Market Overview

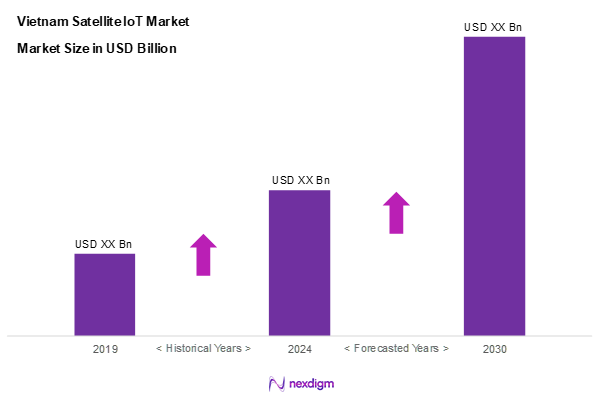

As of 2024, the Vietnam satellite IoT market is valued at USD 4 billion, with a growing CAGR of 13.4% from 2024 to 2030, driven by technological advancements and increasing demand for real-time data across various industries. The development of cost-effective satellite solutions and the nation’s strategic focus on digital infrastructure have facilitated market growth, according to Converged Technologies Report.

Ho Chi Minh City and Hanoi are dominant players in the Vietnam Satellite IoT market due to their status as economic centres with high technology adoption rates and government support. These cities host numerous technology hubs, boosting the demand for satellite-based IoT solutions that require robust infrastructure and innovation capacity.

Market Segmentation

By Satellite Type

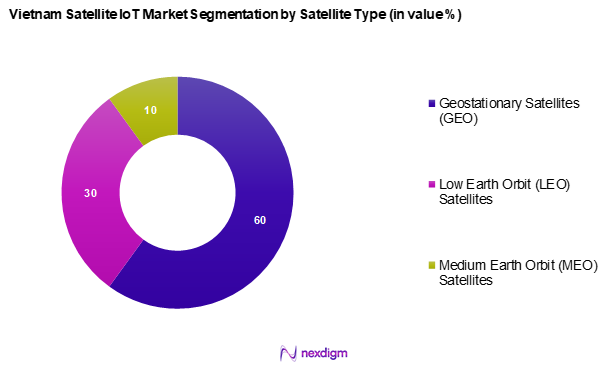

The Vietnam satellite IoT market is segmented into Geostationary (GEO), Medium Earth Orbit (MEO), and Low Earth Orbit (LEO). Geostationary (GEO) satellites dominate market due to their fixed position above the equator, providing consistent coverage over the same geographic area. This allows for reliable communication and data transmission with minimal latency, crucial for IoT applications. Their extensive coverage facilitates nationwide connectivity, essential for rural and remote areas. Additionally, the established infrastructure and technological maturity of GEO satellites make them a cost-effective option for large-scale deployments in Vietnam.

By Connectivity

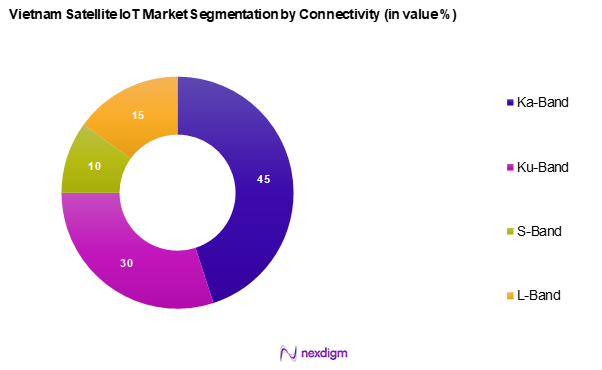

The Vietnam satellite IoT market is segmented into L-Band, Ku-Band, S-Band and Ka-Band. Ka-Band connectivity is dominant the market driven by its ability to offer higher data rates and improve bandwidth efficiency. This has led to its preferred use in applications requiring significant data throughput like environmental monitoring.

