Nexdigm represents our global readiness to serve our clients and lead ourselves into the ‘Next Paradigm’ of business.

Ideation to Implementation

Value based

Flexible

Onshore & Offshore

what's new

Nexdigm consistently produces thought leadership, publications and updates on the latest developments in the world of business. We strive to provide the information that matters most to professionals across the globe.

Union Budget 2024-25

The Union Budget 2024 represents a pivotal moment in India's economic journey. The new government has presented a detailed roadmap for India's burgeon...

The future of FDI from land-bordering countries in India

In April 2020, the government introduced Press Note 3 (PN3), requiring prior approval for all investments from bordering nations, including Chin...

Budget Expectations – Sustainable Energy Sector

The Interim Budget 2024 was announced in February 2024. It was an inclusive budget focusing on all the major sectors of the economy. In the Inte...

Expectations on Indirect Taxes front

The recently re-elected central government is set to present its thirteenth Union Budget on 23 July 2024. There is much anticipation from NDA 3.0 ...

Key expectation from Transfer Pricing (‘TP’) perspective amidst the economic vision of the new government

The Annual Budget 2024 will be presented in the Monsoon Session of Parliament. The Annual Budget 2024 is expected to build upon the principles of ...

Direct Tax Recommendations for Budget 2024

The much-anticipated Union Budget 2024, under the Modi 3.0 government, will be presented on 23 July 2024. Globally, various stakeholders are keenl...

Tax Street – June 2024

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Deemed Dividend under Section 2(22)(e) – Shareholders to Watch-out!

Dividends traditionally have been taxable either in the hands of the company as Dividend Distribution Tax or in the hands of the shareholders as 'Inco...

Limited Liability Partnership needs to disclose the Significant Beneficial Owner

The Ministry of Corporate Affairs (MCA) had introduced the concept of Significant Beneficial Ownership (SBO) for Limited Liability Partnerships (...

Dematerialization of Shares in Private Limited Companies

Dematerialization is the process of converting physically held shares and securities (in the form of paper certificates) into a digital or electro...

Tax Street – May 2024

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Incentives for New Manufacturing Set Ups in India

India's push for local manufacturing is evidenced by the various government incentives offered to attract increased investment. With its dynamic ma...

Valuation of Optionally Convertible Debt Instruments

Convertible securities emerged during the nineteenth century in the U.S. This was during a period in which securing capital in a swiftly expanding ...

Navigating the New Trade Agreements – A Strategic Guide for Exporters

India's recent endeavors in bilateral and Free Trade Agreements (FTAs) signal a transformative era for various stakeholders. With an aim to reduce ...

India-EFTA Trade & Economic Agreement: A Win-Win Deal

In March, India marked a pivotal milestone in its pursuit of sustainable development, economic growth, and strengthening of its international tr...

How GST ensured fast credit growth to MSMEs

The Finance Ministry has expressed confidence that India’s economy is poised to become the world’s third largest within the next three years,...

Substance and Significance of Beneficial Ownership Provisions

This article focuses on the substantive provisions relating to the declaration of beneficial ownership in a company.

Sections 89 and 90...

Tax Street – April 2024

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Lok Sabha Elections 2024: Need for GST reforms to cater MSMEs

The Goods and Services Tax (GST) regime, a pivotal reform in the nation's taxation structure, has evolved over the last seven years. Nonetheless...

Incentives for New Manufacturing Set Ups in Punjab

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up of n...

Revamping Indian Real Estate: How Amendments to Insolvency Laws Promote Resolving Projects?

From an optimistic future outlook, the Indian real estate market appears bright. According to a Concorde analysis, the real estate industry is expe...

How Companies Can Avoid Unnecessary GST Frauds

The Goods and Services Tax (GST) regime was implemented with the primary aim of simplifying the taxation system. However, despite concerted eff...

India’s Macro Economic Outlook: A CFO’s Viewpoint

2024 could be an unpredictable year for the Indian economy. Being an election year, the re-election of the current government would provide a ...

