Market Overview

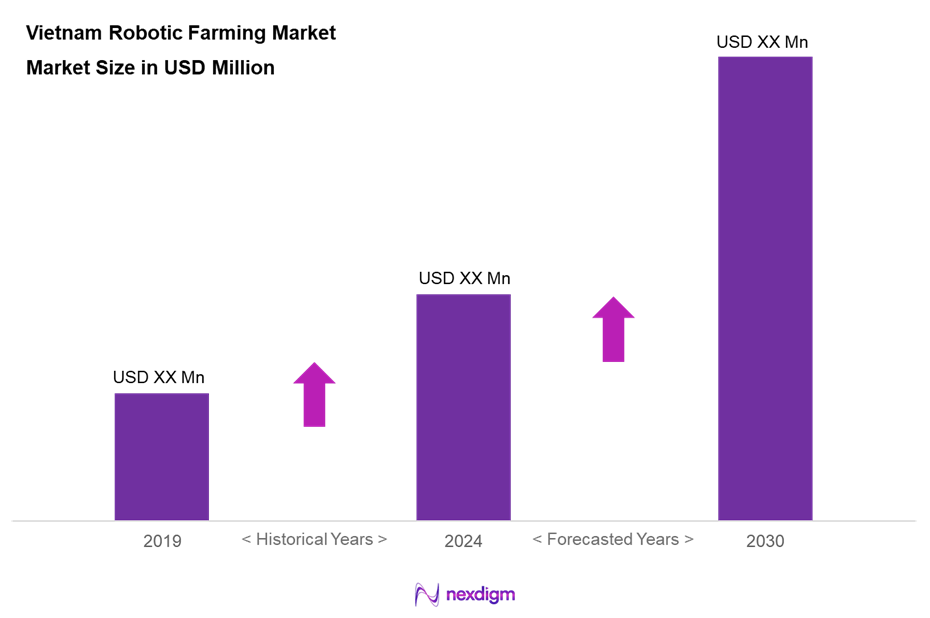

As of 2024, the Vietnam robotic farming market is valued at USD 259.1 million, with a growing CAGR of 4.3% from 2024 to 2030, supported by the escalating adoption of advanced agricultural technologies and government initiatives promoting automation in farming practices. The continued enhancement of agricultural efficiency due to robotic applications, such as autonomous tractors and drones, further propels this growth, reflecting increasing investment from both local and international entities in the agricultural sector and its technological advancement.

In the landscape of robotic farming, Northern Vietnam emerges as a dominant region due to its established agricultural infrastructure and investment in high-tech farming solutions. Major cities like Hanoi demonstrate an inclination toward adopting smart farming practices, significantly influenced by government policies aimed at modernization and efficiency. Southern Vietnam, with its extensive agricultural production zones, also plays a crucial role in shaping the market, driven by its diverse farming activities and growing interest in sustainable agricultural practices.

Market Segmentation

By Type of Robotics

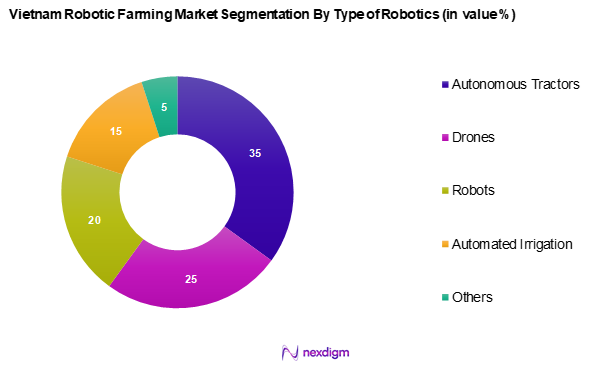

The Vietnam robotic farming market is segmented into autonomous tractors, drones, robots, automated irrigation systems, and others. Autonomous tractors are currently leading the market segment, driven by increased demand for mechanization in agriculture. Their ability to perform farming tasks autonomously reduces labour costs and improves operational efficiency, making them a preferred choice among farmers aiming to enhance productivity.

By Application

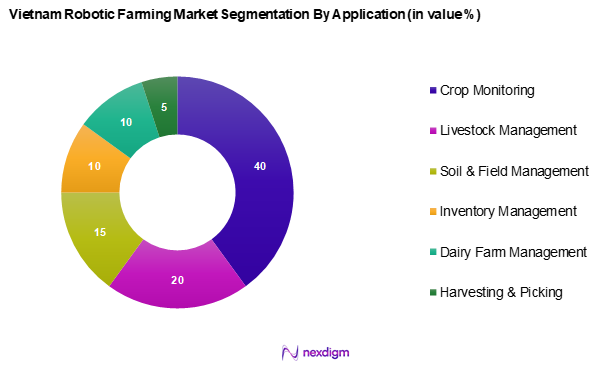

The Vietnam robotic farming market is segmented into crop monitoring, livestock management, soil and field management, inventory management, dairy farm management, and harvesting & picking. Crop monitoring currently leads this application segment, attributed to the crucial need for real-time data analytics in agriculture. Innovations in sensory technology for crop surveillance enable farmers to make informed decisions based on actionable insights, enhancing yield and resource optimization.

