Market Overview

As of 2024, Vietnam power tools market is valued at USD 1.3 billion, with a growing CAGR of 3.2% from 2024 to 2030, showcasing significant growth driven by robust construction activities, ongoing industrialization, and the increasing popularity of DIY home improvement projects. Factors such as the growing awareness of the benefits of power tools in enhancing productivity and efficiency are contributing to this expansion. Additionally, the rising disposable income among consumers encourages investments in home renovation and repairs, driving sustained demand for both professional and amateur power tools.

The dominant cities influencing the Vietnam power tools market include Ho Chi Minh City, Hanoi, and Da Nang. These cities have strong economic activities, with Ho Chi Minh City serving as the economic powerhouse of Vietnam, while Hanoi is the political and cultural capital. Da Nang, recognized for its burgeoning tourism and construction sectors, further propels the demand for power tools. Their strategic urban development and continued infrastructure projects significantly boost the power tools market.

Market Segmentation

By Product Type

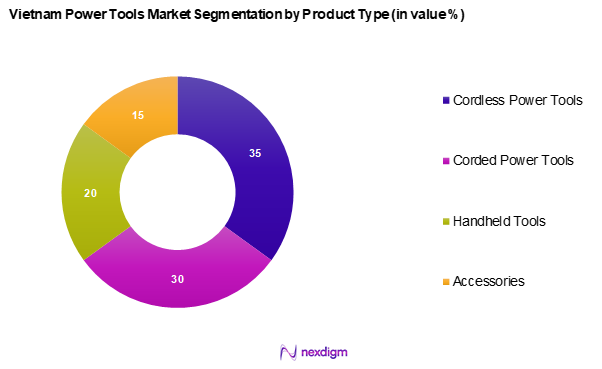

The Vietnam power tools market is segmented into corded power tools, cordless power tools, handheld tools, and accessories. Cordless power tools dominate the market due to their portability and ease of use. The convenience offered by cordless power tools allows for flexibility in various applications, from construction sites to home improvement tasks. As more consumers adopt DIY practices and a growing number of industries recognize the efficiency provided by these tools, the segment has become increasingly dominant, with leading brands continuously innovating to enhance battery life and tool performance.

By End-User Industry

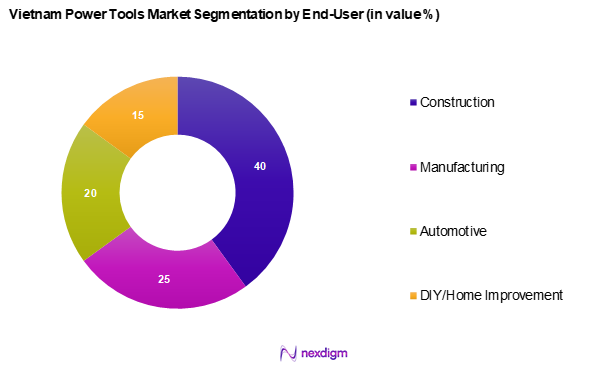

The Vietnam power tools market is segmented into construction, manufacturing, automotive, and DIY/home improvement. The construction segment dominate the market driven by rapid urbanization and extensive infrastructure projects. The Vietnamese government’s focus on developing urban infrastructure and housing has led to increased construction activities, thus leading to substantial investments in power tools. This segment’s growth is propelled by the need for efficient and reliable tools that enhance worker productivity and safety on job sites, solidifying its strong position in the market.

Competitive Landscape

The Vietnam power tools market is dominated by a few major players, including local manufacturers and global brands such as Bosch, Makita, and DeWalt. This consolidation highlights the significant influence of these key companies, whose market presence is reinforced by their diverse product offerings and strong distribution networks. Their strategic focus on innovation, quality, and customer service has enabled them to establish a loyal customer base within the country.

| Company | Established Year | Headquarters | Product Range | Market Leadership Strategy | Revenue (USD) | Key Partnerships |

| Bosch | 1886 | Gerlingen, Germany | – | – | – | – |

| Makita | 1915 | Anjo, Japan | – | – | – | – |

| DeWalt | 1924 | Towson, Maryland | – | – | – | – |

| Hitachi | 1910 | Tokyo, Japan | – | – | – | – |

| Stanley Black & Decker | 1843 | New Britain, Connecticut | – | – | – | – |

Vietnam Power Tools Market Analysis

Growth Drivers

Rising Construction Activities

Rising construction activities in Vietnam are a significant growth driver for the power tools market. The construction sector has witnessed substantial investment, with the government projected to allocate approximately USD 22.0 billion for infrastructure development by 2025. This spending aims to boost the urban infrastructure, including road construction, housing, and commercial complexes. Additionally, the construction industry contribution to Vietnam’s GDP was approximately 7.5% in 2022. This growth is complemented by a surge in foreign direct investments in construction, further solidifying the demand for efficient power tools to meet project timelines and quality standards.

Increased DIY Trend

The increasing trend towards DIY (do-it-yourself) projects has fuelled significant demand for power tools in Vietnam. The DIY market is boosted by a growing middle-class population, which reached 33 million in 2022, possessing higher disposable incomes. A survey conducted by Nielsen revealed that about 65% of consumers showed interest in home improvement projects, leading to increased sales of power tools. This trend is further driven by the proliferation of online home improvement tutorials and workshops, encouraging individuals to invest in quality tools for personal use and small-scale projects.

Market Challenges

Competition and Price Wars

Intense competition in the Vietnam power tools market presents a considerable challenge for manufacturers. The influx of both international and local brands has led to price wars, which has caused reduced profit margins across the board. A report by the Vietnam Competition Authority indicates that price competition has lowered average prices by approximately 7% in 2023. Companies like Bosch and Makita face continuous pressure to innovate while maintaining competitive pricing, which can hinder investment in product development and technology enhancement. Consequently, maintaining a balance between competitive pricing and quality becomes a key challenge for players in this saturated market.

