Market Overview

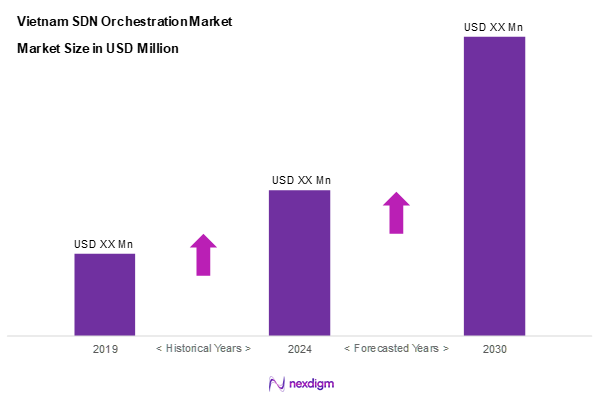

As of 2024, the Vietnam SDN orchestration market is valued at USD 55.9 million, with a growing CAGR of 48.7% from 2024 to 2030, this is reflecting a substantial increase in demand driven by the rapid adoption of cloud technologies and the need for efficient network management solutions. The enhancement of telecommunications infrastructure and an increasing number of data centres in the region contribute significantly to this growth, supported by substantial investment from both private and public sectors. Increased organizational focus on digital transformation underlines the growing relevance of SDN technologies.

Dominant cities in the Vietnam SDN orchestration market include Ho Chi Minh City and Hanoi, owing to their status as key economic hubs. These cities host a concentration of telecommunications companies and tech start-ups, fostering a robust ecosystem for SDN implementation. The government’s push for smart city initiatives and modernization of telecommunications infrastructure further solidifies the position of these urban areas as leaders in the market, driving innovation and demand for advanced networking solutions.

Market Segmentation

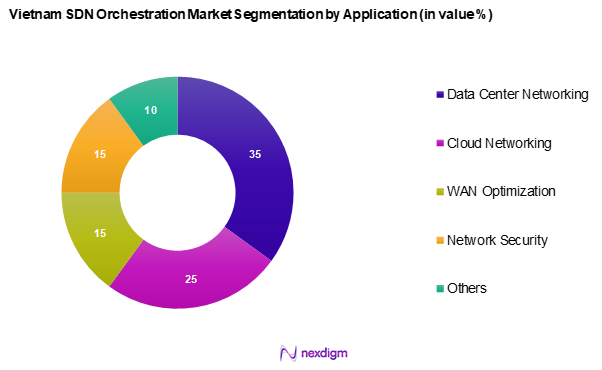

By Application

The Vietnam SDN orchestration market is segmented into data centre networking, cloud networking, wan optimization, network security, and others. Data centre networking maintains a dominant market position owing to the increasing reliance on data centres for managing vast volumes of data and applications. With the rapid expansion of enterprises utilizing cloud services, efficient data centre operations have become critical. Companies are recognizing the need for agility and flexibility in managing their networking resources, resulting in widespread adoption of SDN solutions in data centre environments.

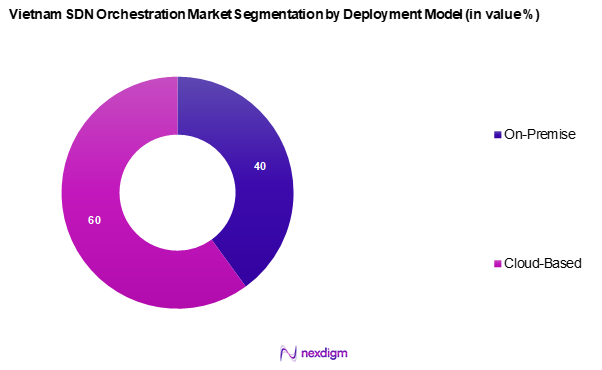

By Deployment Model

The Vietnam SDN orchestration market is segmented into on-premise and cloud-based. The cloud-based segment dominate the market due to its scalability and cost-effectiveness, which are highly attractive to businesses. As organizations seek to reduce capital expenditures while increasing operational efficiency, the shift towards cloud-based solutions becomes evident. The flexibility and reduced maintenance burdens associated with cloud deployments also contribute to its growing dominance in the SDN landscape in Vietnam.

