Market Overview

As of 2024, the Vietnam prefabricated house market is valued at USD 2.8 billion, with a growing CAGR of 5.1% from 2024 to 2030, this is reflecting a robust growth trajectory driven largely by rising urbanization and demand for affordable housing solutions. According to the Ministry of Construction of Vietnam, the construction sector is undergoing a significant transformation, with prefabricated methods gaining traction due to their time efficiency and cost-effectiveness compared to traditional construction methods. The growing need for quicker construction turnaround amidst urban population growth has propelled this market, creating favourable conditions for prefabricated house adoption.

Key cities such as Ho Chi Minh City and Hanoi dominate the prefabricated house market due to their significant economic activities and rapid urban development. Ho Chi Minh City, the financial hub, exhibits a strong demand for affordable housing solutions as the population influx accelerates. Meanwhile, Hanoi benefits from government initiatives aimed at promoting sustainable urban development, making it a focal point for prefabricated housing projects. The combined economic vigor and supportive policy framework in these cities position them at the forefront of the prefabricated house market.

Market Segmentation

By Type of Prefabricated Structures

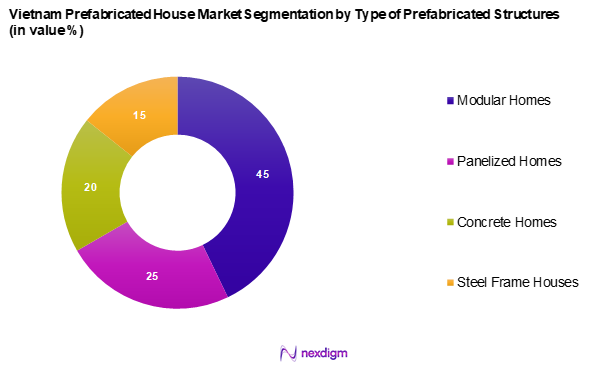

The Vietnam prefabricated house market is segmented into modular homes, panelized homes, concrete homes, and steel frame houses. Modular homes currently dominate the market due to their flexibility in design and construction speed. The modular approach allows for customization and efficient assembly, leading to reduced labour costs and quicker project completion times. Moreover, the increasing demand for eco-friendly and sustainable housing options further reinforces the popularity of modular homes, as they often incorporate sustainable materials and energy-efficient designs. This adaptability to consumer preferences has solidified the dominance of modular homes within the market.

By Construction Method

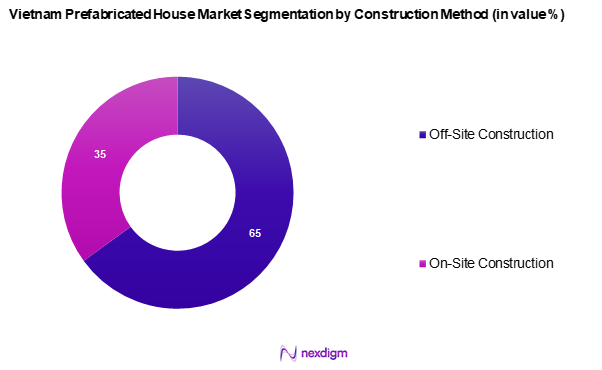

The Vietnam prefabricated house market is segmented into off-site construction and on-site construction. Off-site construction dominate the market share due to its inherent advantages in cost-efficiency and quality control. By manufacturing components in a controlled factory environment, off-site construction methods reduce waste and ensure higher build-quality through stringent quality controls. Furthermore, these methods expedite the assembly process on-site, which is particularly important given the increasing demand for timely housing solutions. The growth of urban development projects across Vietnam showcases the efficacy of off-site construction, enhancing its dominance in the prefabricated house market.

