Market Overview

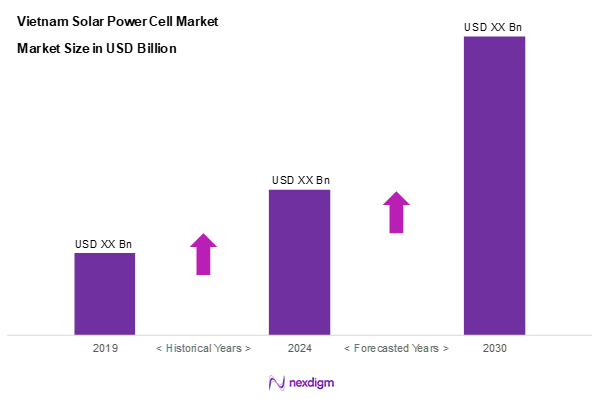

As of 2024, the Vietnam solar power cell market is valued at USD 1.8 billion, with a growing CAGR of 8.5% from 2024 to 2030, driven by governmental initiatives and the growing demand for sustainable energy sources. The significant investments in renewable energy infrastructure have enhanced the market landscape, fostering a boosting trend for solar cell technologies. The demand for solar power aligns with global sustainability goals, further facilitating an increase in its market size.

Key dominant regions in the Vietnam solar power cell market include Hanoi and Ho Chi Minh City. These urban centers benefit from supportive governmental policies, high energy consumption rates, and an increasing number of residential and commercial solar projects. Their strategic positions enable better access to resources and funding, hence amplifying their market influence.

Market Segmentation

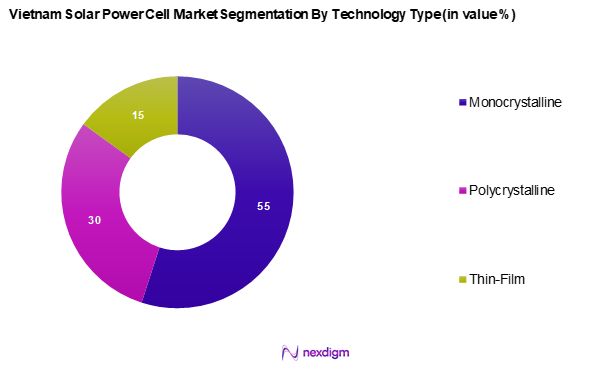

By Technology Type

The Vietnam solar power cell market is segmented into monocrystalline, polycrystalline, and thin-film. Monocrystalline solar cells currently hold a dominant market share, primarily attributed to their high efficiency and performance in limited spaces. Known for their durability and longevity, monocrystalline technology is particularly favored in urban installations where space is constrained. Companies like Trina Solar and JinkoSolar have solidified their market positions by offering innovative monocrystalline solutions, contributing to their growing popularity and adoption among consumers.

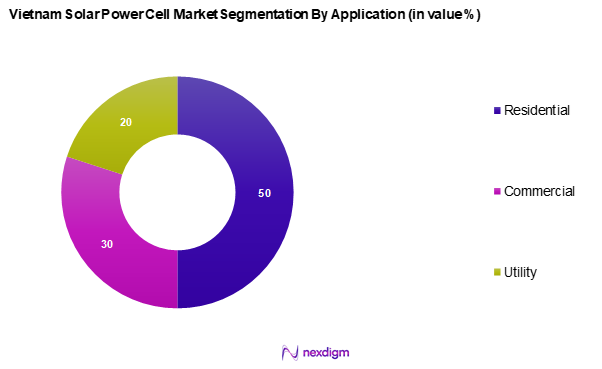

By Application

The Vietnam solar power cell market is segmented into residential, commercial, and utility. The residential segment is experiencing the most significant growth due to the increased implementation of rooftop solar systems. These systems provide homeowners with cost savings on energy bills and foster energy independence, leading to a heightened adoption rate across the country. Moreover, government incentives for residential solar installations, such as tax credits and grants, significantly contribute to the expansion and dominance of this sub-segment.

Competitive Landscape

The Vietnam solar power cell market is characterized by the presence of several major players, including both domestic and international companies. Key competitors such as Trina Solar, JinkoSolar, and Canadian Solar dominate the market landscape, highlighting their significant influence over market trends and pricing strategies.

| Company | Establishment Year | Headquarters | Technology Focus | Market Share | Key Projects | Strategic Partnerships |

| Trina Solar | 1997 | China | – | – | – | – |

| JinkoSolar | 2006 | China | – | – | – | – |

| Canadian Solar | 2001 | Canada | – | – | – | – |

| LG Solar | 1947 | South Korea | – | – | – | – |

| Hanwha Q CELLS | 1999 | South Korea | – | – | – | – |

Vietnam Solar Power Cell Market Analysis

Growth Drivers

Government Incentives

The Vietnamese government has actively promoted renewable energy through various initiatives such as tax benefits and favorable pricing mechanisms. Policies supporting rooftop solar adoption, especially for households, have led to widespread implementation of solar projects across the country. These incentives are designed to enhance the share of renewable energy in the national grid, ensuring long-term sustainability and energy security.

Increasing Energy Demand

Vietnam’s electricity consumption is experiencing rapid growth, driven by urbanization and industrial expansion. To address rising energy needs, the government is prioritizing sustainable energy solutions, with a strong focus on solar power. The increasing electricity demand has positioned solar energy as a key contributor to the country’s future energy mix, encouraging greater investment in solar infrastructure.

