Market Overview

The Vietnam online grocery market is valued at USD 2.8 billion. A five‑year historical analysis reveals this figure is anchored in rising internet penetration, expanding smartphone usage, urbanization, increasing disposable income among the middle class, and digital transformation accelerated by the COVID‑19 pandemic.

Urban centers, notably Ho Chi Minh City and Hanoi, dominate the Vietnam online grocery market due to dense populations, superior digital infrastructure, higher ordering frequency, and established logistics networks. These cities benefit from concentrated middle‑class consumption, better cold‑chain capabilities, and faster last‑mile delivery systems, ensuring convenient service and fostering greater market penetration.

Market Segmentation

By Product Type

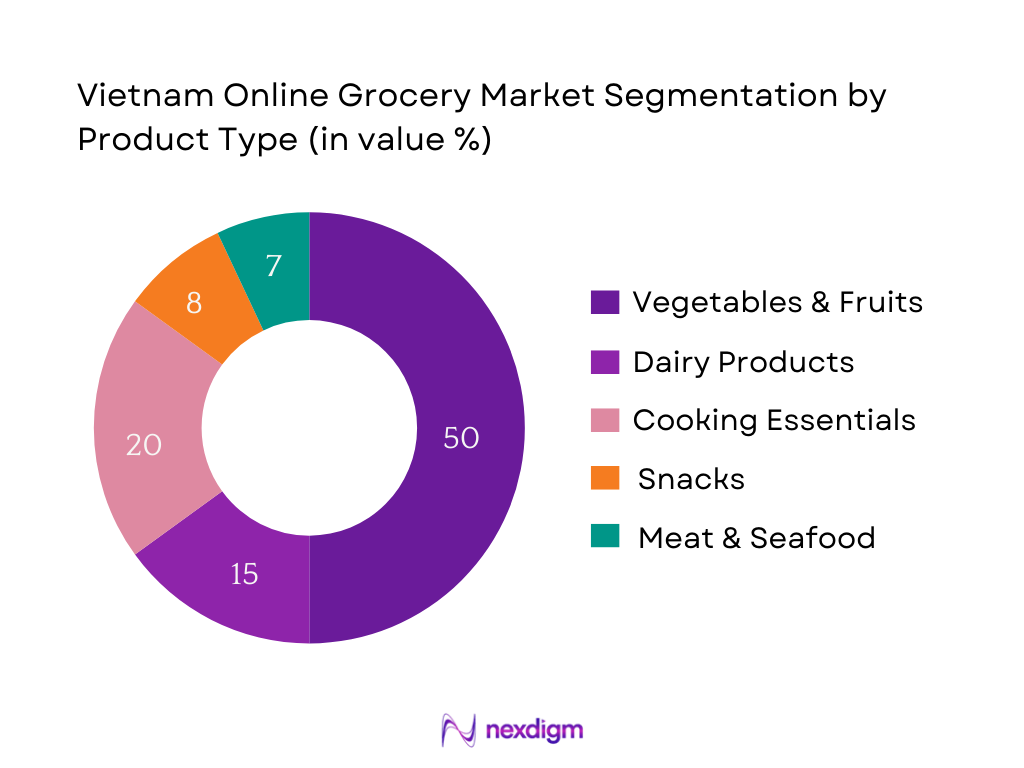

The Vietnam online grocery market is segmented into Vegetables & Fruits, Dairy Products, Staples & Cooking Essentials, Snacks, Meat & Seafood, and Others. Among these sub‑segments, Vegetables & Fruits command a dominant share. This is due to strong consumer preferences for fresh produce, enhanced cold-chain delivery capabilities enabling reliable freshness, and high-frequency repeat purchases. Urban consumers prioritize convenience and freshness—attributes that produce-first platforms deliver. Local sourcing and promotional tie-ups also reinforce its popularity.

