Market Overview

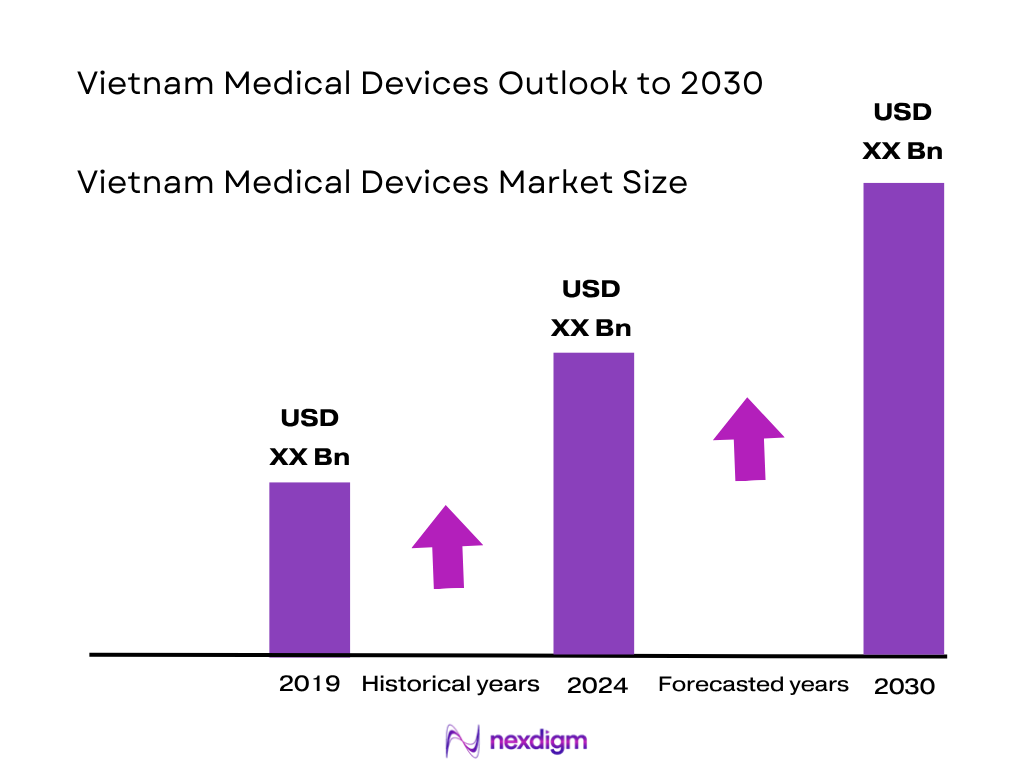

The Vietnam Medical Devices market is valued at USD 1,550.35 million in 2024. This follows a value of approximately USD 1,550 million in 2023, reflecting a steady expansion driven by increased healthcare infrastructure spending, rapid urbanization, rising chronic disease burden, and growing medical tourism

Healthcare markets are strongest in Southern Vietnam, particularly Ho Chi Minh City and surrounding provinces, due to their higher density of hospitals, clinics, diagnostic centres, and status as a medical tourism hub. Hanoi and other Northern cities also play a leading role given their concentration of flagship public hospitals and regulatory influence.

