Finance & Accounting Management

Outsourcing finance and accounting management gives you strategic control over finances while optimizing cost, compliance, and operational efficiency.

Why Choose Professional Finance & Accounting Management Services

In today’s fast-paced global economy, companies need reliable finance and accounting management to maintain financial health, support growth, and make well-informed decisions. With specialized finance and accounting management services, you benefit from:

- Access to experienced finance professionals and deep accounting expertise

- Scalable solutions tailored to your business size — from small enterprises to large corporates

- Reduced overheads compared to maintaining a full in-house finance department.

Outsourcing to a trusted partner enables you to transform your F&A operations into a strategic business enabler, rather than just a back-office burden.

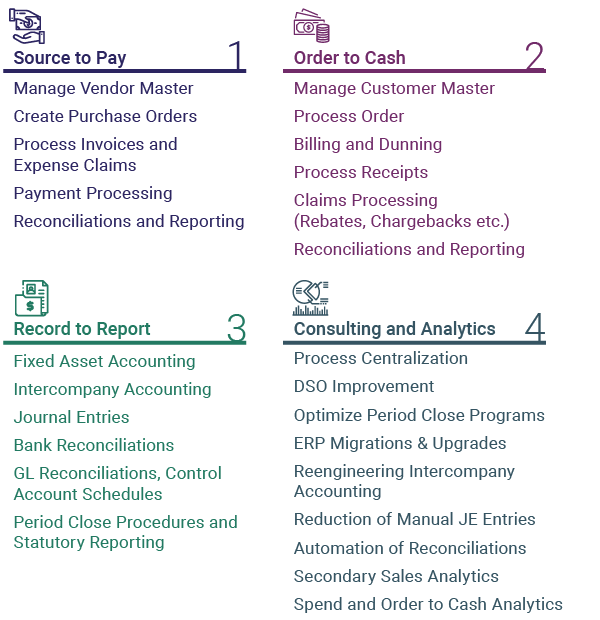

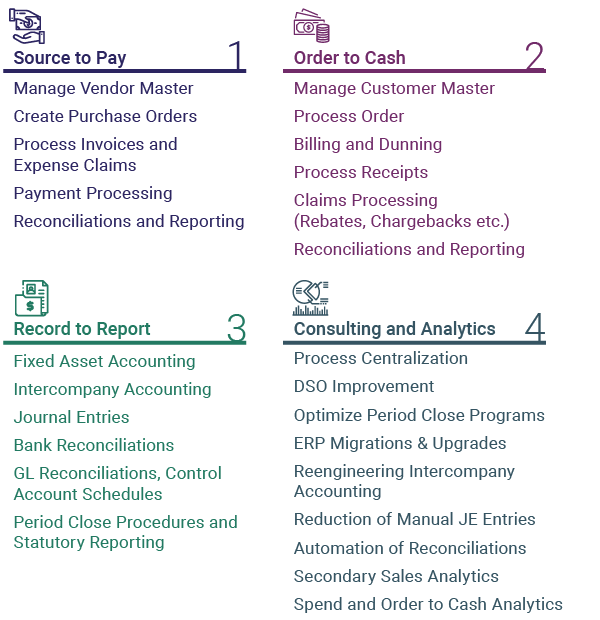

What Our Financial Management Solutions Include

Our

financial management solutions cover the entire spectrum of finance and accounting tasks — from daily bookkeeping to strategic financial planning. Typical services include:

- Accounts Payable (AP) and Accounts Receivable (AR) processing

- General Ledger accounting and reconciliations

- Payroll processing, tax filing, and compliance management

- Financial reporting, regulatory compliance, and audit support

- Budgeting and forecasting, financial planning & analysis (FP&A)

- Cash flow management, working capital optimization, and decision-support analytics

This end-to-end approach allows businesses to delegate critical finance functions — ensuring accuracy, compliance, and timely delivery.

Role of Accounting Management in Business Decision Making

With robust financial management solutions, businesses gain more than just transaction records. Outsourced accounting enables:

- Real-time visibility into financial health — cash flow status, working capital, profitability

- Data-driven insights via financial reports, forecasts, and variance analyses — empowering leaders to make informed strategic decisions

- Efficient compliance, risk management, and audit readiness — reducing the burden on internal teams and avoiding regulatory pitfalls

- Scalability and flexibility — as business cycles fluctuate, services adjust to match your evolving financial needs without overburdening in-house resources

In essence, proper accounting management becomes a foundation for sustainable growth and strategic planning, rather than a monthly chore.

Benefits of End-to-End Finance & Accounting Management Services

Opting for full-spectrum finance and accounting services yields several strategic advantages:

- Cost efficiency: Outsourcing helps reduce overhead — you avoid hiring, training, infrastructure and software costs associated with an in-house team.

- Access to expertise: Professionals with deep domain knowledge of accounting standards, regulations, tax compliance, and financial best practices handle your F&A operations.

- Scalability & flexibility: Services expand or contract based on business needs — ideal for growing companies, seasonal businesses, or those with variable transaction volumes.

- Accuracy & compliance: Outsourced providers often leverage automation and standardized processes to minimize human error and stay updated with regulatory changes.

- Strategic focus: With back-office finance tasks handled externally, your internal team can focus on core operations — growth, product development, customer engagement — rather than bookkeeping and reporting.

Who Can Benefit — From Startups to Established Enterprises

Our finance and accounting management services cater to a wide spectrum of clients:

- Small businesses & startups seeking cost-effective, compliant finance operations without the burden of hiring full-time staff

- Medium and large enterprises requiring scalable, efficient, and standardized financial processes

- International companies / cross-border businesses needing multi-jurisdiction compliance, cross-border accounting support, and global financial reporting — ideal for firms expanding in or from India. Given Nexdigm’s global presence, this makes outsourced F&A especially relevant.

Conclusion — Transform Finance from Overhead to Strategic Asset

With the right partner delivering comprehensive finance and accounting management services, you can transform what was once a back-office cost center into a strategic asset — boosting efficiency, ensuring compliance, improving cash flow, and enabling data-driven decision-making.

Whether you're a small business looking for stability or a multinational seeking robust financial management, outsourcing your finance & accounting operations offers a path to growth with minimal overhead.