By Business Model

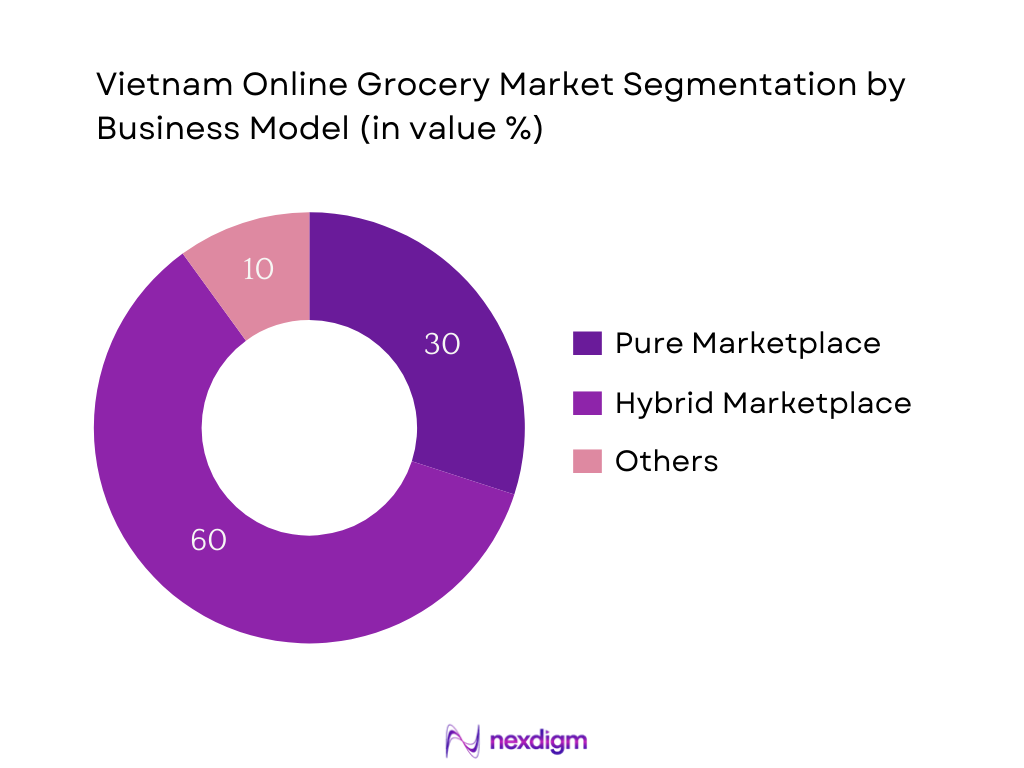

The market is segmented by business model into Pure Marketplace, Hybrid Marketplace, and Others. The Hybrid Marketplace model leads the market. This model offers a compelling combination of marketplace breadth and controlled fulfillment. Platforms under this model often manage inventory for select SKUs and partner with third-party vendors for others, ensuring better quality control, faster delivery, and optimized fulfillment costs. The hybrid approach instils higher consumer trust and reliable freshness, crucial for grocery retail.