Market Challenges

High Initial Costs

Despite the long-term benefits of solar energy, the upfront costs for installation remain a major challenge for widespread adoption. Many households, particularly in rural areas, find the cost of installing solar panels prohibitive. Addressing financing barriers through subsidies or alternative payment structures is crucial to improving accessibility and adoption rates.

Regulatory Hurdles

Complex regulations and administrative delays have slowed the development of solar projects in Vietnam. Investors often face challenges in obtaining permits and navigating regional policy inconsistencies. These bureaucratic obstacles can deter foreign investments and stall project implementation. A more streamlined regulatory framework would significantly enhance the sector’s growth potential.

Opportunities

Expansion of Renewable Energy Policies

Government policies continue to create a favorable environment for solar energy expansion, with strong commitments to increasing renewable capacity. Industry stakeholders anticipate that renewable energy will play a dominant role in the country’s future energy landscape, fostering investment opportunities in solar technologies and infrastructure development.

Technological Innovations

Advancements in solar technology are improving efficiency and affordability, making solar power a more viable solution for both residential and industrial users. Innovations in photovoltaic panels and energy storage solutions are enhancing reliability and cost-effectiveness, driving broader adoption of solar energy systems across Vietnam.

Future Outlook

Over the next five years, the Vietnam solar power cell market is expected to experience robust growth driven by supportive government policies, technological advancements, and a rising awareness of renewable energy benefits. The increasing number of residential solar installations fuelled by economic incentives and consumer trend shifts towards sustainable energy are projected to further enhance market dynamics. Moreover, collaborations among industry players and government will likely facilitate significant infrastructure developments.

Major Players

- Trina Solar

- JinkoSolar

- Canadian Solar

- First Solar

- Hanwha Q CELLS

- Yingli Green Energy

- LONGi Green Energy

- SunPower

- REC Group

- LG Solar

- GCL-Poly Energy

- SMA Solar Technology

- Enphase Energy

- ABB

- Sunrun

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Industry and Trade)

- Energy Sector Stakeholders

- Renewable Energy Project Developers

- Environmental Organizations

- Large Commercial Entities

- Utilities and Electric Providers

- Corporate Buyers of Renewable Energy Solutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders within the Vietnam solar power cell market. This step relies on thorough desk research using secondary and proprietary databases to assemble comprehensive industry-level information aimed at identifying critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

This phase compiles and analyses historical data related to the Vietnam Solar Power Cell Market. It assesses market penetration rates, the ratio of solar technology providers to end-users, and resultant revenue generation. Furthermore, service quality metrics and feedback from industry stakeholders will be evaluated to ensure the credibility and accuracy of the revenue estimates, fostering a solid groundwork for projections.

Step 3: Hypothesis Validation and Expert Consultation

In this step, market hypotheses are formulated and validated through telephone interviews with industry experts from various companies functioning in the solar power sector. These consultations provide invaluable operational insights and financial perspectives directly from practitioners, thus refining and substantiating the market data with real-world applications and trends.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with solar power manufacturers, aiming to extract detailed insights regarding product segments, sales performance, consumer preferences, and other relevant market factors. This direct interaction serves to verify and enrich the statistics derived from the initial bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam Solar Power Cell Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Government Incentives

Increasing Energy Demand - Market Challenges

High Initial Costs

Regulatory Hurdles - Opportunities

Expansion of Renewable Energy Policies

Technological Innovations - Trends

Increase in Solar Energy Adoption

Shift Towards Complete Energy Solutions - Government Regulation

Renewable Energy Policies

Feed-in Tariffs

Grid Connection Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Technology Type (In Value %)

Monocrystalline

– PERC (Passivated Emitter Rear Cell)

– Bifacial Monocrystalline

– Standard Monocrystalline

Polycrystalline

– Standard Polycrystalline

– High-Efficiency Polycrystalline

Thin-Film

– Cadmium Telluride (CdTe)

– Amorphous Silicon (a-Si)

– Copper Indium Gallium Selenide (CIGS) - By Application (In Value %)

Residential

– Rooftop Solar Systems

– Hybrid (On-grid + Battery Backup)

Commercial

– Office Buildings

– Shopping Malls and Warehouses

Utility

– Solar Farms

– Government Grid Projects

– Private Utility Installations - By Region (In Value %)

Northern Region

Central Region

Southern Region - By End-User (In Value %)

Industrial

– Manufacturing Plants

– Export Processing Zones (EPZs)

Government Institutions

– Municipal Buildings

– Public Infrastructure (schools, hospitals)

Residential Users

– Single-Family Homes

– Housing Societies & Apartments - By Installer Type (In Value %)

Independent Solar Installers

– Small-Scale Local Integrators

– Certified Solar Technicians

Utility Companies

– EVN (Vietnam Electricity)

– Regional Power Companies

Others

– Engineering, Procurement and Construction (EPC) Contractors

– Foreign Direct Investment (FDI)-backed Players

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Technology Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths & Weaknesses, Product Portfolio, Revenue Streams, R&D Investments, Manufacturing Capacity, Cost Structure, Distribution Channels, Market Position, Technology Differentiation, Geographic Reach, Sustainability Metrics)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Trina Solar

JinkoSolar

Canadian Solar

First Solar

Hanwha Q CELLS

Yingli Green Energy

LONGi Green Energy

SunPower

REC Group

LG Solar

GCL-Poly Energy

SMA Solar Technology

Enphase Energy

ABB

Sunrun

- Market Demand and Utilization

- Purchasing Patterns

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030