Competitive Landscape

The Vietnam robotic farming market is dominated by a few key players, including global leaders and innovative local firms that contribute to the competitive landscape. This consolidation underscores the growing significance of established companies in driving technological advancements and maintaining market leadership.

| Company | Establishment Year | Headquarters | Product Lines | Revenue (USD) | Market Strategies | Market

Share |

| Yara | 1905 | Oslo, Norway | – | – | – | – |

| John Deere | 1837 | Illinois, USA | – | – | – | – |

| DJI | 2006 | Shenzhen, China | – | – | – | – |

| AG Leader Technology | 1992 | Lowa, USA | – | – | – | – |

| Trimble Inc. | 1978 | Colorado, USA | – | – | – | – |

Vietnam Robotic Farming Market Analysis

Growth Drivers

Increase in Agricultural Efficiency

The integration of robotics in Vietnamese agriculture is playing a crucial role in enhancing efficiency. With advancements in mechanization, farmers are witnessing improvements in crop yields and resource optimization. The government’s commitment to modernizing farming practices through technology adoption is aligned with national development strategies. By implementing robotic systems, the agricultural sector is undergoing a transformation to meet both domestic and export demands, reinforcing the importance of technology in the country’s farming landscape.

Labour Shortage in Agriculture

The agricultural sector in Vietnam is facing a persistent labor shortage due to the migration of the workforce to urban areas in search of better opportunities. This demographic shift has led to a reduction in the availability of farm labor, prompting farmers to adopt robotic solutions. Automation, including the use of drones and autonomous tractors, is helping to maintain productivity levels and sustain agricultural operations despite the decreasing workforce. These innovations are becoming essential for modernizing Vietnam’s farming industry.

Market Challenges

High Initial Investment

One of the key barriers to the adoption of robotic farming in Vietnam is the significant upfront investment required for advanced agricultural technologies. While the long-term benefits include improved efficiency and reduced labor costs, many small-scale farmers struggle to access the necessary capital for such investments. The financial constraints faced by these farmers continue to slow the widespread adoption of robotics in the agricultural sector, making it difficult for them to transition from traditional farming methods to modernized systems.

Technological Integration Issues

The adoption of robotic farming is also hindered by challenges related to technological integration. Many farmers face difficulties in operating and maintaining advanced machinery due to a lack of training and technical support. The absence of standardized protocols and infrastructure further complicates the implementation of these technologies. Without adequate support and knowledge, farmers may be hesitant to fully embrace automation, limiting the potential efficiency gains that robotic farming could offer.

Opportunities

Government Incentives for Automation

Government-led initiatives aimed at encouraging automation present a major opportunity for the robotic farming market in Vietnam. Policies introduced by the relevant authorities include financial support through grants and subsidies for farmers investing in modern technologies. These incentives help bridge the gap between traditional farming practices and technological advancements. Additionally, collaboration between public and private entities is fostering an environment conducive to increased adoption of robotics in agriculture, ensuring a more sustainable and productive future for the sector.

Growing Interest in Sustainable Farming

The rising emphasis on sustainable farming practices is driving interest in robotic solutions that promote environmental stewardship. Vietnamese farmers are increasingly aware of the ecological impact of conventional farming methods and are exploring technology-driven solutions to enhance efficiency while minimizing resource consumption. The alignment of robotic farming with sustainable agricultural practices is fostering innovation in the sector, creating new opportunities for market growth. As sustainability becomes a priority in both national and international agricultural frameworks, the demand for robotics in farming is expected to expand significantly.

Future Outlook

Over the next five years, the Vietnam robotic farming market is projected to exhibit substantial growth, driven by continuous advancements in agricultural technologies, government policies encouraging automation, and the escalating demand for efficient farming practices. Enhanced collaboration between technology providers and farmers will likely foster an environment conducive to innovation, facilitating the integration of robots and automated systems in everyday agricultural operations.

Major Players

- Yara

- AG Leader Technology

- John Deere

- Trimble Inc.

- Agrointelli

- Naïo Technologies

- Harvest CROO Robotics LLC.

