Market Overview

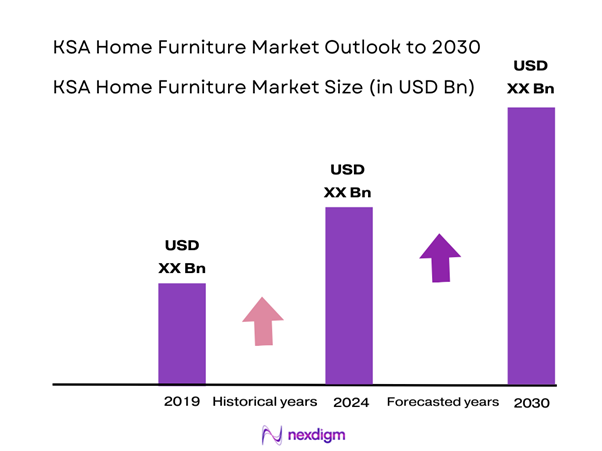

The KSA Home Furniture Market is valued at approximately USD 4.76 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 5.91 % from 2025-2030 and is driven by factors such as increasing disposable income, urbanization, and a growing real estate sector. The rising standard of living has resulted in enhanced consumer spending on home interiors and furnishings, fostering demand for various home furniture products.

The dominant cities within the KSA Home Furniture Market include Riyadh, Jeddah, and Dammam, which contribute significantly to the overall demand. Riyadh, being the capital, is at the forefront of consumer spending and urban development, while Jeddah serves as a commercial hub with high demand for both residential and commercial furniture. Dammam’s strategic location as an industrial city further boosts the market presence, with various furniture brands establishing their operations to cater to the needs of local consumers.

The interior design trends in Saudi Arabia are increasingly shaping consumer preferences in the home furniture sector. According to the Ministry of Housing, 2023 saw a marked increase in demand for stylish and trendy decor aligning with modern aesthetics. The emphasis on contemporary designs and multifunctional furniture reflects evolving tastes as Saudi consumers seek to enhance their living spaces. This growth is also supported by an increase in home renovations, with reports indicating that 52% of homeowners made changes to their interiors, spurring the furniture industry’s growth due to the desire for innovative, stylish solutions.

Market Segmentation

By Product Type

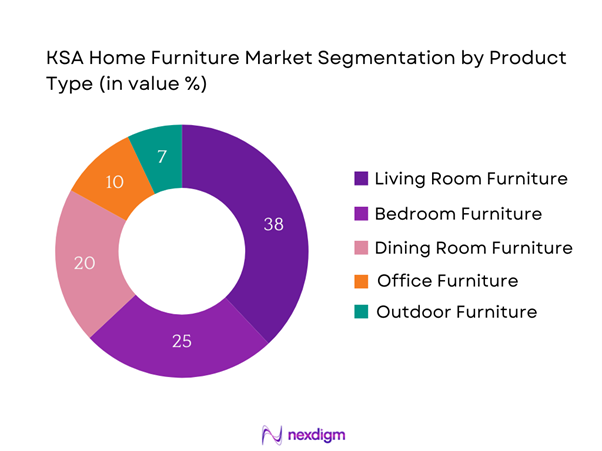

The KSA Home Furniture Market is segmented by product type into living room furniture, bedroom furniture, dining room furniture, office furniture, and outdoor furniture. The living room furniture segment holds a dominant market share, as it encompasses essential pieces like sofas, coffee tables, and entertainment units. The significant consumer inclination towards creating stylish and comfortable living spaces drives this segment, as brands invest in innovative designs and quality materials. Prominent furniture retailers are introducing modular solutions that cater to diverse consumer preferences, further solidifying the living room furniture segment’s prominence.

By Material Type

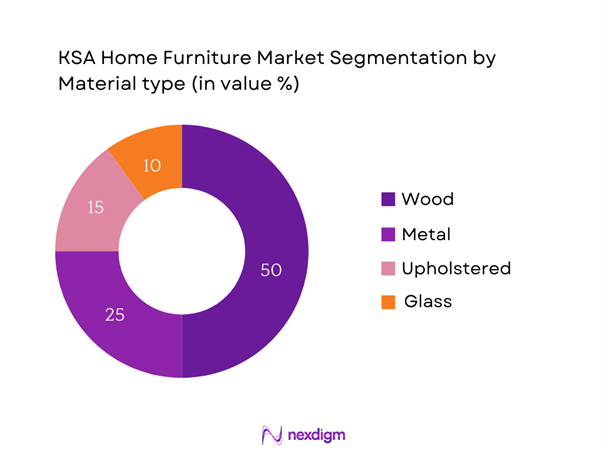

The market is further segmented by material type into wood, metal, upholstered, and glass furniture. Wooden furniture leads the market, primarily due to its durability, aesthetic appeal, and adaptability to various interior design styles. In KSA, traditional and modern wooden furniture contributes to cultural aesthetics, making it a favorite among consumers. Additionally, the versatility of wood in design and craftsmanship continues to drive its popularity, positioning it as the most preferred material in the home furniture sector.

