Market Overview

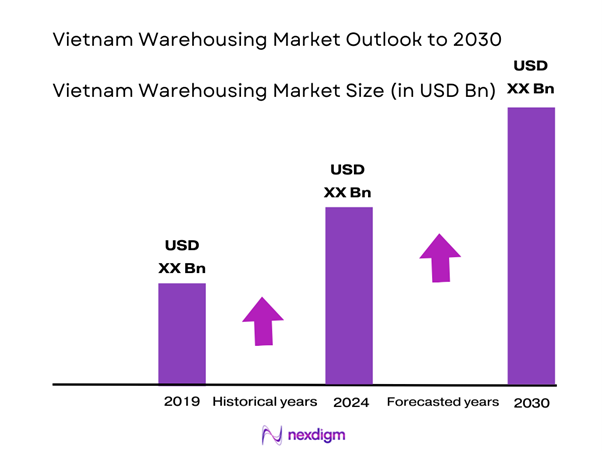

The Vietnam Warehousing market is estimated at 950,000 square feet in 2024 with an approximated compound annual growth rate (CAGR) of 10.66% from 2024-2030, driven by the rapid growth of e-commerce and the increasing demand for efficient logistics solutions. The expanding manufacturing sector and urbanization in key cities bolster this demand, as businesses require reliable storage solutions for their goods. With a projected market size of USD 1.5 billion, this industry is on a growth trajectory, supported by significant investments in infrastructure and technology, facilitating improved supply chain efficiencies.

Key cities such as Ho Chi Minh City and Hanoi dominate the Vietnam Warehousing market due to their strategic geographical locations and ongoing urbanization. These cities serve as key economic hubs with a strong presence of manufacturing and retail industries. Ho Chi Minh City, for instance, benefits from its proximity to major ports, making it a logistical hotspot for domestic and international trade. Additionally, the increasing concentration of industries around these urban centers amplifies the demand for warehousing and logistics services.

Market Segmentation

By Type of Warehouse

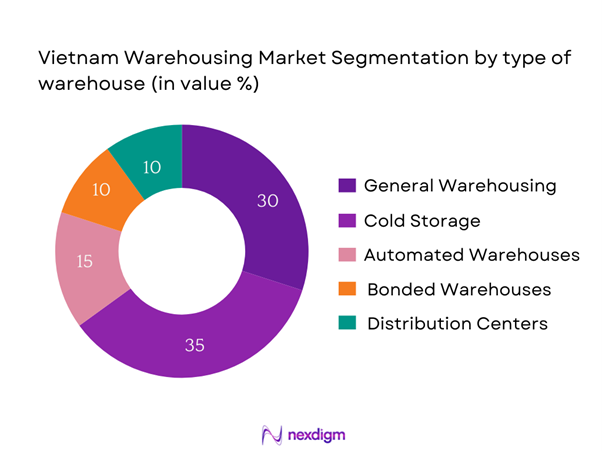

The Vietnam Warehousing market is segmented by type of warehouse into general warehousing, cold storage, automated warehouses, bonded warehouses, and distribution centers. Currently, the cold storage segment holds a dominant market share driven by the growing food and pharmaceutical industries, where temperature-controlled environments are essential. The increasing consumer demand for perishable goods has led to the investment in cold storage facilities, ensuring product preservation and compliance with safety standards.