Tax Street – March 2024

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

GST in Realty: Building Blocks or Stumbling Stones?

When GST was implemented on 1 July 2017, it set the foundation for a monumental tax structure that continues to be constructed, piece-by-piece, re...

Mandatory ISD Provisions: Do they end the need to cross charge?

The debate between the Input Service Distributor (ISD) vs. Cross Charge mechanism has been ongoing since the introduction of the GST regime. Bef...

Tax Street – February 2024

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

IFRS vs ASC: Valuation Perspective

This article aims to highlight the key valuation triggers that stem from the application of various International Financial Reporting Standards (IFRS...

Specter of multi-authority, repetitive and multi-directional proceedings haunting GST-payers

The GST regime, implemented in 2017, turns seven years soon, stepping into its proverbial childhood. In many ways, the sweeping tax reform ha...

Historical Perspective and Conceptual Understanding of Beneficial Interest/Ownership

Entities such as companies, trusts, foundations, partnerships, and other types of legal persons and arrangements conduct a wide variety of comm...

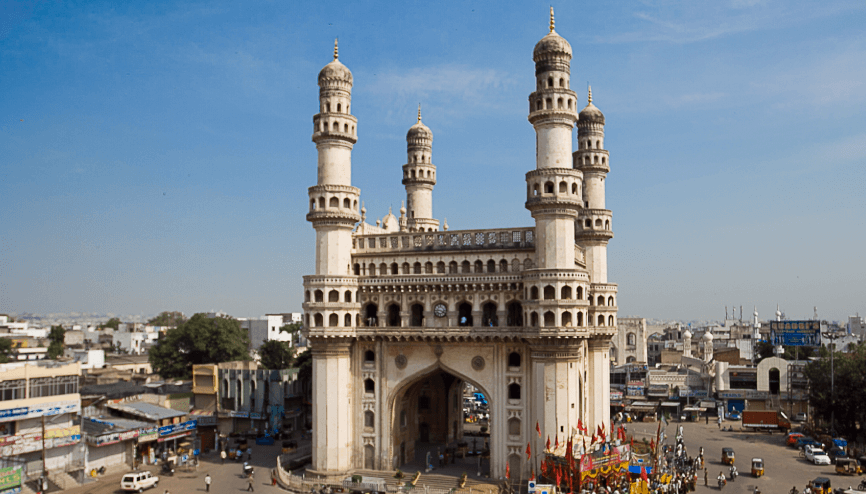

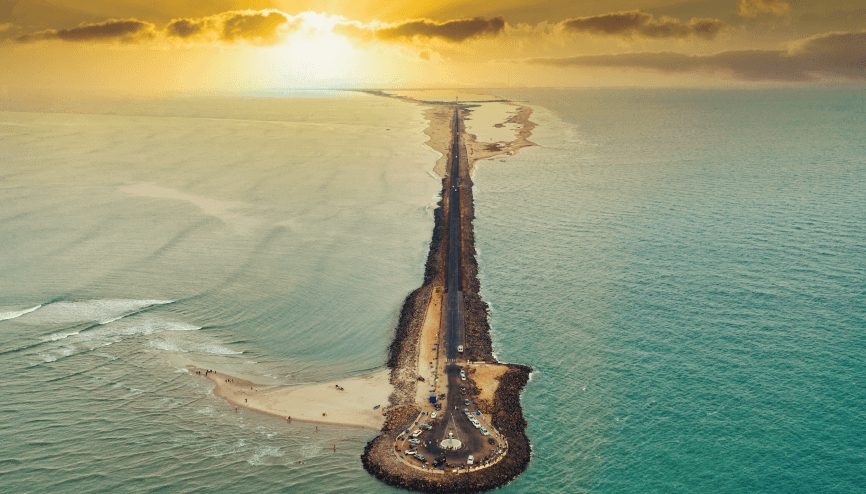

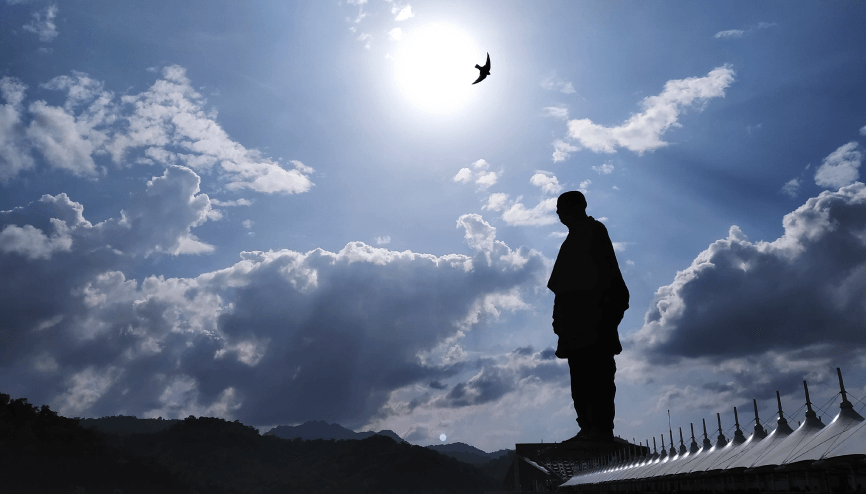

India’s Path to Progress

As the Indian government led by Prime Minister Narendra Modi completes one decade, we take this opportunity to look back at some of the key deve...

Tax Street – January 2024

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Key Highlights – Food Processing Industry

Budget 2024 charts a growth-focused course, emphasizing capital expenditure for positive economic impact. Initiatives in transport and green ...

Key Highlights of Interim Budget 2024

The Interim Budget 2024 was a reflection of past achievements and attempted to provide an impetus to India’s current optimistic trajectory. The...

Healthcare Sector Expectations from Budget 2024