Market Segmentation

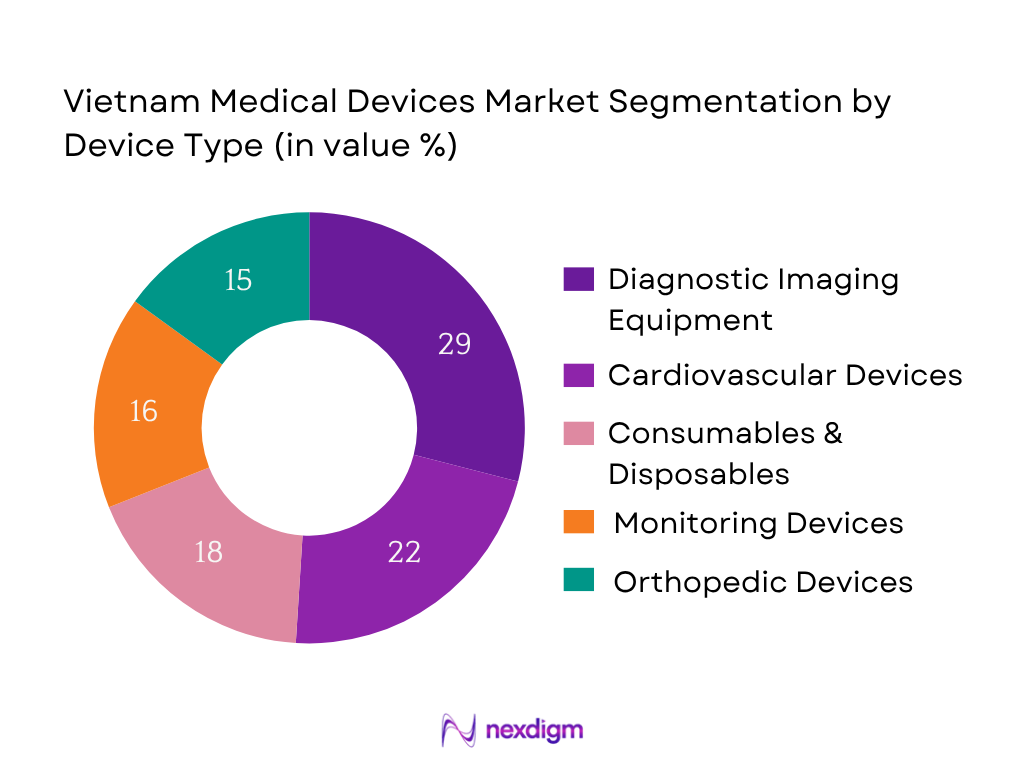

By Device Type

Diagnostic Imaging Equipment dominates with approximately 29 % market share in 2024. This dominance reflects widespread hospital investments in CT, MRI, ultrasound for diagnosis of rising non‑communicable diseases, alongside international players supplying advanced imaging systems. Demand is further heightened by medical tourism and public hospital modernization programs.