By Application

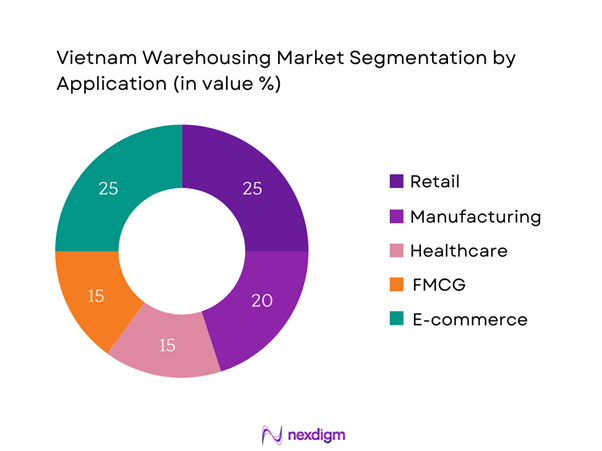

The market is also segmented by application into retail, manufacturing, healthcare, FMCG, and e-commerce. The e-commerce segment is currently leading this sector, fueled by a surge in online shopping, particularly following the pandemic. As consumer preferences shift towards online channels, businesses are increasingly investing in warehousing solutions to meet the logistics challenges associated with e-commerce, ensuring quick and efficient order fulfillment.

Competitive Landscape

The Vietnam Warehousing market is characterized by a competitive landscape dominated by both local and international players. Major players include Gemadept Logistics, Transimex Corporation, and DHL Vietnam. The presence of these robust companies highlights the consolidation in the market, allowing them to leverage their extensive networks and technological advancements to streamline operations and enhance customer experience.

| Company | Establishment Year | Headquarters | Market Specific Parameter 1 | Market Specific Parameter 2 | Market Specific Parameter 3 | Market Specific Parameter 4 | Market Specific Parameter 5 | Market Specific Parameter 6 |

| Gemadept Logistics | 1990 | Ho Chi Minh City | – | – | – | – | – | – |

| Transimex Corporation | 1992 | Ho Chi Minh City | – | – | – | – | – | – |

| DHL Vietnam | 2001 | Ho Chi Minh City | – | – | – | – | – | – |

| Sotrans Group | 1995 | Ho Chi Minh City | – | – | – | – | – | – |

| Kuehne + Nagel | 1988 | Ho Chi Minh City | – | – | – | – | – | – |

Vietnam Warehousing Market Analysis

Growth Drivers

Expanding E-commerce Sector

The expanding e-commerce sector is a significant growth driver for the Vietnam warehousing market, with online retail sales projected to reach USD 23 billion in 2025, as reported by the Vietnam E-commerce Association (VECITA). This surge in online shopping is primarily fueled by the increasing internet penetration rate, which stood at 73.2% in 2023, according to the International Telecommunication Union. Additionally, the population utilizing online shopping platforms is expected to increase to over 50 million by end of 2025, indicating a robust trend that necessitates the growth of warehousing facilities to manage inventory and distribution efficiently.

Industrialization and Urbanization

Vietnam’s rapid industrialization and urbanization play a crucial role in enhancing the demand for warehousing solutions. The country’s urban population is forecasted to exceed 42% by end of 2025, as per World Bank reports. This urban influx drives business activities, particularly in cities like Ho Chi Minh City and Hanoi, which are becoming key manufacturing and logistics hubs. Furthermore, Vietnam’s GDP growth rate is projected at 6.3% for 2024, creating a robust economic environment that encourages investments in logistics infrastructure and logistics-related real estate, thus further elevating warehousing needs.

Market Challenges

Land Acquisition and Regulation

Land acquisition regulations present a significant challenge in the expansion of warehousing facilities in Vietnam. Reports indicate that the process for obtaining land-use rights can take between 6 to 12 months, causing delays in the establishment of new warehouses. Additionally, the Vietnamese government has placed restrictions on land leasing, particularly in urban areas, where demand is high. The land price fluctuations have also seen prices rise from USD 90 per square meter in 2022 to approximately USD 150 per square meter in 2025, further complicating land acquisition processes for new warehousing developments.

Infrastructure Limitations

Infrastructure limitations serve as a barrier to the warehousing market in Vietnam. As of 2024, the country has approximately 19,000 kilometers of national roads, but only 20% of these are considered in good condition according to reports from the Ministry of Transport. Poor road conditions can significantly delay transportation and affect the efficiency of logistics operations. The escalating traffic congestion in major cities also aggravates delivery challenges, making it imperative for stakeholders to invest heavily in upgrading existing infrastructure to meet the rising demands of the warehousing sector.