The COVID-19 pandemic put a spotlight on healthcare systems across the globe and exposed areas of improvement within the system. Post-pandemic, all ...

Food Processing Sector Expectations from Budget 2024

As India gears up for Union Budget 2024-2025 which sets the tone for national development, the Food Processing Sector expects an emphasis on agricu...

Getting acquainted with the concept of “deemed international transaction” in India

Transfer Pricing (TP) in India, was first introduced in 2001, in the Income-tax Act 1961 (the Act) and has seen various developments in the past ...

Chennai ITAT Ruling in Cognizant’s Shares Buyback: A Panoramic Analysis

Recently, the Chennai Income-tax Appellate Tribunal (ITAT or Tribunal) in the case of Cognizant Technology Solutions India Pvt. Ltd (Company or th...

Expansion into overseas markets: The tax and regulatory framework

As the Indian GDP grows, the Indian industry continues to expand across the global, supplemented by digitalization. In recent years, there’s been...

Tax Considerations for Mergers and Acquisitions: Structuring Deals for Optimal Tax Efficiency

Mergers and Acquisitions (M&A) is the most popular route used by companies looking to consolidate businesses, expand operations, rationalize holdi...

Online Gaming – Are all bets off? Who wins? Who loses?

The GST Council in its 50th and 51st meetings had recommended to levy GST on Casino, Horse Racing and Online gaming at the uniform rate of 28% on ...

Foreign Trade Policy 2023 Roadmap to India’s Global Leadership in Exports

Over the years, India’s Foreign Trade Policies have reflected the nation’s standing among the world economies. The initial policies, which ca...

5 things early-stage start-ups must be aware of to avoid GST notices

The last decade has witnessed an exponential rise in the start-up ecosystem in the country. While the COVID-19 outbreak and the effects of the lo...

GST Council hits half-century An all-round performance

While marking its 50th meeting milestone, the GST Council has announced a slew of recommendations relating to changes in GST rates, measures for ...

