Market Overview

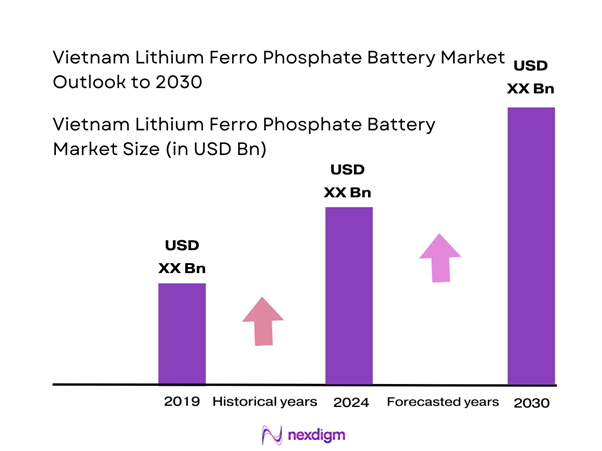

The Vietnam Lithium Ferro Phosphate Battery Market is valued at USD 1.2 billion in 2024 with an approximated compound annual growth rate (CAGR) of 19% from 2024-2030, reflecting robust expansion driven by surging demand across electric vehicle and energy storage applications. Key growth factors include government incentives for clean energy technologies and investments in renewable sector infrastructure.

Among the dominant cities contributing significantly to the Vietnam market are Ho Chi Minh City, Hanoi, and Da Nang. These urban areas are fostering innovation and attracting investment due to their strategic importance in the energy and transportation sectors. Ho Chi Minh City stands out as an economic powerhouse with a booming automotive industry, while Hanoi’s efforts in policy implementation and infrastructure development enhance its viability for battery production. Da Nang’s emerging technology hubs and clean energy initiatives further exemplify the geographic concentration of the market in Vietnam.

Vietnam’s government has introduced various policies and incentives to support the adoption of electric vehicles and battery technologies. The Electric Vehicle Development Plan outlines subsidies such as tax exemptions and reduced registration fees for EVs. In 2022, the government allocated approximately VND 1 trillion (around USD 43 million) to support the development of EV infrastructure, including charging stations and battery manufacturing facilities.

Market Segmentation

By Application

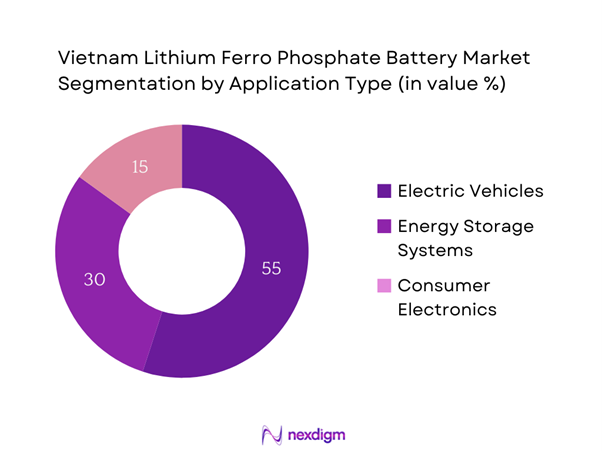

The Vietnam Lithium Ferro Phosphate Battery Market is segmented by application into the following sub-segments: Electric Vehicles (EVs), Energy Storage Systems (ESS), and Consumer Electronics. The electric vehicles (EVs) sub-segment is leading the market, driven by a growing preference for sustainable transportation solutions and significant government support for EV adoption. Several initiatives, such as tax incentives and infrastructure development for charging stations, are boosting the adoption of lithium ferro phosphate batteries in EVs. Major automakers are increasingly investing in this technology due to its safety profile, thermal stability, and lifecycle advantages, which have made it the preferred battery technology for electric mobility.

By End-user Industry

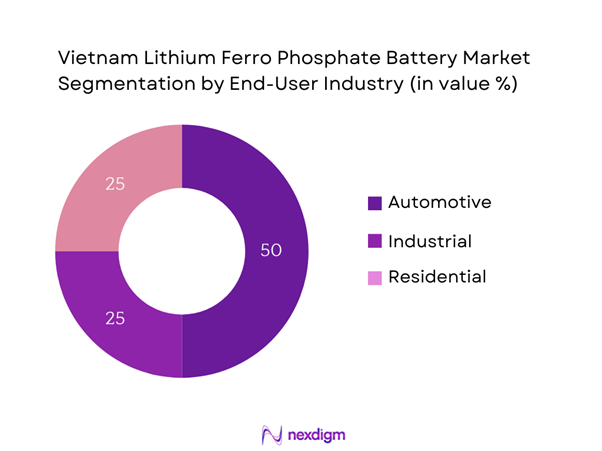

The Vietnam Lithium Ferro Phosphate Battery Market is further segmented by end-user industry into: Automotive, Industrial, and Residential. The automotive industry dominates this segment due to the significant shift towards electric and hybrid vehicles. Major automotive manufacturers are pivoting from traditional combustion engines to electric powertrains, which require efficient and reliable battery solutions. The focus on reducing carbon footprints and adhering to stringent emission regulations is compelling industry leaders in Vietnam to adopt lithium ferro phosphate batteries known for their safety and efficiency in high-performance automotive applications.