Competitive Landscape

The Vietnam prefabricated house market is dominated by several key players, including both local and international firms. These companies leverage their unique strengths, from innovative technologies to established distribution networks, to maintain competitive positions. Leading brands such as VinaHouse and Smart Housing Vietnam are notable for their specialization in modular construction, while other players emphasize sustainable practices.

| Company Name | Establishment Year | Headquarters | Market Share (%) | Product Offering | Innovation Focus | Customer Segment |

| VinaHouse | 2002 | Ho Chi Minh City | – | – | – | – |

| VietModular | 2010 | Hanoi | – | – | – | – |

| Smart Housing Vietnam | 2015 | Da Nang | – | – | – | – |

| EcoHome Vietnam | 2018 | Ho Chi Minh City | – | – | – | – |

| Prefab House Vietnam | 2011 | Hanoi | – | – | – | – |

Vietnam Prefabricated House Market Analysis

Growth Drivers

Urbanization Trends

Urbanization in Vietnam is progressing rapidly, with over 38% of the population residing in urban areas in 2023, projected to reach 40% by 2025, according to the Ministry of Planning and Investment. This urban migration underscores the increasing demand for efficient housing solutions in metropolitan hubs like Ho Chi Minh City and Hanoi. The growth in the urban population pushes for quick, affordable housing solutions, making prefabricated homes increasingly appealing due to their quick construction times and cost-effectiveness. Additionally, as urban infrastructure expands, the integration of prefabricated housing within urban planning becomes essential for sustainable development.

Increasing Disposable Income

The disposable income of the Vietnamese population has risen significantly, with an average growth reaching USD 3,500 by 2023, as reported by the General Statistics Office of Vietnam. This increase in disposable income contributes to the demand for quality housing, as consumers are now more willing to invest in modern and efficient home designs, such as prefabricated houses. As more households enter the middle class, the propensity to spend on homeownership rises, favouring sectors like prefabricated construction that offer value without compromising quality. This economic trend highlights a shift in consumer behaviour, prioritizing quality housing options.

Market Challenges

Regulatory Hurdles

The prefabricated housing market faces significant regulatory challenges, with construction regulations often hindering the speed at which these homes can be built. Current building codes are extensive and require compliance with various local and national standards, which can lead to delays in approvals and project execution. In Vietnam, the time taken for construction permit approvals has been reported to average up to 90 days, impacting project timelines. This complexity in the regulatory landscape creates uncertainty for developers looking to invest in prefabricated solutions, thus inhibiting market growth.

Competition from Traditional Construction

The prefabricated house market in Vietnam faces strong competition from traditional construction methods. Many consumers and builders still prefer conventional techniques due to familiarity and established perceptions about durability and quality. Vietnam’s construction sector remains heavily rooted in traditional practices, which poses a challenge for new methods like prefabrication. According to industry insights, it is estimated that traditional construction still accounts for over 70% of the total building processes in Vietnam, creating a long-standing barrier for the prefabricated home segment to exceed.

Opportunities

Technological Innovations

Currently, investments in construction technology offer significant opportunities for the growth of the prefabricated house market. Technology such as Building Information Modeling (BIM) and automated manufacturing processes improve both efficiency and quality in prefabricated construction. In Vietnam, the adoption of digital construction methods is gaining traction, with a 35% increase in investment in technology by construction firms compared to 2022. These advancements not only lower production costs but also enhance design capabilities, making prefabrication an increasingly attractive option for modern housing projects.

Investment in Sustainable Materials

The global shift towards sustainable building practices presents a favorable opportunity for Vietnam’s prefabricated house market. As consumer awareness surrounding environmental issues grows, demand for sustainable construction materials continues to rise. In 2023, the usage of eco-friendly materials in construction saw a 42% increase compared to previous years. This trend is supported by government incentives aimed at promoting green building practices, thereby fostering innovation in the prefabricated house segment that incorporates renewable resources and sustainability-focused design.

Future Outlook

Over the next five years, the Vietnam prefabricated house market is expected to experience substantial growth driven by continuous government support, rising urbanization, and increasing consumer demand for affordable and sustainable housing solutions. Government initiatives aimed at promoting sustainable building practices, alongside advancements in prefabricated construction technologies, are likely to enhance market adoption. Additionally, as awareness grows about the advantages of efficiency and quality in prefabricated homes, consumer preferences will continue to shift towards these innovative housing solutions.