Competitive Landscape

The Vietnam satellite IoT market is dominated by a few major players, with significant contributions from global and local companies such as VNPT and Viettel Group alongside SpaceX and Inmarsat, highlighting their influence through strong technological infrastructures and wider reach.

| Company | Establishment Year | Headquarters | Revenue (2024) | Revenues by Type of Component | Market

Share |

Weakness |

| VNPT | 2003 | Hanoi, Vietnam | – | – | – | – |

| Viettel Group | 1989 | Hanoi, Vietnam | – | – | – | – |

| SpaceX | 2002 | Hawthorne, USA | – | – | – | – |

| Inmarsat | 1979 | London, UK | – | – | – | – |

| FPT Corporation | 1988 | Hanoi, Vietnam | – | – | – | – |

Vietnam Satellite IoT Market Analysis

Growth Drivers

Advancements in Satellite Technology

The continuous advancements in satellite technology are a critical driver for the Vietnam Satellite IoT market. The global satellite manufacturing market, expected to grow from USD 87 billion in 2022 to USD 101.0 billion by 2025, illustrates the shift towards innovative satellite technologies. Enhanced capabilities such as small satellite development, improved launch technologies, and better data transmission rates have made satellite IoT solutions more viable. Vietnam’s space initiatives, supported by projected increases in satellite launches, which are expected to reach 100 annually by 2025, further underscore the country’s commitment to leveraging satellite technologies for IoT applications.

Expanding IoT Ecosystem

Vietnam’s IoT ecosystem is expanding robustly, aligned with the government’s strategy to foster digital transformation. The report states that the country’s IoT market is projected to grow from USD 2.4 billion in 2022 to USD 4.0 billion by 2025. Factors such as increased internet penetration, which stood at 73% in 2022, and a growing number of smart devices enhance the deployment and utilization of satellite IoT solutions. This expanded ecosystem fosters collaboration between various industries and tech companies, leading to comprehensive solutions that can cater to specific needs while driving market growth.

Market Challenges

Regulatory Barriers

Regulatory barriers pose significant challenges for the Vietnam Satellite IoT market, particularly regarding licensing and compliance. The telecommunications sector, which encompasses satellite operations, is highly regulated, with stringent requirements that can hinder the rapid deployment of IoT services. In Vietnam, it is estimated that the licensing process can take from 6 to 12 months, impacting market entry for new players. Additionally, strict adherence to spectrum allocation policies can limit the number of satellite devices that can operate concurrently, thus stifling innovation and market expansion.

High Initial Investment Costs

High initial investment costs are another major barrier faced by the Vietnam Satellite IoT market. Establishing an IoT ecosystem requires significant capital, with estimates suggesting that satellite launch costs alone can range from USD 10.0 million to USD 150.0 million depending on the capacity and technology used. Furthermore, operational costs associated with maintaining satellite infrastructure and deploying ground stations contribute to the financial burden on companies. This financial aspect often discourages smaller enterprises from entering the market, leading to a slower rate of adoption compared to regions with lower entry costs

Opportunities

Partnerships and Collaborations

There are considerable opportunities for the Vietnam Satellite IoT market through strategic partnerships and collaborations. The telecommunications sector is actively seeking synergies with technology and data analytics firms to enhance their service offerings. Current statistics show that the number of telecommunications partnerships in Vietnam increased by 25% from 2022 to 2023, fostering innovation in connectivity solutions. Collaborations not only improve technological capabilities but also expand market reach and create integrated solutions that address complex customer requirements, paving the way for future growth.

Emerging IoT Applications

Emerging applications such as smart agriculture and environmental monitoring present vast opportunities for growth within the Vietnam satellite IoT market. The agriculture sector alone, which contributes approximately 14% to Vietnam’s GDP, is increasingly adopting IoT tools for precision farming. It is estimated that by 2025, smart farming applications could lead to yield increases of up to 30% in staple crops if adequately supported by satellite connectivity. This trend illustrates not only growing market potential but also highlights the opportunity for various sectors to benefit from the efficiencies offered by satellite IoT.

