Market Overview

The Vietnam Logistics Market is valued at USD 52.06 billion in 2025 with an approximated compound annual growth rate (CAGR) of 6.67% from 2025-2030, backed by robust economic growth and increasing trade activities. The sector is driven by significant investments in infrastructure, especially in road and rail networks, which are enhancing connectivity and reducing transportation costs. The rapid expansion of e-commerce is also contributing to market dynamics, as businesses increasingly rely on efficient logistics services to meet consumer demands.

The dominant player cities in this market include Ho Chi Minh City and Hanoi, which account for a substantial share of logistics operations. These cities benefit from their strategic locations, extensive transportation networks, and ports. Ho Chi Minh City, as the commercial hub, attracts considerable investment in logistics infrastructure, while Hanoi serves as the political and administrative center, facilitating government support and trade facilitation.

Vietnam is prioritizing investments in transportation infrastructure, with a government plan allocating over USD 90 billion to infrastructure projects, including road, rail, and port developments by end of 2025. Major infrastructure projects, such as the North-South Expressway and upgrades to key ports, including Ho Chi Minh City’s Cat Lai, are crucial to improving logistics efficiency. In 2023, Vietnam’s logistics infrastructure ranked 39th globally, showing a marked improvement due to these developments. Enhanced supply chain networks will drive logistics performance, enabling quicker delivery and reduced transportation costs.

Market Segmentation

By Mode of Transportation

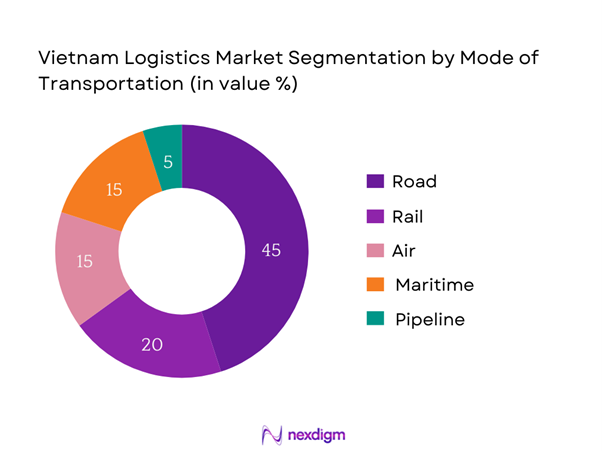

The Vietnam logistics market is segmented by mode of transportation into road, rail, air, maritime, and pipeline. Currently, road transportation is the dominant sub-segment, accounting for 45% of the market share in 2024. This dominance is attributable to the extensive road network covering urban and rural areas, making road transport the most flexible and accessible means for logistics. The increasing number of freight vehicles and the rise of last-mile delivery services amplify the reliance on road transport. As urbanization accelerates and e-commerce expands, road logistics continues to be the most favored method for transporting goods across the country.

By End-User Industry

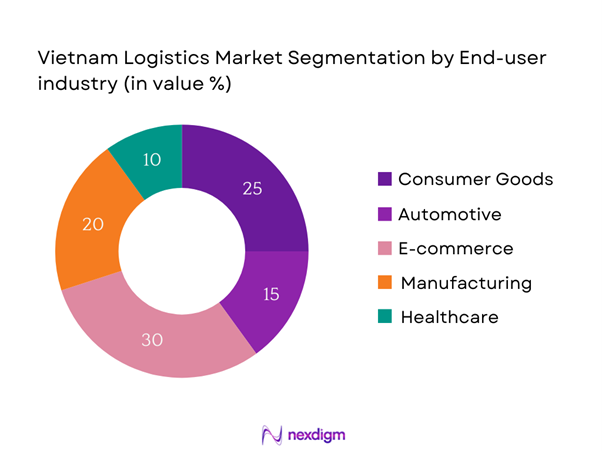

Additionally, the market is segmented by end-user industry into consumer goods, automotive, e-commerce, manufacturing, and healthcare. The e-commerce sector is currently leading the market with a 30% share in 2024. The rapid growth of online shopping platforms, coupled with changing consumer behavior favoring digital purchases, has heightened the demand for efficient logistics solutions to ensure fast deliveries. Companies like Shopee and Tiki require agile and reliable logistics partnerships to manage their intricate supply chains, placing e-commerce at the forefront of the logistics industry in Vietnam.