Major Players

- VinaHouse

- VietModular

- Smart Housing Vietnam

- EcoHome Vietnam

- Prefab House Vietnam

- Hoang Phuc Investment

- An Phu Construction

- Vietnam Eco Solutions

- Green House Construction

- Ducth House Vanessa

- Nova Group

- AMW Home

- Hoang Long Prefab

- Bamboo House Vietnam

- CEN Group

Key Target Audience

- Real Estate Developers

- Construction Companies

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Construction, Urban Planning Department)

- Sustainable Housing Advocates

- Industry Associations

- Home Buyers

- Prefabricated Materials Suppliers

Research Methodology

Step 1: Identification of Key Variables

The research begins with the identification of key variables affecting the Vietnam prefabricated house market. This involves constructing an ecosystem map that details all major stakeholders and relevant parameters within the industry. Extensive desk research is performed using a combination of secondary databases and proprietary industry reports to gather comprehensive insights.

Step 2: Market Analysis and Construction

In this phase, comprehensive historical data on the prefabricated house market is compiled and analysed. Important metrics including market penetration, types of construction methodology, consumer preferences, and revenue generation are examined. This step ensures that the analysis reflects the evolving dynamics of the prefabricated housing sector.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts. This includes conducting structured interviews with stakeholders such as manufacturers, builders, and policy makers to gather insights on market dynamics and operational aspects. These discussions provide critical context and data that supports the overall analysis.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the findings from prior research steps to compile a cohesive report on the market. Direct engagement with prefabricated house manufacturers allows for the acquisition of detailed information on product segments, consumer preferences, and future trends. This interaction serves to validate and complement quantitative findings, resulting in a thorough and reliable market analysis.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Urbanization Trends

Increasing Disposable Income - Market Challenges

Regulatory Hurdles

Competition from Traditional Construction - Opportunities

Technological Innovations

Investment in Sustainable Materials - Trends

Rise in Eco-Friendly Construction

Growing Popularity of DIY Prefabricated Homes - Government Regulation

Building Codes and Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type of Prefabricated Structures (In Value %)

Modular Homes

– Fully Finished Modules

– Partially Finished Modules

– Stackable/Expandable Modular Units

Panelized Homes

– Pre-cut Wall Panels

– Structural Insulated Panels (SIPs)

– Roof Truss Systems

Concrete Homes

– Precast Concrete Panels

– Reinforced Concrete Modules

– Concrete Block Systems

Steel Frame Houses

– Light Gauge Steel Framing

– Heavy Steel Structures

– Hybrid Steel-Wood Structures - By Construction Method (In Value %)

Off-site Construction

– Factory-Assembled Units

– Turnkey Modules

– Controlled Environment Fabrication

On-site Construction

– Flat-Pack Assembly

– Hybrid On-site & Off-site Installation

– Partial Prefabrication with On-site Finishing - By Application Segment (In Value %)

Residential

– Single-Family Homes

– Low-Cost Housing

– Vacation Homes

Commercial

– Office Cabins

– Pop-Up Retail Stores

– Temporary Accommodation Units

Industrial

– Worker Dormitories

– Site Offices

– Storage and Utility Buildings - By Region (In Value %)

Northern Vietnam

Southern Vietnam

Central Vietnam - By Market Structure (In Value %)

Organized

Unorganized

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Prefabricated Structure Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Prefabricated Structure, others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

VinaHouse

VietModular

Smart Housing Vietnam

Viettel Construction

Avante Homes

Ducth House Vanessa

Hoang Phuc Investment

Green House Construction

An Phu Construction

Nha Cach Tan

Ecotect Vietnam

Vietnam Eco Solutions

Prefab House Vietnam

Nova Group

AMW Home

- Market Demand and Utilization

- Purchasing Behaviour and Preferences

- Regulatory and Compliance Requirements

- Consumer Needs and Expectations

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030