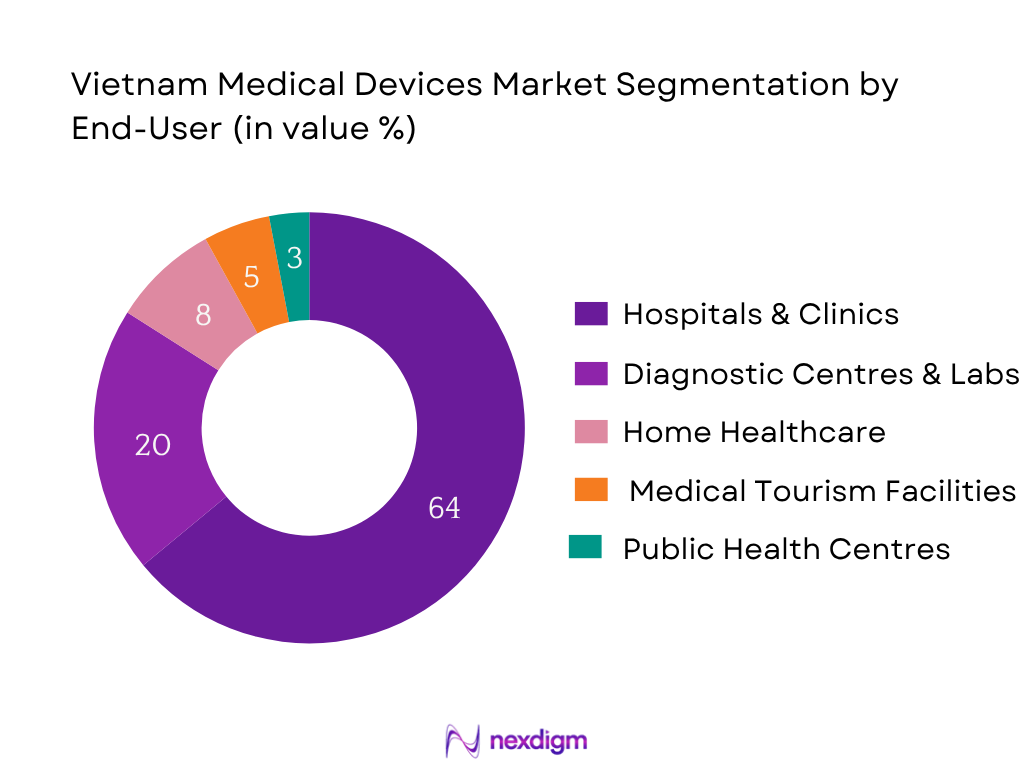

By End‑User

Hospitals & Clinics (both public and private) hold the largest share at 64 % in 2024, owing to structured procurement budgets, capacity expansion, surgical and ICU needs, and public hospital dominance in Vietnam’s health system. Diagnostic centres follow, driven by increasing outpatient imaging and lab services.

Competitive Landscape

The Vietnam medical devices market is concentrated among a handful of multinational and local firms. Leading players include Stryker Vietnam, USM Healthcare, Getz Healthcare Vietnam, Omron Healthcare Vietnam, and GE Healthcare Vietnam, reflecting strategic dominance through advanced technology, local distribution networks, and regulatory alignment.

| Company | Establishment Year | Headquarters | Device portfolio focus | Local assembly capacity | Import vs local revenue split | After‑sales service network | Regulatory engagement & speed | Pricing strategy / public tender pricing |

| Stryker Vietnam | 2000s | U.S. | – | – | – | – | – | – |

| USM Healthcare JSC | 2004 | Vietnam (local FDI) | – | – | – | – | – | – |

| Getz Healthcare Vietnam | 1990s | Australia/Vietnam | – | – | – | – | – | – |

| Omron Healthcare Vietnam | 2010s | Japan | – | – | – | – | – | – |

| GE Healthcare Vietnam | 2000s | U.S. | – | – | – | – | – | – |

Vietnam Medical Devices Market Analysis

Growth Drivers

Ageing Population & Rise in NCD Burden

Vietnam’s population aged 65 and above reached 9.05 % in 2024, up from 8.62 % in 2023. This ageing shift translates to approximately 9.5 million individuals aged 65+, necessitating a higher prevalence of chronic illnesses such as cardiovascular disease, diabetes, and cancer. Vietnam recorded an average life expectancy of ~73.6 years in 2022. The expanding elderly population increases demand for diagnostics, monitoring devices, implants, and long‑term care equipment in hospitals and clinics, driving growth in these domains.

Expansion of Hospital Infrastructure & Bed Capacity

Vietnam offered approximately 3.1 hospital beds per 1,000 people in 2021, rising from earlier years and remaining below WHO recommendation of 5 beds. Private hospital beds doubled to 22,000 beds across 320 facilities by 2023, comprising about 8 % of total beds. This surge in infrastructure expansion, especially in private sector growth and new facilities, supports rising procurement of diagnostics, surgical systems, and consumables, fueling medical device demand throughout the network.

Market Challenges

High Import Dependence & Foreign Exchange Exposure

Vietnam imports over 90 % of advanced diagnostic and therapeutic devices; even consumables rely heavily on foreign supply. Currency volatility, notably VND depreciation in 2023, increased equipment costs. GDP growth slowed to ~5.6 % in 2023 (General Statistics Office), tightening public procurement budgets. The reliance on imports exposes procurement costs to foreign exchange shifts, adding unpredictability and raising total cost of ownership for hospitals and distributors.