Competitive Landscape

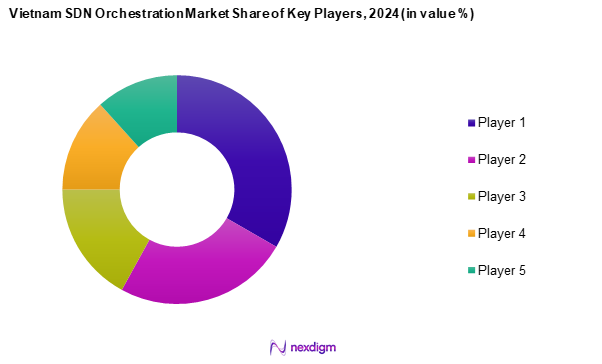

The Vietnam SDN orchestration market is dominated by a few major players, including local firms and international giants that significantly shape the industry’s landscape. These companies leverage technological expertise and established networks to maintain a competitive edge in the rapidly evolving SDN environment.

| Company | Establishment Year | Headquarters | Company Revenue | Business Strategies | Global Presence | Business Segment Revenue | Weakness |

| Cisco Systems | 1984 | San Jose, USA | – | – | – | – | – |

| VMware | 1998 | Palo Alto, USA | – | – | – | – | – |

| Huawei Technologies | 1987 | Shenzhen, China | – | – | – | – | – |

| Juniper Networks | 1996 | Sunnyvale, USA | – | – | – | – | – |

| Arista Networks | 2004 | Santa Clara, USA | – | – | – | – | – |

Vietnam SDN Orchestration Market Analysis

Growth Drivers

Increased Bandwidth Demand

The rapid growth in digital content consumption is fuelling an unprecedented demand for bandwidth in Vietnam. With internet penetration rates projected to reach 71% by the end of 2025, higher than the global average of 64%, the nation is investing heavily in its telecommunications infrastructure. As of 2023, Vietnam ranked 12th globally in online activity, indicating a substantial rise in data consumption, which is expected to continue. This surge necessitates more effective network management solutions, particularly SDN orchestrations, to handle increased data loads efficiently. Increasing mobile data usage, which exceeded 12.3 GB per subscriber in 2022, further accentuates the need for responsive network architectures.

Efficiency in Network Management

Organizations are increasingly prioritizing operational efficiency, driving the adoption of SDN technologies. As the volume of network traffic rises, efficient network management has become critical. According to the Ministry of Information and Communications of Vietnam, the country’s overall internet traffic increased by 48% in 2023 compared to 2022. Additionally, global IT spending on digital transformation is expected to surpass USD 2.8 trillion by 2025, of which network management efficiency is a vital component. This need for streamlining operations effectively positions SDN orchestration as a favoured solution among enterprises seeking to reduce operational complexity while improving service delivery.

Market Challenges

High Implementation Costs

Despite the benefits of SDN orchestration, the high initial investment can deter organizations from adopting these solutions. As per the Vietnamese Ministry of Information and Communications, the cost of replacing legacy systems with advanced SDN technology often reaches roughly USD 3 million for mid-sized enterprises. This upfront capital requirement poses a significant barrier, especially for smaller organizations that may struggle to allocate a sufficient budget towards technological upgrades. The benefits of SDN must be constantly communicated to highlight the long-term cost savings versus the initial expenditure to justify these investments.

Complexity in Integration

Integrating SDN orchestration within the existing IT framework presents a challenge for many organizations. According to the IT Infrastructure Library (ITIL) guidelines used by Vietnamese enterprises, around 60% of organizations report integration complexities as a substantial hurdle in SDN implementation. Enterprises face disruptions during transitions, which can lead to temporary service outages and potential loss of business continuity. Moreover, a lack of skilled personnel who are adept at managing these new technologies exacerbates the integration challenges faced by companies, delaying their transition to SDN-based infrastructures.

Opportunities

Deployment in Smart Cities

Vietnam is on a rapid path to urbanization, with major cities embarking on smart city initiatives. For instance, Ho Chi Minh City has projected investments of approximately USD 1.5 billion towards enhancing digital infrastructure by 2025. The government aims for 10% of its urban area designated as smart zones with integrated SDN networks, significantly promoting SDN deployment. This push is indicative of a broader strategy to leverage innovation and technology to improve infrastructure efficiency, making smart city deployments ripe with opportunities for SDN implementation.

Advancements in Technology

The rapid pace of technological advancements provides substantial opportunities for the growth of the SDN orchestration market in Vietnam. The government has established a policy framework to support the integration of emerging technologies in sectors like telecommunications and IT. Significant funding, estimated at USD 3 billion over several years, is being directed towards research and development in automation and artificial intelligence, key drivers that are integral to advancing SDN technologies. As companies are encouraged to embrace next-generation infrastructure, the rapidly evolving tech landscape in Vietnam fosters an environment conducive to the expansion and deployment of innovative SDN solutions. This combination of government support and technological evolution positions the SDN orchestration market for significant opportunities in addressing the complex needs of modern networking environments.