Competitive Landscape

The Vietnam Lithium Ferro Phosphate Battery Market is dominated by key players including both local manufacturers and international firms. The competitive landscape highlights a mix of established brands vying for market share, with some concentrating on research and development for advanced battery technologies. These companies play pivotal roles in shaping the market by focusing on innovation and meeting the growing demand for sustainable energy solutions.

| Company Name | Establishment Year | Headquarters | Market Position | Key Product Focus | R&D Investments |

| CATL | 2011 | China | – | – | – |

| BYD | 1995 | China | – | – | – |

| A123 Systems LLC | 2001 | USA | – | – | – |

| VinFast | 2017 | Vietnam | – | – | – |

| LG Chem | 1947 | South Korea | – | – | – |

Vietnam Lithium Ferro Phosphate Battery Market Analysis

Growth Drivers

Rising Demand for Electric Vehicles

The demand for electric vehicles (EVs) in Vietnam is experiencing exponential growth, with the Ministry of Industry and Trade reporting that EV sales reached 15,700 units in 2023, an increase of 45% from the previous year. This surge is fueled by increasing environmental awareness and a push towards sustainable transportation. The government aims to have 1 million EVs on the road by 2028, aligning with its commitment to reducing greenhouse gas emissions by 9% by 2030 under the Paris Agreement.

Growing Renewable Energy Sector

Vietnam’s renewable energy sector has seen substantial growth, with a total capacity of installed renewable energy sources reaching 21,664 MW in 2023, according to the Vietnam Renewable Energy Development Strategy. The share of renewable energy in the national power generation mix is projected to reach 41% by 2030, demonstrating a strong commitment to sustainable energy sources. The growth of renewable energy relies heavily on energy storage solutions, where lithium ferro phosphate batteries play a crucial role in stabilizing energy supply from intermittent sources, thus driving their demand in the market.

Market Challenges

High Raw Material Costs

The cost of raw materials used in lithium ferro phosphate battery production continues to pose a significant challenge for manufacturers. The price of lithium rose sharply to USD 51,000 per ton in 2023, influenced by supply constraints and increased global demand for lithium for EVs and energy storage systems. Additionally, the price of iron phosphate has also seen considerable volatility, arising from fluctuating mining outputs and global shipping disruptions. These factors contribute to rising production costs, which could slow the expansion of the lithium ferro phosphate battery market in Vietnam if not addressed through strategic sourcing and supply chain management.

Supply Chain Issues

Supply chain disruptions remain a critical challenge for the lithium ferro phosphate battery market, exacerbated by the COVID-19 pandemic and the global semiconductor shortage. Delays in the import of essential components and raw materials have been a prevalent concern, with average lead times increasing by 25% across various sectors in Southeast Asia. This situation not only affects production timelines but also impacts the pricing and availability of lithium ferro phosphate batteries in the market. Strengthening local supply chains and diversifying sourcing strategies will be essential for overcoming these hurdles.

Opportunities

Export Potential to ASEAN Countries

Vietnam is strategically positioned to tap into the growing demand for lithium ferro phosphate batteries across ASEAN countries, which are increasingly adopting electric vehicles and renewable energy solutions. The combined population of ASEAN nations exceeds 650 million, with many governments offering incentives for local and foreign companies to enter the EV and renewable energy markets. In 2023, ASEAN countries collectively imported around USD 1 billion worth of lithium batteries, presenting a lucrative opportunity for Vietnamese manufacturers to export their products, establish regional supply chains, and enhance their market footprint throughout Southeast Asia.

Investments in R&D

There is a substantial opportunity for growth through increased investments in research and development focused on lithium ferro phosphate battery technology. In Vietnam, the government has allocated around VND 2 trillion (approximately USD 86 million) towards boosting clean energy innovation and related technologies through its Energy Transition Strategy. Such investments not only enhance technological advancements but also encourage collaborations between educational institutions and industry players to develop next-generation lithium ferro phosphate batteries that are cost-effective and highly efficient. This focus on R&D will likely drive both local and international partnerships, fostering innovation within the market.