Opportunities

Increasing Demand for Efficient Logistics

The increasing demand for efficient logistics presents substantial opportunities for growth in the Vietnam warehousing market. As businesses strive to optimize supply chains, logistics companies are expected to invest in advanced technologies such as warehouse management systems (WMS) and real-time tracking solutions. Logistics outsourcing is currently experiencing a notable uptick, with an estimated 61% of companies in Vietnam opting for third-party logistics (3PL) solutions to streamline operations. This indicates a clear trend towards adopting more efficient logistics processes, which will consequently drive the demand for modernized warehousing facilities that can accommodate these evolving needs.

Growth in Cold Storage Capacity

The growth in cold storage capacity is paving the way for market expansion in Vietnam, particularly in the food and pharmaceutical sectors. As of 2023, Vietnam had identified a need for 400,000 square meters of additional cold storage space to accommodate rising consumer demand for perishable goods, reflecting the increasing import and export figures in these sectors. Furthermore, as the country’s exports of agricultural products reached USD 48.5 billion in 2022, the need for cold chain logistics is becoming increasingly paramount. This calls for significant investment in cold storage infrastructure, which will unlock further growth opportunities within the warehousing market.

Future Outlook

The Vietnam Warehousing market is expected to show robust growth over the next several years, with a projected CAGR of 10.66% from 2024 to 2030. Factors contributing to this growth include continued government support for infrastructure development, the rise of e-commerce, and advancements in logistics technologies. Heightened consumer demand for speedy delivery options will further push businesses to optimize their warehousing capabilities, ensuring they remain competitive in this evolving market landscape. Companies that invest in automation, real-time inventory tracking, and data analytics will be better positioned to capitalize on these trends, enhancing operational efficiency and customer satisfaction.

Major Players

- Gemadept Logistics

- Transimex Corporation

- DHL Vietnam

- Sotrans Group

- Kuehne + Nagel

- ITL Corporation

- Viettel Post

- CJ Logistics

- Nippon Express

- Vinafco

- Giao Hang Nhanh

- Golden Gate Logistics

- Vietnam Logistics

- E Logistics Vietnam

- Pike Logistics

Key Target Audience

- Logistics and Supply Chain Managers

- E-commerce Platform Operators

- Manufacturing Companies

- Food and Beverage Industries

- Pharmaceutical Companies

- Government and Regulatory Bodies (Ministry of Industry and Trade, General Department of Customs)

- Investments and Venture Capitalist Firms

- Real Estate Developers specializing in logistics facilities

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, an ecosystem map is constructed to identify all major stakeholders within the Vietnam Warehousing market. This involves extensive desk research, employing a blend of secondary sources like industry reports and proprietary databases. The objective is to determine the critical variables influencing market dynamics, such as consumer trends and technological advancements.

Step 2: Market Analysis and Construction

This stage entails compiling and analyzing historical data related to the Vietnam Warehousing market. Key aspects include assessing market penetration rates across various segments, the ratio of warehousing services to logistical needs, and detailed revenue generation figures. An evaluation of service quality statistics is conducted to ensure the accuracy and reliability of estimates gathered.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are formulated based on the data gathered and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts. This outreach encompasses a wide range of companies including logistics providers, warehouse operators, and technology vendors, offering firsthand operational insights that refine and corroborate earlier findings.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing information through direct engagement with multiple warehousing companies to gain deeper insights into their operations, product segments, and consumer preferences. This engagement serves to verify and complement statistics derived from bottom-up approaches, ensuring a thorough and validated analysis of the Vietnam Warehousing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Market Sizing Approach, In-Depth Interviews, Primary Research Approach, Critical Analysis Techniques)

