Market Overview

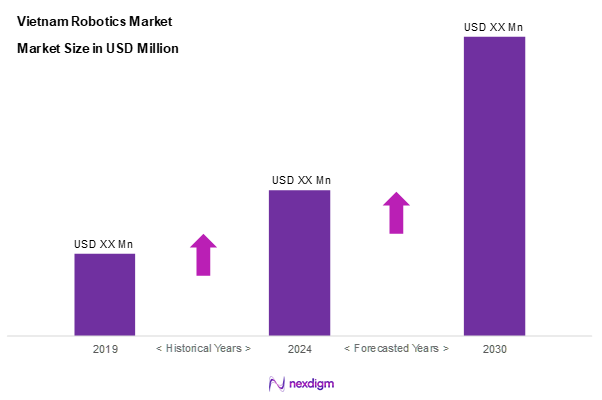

As of 2024, the Vietnam robotics market is valued at USD 480.2 million, with a growing CAGR of 3.7% from 2024 to 2030, driven by factors such as increasing automation in various sectors and government initiatives promoting advanced technologies. The rapid industrialization in Vietnam, coupled with a higher adoption rate of robotics in manufacturing and healthcare, positions the country for substantial market growth. Factors like improving technological infrastructure and a skilled workforce are contributing to the momentum of this market.

Dominant cities contributing to the growth of the robotics market include Ho Chi Minh City and Hanoi. These urban centres are recognized for hosting a large number of manufacturing hubs and technology companies that are progressively adopting automation solutions. Furthermore, government policies incentivizing technological advancements and investment in R&D are present in these regions, further driving the market dominance.

Market Segmentation

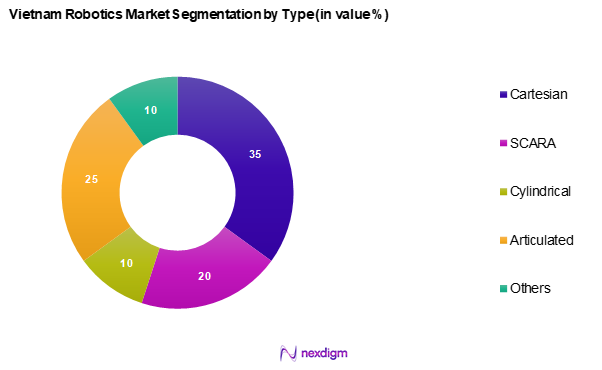

By Type

The Vietnam robotics market is segmented into Cartesian, SCARA, cylindrical, articulated, and others. Cartesian segment dominates the Vietnam robotics market due to its straightforward design and ease of programming, making it an ideal choice for various applications, including CNC machinery and automated assembly lines. Additionally, Cartesian robots offer high precision and repeatability, which are critical for the manufacturing industry’s quality standards. Their cost-effectiveness and versatility further enhance their appeal, leading to increased adoption in numerous sectors across Vietnam.

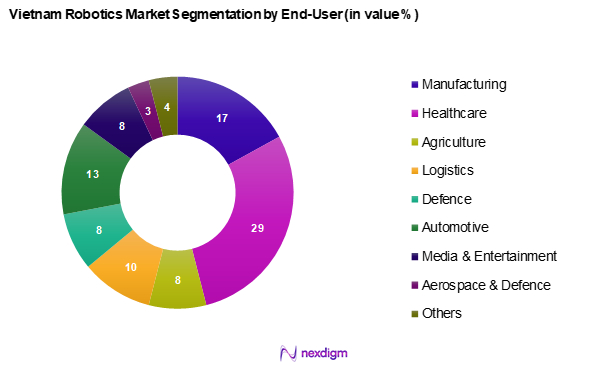

By End-User

The Vietnam robotics market is segmented into manufacturing, healthcare, agriculture, logistics, defence, automotive, media & entertainment, aerospace & defence, and others. The healthcare segment dominates the Vietnam robotics market primarily due to the growing demand for advanced medical technologies and automation in surgical procedures. Innovations such as robotic-assisted surgeries and rehabilitation robots enhance precision, minimize recovery times, and improve patient outcomes, making them invaluable in healthcare settings. Additionally, the increasing investment in healthcare infrastructure and the government’s focus on improving medical services further bolster the adoption of robotics within this sector.