Economic Fluctuations

Economic fluctuations pose significant challenges and uncertainties for the power tools market in Vietnam. The country’s GDP growth rate was recorded at 5.8% in 2022, reflecting a decline from previous years due to global economic pressures. Inflation surged to 4.5% in 2023, affecting consumers’ purchasing power and leading to a cautious approach towards spending on discretionary items, including power tools. Additionally, rising material costs and supply chain disruptions tied to the global market can adversely impact manufacturer operations, contributing to uncertainty within the market. These economic variables highlight the fragility of growth prospects for the power tools sector.

Opportunities

Digital Marketing Strategies

Digital marketing strategies present a lucrative opportunity for stakeholders in the Vietnam power tools market. With internet penetration rate reaching approximately 74% in 2023, companies can leverage online platforms for marketing and direct sales to reach a broader audience. E-commerce giants such as Tiki and Shopee are becoming increasingly popular for purchasing power tools, further driving online sales growth. Businesses adopting digital marketing strategies to educate consumers about product benefits and usage will likely gain competitive advantages and increase brand recognition among tech-savvy consumers. This trend signals a shift towards more consumer-driven approaches in the retail landscape.

Product Innovation and Development

Product innovation and development remain key avenues for growth within the Vietnamese power tools market. Local manufacturers and international brands are investing heavily in research and development to introduce advanced tools with improved efficiency, durability, and user-friendliness. A significant drive towards smart power tools equipped with IoT technology is taking place, catering to the growing demand for efficiency across construction and DIY sectors. As consumer preferences evolve, particularly towards multifunctional tools, companies focusing on innovation can better position themselves in the market and capture larger segments of consumer interest and loyalty.

Future Outlook

Over the next five years, the Vietnam power tools market is expected to experience significant growth driven by an increase in infrastructure spending, advancements in battery technology, and the ongoing rise of the DIY culture among consumers. As urbanization accelerates and more individuals invest in home improvement projects, demand for efficient and user-friendly power tools will continue to rise.

Major Players

- Bosch

- Makita

- DeWalt

- Hitachi

- Stanley Black & Decker

- Ryobi

- Milwaukee

- Festool

- Karcher

- Metabo

- AEG

- Einhell

- Dremel

- Hilti

- TTI (Techtronic Industries)

Key Target Audience

- Manufacturers of Power Tools

- Suppliers and Distributors

- Home Improvement Retailers

- Construction Companies

- Automotive Service Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Construction, Ministry of Industry and Trade)

- DIY Enthusiasts and Home Improvement Consumers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the Vietnam power tools market, including all major stakeholders such as manufacturers, suppliers, and end-users. This step relies on comprehensive desk research that utilizes a blend of secondary data and proprietary databases, ensuring an in-depth understanding of the market landscape and its dynamics.

Step 2: Market Analysis and Construction

During this phase, historical data relevant to the Vietnam power tools market will be compiled and analysed. This includes assessing market penetration rates, the distribution of different product types, and revenue generation patterns. Moreover, service quality metrics will be evaluated to enhance the reliability and accuracy of the resultant market estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed from initial findings will be validated through comprehensive interviews with industry experts and stakeholders. These consultations will allow for the gathering of operational insights from key players in the market, which will serve to refine and corroborate the data collected during the previous phases.

Step 4: Research Synthesis and Final Output

In the concluding phase, interactions with manufacturers and distributors will be conducted to achieve detailed insights regarding product segments, sales performance, and consumer preferences. This interaction will be vital in verifying and complementing data obtained from the bottom-up approach, thereby enabling a thorough, accurate analysis of the Vietnam Power Tools market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Evolution and Historical Context

- Timeline of Key Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Construction Activities

Increased DIY Trend - Market Challenges

Competition and Price Wars

Economic Fluctuations - Opportunities

Digital Marketing Strategies

Product Innovation and Development - Trends

Adoption of Smart Power Tools

Shift Towards Eco-friendly Products - Regulatory Environment

Compliance with Safety Standards

Import Regulations - SWOT Analysis

- Market Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Product Type (In Value %)

Corded Power Tools

– Drills

– Grinders

– Saws

– Sanders

– Routers

Cordless Power Tools

– Cordless Drills

– Cordless Impact Wrenches

– Cordless Screwdrivers

– Cordless Grinders

Handheld Tools

– Manual Screwdrivers

– Hammers

– Wrenches

– Pliers

Accessories

– Drill Bits

– Blades

– Batteries & Chargers

– Sanding Pads - By End User Industry (In Value %)

Construction

– Residential Construction

– Commercial Infrastructure

– Civil Engineering Projects

Manufacturing

– Electronics Manufacturing

– Furniture & Woodworking

– Heavy Machinery Assembly

Automotive

– OEM Assembly Plants

– Auto Repair Workshops

DIY/Home Improvement

– Hobbyist/Personal Use

– Home Renovation Projects - By Distribution Channel (In Value %)

Online Retail

Offline Retail

Distributors/Wholesalers - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, End-User Segmentation, Battery and Motor Technology, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Certification and Quality Standards, Geographic Reach, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Profiles of Major Competitors

Bosch

Makita

DeWalt

Hitachi

Stanley Black & Decker

Festool

Ryobi

Milwaukee

Hilti

Skil

Karcher

Metabo

AEG

Einhell

Dremel

- Market Demand and Utilization

- Purchasing Power Analysis

- Regulatory and Compliance Needs

- Customer Preferences and Pain Points

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030