CMC Corporation

- VNG Corporation

- Vietnam Posts and Telecommunications Group (VNPT)

- SafeGate

- VSEC

- Nexus

- TechX Corporation

- DataSpace

- Trustwave

- Kaspersky Vietnam

- Trend Micro Vietnam

Key Target Audience

- Corporate Enterprises

- Small and Medium Enterprises (SMEs)

- Financial Institutions (Banking and Insurance)

- Government Agencies (Ministry of Information and Communications, Cyber Security Center)

- Healthcare Providers

- Educational Institutions (Universities/Technical Schools)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Vietnam National Cyber Security Center)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam IT Security Market. By conducting a thorough review and analysis of available literature, industry reports, and other credible sources, this step focuses on defining the critical variables that influence market dynamics, ensuring a sound foundation for further analysis.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Vietnam IT Security Market is compiled and analyzed. This includes evaluating market penetration, key players, product/service offerings, and revenue generation patterns. The analysis also incorporates expert insights and statistical data gathered from various credible sources to validate the conclusions drawn.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed through desktop research and validated via consultations with industry experts across various sub-segments in the IT security domain. Interviews and discussions with key stakeholders provide nuanced insights that contribute to a clearer understanding of market trends, operational challenges, and growth opportunities.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the data collected and analyzed throughout the research process. This is achieved through direct engagement with IT security companies to obtain detailed insights regarding market dynamics, customer preferences, market shares, and emerging trends. This interaction allows for the triangulation of data and ensures that the final output is accurate and comprehensive.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Cyber Threats and Data Breaches

Rising Demand for Cloud-Based Cybersecurity Solutions

Government Initiatives to Boost Cybersecurity - Market Challenges

High Initial Costs and Complexities

Lack of Skilled IT Security Professionals - Opportunities

Growing Adoption of IoT and BYOD Policies

Emergence of AI and Machine Learning in Cybersecurity - Trends

Integration of Blockchain in Security Solutions

Advancements in Threat Intelligence Solutions - Government Regulation

Compliance Standards and Frameworks - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Average Revenue per Customer, 2019-2024

- By Average Subscription Cost, 2019-2024

- By Solution Type (In Value %)

Network Security

– Firewalls

– Intrusion Detection & Prevention Systems (IDPS)

– Virtual Private Networks (VPNs)

Endpoint Security

– Antivirus/Anti-malware

– Endpoint Detection and Response (EDR)

– Device Control

Application Security

– Web Application Firewalls (WAF)

– Runtime Application Self-Protection (RASP)

– Mobile Application Security

Cloud Security

– Cloud Access Security Brokers (CASB)

– Secure Web Gateways (SWG)

– Cloud Workload Protection Platforms (CWPP)

Data Security

– Data Loss Prevention (DLP)

– Encryption

– Identity and Access Management (IAM) - By Service Type (In Value %)

Professional Services

– Risk & Compliance Assessment

– Architecture Design & Integration

Managed Security Services

– Threat Monitoring & Incident Response

– Security Operations Center (SOC) as a Service

Consulting and Training

– Cybersecurity Awareness Programs

– Security Audits & Penetration Testing

Support and Maintenance

– Software Patches & Updates

– Hardware & System Maintenance - By Deployment Mode (In Value %)

On-Premises

– Hosted in Local Data Centers

– Self-managed Security Infrastructure

Cloud

– Public Cloud

– Private Cloud

– Hybrid Cloud - By End-User Industry (In Value %)

Banking, Financial Services, and Insurance (BFSI)

Government and Defense

IT and Telecom

Healthcare

Retail - By Organization Size (In Value %)

Small and Medium Enterprises (SMEs)

Large Enterprises

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of IT Security Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Customer Segmentation, Technological Solutions Offered, Regulatory Compliance, Innovation in Security Solutions, Partnerships and Collaborations, Customer Feedback and Satisfaction, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Players

- Detailed Profiles of Major Companies

FPT Corporation

Viettel Cybersecurity

CyRadar

CMC Corporation

VNG Corporation

Vietnam Posts and Telecommunications Group (VNPT)

SafeGate

BKAV

VSEC

Nexus

TechX Corporation

DataSpace

Trustwave

Kaspersky Vietnam

Trend Micro Vietnam

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Average Revenue per Customer, 2025-2030

- By Average Subscription Cost, 2025-2030