Competitive Landscape

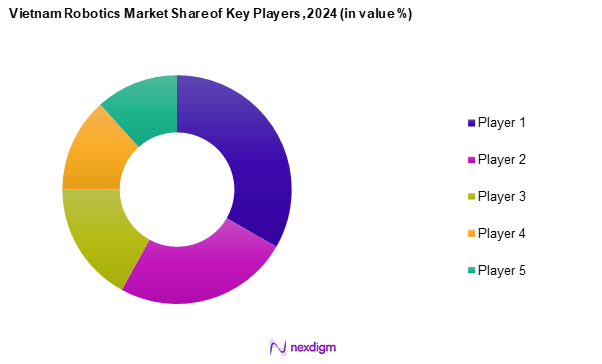

The Vietnam robotics market is dominated by a few major players, including both local entities and international brands. This consolidation highlights the significant influence of these key companies, which have established a strong foothold through strategic partnerships and technological advancements.

| Major Player | Establishment Year | Headquarters | Market Share (%) | Key Product Offerings | Revenue

(USD Mn) |

R&D Investment (USD) |

| ABB | 1988 | Zurich, Switzerland | – | – | – | – |

| Fanuc | 1956 | Oshino, Japan | – | – | – | – |

| KUKA | 1898 | Augsburg, Germany | – | – | – | – |

| Yaskawa Electric | 1915 | Kitakyushu, Japan | – | – | – | – |

| Universal Robots | 2005 | Odense, Denmark | – | – | – | – |

Vietnam Robotics Market Analysis

Growth Drivers

Increasing Automation Demand

The demand for automation in Vietnam is significantly driven by the country’s robust economic growth, projected at 6.5% in 2024 according to the Asian Development Bank. The need for higher efficiency and production quality in sectors like manufacturing is leading to increased investments in robotics solutions. In 2022, Vietnam’s manufacturing sector grew by approximately 7%, further accelerating the need for automation. As companies aim to improve productivity amidst rising labour costs, the adoption of robotics technology becomes essential. The trend is expected to strengthen as Vietnam seeks to position itself as a manufacturing hub in Southeast Asia, particularly focusing on high-tech industries.

Government Initiatives

The Vietnamese government is actively promoting the adoption of robotics and automation through various initiatives. The “Vietnam National Strategy on Industry 4.0” aims to advance the technological landscape and increase competitiveness in key sectors. Government investment in tech infrastructure is projected at USD 1.0 billion over the next few years, reflecting its commitment to foster innovation. Furthermore, partnerships with global tech companies are being established to create smart factories and enhance the robotics ecosystem. This government backing is critical in positioning Vietnam as a competitive player in the global robotics market.

Market Challenges

High Initial Investment

The significant upfront costs associated with deploying robotic automation present a major challenge for many Vietnamese businesses. Investment figures indicate that the cost of advanced automation solutions can range from USD 20,000.0 to USD 100,000.0 for individual units, depending on complexity and capabilities. Many SMEs are constrained by limited budgets and are hesitant to commit to such investments, thereby slowing down market adoption. Cost transparency coupled with financing options will be crucial in alleviating this barrier, enabling more businesses to consider implementing robotic technologies.

Skill Shortages

The rapid advancement of robotics technology is outpacing the availability of skilled labour in Vietnam. By 2023, the country faced a shortage of over 300,000 qualified personnel in the science and technology sectors, inhibiting the effective integration of automation into various industries. Additionally, the mismatch between industry requirements and educational outputs underscores the need for specialized training programs to bridge this gap. The government and private sectors must collaborate to design comprehensive training that equips the workforce with necessary skills and knowledge for modern robotics applications.

Opportunities

Expansion in Emerging Markets

Vietnamese robotic technology firms are positioned to capture growth opportunities in emerging markets, particularly in Southeast Asia, where demand for automation is booming. Countries like Thailand and Indonesia are investing heavily in robotics to leapfrog traditional manufacturing models, creating significant opportunities for Vietnamese companies that can offer competitive pricing along with technologically advanced solutions. In 2023, exports of Vietnamese robotic products to neighbouring countries increased by 15%, reflecting the growing interest in enhanced automation solutions across Asia. This trend indicates a potential for Vietnam to become a key player in the regional robotics industry.

Technological Advancements

The pace of technological advancements in robotics is also creating fertile ground for future growth in Vietnam. Areas such as AI-driven robotics, collaborative robots, and automation frameworks are experiencing rapid development, demonstrated by an increase in R&D investments from both government and private sectors. In 2024, the total R&D expenditure is projected to reach USD 1.5 billion, indicating a strong push towards innovation. These advancements not only enhance the functionality of robotic systems but also lower operational costs, making them more accessible to a broader range of industries.

Future Outlook

Over the next five years, the Vietnam robotics market is expected to show significant growth driven by continuous government support, advancements in robotics technology, and increasing demand for automation across various sectors. This trend is reflected in the investments made by firms focusing on enhancing their production capabilities and leveraging robotics to improve operational efficiency. The ongoing digital transformation is set to further fuel innovations in the market, making it a key area of interest for stakeholders.