Future Outlook

Over the next five years, the Vietnam Lithium Ferro Phosphate Battery Market is expected to exhibit strong growth driven by continued government backing for renewable energy initiatives, advancements in battery technology, and a rising consumer shift toward eco-friendly energy solutions. The increasing integration of lithium ferro phosphate batteries in various applications will significantly drive demand, particularly in the automotive and energy sectors. Industry players are poised to benefit from expanding their product portfolios and building strategic partnerships, ensuring resilience and adaptability in a dynamic market landscape.

Major Players

- CATL

- BYD

- A123 Systems LLC

- VinFast

- LG Chem

- Panasonic Corporation

- Samsung SDI Co. Ltd.

- Farasis Energy, Inc.

- Toshiba Corporation

- Contemporary Amperex Technology Co., Ltd. (CATL)

- K2 Energy Solutions, Inc.

- AESC

- EVE Energy Co., Ltd.

- JenaBatteries GmbH

Key Target Audience

- Automotive Manufacturers

- Energy Storage Solution Providers

- Electric Vehicle Component Suppliers

- Battery Manufacturers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Industry and Trade, Ministry of Natural Resources and Environment)

- Renewable Energy Associations

- Research and Development Institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map, incorporating all critical stakeholders in the Vietnam Lithium Ferro Phosphate Battery Market. Extensive desk research utilizes secondary and proprietary databases to gather relevant industry-level information, focusing on identifying and defining key variables that impact market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the Vietnam Lithium Ferro Phosphate Battery Market, evaluating metrics such as market penetration rates and revenue generation associated with various applications and segments. This analysis ensures the reliability and accuracy of revenue estimates and market trends.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses will be tested and validated through a series of computer-assisted telephone interviews (CATIs) with industry experts from diverse companies. These consultations will provide direct operational and financial insights, essential for refining market data and ensuring a comprehensive view of competitive landscapes and growth opportunities.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with several lithium ferro phosphate battery manufacturers to gather detailed insights into current product segments, sales performance, and consumer preferences. This direct interaction will validate data and insights gathered from prior analyses, ensuring a comprehensive and accurate representation of the Vietnam Lithium Ferro Phosphate Battery Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Overview of Market Genesis

- Timeline of Major Players

- Business Cycle Analysis

- Revenue Model Dynamics

- Growth Drivers

Rising Demand for Electric Vehicles

Government Policies and Incentives

Growing Renewable Energy Sector

Technological Advancements in Battery Technology - Market Challenges

High Raw Material Costs

Competition from Alternative Battery Technologies

Supply Chain Issues - Opportunities

Export Potential to ASEAN Countries

Investments in R&D

Partnership with Automotive Companies - Trends

Shift Towards Sustainable Energy Solutions

Increased Focus on Recycling and Second-Life Applications

Integration with Smart Grids - Government Regulation

National Battery Strategy

Environmental Compliance Standards

Safety Regulations for Battery Manufacturing - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024 (In USD)

- By Volume, 2019-2024 (In MWh)

- By Average Price, 2019-2024 (USD per kWh)

- By Application (In Value %)

Electric Vehicles (EVs)

– Two-Wheelers & Three-Wheelers

– Passenger Electric Cars

– Commercial EVs

– Last-Mile Delivery EV Fleets

Energy Storage Systems (ESS)

– Residential ESS

– Commercial & Industrial ESS

– Utility-Scale Grid Storage Projects

– Telecom Backup Power (for tower sites and data centers)

Consumer Electronics

– Power Banks and Portable Battery Packs

– Smart Home Devices (security cameras, thermostats)

– E-toys and Handheld Devices

– Small Drones and Personal Mobility Devices - By End-User Industry (In Value %)

Automotive

Industrial

Residential - By Geography (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam - By Technology Type (In Value %)

Standard Lithium Ferro Phosphate Batteries

Advanced Lithium Ferro Phosphate Batteries - By Configuration (In Value %)

Prismatic

Cylindrical

Pouch

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Lithium Ferro Phosphate Battery Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Organizational Structure, Revenues, Technology Adoption Rate, Customer Segmentation Strategies, Geographic Reach, Product Portfolio Diversity, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plants and Capacity, Unique Value Proposition, Others)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

A123 Systems

BYD Company

CATL

Panasonic Corporation

LG Chem

Samsung SDI

Toshiba

EVE Energy Co.

AESC

Farasis Energy

SK Innovation

Wanxiang A123

Chaojing Technology

Leclanché

TYC Fortune Group

- Market Demand and Utilization Trends

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Customer Preferences and Pain Points

- Decision-Making Process

- By Value, 2025-2030 (In USD)

- By Volume, 2025-2030 (In MWh)

- By Average Price, 2025-2030 (USD per kWh)