Competitive Landscape

The Vietnam logistics market is dominated by a few major players, including local firms and international logistics companies. This consolidation highlights the significant influence of these key companies, which leverage their extensive networks and operational capabilities to maintain competitive advantages. Major players include DHL, Nippon Express, and Agility Logistics. These companies have established strong market positions by offering integrated services and specialized transportation solutions, catering to the diverse needs of their clients.

| Company Name | Establishment Year | Headquarters | Market Share (%) | Services Offered | Geographical Reach | Customer Segments |

| DHL | 1969 | Bonn, Germany | – | – | – | – |

| Nippon Express | 1872 | Tokyo, Japan | – | – | – | – |

| Agility Logistics | 1978 | Kuwait City, Kuwait | – | – | – | – |

| Viettel Post | 2015 | Hanoi, Vietnam | – | – | – | – |

| Sotrans | 1995 | Ho Chi Minh City, Vietnam | – | – | – | – |

Vietnam Logistics Market Analysis

Growth Drivers

Rapid Urbanization

Vietnam is undergoing rapid urbanization, with over 37% of its population residing in urban areas as of 2023. This trend contributes to the escalation of logistics demand, particularly for urban delivery services. The urban population is projected to reach approximately 45% by the end of 2025, increasingly concentrating economic activities in cities like Ho Chi Minh City and Hanoi. The country’s urbanization results in a higher demand for logistics services, driven by expanding middle-class consumption habits, improved infrastructures, and international investments. Urban development initiatives are aligned with Vietnam’s urban planning vision, further enhancing logistics capacities.

Increase in E-commerce Activities

Vietnam’s e-commerce sector has seen significant growth, with online retail sales expected to surpass USD 23 billion in 2023, driven by increased internet penetration, which reached 73% of the population in 2023. The e-commerce market is expanding rapidly, with a projected annual growth rate exceeding 20%, largely supported by mobile commerce trends. The proliferation of digital payment platforms and logistics services tailored for e-commerce are critical in facilitating this growth. As a result, logistics companies are investing in smart warehouses and efficient delivery systems to meet the rising order volumes.

Market Challenges

Regulatory Compliance Issues

The Vietnam logistics market faces various regulatory compliance challenges that can hinder operational flexibility. As of 2023, numerous regulations governing transportation, import-export procedures, and customs have been emphasized by government authorities, often leading to operational delays. For example, the Ministry of Finance noted a rise in compliance requirements impacting logistics operations. The complexity of regulations means that logistics companies may incur additional costs to comply with customs procedures, which could take up to 3 days for clearance, complicating supply chains.

Infrastructure Limitations

Despite improvements, Vietnam’s logistics infrastructure continues to experience significant limitations. In particular, only 30% of the country’s roads are paved, resulting in inefficient transportation routes and long delivery times. According to the Ministry of Transport, urban congestion costs businesses around USD 1.2 billion annually due to delays. Furthermore, the rail system, which accounts for only 2% of freight transport, requires modernization to increase operational efficiency. These limitations impede the ability to meet growing logistics demands and challenge the sector’s overall development.

Opportunities

Technological Advancements

Technological advancements present substantial growth opportunities in the Vietnam logistics market. The implementation of Industry 4.0 technologies, including artificial intelligence (AI) and automation, is expected to enhance logistics efficiency significantly. Currently, 58% of logistics firms are investing in technology solutions to streamline operations. Furthermore, the adoption of technologies such as Internet of Things (IoT) for real-time tracking systems is becoming integral for logistics operations. Enhanced efficiency through technology is critical in accommodating the increasing demand for logistics services in both urban and rural areas.

Green Logistics Initiatives

The shift towards green logistics initiatives offers an avenue for sustainable growth within the logistics sector. Vietnam’s commitment to reducing carbon emissions aligns with global environmental standards, with the government aiming for a 10% reduction in greenhouse gas emissions by 2030. To achieve this, logistics companies are increasingly adopting eco-friendly practices, including electric vehicles and optimized route planning to minimize fuel consumption. In 2023, approximately 15% of logistics firms reported investing in sustainable logistics initiatives, reflecting a growing trend among businesses to enhance their environmental impact.

Future Outlook

Over the next five years, the Vietnam logistics market is projected to experience significant growth driven by continuous infrastructure enhancements, increasing investment, and rising demand for logistics services due to the booming e-commerce sector. The government’s focus on developing smart logistics solutions and adopting technology to streamline operations will further enhance efficiency and competitiveness in the market. Increasing foreign investments and trade agreements will also contribute to expanding market opportunities for logistics players.