- Piagro

- Sarcos Robotics

- Fieldin

- DJI

- XAG Mekong

- Hogitech Co., Ltd

- Huida Tech

- AGCO

- AgEagle Aerial Systems

- Yamaha Robotics

- MAJ Vietnam

- AgriDrone

Key Target Audience

- Agricultural Equipment Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Agriculture and Rural Development, Vietnam)

- Agricultural Cooperatives

- Technology Providers

- Farmers and Agribusinesses

- Agricultural Research Institutions

- Supply Chain Stakeholders

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam robotic farming market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including technology adoption rates and market demand factors.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyse historical data pertaining to the Vietnam robotic farming market. This includes assessing market penetration rates, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, focusing on technological advancements and consumer adoption rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data, ensuring a well-rounded understanding of current trends and future projections.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple robotic farming equipment manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam robotic farming market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increase in Agricultural Efficiency

Labour Shortage in Agriculture - Market Challenges

High Initial Investment

Technological Integration Issues - Opportunities

Government Incentives for Automation

Growing Interest in Sustainable Farming - Trends

Rise in Digital Agriculture Initiatives

Adoption of Cloud-Based Solutions - Government Regulation

Agricultural Policies

Standards for Robotic Equipment - Safety Regulations

- SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type of Robotics (In Value %)

Autonomous Tractors

– GPS-Based Navigation Systems

– Auto-Steering and Guidance

– Seeding and Plowing Robots

Drones

– Aerial Crop Monitoring

– Pesticide and Fertilizer Spraying

– Thermal Imaging and Mapping Drones

Robot

– Multi-Function Field Robots

– Weeding and Thinning Robots

– Autonomous Harvesters

Automated Irrigation Systems

– Drip Irrigation Controllers

– Smart Sprinkler Systems

– Moisture Sensor-Based Systems

Others

– Seed Planting Robots

– Sorting and Packaging Robotics

– Autonomous Feed Dispensers - By Application (In Value %)

Crop Monitoring

– Aerial Imaging and NDVI Analytics

– Disease and Pest Detection

– Crop Health Monitoring

Livestock Management

– Cattle Tracking Systems

– Automated Feeding and Milking

– Health Monitoring Wearables

Soil & Field Management

– Soil Nutrient Sensing

– Automated Tilling and Plowing

– Smart Fertilization

Inventory Management

– Autonomous Storage Robots

– Smart Warehouse Systems

– RFID and Sensor-Based Tracking

Dairy Farm Management

– Robotic Milking Systems

– Automated Cooling Units

– Real-Time Dairy Monitoring

Harvesting & Picking

– Fruit and Vegetable Harvesting Robots

– AI-Powered Yield Estimators

– Sorting and Packing Machines

Others

– Farm Surveillance Robots

– Autonomous Transport Vehicles

– Weather Data Integration Tools - By Farm Size (In Value %)

Small Scale Farms

– Low-Cost Robotic Solutions

– Shared Drone Services

– Simplified IoT Devices

Medium Scale Farms

– Mid-Range Precision Agriculture Equipment

– Semi-Autonomous Tractors

– Mobile App-Enabled Robotics

Large Scale Farms

– Fully Integrated Smart Farming Systems

– Fleet of Autonomous Machinery

– Enterprise-Grade Robotics and Drones - By Region (In Value %)

Northern Vietnam

Southern Vietnam

Central Vietnam

Mekong Delta

Coastal Regions - By Technology Integration (In Value %)

AI and Machine Learning

– Predictive Analytics for Crop Yields

– Behavior Pattern Recognition in Livestock

– Automated Decision-Making Systems

IoT and Connectivity

– Sensor-Connected Equipment

– Mobile App-Controlled Robots

– Data-Driven Cloud Platforms

Sensor Technologies

– Soil Moisture Sensors

– Climate Monitoring Sensors

– Livestock Vital Sign Sensors

Others

– Blockchain for Supply Chain Traceability

– GIS and Satellite Mapping Integration

– Voice-Activated Farming Controls - By Farming Environment (In Value %)

Indoor Farming

– Greenhouse Automation Robots

– Climate-Controlled Irrigation Systems

– Vertical Farming Platforms

Outdoor Farming

– Terrain-Specific Drones and Tractors

– Weather-Responsive Fertilizer Application

– Large-Scale Field Robotics

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Robotics Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Innovations, Strengths, Weaknesses, Organizational Structure, Revenue, Product Lines, Distribution Network, Customer Base, and Technological Advancements)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Yara

AG Leader Technology

John Deere

Trimble Inc.

Agrointelli

Naïo Technologies

Harvest CROO Robotics LLC.

Piagro

Sarcos Robotics

Fieldin

DJI

XAG Mekong

Hogitech Co., Ltd

Huida Tech

AGCO

- Market Demand Assessment

- Purchasing Patterns and Budget Allocations

- Regulatory and Compliance Impact

- Needs and Challenges Analysis

- Decision-Making Processes

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030