Regulatory Approval Timelines & Compliance Complexity

Registration under Vietnam’s MOH and IMDA often requires dossier preparation with over 200 pages, labelling in Vietnamese, and approval can take up to 9–12 months. Government’s regulatory updates (e.g., Circular 30/2015, Decree 98/2021) have added complexity. Slow processing impacts time‑to‑market for new entrants and affects inventory planning, especially when exchange rates fluctuate. Institutional delays in public sector procurement further compound strategic planning for device firms.

Opportunities

Growth in Telehealth Devices & Home Monitoring Solutions

With 69 % of population in working age and widespread mobile connectivity, Vietnam’s digital infrastructure supports remote care adoption. Urban households exceeding 70 % internet access rates facilitate adoption of home-use BP monitors, glucometers, and wearable ECG devices. Private clinics link remote monitoring apps with device sales, creating growing demand beyond institutional procurement. Government efforts toward universal health coverage further support decentralized diagnostics and patient monitoring at home.

Expansion of Domestic Manufacturing for Consumables

Vietnam’s local manufacturing base for gloves, catheters, syringes, and basic diagnostics is expanding due to rising domestic FDI and government incentives targeting 10–15 % private hospital bed share by 2025. Several industrial zones now host medical consumable factories with monthly output in tens of thousands units. Increased self‑reliance on locally produced low‑value consumables reduces import reliance, stabilizes supply chains, and supports broader adoption in both public and private hospitals across provinces.

Future Outlook

Vietnam’s medical devices market is expected to continue its robust upward trajectory over the 2024–2030 period, with forecasted CAGR of ~8.45 %. Expansion will be fueled by ongoing healthcare infrastructure upgrades, rising middle‑class healthcare access, government reforms including regulatory rationalization, and growing adoption of digital diagnostics and minimally invasive surgical equipment. These factors are expected to propel the market value from USD 1.55 billion in 2024 toward USD 2.5–2.8 billion by 2030, with high growth in diagnostic imaging and cardiovascular segments.

Major Players

- Terumo Vietnam Medical Equipment Co. Ltd

- USM Healthcare Medical Devices Factory JSC

- Getz Healthcare (Vietnam)

- Omron Healthcare Vietnam

- Braun Vietnam Co. Ltd

- GE Healthcare Vietnam

- Nihon Kohden Vietnam

- Medtronic Vietnam

- Abbott Laboratories Vietnam

- Philips Vietnam

- Boston Scientific Vietnam

- Becton Dickinson Vietnam

- Hoya Lens Vietnam

- Armephaco JSC

- Japan Vietnam Medical Instrument JSC

Key Target Audience

- Healthcare device OEMs and importers

- Distributors and hospital procurement heads

- Private hospital groups & diagnostic centre operators

- Medical device joint venture and investment partners

- Investments and venture capitalist firms

- Government and regulatory bodies (Ministry of Health, IMDA)

- Hospital group CFOs and procurement committees

- Medical tourism facilitators and infrastructure investors

Research Methodology

Step 1: Identification of Key Variables

Develop a comprehensive ecosystem map encompassing major stakeholders—MOH, IMDA, importers, distributors, hospitals, and FDI manufacturers. Gather secondary intelligence from proprietary databases, MOH publications, and import/export trade data to outline critical variables influencing Vietnam’s medical devices market.

Step 2: Market Analysis and Construction

Compile historical data on market value and volume, import vs local manufacturing ratios, hospital bed counts, and device installations. Analyze provider/service quality data. Triangulate public spend and procurement tender data to estimate market revenue reliably via both top‑down and bottom‑up approaches.

Step 3: Hypothesis Validation and Expert Consultation

Formulate data validation hypotheses. Conduct CATI and video interviews with industry experts—device distributors, hospital procurement directors, local manufacturers—to validate product mix assumptions, understand price dynamics, supply chain challenges, and confirm forecast drivers.

Step 4: Research Synthesis and Final Output

Engage with global and local device companies to verify company-level strategies, sales volume, product adoption trends, and partnership structures in Vietnam. Integrate these insights to reconcile bottom‑up and top‑down estimates, delivering an accurate, validated report output.