Major Players

- DHL

- Nippon Express

- Agility Logistics

- Viettel Post

- Sotrans

- Gemadept

- Transimex

- Cuu Long JSC

- VNT Logistics

- Maritime Transportation Services

- Masan Group

- New Century Logistics

- Giao Hang

- Hai Phong Port Logistics

- Vinafco

Key Target Audience

- E-commerce Platforms

- Retail Corporations

- Manufacturing Firms

- Logistics and Supply Chain Management Companies

- Freight Forwarders

- Government and Regulatory Bodies (Ministry of Industry and Trade, General Department of Vietnam Customs)

- Investments and Venture Capitalist Firms

- Automotive Industry Stakeholders

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Logistics Market. This step leverages extensive desk research through a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including players, market drivers, consumer preferences, and regulatory factors.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Vietnam Logistics Market. This includes assessing market penetration, the ratio of transportation modes to service providers, and resultant revenue generation. Additionally, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates. This analysis helps in constructing a robust market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing various companies within logistics, e-commerce, and transportation sectors. These consultations provide operational and financial insights that are instrumental in refining and corroborating existing market data. This step ensures the depth of understanding regarding market challenges and growth opportunities.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple logistics service providers and industry stakeholders to acquire detailed insights into service segments, sales performance, consumer preferences, and pertinent factors guiding market evolution. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam Logistics Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Overview of Logistics Growth

- Key Economic Indicators

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rapid Urbanization

Increase in E-commerce Activities - Market Challenges

Regulatory Compliance Issues

Infrastructure Limitations - Opportunities

Technological Advancements

Green Logistics Initiatives - Trends

Automation in Logistics

Rise of Last-Mile Delivery Solutions - Government Regulations

Logistics Policy Framework

Trade Agreements - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Freight Type, 2019-2024

- By Mode of Transportation (In Value %)

Road

– Full Truck Load (FTL)

– Less-than-Truckload (LTL)

– Intra-city Delivery

– Long-haul Freight

Rail

– Intermodal Freight

– Bulk Cargo

– Containerized Rail Logistics

– Cross-border Rail to China/ASEAN

Air

– Domestic Air Freight

– International Air Cargo

– Time-sensitive Goods (e.g., electronics, perishables)

– Courier and Express Services

Maritime

– Container Shipping

– Bulk Shipping (Dry and Liquid)

– RoRo (Roll-on/Roll-off) Services

– Feeder and Coastal Shipping

Pipeline

– Crude Oil Transport

– Natural Gas Distribution

– Petroleum Products

– Industrial Chemical Pipelines - By End-User Industry (In Value %)

Consumer Goods

– Fast-Moving Consumer Goods (FMCG)

– White Goods and Appliances

– Packaged Foods and Beverages

Automotive

– OEM Supply Chain

– Spare Parts and Accessories

– Finished Vehicle Transport

E-commerce

– Last-Mile Delivery

– Fulfillment Centers

– Reverse Logistics

Manufacturing

– Heavy Machinery and Equipment

– Electronics and Semiconductors

– Industrial Components

Healthcare

– Pharmaceutical Logistics

– Medical Equipment

– Cold Chain for Vaccines and Biologics - By Services Provided (In Value %)

Transportation

– Domestic

– Cross-border

– Multi-modal

Warehousing

– General Warehousing

– Temperature-Controlled Storage

– Value-Added Services

Freight Forwarding

– International Freight (Air/Sea)

– Customs Coordination

– Documentation and Compliance

Customs Brokerage

– Import/Export Clearance

– Tariff Consulting

– Trade Compliance

Integrated Logistics

– End-to-End Supply Chain Management

– Third-Party Logistics (3PL)

– Fourth-Party Logistics (4PL) - By Region (In Value %)

Northern Region

Central Region

Southern Region

Mekong Delta - By Company Size (In Value %)

Large Enterprises

– Multinational Logistics Providers

– Conglomerates with In-house Logistics

Medium Enterprises

– Regional Freight and Warehousing Firms

– Specialized Cold Chain or Industrial Movers

Small Enterprises

– Local Courier Services

– Family-Owned Freight Companies

– Niche Logistics Operators

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenues, Number of Warehouses, Fleet Size, Distribution Channels, Technology Adoption, Service Portfolio, Geographic Reach, Key Client Verticals, Sustainability Initiatives, Operational Capacity and Utilization Rates)

- SWOT Analysis of Major Competitors

- Pricing Strategies of Major Competitors

- Detailed Profiles of Major Companies

DHL Supply Chain

Nippon Express

DB Schenker

Agility Logistics

Kuehne + Nagel

Viettel Post

Sotrans

Vietrans

Mardeco

Tran Dai Nghia

Gemadept

Transimex

Cuu Long JSC

SEALINKS

Hai Phong Port Logistics

- Demand Characteristics

- Purchasing Patterns

- Customer Preferences

- Pain Points Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- By Freight Type, 2025-2030