Purchase of own shares under the scheme whether dehors buyback or capital reduction

Recently, the Chennai Income-tax Appellate Tribunal (ITAT) in the case of Cognizant Technology Solutions India Pvt. Ltd [TS-531-ITAT-2023(CHNY)] (...

Why Every Start-up Needs a Full-time or Virtual CFO

Finance is a foundational pillar for start-ups where the role of a CFO differs significantly from that in an established corporation. While the rol...

Tax Street – December 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Tax Street – November 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

From cost arbitrage to core value drivers: Setting up a successful GCC

Global Capability Centers (GCC) have evolved from cost generators to strategic business enablers and value generators. During the initial stage, th...

Incentives for New Manufacturing Set Ups in Uttar Pradesh

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up...

Investing in Manufacturing – Top Investment Destinations in Asia

Global markets today are becoming more interconnected with liberalized trade policies, growing access across countries, and increasing bilateral ag...

Incentives for New Manufacturing Set Ups in Rajasthan

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up of ...

Tax Street – October 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Tax Street – September 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Tax Street – August 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Promotion for Research and Innovation in Pharma-MedTech

The Government of India (GoI) has focused on encouraging manufacturing in India and introducing innovative technologies. It has been instrumental in e...

Navigating the credit distribution saga

The GST Council has its ears to the ground and is seeking to resolve to remove ambiguities. One such recommendation of the Council was to resolve a lo...

Incentives for New Manufacturing Set Ups in Odisha

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up of ...

Incentives for New Manufacturing Set Ups in Andhra Pradesh

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up ...

Tax Street – July 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Tax Podcast

EP:07 UAE Corporate Tax and Transfer Pricing

The UAE Corporate Tax and Transfer Pricing implementation requires an in-depth ...

Incentives for New Manufacturing Set Ups in Tamil Nadu

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up ...

Tax Street – June 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Incentives for New Manufacturing Set Ups in Gujarat

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up of ...

Family Arrangements – Taxation Aspects Involving Companies

Over the years, India has witnessed the rise of many prominent family empires. A family business generally starts with a small business being set up...

Tax Street – May 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Incentives for New Manufacturing Set Ups in Karnataka

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up o...

Tax Street – April 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

National Medical Device Policy 2023

On 26 April 2023, the Government of India (GOI) approved the National Medical Device Policy 2023.

The Medical Devices sector is an inte...

Significance and implications of the Apex Court’s Ruling on ‘Substantial Question of Law’ for Transfer Pricing matters

The Hon’ble Apex Court, in its order dated 19 April 2023, in the case of SAP Labs India Pvt. Ltd. quashed and set aside the ruling of the High ...

Incentives for New Manufacturing Set Ups in Maharashtra

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up...

Secondment of employees – the tax controversy continues

The taxability of salary reimbursement for seconded employees has been debatable with various contrary judicial precedents. The recent Supreme Cour...

Tax Street – March 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Foreign Companies may be required to file tax returns in India

Impact of increase in withholding tax on rates for Fees for Technical Services and Royalty

As per Indian Tax laws, paymen...

GST on Transportation Services – Navigating through turbulent waters

GST on services by way of transportation of goods by aircraft/vessel is certainly on a roller-coaster ride these days. The story began in Septemb...

Foreign Tax Credit: Overview and Related issues

The era of globalization and digitalization has brought a revolution in the way businesses are conducted, bringing the economies/geographies cl...

Decoding the intricacies of the Angel Tax Provisions

In the recently presented Union Budget 2023, it has been proposed to expand the applicability of Section 56(2)(viib) of the Income-Tax Act, 196...

Incentives for New Manufacturing Set Ups in Haryana

Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up ...

Tax Street – February 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Tax Street – January 2023

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Union Budget 2023: Accelerate. Advance. Ascend.

India remains steadfast on its course for progress. Despite the global geo-political and economic crises, India’s economic growth for the curre...