- Executive Summary

- Research Methodology (Market Definitions & Classifications [Vietnam MOH medical device classes I/II/III], Abbreviations, Market Sizing Approach [Import‑export data + hospital procurement], Consolidated Research Approach, Primary & Secondary Data Sources, In‑depth Industry Interviews with Manufacturers, Distributors & Hospital Procurement Heads, Limitations & Future Assumptions)

- Definition & Scope

- Market Genesis & Evolution

- Timeline of Major Regulatory Changes

- Industry Life Cycle Stage

- Supply Chain & Value Chain Analysis

- Growth Drivers

Ageing Population & Rise in NCD Burden

Expansion of Hospital Infrastructure & Bed Capacity

Government Investment & FDI Incentives in Healthcare

Rising Medical Tourism Demand in HCMC & Hanoi

Technological Adoption – Digital Health & Remote Monitoring - Market Challenges

High Import Dependence & Foreign Exchange Exposure

Regulatory Approval Timelines & Compliance Complexity

Limited Skilled Workforce for Advanced Equipment

Price Sensitivity in Public Procurement

Uneven Access to Healthcare in Rural Areas - Opportunities

Growth in Telehealth Devices & Home Monitoring Solutions

Expansion of Domestic Manufacturing for Consumables

Partnerships for Technology Transfer & Assembly Plants - Trends

AI Integration in Diagnostics & Imaging

Shift Toward Minimally Invasive Surgeries

Outsourcing & Contract Manufacturing Hub Potential - Government Regulation

Medical Device Registration Requirements

Import Tariffs & VAT Adjustments

Quality & Safety Standards Compliance - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Device Type (In Value %)

Diagnostic Imaging Devices (CT, MRI, Ultrasound, X‑ray)

Patient Monitoring Devices (ECG, Vital Signs Monitors)

Therapeutic Devices (Ventilators, Infusion Pumps, Dialysis)

Surgical Equipment (Endoscopes, Surgical Robots)

Consumables & Disposables (Syringes, Gloves, Catheters) - By Therapeutic Application (In Value %)

Cardiology

Orthopedics

Oncology & Diagnostic Imaging

Respiratory Care

Diabetes & Chronic Disease Management - By End User (In Value %)

Public Hospitals

Private Hospitals & Clinics

Diagnostic Centres & Laboratories

Home Healthcare

Medical Tourism Facilities - By Region (In Value %)

Northern Vietnam (Hanoi, Hai Phong)

Central Vietnam (Da Nang, Hue)

Southern Vietnam (HCMC, Can Tho) - By Source of Supply (In Value %)

Imported Devices (US, Japan, Germany, China, Singapore)

Locally Manufactured Devices (Consumables, Low‑cost Diagnostics)

- Market Share of Major Players (Value & Volume)

Cross Comparison Parameters (Company Overview, Product Portfolio by Device Class, Distribution Network in Vietnam, Local Assembly/Manufacturing Capabilities, Import vs Local Revenue Split, After‑Sales Service Infrastructure, Strategic Partnerships & MOH Engagement, Pricing & Market Penetration Strategies) - SWOT of Major Players

Pricing Analysis (Key SKUs & Hospital Procurement Prices) - Detailed Company Profiles

- Terumo Vietnam Medical Equipment Co. Ltd

USM Healthcare Medical Devices Factory JSC

Getz Healthcare Vietnam

Omron Healthcare Vietnam

B. Braun Vietnam Co. Ltd

GE Healthcare Vietnam

Nihon Kohden Vietnam

Medtronic Vietnam

Abbott Laboratories Vietnam

Philips Vietnam

Boston Scientific Vietnam

Becton Dickinson Vietnam

Hoya Lens Vietnam

Armephaco JSC

Japan Vietnam Medical Instrument JSC

- Demand & Utilization Patterns

- Procurement Budgets & Decision‑Making Process

- Pain Points & Unmet Needs

- Compliance & Training Requirements

- Replacement vs. New Purchase Trends

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030