Market Overview

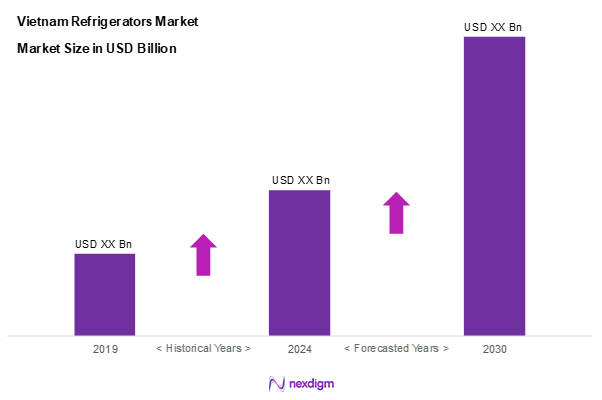

As of 2024, the Vietnam refrigerators market is valued at USD 1.8 billion, with a growing CAGR of 5.5% from 2024 to 2030, this is reflecting the growing demand for advanced refrigeration solutions among consumers and businesses alike. Key drivers include rising disposable incomes and changing consumer preferences for energy-efficient products. Additionally, the increasing urbanization rate has led to a higher demand for household appliances, contributing to significant market growth.

Major cities like Ho Chi Minh City, Hanoi, and Da Nang dominate the market due to their dense populations and rapid economic development. These urban centres also exhibit a higher adoption of modern appliances driven by the preference for convenience and quality among the growing middle class. The favourable business environment in these cities supports the presence and expansion of both local and international refrigerator brands, enhancing their market share.

Market Segmentation

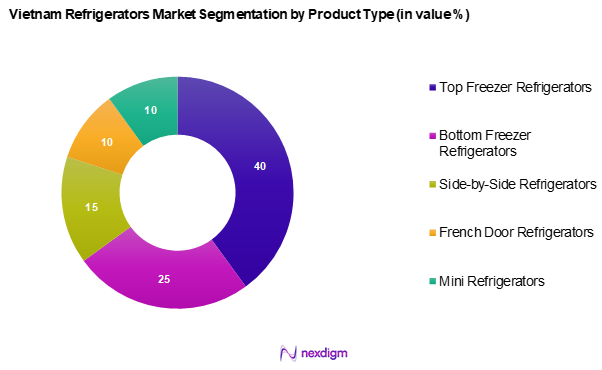

By Product Type

The Vietnam refrigerators market is segmented into top freezer refrigerators, bottom freezer refrigerators, side-by-side refrigerators, French door refrigerators, and mini/refrigerators. Top freezer refrigerators have a dominant market share in Vietnam’s refrigeration segment. This preference is attributed to their traditional design, affordability, and efficient space utilization, aligning with the needs of urban households. Brands like LG and Samsung have effectively marketed these refrigerators to a wide demographic, reinforcing their popularity and demand.

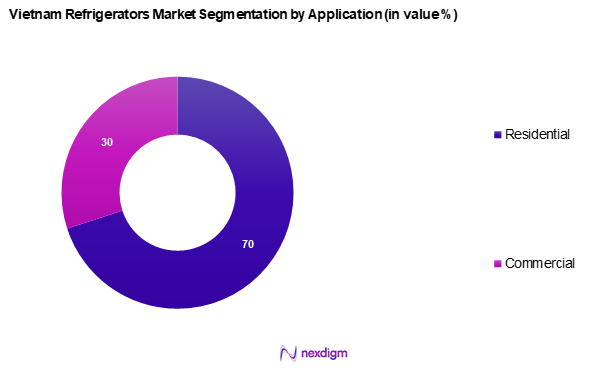

By Application

The Vietnam refrigerators market is segmented into residential and commercial uses. The residential segment holds the majority share of the market. This dominance is fuelled by the expanding middle class and increased consumer interest in modern kitchen appliances, driven by lifestyle changes and a desire for enhanced convenience. As more households upgrade their appliances for energy efficiency and aesthetics, the residential application continues to drive significant sales in the market.