Union Budget 2023 – Key Highlights

The much-awaited Union Budget 2023 is out, and it can be said that budget is focused towards growth and continues on its path of boosting capital s...

Healthcare Sector’s Expectation from Budget 2023

As we enter 2023, the world is recovering from the pandemic and is well on its way to reaching pre-pandemic level normalcy. India is no different and ...

CFOs Expectations of Union Budget 2023

As Union Budget 2023-24, the last full-year budget for the current government, will be closely watched by India Inc. as it sets the tone for the econo...

Tax Street – December 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Tax Street – November 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Tax Street – October 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Tax Street – September 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Rationalization of Entities: Simplify and Streamline your Business

Technological advancements have made it easier for people to connect across the globe. In this pursuit of growth and global presence, many busine...

Food Processing Sector in India: Opportunities and Challenges

The Indian food processing sector is expected to grow to over half a trillion dollars by 2025 (from ~USD 260 billion in 2020, expected to achieve ...

Tax Street – August 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Tax Street – July 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Tax Street – June 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

India’s Grand Slam entry into the Aussie markets!

After concerted efforts since 2011, an Economic Cooperation and Trade Agreement (ECTA) was signed in April 2022 between India and Australia, thus pavi...

Tax Street – May 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

NCLT allows amalgamation while rejecting invocation of GAAR

Recently, the National Company Law Tribunal, Chandigarh Bench (Tribunal), while approving the Scheme of Amalgamation [(Re Panasonic Life Solution...

Tax Street – April 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Amendments to SEBI LODR and its impact on Related Party Transactions

Over the years, Related Party Transactions (RPT) have become a key focus area for the board of directors, not only from a tax perspective but also to ...

Tax Street – March 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Healthcare Supply Chain Excellence

In our podcast series, Healthcare...

Tax Street – February 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

Intangible Asset Valuation – Valuing Customer Relationships

Intangible asset valuation is a complex process. Though these assets do not have any physical substance, they are at the heart of any ...

Women In Technology

Our Women in Technology Podcast Se...

Digital Assets – Special Tax Law for Cryptocurrency and Non-fungible Tokens

India has become one of the largest markets for cryptocurrencies with Indians parking nearly USD 6.6 billion in cryptocurrencies until May this year...

Tax Street – January 2022

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxatio...

India’s Union Budget 2022-23: Balance. Bolster. Boost.

India's Union Budget 2022-23 provided a roadmap towards economic stability and growth. Finance Minister Nirmala Sitharaman presented the Union Budget ...

Setting up Enterprise Analytics in 2022

Advanced Analytics, which includes Predictive Techniques, Machine Learning, and Artificial Intelligence, is leading the next wave of disruption. Us...

Enterprise Analytics 101 – Think Next!

Netflix uses its recommendation systems to keep you hooked. Uber uses real-time analytics to match you with fitting co-riders. Apart from these, on...

Enterprise Analytics 102 – People Matter!

As a generation growing up on science fiction, AI vs. homo sapiens always seemed like a near possibility. (hint – The Matrix). Will this be the n...

Enterprise Analytics 104 – Insights to Action!

Is the buzz around analytics dwindling? Once hyped as the gamechanger for every enterprise, is analytics letting businesses down now? While investm...

Enterprise Analytics 105 – The Feedback Loop

Amazon started as an online bookstore, and now, it has revolutionized the retail ecosystem completely. Netflix started as a DVD rental store, and n...

What business leaders need to know before setting up Enterprise Analytics in 2022

Artificial Intelligence (AI) is the buzzword nowadays. Organizations across the globe are pouring investments worth billions of dollars into data...

Events

-

25May

2021New Age Selling: A customer-centric approach to sales using AI

This webinar explores the role of analytics in driving sales transformation and the key challenges faced by sales leaders within an organization.

-

24Nov

2020Diversify to Differentiate – Think India, Think Next! – Success Showcase

This webinar covers advantages and key considerations, regulatory reforms, and incentive programs that have affected investing and FDI in India.