Competitive Landscape

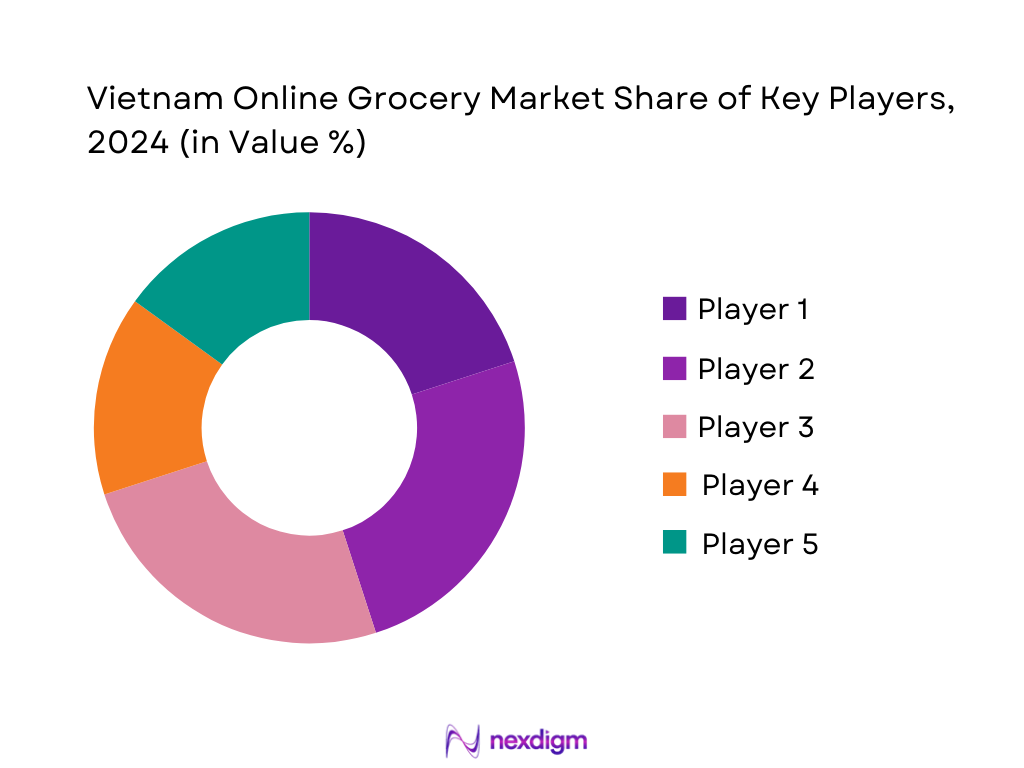

The Vietnam online grocery sector is shaped by a mix of local and regional players. This consolidation reflects the notable market power of key platforms and their ability to leverage logistics, technology, and brand equity.

| Company | Establishment Year | Headquarters | Platform Reach (users/month) | Fulfilment Model | Delivery Speed | App/App Integration | SKU Variety |

| TikiNOW (Tiki) | 2010 | Ho Chi Minh City | – | – | – | – | – |

| GrabMart (Grab VN) | 2012 | Ho Chi Minh City | – | – | – | – | – |

| BachhoaXANH (MWG) | 2015 | Ho Chi Minh City | – | – | – | – | – |

| WinMart+ (Masan) | 2016 | Hanoi | – | – | – | – | – |

| Shopee Mart (Shopee) | 2015 | Singapore (VN Ops) | – | – | – | – | – |

Vietnam Online Grocery Market Analysis

Growth Drivers

Integration of Cashless Payment Ecosystem (MoMo, ZaloPay, etc.)

Vietnam’s digital payments ecosystem is rapidly expanding, supported by rising financial inclusion. In 2024, 40% of adults in developing economies—Vietnam included—saved using formal financial accounts, and mobile-money usage accounted for 10% of those, increasing by five percentage points since 2021, per World Bank’s Global Findex. Mobile-money adoption eases transaction frictions and encourages cashless grocery purchases. Vietnam’s promotion of e-wallets such as MoMo and ZaloPay simplifies checkout, enables offers and wallet cashback, and reduces cash handling for delivery riders. This frictionless conduct drives frequency, loyalty, and trust among urban and increasingly rural consumers, reinforcing the core adoption of online grocery platforms.

Retail E‑commerce Push under National Digital Economy Plan

Vietnam’s digital economic framework promotes e-commerce expansion. While precise macro data isn’t directly stated, related trends are evident: enterprise-level digital transformation reached 47% by 2023, showing rapid modernization across sectors. Concurrently, e-commerce spending surged—from USD 13.7 billion in 2021, projected to reach USD 32 billion by 2025. Grocery is part of this growth wave, propelled by government-led plans to boost digital infrastructure and platform adoption. Platforms benefit from structural support—regulatory clarity, improved payments, and logistics incentives—aligning with overall national digitization strategy. The clear increase in digital adoption among both businesses and consumers underscores the enabling environment for online grocery expansion.