Competitive Landscape

The Vietnam refrigerators market is dominated by several key players, including local manufacturers and international giants, which together shape the competitive landscape. Major companies like LG Electronics, Samsung, and Whirlpool lead the market due to their commitment to innovation, strong distribution channels, and effective marketing strategies. Their ability to adapt to local consumer preferences gives them a competitive edge in a rapidly growing market.

| Company | Establishment Year | Headquarters | Market Share | Product Range | Distribution Channels | Customer Service Rating |

| LG Electronics | 1958 | Seoul, South Korea | – | – | – | – |

| Samsung Electronics | 1938 | Suwon, South Korea | – | – | – | – |

| Whirlpool Corporation | 1911 | Benton Harbor, USA | – | – | – | – |

| Panasonic | 1918 | Osaka, Japan | – | – | – | – |

| Haier | 1984 | Qingdao, China | – | – | – | – |

Vietnam Refrigerators Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant growth driver within the Vietnam refrigerators market, as the nation continues to experience rapid urban migration. In 2023, approximately 40.2% of Vietnam’s population resides in urban areas, reflecting a notable increase from 37.6% in 2019 (World Bank). This urban expansion leads to increased housing development, which in turn escalates demand for household appliances, including refrigerators. The growing urban middle class, which is projected to reach about 43 million by 2025, is seeking modern and effective refrigeration options, further propelling the growth of the market. The migration towards urban centres also catalyses a shift toward more affluent lifestyles, driving a demand for higher technology and quality in household appliances.

Rising Disposable Income

Rising disposable income is another essential driver for the Vietnam refrigerators market. The average disposable income per capita in Vietnam was estimated at USD 3,500.0 in 2023, a significant increase from USD 3,200.0 in 2022 (General Statistics Office of Vietnam). As incomes rise, consumer spending on durable goods, including home appliances, is expected to increase correspondingly. The urban middle class is identified as a primary consumer group, whose income growth is anticipated to be around 6.7% annually through 2025, leading to greater demand for modern refrigeration solutions. Furthermore, the trend in purchasing power indicates that consumers are willing to invest in high-quality and energy-efficient appliances, fostering a favourable environment for market growth.

Market Challenges

Intense Competition

The Vietnam refrigerators market faces intense competition, characterized by both local and international manufacturers vying for market share. In 2023, it was estimated that over 50 brands are actively contributing to the market, combining domestic start-ups with established global players. This saturation creates a challenging environment for differentiation, leading brands to engage in aggressive pricing strategies and increased marketing expenditures. As a result, margins are under constant pressure, compelling companies to innovate and enhance the value proposition offered to consumers. This landscape necessitates constant adaptation and strategic positioning from market players to maintain a competitive advantage and meet evolving consumer preferences.

Price Sensitivity among Consumers

Price sensitivity is a critical challenge in the Vietnam refrigerators market, reflecting the economic realities of many consumers. In mid-2023, nearly 65% of Vietnamese consumers indicated that the pricing of household appliances significantly influenced their purchasing decisions. This heightened sensitivity is buttressed by the country’s growing concern over inflation, where the inflation rate in Vietnam was projected to be around 3.7% in 2023, affecting disposable incomes and household budgeting. Consequently, brands must strike a balance between offering attractive pricing models and maintaining product quality, which can complicate market strategies and diminish profitability for vendors.

Opportunities

Expansion of E-commerce Platforms

The expansion of e-commerce platforms presents a substantial opportunity for growth within the Vietnam refrigerators market. In 2023, Vietnam’s e-commerce sector reached approximately USD 16.0 billion, showcasing a growth rate of 25% year-over-year, which is significantly higher than the global average (Vietnam Ecommerce Association). This growth provides a pivotal opportunity for refrigerator brands to enhance their online presence and reach a broader consumer base, particularly in urban areas where consumer preferences are rapidly shifting towards online shopping. Online platforms not only facilitate convenience for consumers but also offer brands lower operational costs and the ability to tailor marketing strategies directly to target demographics. Furthermore, increased internet penetration, with a projected 71% of the population using the internet by the end of 2024, bolsters this opportunity, driving sales of home appliances through digital channels.