Competitive Landscape

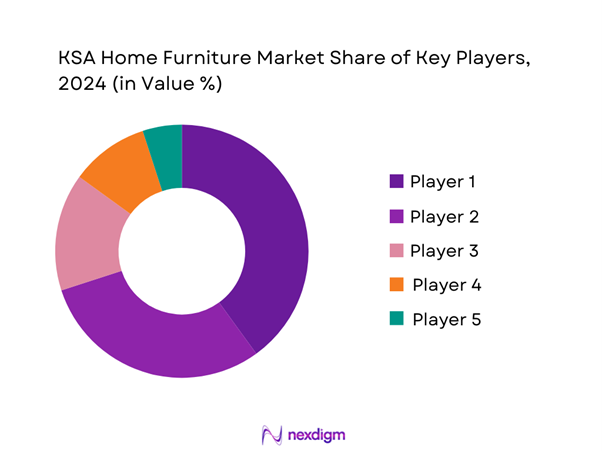

The KSA Home Furniture Market is dominated by several major players, setting the tone for industry standards and consumer preferences. Notable companies include IKEA, Al-Futtaim, Home Centre, United Furniture, and Pan Emirates. This consolidation of leading brands highlights their significant influence and competitive strategies, ensuring they remain prominent through innovative designs, expansive distribution networks, and strong brand loyalty.

| Company Name | Establishment Year | Headquarters | Product Range | Distribution Channels | Notable Initiatives |

| IKEA | 1943 | Riyadh, KSA | – | – | – |

| Al-Futtaim | 1971 | Dubai, UAE | – | – | – |

| Home Centre | 1995 | Jeddah, KSA | – | – | – |

| United Furniture | 2000 | Dammam, KSA | – | – | – |

| Pan Emirates | 1992 | Dubai, UAE | – | – | – |

KSA Home Furniture Market Analysis

Growth Drivers

Increasing Disposable Income

The rise in disposable income among Saudi households has been a strong driver of the home furniture market. According to the World Bank, Saudi Arabia’s gross national income (GNI) per capita increased from USD 26,032 in 2022 to USD 28,434 in 2023, reflecting a positive trend in economic recovery and individual purchasing power. The increasing financial capacity of households encourages higher spending on home improvement and furnishing, indicating a robust market potential. As disposable income continues to grow, more consumers are likely to invest in quality furniture, enhancing demand significantly.

Rapid Urbanization

Rapid urbanization is propelling the demand for home furniture as Saudi Arabia’s urban population continues to expand. The United Nations reports that the urban population in Saudi Arabia grew from 81.2% in 2020 to 85% in 2023, with urban areas becoming the focal point for economic activity and residential developments. This shift has led to a spike in real estate projects, resulting in an increased need for home furnishings. Urban dwellers fashionable towards modern living options further drive the demand for contemporary furniture solutions, thus creating significant opportunities for manufacturers and retailers in the market.

Market Challenges

Fluctuations in Raw Material Prices

Fluctuations in raw material prices pose substantial challenges for the home furniture market in Saudi Arabia. The Saudi Arabian Monetary Authority reported that wood prices have experienced volatility due to supply chain disruptions and international demand dynamics. For instance, the price of lumber rose sharply from USD 250 per cubic meter in 2022 to USD 300 in early 2023, impacting overall production costs for furniture manufacturers. This unpredictability forces companies to adjust pricing strategies and could hinder their ability to invest in new product lines, thereby affecting market growth.

Competition from Imported Products

Intense competition from imported furniture products presents a challenge for the local home furniture market. It is estimated that around 60% of furniture available in Saudi Arabia is imported, primarily from countries like China, Italy, and Turkey. The ease of access to cheaper alternatives from these markets threatens local manufacturers, who are often unable to match these prices due to higher production costs. As the global supply chain stabilizes post-pandemic, the influx of imports exacerbates competition, compelling local businesses to innovate and adapt to stay relevant in a price-sensitive environment.

Opportunities

Growing Demand for Sustainable Furniture

There is a growing trend toward sustainable furniture in Saudi Arabia, reflecting a shift in consumer priorities toward environmentally friendly products. According to the Environmental Protection Agency, the eco-friendly furniture market is experiencing a surge as about 25% of consumers indicate a preference for products made from renewable resources and sustainable materials. This trend is prompting furniture manufacturers in KSA to adopt greener practices, leading to the development and introduction of sustainable product lines that align with the increasing awareness of environmental issues among consumers, suggesting a bright growth trajectory for the segment.