Market Challenges

Low Margins Due to Discount‑led Consumer Behavior

E-commerce in Vietnam is highly promotional. While categories like grocery benefit from low price appeal, aggressive discounts squeeze margins. From macro trends: GDP per capita rose to ~USD 4,500, but household income remains modest for sustained premium purchase. Consumers shop on price, expecting frequent deals. Platforms must absorb discount costs to win orders, resulting in pressure on profitability—especially difficult given logistics overhead in grocery.

Inconsistent SKU Availability and Inventory Forecasting

Vietnam’s e-grocery platforms often struggle with SKU consistency—especially fresh produce. Although e-commerce grew from USD 13.7 billion to expected USD 32 billion between 2021–2025, rapid expansion strains supplier coordination, forecasting tools, and replenishment cycles. This results in stockouts and consumer dissatisfaction. Coupled with uneven digitalization (47% among businesses), insufficient inventory systems and regional supplier networks remain key challenge areas.

Market Opportunities

Expansion to Tier‑2 and Tier‑3 Cities via Dark‑Store Models

Vietnam’s robust macroeconomic backdrop—GDP growth of 7.1% in 2024 and improved GDP per capita (~USD 4,500)—supports untapped demand beyond metro areas. As internet (80% access) and smartphone accessibility expand, second-tier and tertiary cities become viable markets for online grocery. Dark-store models, offering centralized micro-fulfillment close to suburbs, can service emerging demand effectively. This infrastructure enables faster service, reduces logistics costs, and aligns with growing urban consumption power in non-metro regions.

White‑Label and Private‑Label Brand Penetration

With rising digital adoption (47% of businesses digitally transformed) and incomes improving, platforms have the opportunity to introduce white-label products. These house brands can offer affordable, high-margin options, and appeal to budget-conscious consumers in an economy where GDP per capita is still modest (~USD 4,500). Private-label lines also allow platforms to differentiate and foster loyalty, capturing value in a market driven by price sensitivity and frequent promotions.

Future Outlook

Over the coming years, the Vietnam online grocery market is projected to experience robust expansion, driven by evolving consumer behaviour, technological innovations, and infrastructure improvements. Consumers will increasingly embrace quick‑commerce, subscription models, and AI‑enhanced personalization. The proliferation of dark stores, micro‑fulfilment hubs, and integrated logistics will further reduce delivery times and expand reach beyond tier‑1 cities. Continued investments in cold‑chain infrastructure, mobile payment adoption, and platform innovation will catalyze sustained, high‑growth dynamics.

Major Players

- TikiNOW

- GrabMart

- Go! Grocery

- Lazada Grocery

- Shopee Mart

- BachhoaXANH

- WinMart+

- opFood Online

- VinMart

- AEON E-commerce

- LOTTE Mart Online

- CJ Fresh Express

- K-Market Online

- Nông Sản Xanh Direct

- BeGrocer

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Multi-sector Retail Conglomerates

- Logistics and Cold-Chain Operators

- Digital Payment & Fintech Institutions

- Supermarket/Hypermarket Chains

- Agriculture Cooperatives & Farmers’ Alliances

- Technology Platform & SaaS Providers

Research Methodology

Step 1: Identification of Key Variables

Initial mapping of the Vietnam online grocery ecosystem—including key stakeholders such as platforms, logistics firms, producers, and payment enablers—was performed via detailed desk research using secondary datasets, industry reports, and proprietary e‑commerce analytics. This step defined variables like user counts, order volumes, fulfillment models, and platform reach.

Step 2: Market Analysis and Construction

Historical sales data, average basket sizes, and user growth metrics were compiled from sources. Cross‑validation across multiple data sources allowed accurate revenue and volume estimation. Platform-specific order frequencies and SKUs were assessed for reliability and consistency.

Step 3: Hypothesis Validation and Expert Consultation

Developed hypotheses on growth drivers and barriers were validated through structured interviews (CATI) with executives from e‑grocery platforms, logistics providers, and fintech partners in Vietnam. These consultations offered operational insights and nuanced understanding of delivery challenges, consumer preferences, and model viability.