Major Players

- ABB

- Fanuc

- KUKA

- Yaskawa Electric

- Universal Robots

- Mitsubishi Electric

- Siemens

- Boston Dynamics

- Intuitive Surgical

- iRobot

- Teradyne

- Clearpath Robotics

- Epson Robots

- SoftBank Robotics

- DJI

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Industry and Trade, Vietnam)

- Large Manufacturing Companies

- Healthcare Providers and Institutions

- Agricultural Corporations

- Logistics and Supply Chain Management Firms

- Research and Development Departments

- Technology Start-ups focusing on Robotics

Research Methodology

Step 1: Identification of Key Variables.

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam robotics market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including technological advancements, regulatory frameworks, and consumer acceptance.

Step 2: Market Analysis and Construction.

In this phase, we compile and analyze historical data pertaining to the Vietnam robotics market. This includes assessing market penetration rates, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates, providing insights into market growth patterns and consumer behaviour.

Step 3: Hypothesis Validation and Expert Consultation.

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies within the robotics sector. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data collected.

Step 4: Research Synthesis and Final Output.

The final phase involves direct engagement with multiple robotics manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam robotics market. By synthesizing expert opinions and market data, we can deliver well-rounded insights that drive informed decision-making.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Automation Demand

Government Initiatives - Market Challenges

High Initial Investment

Skill Shortages - Opportunities

Expansion in Emerging Markets

Technological Advancements - Trends

Adoption of Collaborative Robots

Edge Computing in Robotics - Government Regulation

Safety Standards

Import Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type (In Value %)

Cartesian Robots

– Gantry Robots

– Pick and Place Systems

– CNC and 3D Printing Applications

SCARA Robots

– Assembly Line Robotics

– Electronic Component Handling

– High-Speed Pick & Place

Cylindrical Robots

– Precision Welding

– Material Handling

– Tooling Applications

Articulated Robots

– Welding

– Painting & Coating

– Machine Tending

– Packaging

Others

– Delta Robots

– Spherical Robots

– Collaborative Robots (Cobots) - By End-User Industry (In Value %)

Manufacturing

– Electronics & Semiconductor

– Textile & Apparel

– Food Processing

– Packaging

Healthcare

– Surgical Assistance

– Laboratory Automation

– Disinfection Robots

Agriculture

– Crop Monitoring

– Harvesting Robots

– Livestock Management

Logistics

– Automated Storage & Retrieval Systems (ASRS)

– Warehouse Automation

– Last-Mile Delivery Robots

Defense

– Surveillance Robots

– Bomb Disposal Units

– Unmanned Ground Vehicles (UGVs)

Automotive

– Assembly Line Robots

– Painting & Welding

– Parts Inspection

Media & Entertainment

– Robotic Camera Systems

– Animation Support Robots

– Event Automation

Aerospace & Defence

– Composite Material Handling

– Precision Machining

– Autonomous Inspection Drones

Others

– Education & Research

– Hospitality

– Retail Automation - By Component (In Value %)

Hardware

– Sensors & Actuators

– Controllers

– Drive Systems

– End Effectors

Software

– Robot Operating Systems (ROS)

– AI & Decision-Making Algorithms

– Real-Time Operating Systems

Services

– Integration & Customization

– Maintenance & Support

– Training & Consulting - By Technology (In Value %)

AI and Machine Learning

– Predictive Maintenance

– Behavior-Based Control

– Task Optimization

IoT Integration

– Remote Monitoring

– Predictive Analytics

– Cloud-Based Robotics

Autonomous Navigation

– SLAM (Simultaneous Localization and Mapping)

– Path Planning Algorithms

– GPS and Sensor Fusion

Vision Systems

– 2D/3D Machine Vision

– Object Recognition

– Quality Control and Inspection - By Region (In Value %)

Northern Region

Central Region

Southern Region

- Market Share of Major Players (By Value/Volume)

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type, Number of Employees, Market Reach, and Product Range)

- SWOT Analysis

- Pricing Strategies on the Basis of SKUs for Major Players

- Detailed Profiles of Major Companies

ABB

FANUC CORPORATION

YASKAWA ELECTRIC CORPORATION.

KUKA AG

Universal Robots A/S

Siemens

Boston Dynamics

iRobot Corporation

SoftBank Robotics Group

Teradyne Inc.

Intuitive Surgical

Epson America, Inc.

Rockwell Automation, Inc.

DJI

Sony Group Corporation

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030