Future Outlook

Over the next five years, the Vietnam satellite IoT market is expected to show significant growth driven by continuous government support, advancements in satellite technology, and increasing demand for real-time data solutions. The country’s strategic investments in IoT infrastructure and focus on smart city initiatives are expected to further propel market expansion, bolstering the demand for innovative satellite services across various sectors.

Major Players

- VNPT

- Viettel Group

- Vinfast

- VINASAT Satellite Technology Co.

- FPT Corporation

- SpaceX

- Inmarsat

- Eutelsat Communications

- O3b Networks

- Thuraya Telecommunications Company

- Iridium Communications

- Globalstar

- Orbcomm

- Astrocast

- Blue Sky Network

Key Target Audience

- Hardware Manufacturers

- IoT Solution Providers

- Software Developers

- Telecommunications Companies

- Government and Regulatory Bodies (Vietnam Telecommunications Authority, Ministry of Communications)

- Agriculture and Logistics Enterprises

- Defense Agencies (Vietnam Ministry of Defence)

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam satellite IoT market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data pertaining to the Vietnam satellite IoT market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple satellite IoT manufacturers and service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam Satellite IoT Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Major Players Timeline

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Advancements in Satellite Technology

Expanding IoT Ecosystem - Market Challenges

Regulatory Barriers

High Initial Investment Costs - Opportunities

Partnerships and Collaborations

Emerging IoT Applications - Trends

Miniaturization of Satellites

Hybrid Satellite-Terrestrial Connectivity - Government Regulation

Spectrum Management Policies

Satellite Licensing Procedures - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019–2024 (in USD Billion)

- By Volume, 2019–2024 (in MW or GW)

- By Average Selling Price, 2019–2024 (in USD/Watt)

- By Satellite Type (In Value %)

Geostationary (GEO)

– Fixed Satellite Services (FSS)

– Broadcasting Satellites

Medium Earth Orbit (MEO)

– Navigation Satellites (e.g., GNSS)

– Broadband Connectivity Satellites

Low Earth Orbit (LEO)

– IoT-Specific Constellations (e.g., Swarm, Astrocast)

– Earth Observation & Data Relay - By End-Use (In Value %)

Agriculture

– Smart Irrigation Monitoring

– Livestock & Equipment Tracking

Transportation & Logistics

– Real-Time Freight Tracking

– Cross-Border Fleet Coordination

Defence & Surveillance

– Border Monitoring

– Secure Communications

Environmental Monitoring

– Weather Pattern Tracking

– Disaster Alert Systems

Maritime

– Vessel Tracking

– Coastal Monitoring

Others

– Mining & Energy (e.g., offshore rigs)

– Infrastructure & Utilities - By Connectivity (In Value %)

L-Band

– Low-Bandwidth IoT Applications

– Global Coverage Services (e.g., Inmarsat)

Ku-Band

– High-Speed Data Transmission

– Maritime & Aviation IoT

S-Band

– Emergency Services & Mobile Communication

– IoT Backhaul for Remote Areas

Ka-Band

– High-Capacity IoT Data Links

– Enterprise-Grade Solutions - By Application (In Value %)

Asset Tracking

– High-Value Cargo Monitoring

– Remote Equipment Surveillance

Remote Monitoring

– Utility Infrastructure Monitoring

– Unmanned Field Equipment

Fleet Management

– Vehicle Location & Diagnostics

– Route Optimization

Environmental Monitoring

– Deforestation & Emissions Surveillance

– Air & Water Quality Sensors Integration - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Component Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Component Type, Satellite Coverage and Capabilities, Industry Focus, Customer Segments, Integration Ecosystem, Pricing Model, Regulatory Compliance, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Vinasat

VNPT

Viettel Group

VINASAT Satellite Technology Co.

FPT Corporation

SpaceX

Inmarsat

Eutelsat Communications

O3b Networks

Thuraya Telecommunications Company

Iridium Communications

Globalstar

Orbcomm

Astrocast

Blue Sky Network

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030 (in USD Billion)

- By Volume, 2025-2030 (in MW or GW)

- By Average Selling Price, 2025- 2030 (in USD/Watt)