Step 4: Research Synthesis and Final Output

Synthesis involved engaging platforms and logistics partners for clarity on fulfillment strategies, SKU categorization, subscription models, and tech stacks. This enriched bottom‑up market figures with granular qualitative insights, yielding a validated, detailed, and comprehensive market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Platform Metrics Analysis, Primary Interviews with Retailers & Last-mile Providers, Secondary Research Validation, Limitations and Future Assumptions)

- Definition and Scope

- Market Genesis and Evolution in Vietnam

- Timeline of Key Industry Events and Milestones

- Sectoral Business Cycle and Value Generation Nodes

- Supply Chain, Cold Chain and Fulfilment Value Chain Analysis

- Growth Drivers

4G/5G Penetration and Smartphone Access in Urban & Rural Vietnam

Shift in Food Purchase Habits among Millennials and Gen Z

Rise in Dual-income Urban Households and Convenience Spending

Integration of Cashless Payment Ecosystem (MoMo, ZaloPay, etc.)

Retail E-commerce Push under National Digital Economy Plan

COVID-accelerated Platform Adoption - Market Challenges

High Cash-on-Delivery (COD) Preferences and Return Handling

Fragmented Last-mile Cold Chain Logistics

Low Margins Due to Discount-led Consumer Behaviour

Inconsistent SKU Availability and Inventory Forecasting - Market Opportunities

Expansion to Tier-2 and Tier-3 Cities via Dark Store Models

White-label and Private Label Brand Penetration

Community-led Group Buying and Fulfilment Models

Digitization of Traditional Wet Markets - Trends

Social Commerce and Livestream Grocery Shopping

AI and ML Integration for Inventory Planning and Pricing

BNPL and Wallet Cashback-Driven Loyalty Programs

Voice-enabled Grocery Ordering via Smart Assistants - Government Regulation

Digital Taxation Policies on E-Commerce

Food Safety and Traceability Mandates for Online Sellers

E-wallet Licensing and Transaction Monitoring - SWOT Analysis

- Stakeholder Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Order Volume, 2019-2024

- By Average Basket Size, 2019-2024

- By Number of Active Monthly Users, 2019-2024

- By Channel Type (In Value %)

Mobile App

Website/Desktop Portal

Social Commerce via Messaging Apps

Voice Commerce - By Product Category (In Value %)

Fresh Produce

Dairy and Frozen

Packaged Foods & Staples

Beverages

Health & Organic

Household Essentials - By Consumer Demographics (In Value %)

Urban Millennials

Suburban Families

Digital Natives

Working Professionals

Rural Consumers

Seniors with App Adoption - By Order Type (In Value %)

Instant 30-min Delivery

Same-day Scheduled Order

Weekly Subscriptions

Bulk Replenishment Orders - By Region (In Value %)

Ho Chi Minh City

Hanoi Capital Region

Northern Provinces

Central Vietnam

Mekong Delta Provinces

- Market Share of Major Players (By GMV, Monthly Orders, Active Users)

- Cross Comparison Parameters (Company Overview, Platform Reach, Fulfilment Network Density, Average Delivery Time, Order Accuracy %, Technology Stack Maturity, SKU Depth, Product Mix Breadth, Loyalty Program Structure, Customer Retention %, Complaint Redressal TAT)

- SWOT Analysis of Major Players

- Pricing and Promotion Analysis (By Order Type and Category)

- Detailed Company Profiles

TikiNOW

GrabMart

Go! Grocery

Lazada Grocery

Shopee Mart

BachhoaXANH

WinMart+

Co.opFood Online

VinMart

AEON E-commerce

LOTTE Mart Online

CJ Fresh Express

K-Market Online

Nông Sản Xanh Direct

BeGrocer

- Frequency of Orders by Demographic Segments

- Spending Patterns by Basket Category and Region

- Key Purchase Triggers and Inhibitors

- Service Expectations and Complaint Patterns

- Preference Shifts Between Direct Retail vs. Aggregator Apps

- By Value, 2025-2030

- By Order Volume, 2025-2030

- By Average Basket Size, 2025-2030

- By Number of Active Monthly Users, 2025-2030