Increase in E-commerce Adoption

The rise of e-commerce is significantly impacting the home furniture market, providing consumers with greater access to products and brands. In 2023, e-commerce sales accounted for over USD 3 billion in the Saudi retail sector, according to the Saudi Arabian Ministry of Commerce. The convenience of online shopping, coupled with improved digital payment systems and logistics networks, enables customers to explore a vast array of furniture options from the comfort of their homes. As more businesses strengthen their online presence, the expected growth in e-commerce sales may become a critical factor for future market expansion.

Future Outlook

The KSA Home Furniture Market is expected to show significant growth driven by an ongoing boom in residential construction, enhanced consumer awareness regarding interior design, and increased demand for eco-friendly furniture options. Additionally, the rise of e-commerce platforms has revolutionized the consumer shopping experience, allowing for broader access to diverse products. As consumer preferences shift towards more personalized and technologically integrated furniture solutions, the market is poised for sustained growth over the coming years.

Major Players

- IKEA

- Al-Futtaim

- Home Centre

- United Furniture

- Pan Emirates

- Al-Mahmal Furniture

- Litai Furniture

- Landmark Group

- City Furniture

- The One

- Damas

- Mamas & Papas

- Al-Dhafra

- KSR Furniture

- Abdul Samad Al Qurashi

Key Target Audience

- Homeowners

- Interior Designers

- Real Estate Developers

- Architects

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Municipality of Riyadh, Ministry of Housing)

- Retail Chains and Distributors

- Hospitality Industry Professionals

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the KSA Home Furniture Market. This step leverages extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical variables that influence market dynamics, including consumer trends and competitive landscapes.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the KSA Home Furniture Market. This includes assessing market penetration rates, the ratio of physical retail to e-commerce platforms, and resultant revenue generation. An evaluation of sales performance data will be conducted to ensure the reliability and accuracy of the revenue estimates and market growth factors.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through computer-assisted telephone interviews (CATIs) and face-to-face consultations with industry experts representing a diverse array of companies within the home furniture sector. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with multiple home furniture manufacturers and key stakeholders to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement statistics derived from a bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the KSA Home Furniture Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Disposable Income

Rapid Urbanization

Trends in Interior Design - Market Challenges

Fluctuations in Raw Material Prices

Competition from Imported Products - Opportunities

Growing Demand for Sustainable Furniture

Increase in E-commerce Adoption - Trends

Customization and Personalization

Smart Furniture Technologies - Government Regulation

Import Tariffs and Duties

Quality Assurance Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Living Room Furniture

– Sofas & Sectionals

– Coffee Tables & Side Tables

– TV Units & Media Consoles

– Recliners & Armchairs

Bedroom Furniture

– Beds & Headboards

– Wardrobes

– Nightstands

– Dressers & Mirrors

Dining Room Furniture

– Dining Tables

– Dining Chairs & Benches

– Bar Units

– Buffets & Sideboards

Office Furniture

– Desks

– Office Chairs

– Bookcases & Cabinets

– Conference Tables

Outdoor Furniture

– Patio Sets

– Outdoor Sofas & Chairs

– Garden Tables

– Sun Loungers & Umbrellas - By Material Type (In Value %)

Wood

– Solid Wood (Teak, Oak, Sheesham)

– Engineered Wood (MDF, Particle Board)

Metal

– Wrought Iron

– Stainless Steel

– Aluminum Frames

Upholstered

– Leather

– Fabric (Cotton, Velvet, Linen)

– Faux Leather

Glass

– Tempered Glass Tops

– Frosted & Designer Glass Panels

– Glass-Metal/Glass-Wood Hybrids - By Distribution Channel (In Value %)

Online Retail

– E-commerce Platforms

– Brand Websites

Furniture Stores

– Organized Chains

– Local Retailers

Home Improvement Stores

– ACE Hardware

– SACO

Wholesale Distributors

– Contract-based Suppliers

– B2B Suppliers to Commercial Projects - By End User (In Value %)

Residential

– Apartment Furniture

– Villa Furniture

Commercial

– Office Setups

– Retail Showrooms

Hospitality

– Hotels & Resorts

– Serviced Apartments

– Furnished Rentals - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Home Furniture Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Total Revenues, Revenue by Product Category, Number of Retail Showrooms & Online Presence, Marketing and Promotion Strategies, Customer Satisfaction Scores, Product Design and Innovation Capabilities, Distribution Channels, Production Facilities and Manufacturing Capacity, Inventory Management Efficiency, Unique Value Proposition, Sustainability and Material Sourcing Practices)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

IKEA

Al-Futtaim

Home Centre

United Furniture

Al-Mahmal Furniture

Litai Furniture

Pan Emirates

Al-Dhafra

KSR Furniture

City Furniture

Landmark Group

The One

Mamas & Papas

Damas

Wilkhahn

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030