Innovations in Refrigeration Technology

Innovations in refrigeration technology hold great potential for market expansion in Vietnam. As consumers increasingly seek advanced features such as smart connectivity and energy-efficient designs, manufacturers are investing in research and development to meet these demands. By 2023, the Vietnam cooling appliance market has observed a rise in IoT-enabled refrigerators, which allow remote access and control, aligning with the growing trend of smart homes. The Vietnamese government and NGOs are also backing initiatives to promote green technology, as seen in the launch of programs aimed at enhancing manufacturing standards in energy-efficient appliances. This technological advancement not only captivates tech-savvy consumers but also aligns with governmental sustainability goals.

Future Outlook

Over the next five years, the Vietnam refrigerators market is poised for robust growth, propelled by advancements in refrigeration technology, aggressive market penetration strategies by key players, and rising disposable incomes. The demand for energy-efficient and innovative products will contribute to increased consumer expenditure on home appliances, making the refrigeration sector a critical area for investment and development.

Major Players

- LG Electronics

- Samsung Electronics

- Whirlpool Corporation

- Panasonic

- Haier

- Toshiba

- Electrolux

- Bosch

- Midea

- Sharp

- Sanyo

- Chigo

- Cuckoo

- Sanaky

- Arctic

Key Target Audience

- Retailers and Distributors

- Wholesale Suppliers

- Investments and Venture Capitalist Firms

- Manufacturing Firms

- Government and Regulatory Bodies (Ministry of Industry and Trade, General Department of Energy, Ministry of Environment and Natural Resources)

- Appliance Service Providers

- Planning and Development Agencies

- Environmental Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the Vietnam Refrigerators Market. This step relies on extensive desk research, utilizing a mixture of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including supply chain actors, consumption patterns, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data associated with the Vietnam refrigerators market. This includes examining trends over the past few years to assess market penetration, the ratio of various product types, and the resultant revenue generation. An evaluation of sales performance and service quality metrics will be undertaken to ensure the reliability and accuracy of revenue estimates made for the current and future market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts from diverse companies within the refrigerators sector. These discussions provide vital operational and financial insights directly from practitioners, contributing to the refinement and corroboration of market data. Engaging with various market players helps in understanding unquantifiable factors affecting market trends, such as consumer preferences and increasing trends towards sustainability.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers and suppliers to gather detailed insights into product segments, sales performance, consumer preferences, and emerging market needs. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam refrigerators market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Historical Perspective

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Urbanization

Rising Disposable Income - Market Challenges

Intense Competition

Price Sensitivity among Consumers - Opportunities

Expansion of E-commerce Platforms

Innovations in Refrigeration Technology - Trends

Increase in Demand for Smart Refrigerators

Sustainability Initiatives in Manufacturing - Government Regulation

Energy Efficiency Standards

Import Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Top Freezer Refrigerators

– Single-Door

– Double-Door

Bottom Freezer Refrigerators

– Drawer Type

– Swing Door Type

Side-by-Side Refrigerators

– With Dispenser

– Without Dispenser

French Door Refrigerators

– 3-Door Design

– 4-Door Design

Mini Refrigerators

– Single-Compartment

– Dual-Compartment - By Application (In Value %)

Residential

– Urban Households

– Rural Households

Commercial

– Hotels & Restaurants

– Retail Stores

– Offices & Institutions - By Distribution Channel (In Value %)

Online Retail

Specialty Stores

Supermarkets/Hypermarkets

Direct Sales - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam - By Technological Features (In Value %)

Energy Efficient Refrigerators

– 3-Star Rated

– 4-Star & Above Rated

Smart Refrigerators

– Wi-Fi Enabled

– Touchscreen & IoT Features

Convertible Refrigerators

– Freezer-to-Fridge Modes

– Dual Cooling Zones - By Refrigeration Capacity (In Value %)

Less than 200L

200L to 300L

More than 300L - By Market Structure (In Value %)

Organized

Unorganized

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Technology Features, Geographic Reach, Brand Positioning, Product Innovation, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

LG Electronics

Samsung Electronics

Whirlpool Corporation

Electrolux

Panasonic

Haier

Toshiba

Beko

Sharp

Midea

Chigo

Sanyo

Koppel

Cuckoo

Sanaky

- Market Demand and Utilization

- Consumer Preferences and Buying Behaviour

- Regulatory Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value Prediction, 2025-2030

- By Volume Prediction, 2025-2030

- By Average Price Prediction, 2025-2030