- Definition and Scope

- Industry Evolution and Milestones

- Supply Chain and Value Chain Analysis

- Market Dynamics and Structure

- Growth Drivers

Expanding E-commerce Sector

Industrialization and Urbanization - Market Challenges

Land Acquisition and Regulation

Infrastructure Limitations - Opportunities

Increasing Demand for Efficient Logistics

Growth in Cold Storage Capacity - Trends

Adoption of Automation Technologies

Sustainability in Warehousing - Regulatory Environment

Zoning and Construction Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price per sq. ft./cubic meter, 2019-2024

- By Type of Warehouse (In Value %)

General Warehousing

– Dry Storage

– Bulk Storage

– Pallet Racking

Cold Storage

– Refrigerated (Chilled 2°C to 8°C)

– Frozen (Below –18°C)

– Controlled Atmosphere (CA) Storage

Automated Warehouses

– Automated Storage and Retrieval Systems (AS/RS)

– Robotic Fulfillment Centers

– IoT & AI-Driven Smart Warehouses

Bonded Warehouses

– Customs-Bonded Import Warehouses

– Duty-Free Logistics Storage

– Re-export Handling Units

Distribution Centers

– Cross-Docking Facilities

– Regional Fulfillment Hubs

– Last-Mile Distribution Warehouses - By Application (In Value %)

Retail

– Fashion and Apparel Warehousing

– Consumer Packaged Goods (CPG)

– Seasonal Inventory Handling

Manufacturing

– Raw Material Warehousing

– Spare Parts and Components

– Assembly Line Supply Storage

Healthcare

– Pharmaceutical Storage

– Medical Device Inventory

– Vaccine and Cold Chain Facilities

FMCG

– Perishable and Non-perishable Goods

– Personal Care and Household Products

– High-Volume Turnover Warehousing

E-commerce

– High-Speed Fulfillment Centers

– Return Logistics Management

– Small Package Sorting Facilities - By Ownership (In Value %)

Private Warehouses

– Manufacturer-Owned

– Retailer-Controlled

– 3PL-dedicated Warehouses

Public Warehouses

– Government-Operated Logistics Parks

– Open Access General Storage

Contract Warehouses

– 3PL-Managed for Fixed Tenure

– Dedicated Long-Term Storage for Specific Clients

– Warehousing-as-a-Service (WaaS) - By Region (In Value %)

Northern Vietnam

Central Vietnam

Southern Vietnam - By End-User Industry (In Value %)

Automotive

– Vehicle Spare Parts Storage

– Assembly Component Warehousing

– Inbound Logistics for Auto OEMs

Electronics

– Semiconductor & PCB Storage

– High-Security Warehousing

– ESD-Protected Facilities

Agriculture

– Grain & Seed Storage

– Fertilizer & Agrochemical Warehousing

– Post-Harvest Cold Chain

Consumer Goods

– Packaged Food Storage

– Home Appliances

– Lifestyle and Durable Goods

Textiles

– Fabric Rolls and Apparel Storage

– Pre-Processing and Dyeing Inventory

– Finished Garment Logistics

- Market Share Analysis by Value/Volume, 2024

Market Share by Warehouse Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Revenue Analysis, Technological Advancements, Geographical Presence, Number and Type of Warehousing Facilities, Storage Capacity and Utilization Rates, Key Client Verticals and Partnerships, Sustainability Initiatives, Service Offerings, Unique Value Proposition)

- SWOT Analysis of Major Competitors

- Detailed profiles of Major Companies

Gemadept Logistics

Transimex Corporation

Sotrans Group

Kuehne + Nagel

DHL Vietnam

Schenker Vietnam

Logitem Vietnam

Nippon Express

YCH Logistics

Viet Pan Pacific Logistics

ITL Corporation

CJ Logistics

Dragon Logistics

Vinafco

Indo Trans Logistics

- User Needs and Preferences

- Cost Analysis and Budget Considerations

- Purchasing Trends

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price per sq. ft./cubic meter, 2025-2030