Future Outlook

Over the next five years, the Vietnam SDN orchestration market is poised for significant growth, driven by continuous government support, advancements in network technology, and surging demand from enterprises seeking more efficient and reliable network solutions. The shift towards digital transformation across various industries will further necessitate the implementation of SDN technologies, allowing for enhanced operational efficiency and reduced costs. As businesses increasingly prioritize agility and scalability, the market is expected to witness robust expansion and innovation.

Major Players

- Cisco Systems

- VMware

- Huawei Technologies

- Juniper Networks

- Arista Networks

- Nokia

- Ciena Corporation

- Extreme Networks

- NETCONF Group

- Pluribus Networks

- Intel Corporation

- Mellanox Technologies

- Spirent Communications

- Ixia (Keysight Technologies)

- Trend Micro

Key Target Audience

- Telecommunications Operators

- Data Center Providers

- Cloud Service Providers

- Large Enterprises (IT Departments)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Vietnam Ministry of Information and Communications)

- Network Security Firms

- System Integrators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam SDN orchestration Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data pertaining to the Vietnam SDN Orchestration Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple SDN orchestration manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam SDN Orchestration market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increased Bandwidth Demand

Efficiency in Network Management - Market Challenges

High Implementation Costs

Complexity in Integration - Opportunities

Deployment in Smart Cities

Advancements in Technology - Trends

Shift Towards AI-integrated SDN Solutions

Growing Focus on Network Security - Government Regulation

IT Infrastructure Policies

Data Privacy Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Revenue per User (ARPU), 2019-2024

- By Adoption Rate, 2019-2024

- By Application (In Value)

Data Center Networking

– Virtual Network Provisioning

– Traffic Management & Load Balancing

– Storage Network Orchestration

Cloud Networking

– Multi-Cloud Connectivity

– Cloud WAN Orchestration

– Cloud-Based Virtual Routing

WAN Optimization

– SD-WAN Integration

-Bandwidth Allocation

– Latency Reduction Tools

Network Security

– Policy-Based Routing

– Dynamic Threat Response

– Firewall & Intrusion Detection Orchestration

Others

– IoT Network Management

– Edge Computing Connectivity

– Network Slicing - By Deployment Model (In Value)

On-premise

– Privately Managed Controllers

– Customizable Infrastructure

– Localized Data Control

Cloud-based

– Centralized Orchestration Platforms

– Subscription-Based Models

– Remote Accessibility & Scalability - By End-User Industry (In Value)

Cloud Services Providers

– Data Sovereignty & Compliance Tools

– High Availability Orchestration

Telecommunications

– 5G Network Orchestration

– Virtualized Core Network Automation

Banking & Finance

– Secure Network Segmentation

– Regulatory-Compliant Network Architecture

Government

– Defense & Critical Infrastructure Networks

– Inter-departmental Network Management

Healthcare

– HIPAA-Grade Security Layers

– Hospital & Lab Network Routing

Others

– Retail Chains

– Educational Institutions

– Transportation & Logistics - By Region (In Value)

Northern Region

Southern Region

Central Region - By Component (In Value)

Software

– SDN Controllers

– Network Management Tools

– APIs & Integration Frameworks

Services

– Consulting & Planning

– Implementation & Deployment

– Support & Managed Services - By Organization Size (In Value)

Large Enterprises

Medium-Sized Enterprises

Small Sized Enterprises

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Application Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Business Segment Revenue, Technological Advancements, Customer Satisfaction Scores, Innovation Capacity, Global Presence)

- SWOT Analysis of Key Players

- Pricing Analysis Basis SKUs for Major Players

- Profiles of Major Companies

Cisco Systems

VMware

Nokia

Huawei Technologies

Juniper Networks

Arista Networks

Ericsson

Mellanox Technologies

Ciena Corporation

Extreme Networks

Brocade Communications Systems

Pluribus Networks

Metaswitch Networks

Intel Corporation

Spirent Communications

- Demand and Utilization Patterns

- Budget Allocation Strategies

- Compliance and Regulatory Requirements

- Needs and Pain Point Analysis

- Decision-Making Processes

- By Value Forecast, 2025-2030

- By Volume Forecast, 2025-2030

- By ARPU Forecast, 2025-2030

- By Adoption Rate Forecast, 2025-2030