UAE’s Advance Pricing Agreement Framework: From Compliance to Certainty

27 Jan 2026

Article 59 of the Corporate Tax Law permits the submission of an application for an Advance Pricing Agreement (“APA”) with the Federal Tax Authority (“FTA”) to determine in advance the arm’s length price (“ALP”) with respect to controlled transactions or arrangements proposed or already entered into by the taxpayers.

The introduction of the APA Guide by the UAE FTA in December 2025 marks a significant milestone in the evolution of the UAE’s TP and corporate tax landscape. While compliance requirements such as TP documentation (benchmarking documents, local file, and master file) and disclosure obligations laid the foundation of TP in the UAE, taxpayers have continued to seek greater certainty, particularly for complex and high-value related-party transactions. Responding to this need, the UAE FTA has issued its APA Corporate Tax Guide, providing long-awaited clarity on the availability, scope, and mechanics of APAs under the UAE Corporate Tax regime. This development signals the UAE’s transition from a compliance-driven TP framework to one that actively promotes certainty, predictability, and cooperative tax administration, and moves to a more structured and certain tax environment. This would also help reduce the risk of tax disputes, audits, adjustments, and double taxation for the taxpayers.

What is an APA?

An APA is a forward-looking agreement between a taxpayer and the FTA that establishes, in advance, the ALP methodology for specified related-party transactions over an agreed period. Once an APA is concluded and its terms are adhered to, the FTA commits not to challenge the pricing of the covered transactions for the covered period, provided the taxpayer complies with the agreed terms and critical assumptions. Globally, APAs are seen as an effective tool for managing TP risk, especially for recurring or complex high value related party transactions. By agreeing on pricing in advance, they help reduce uncertainty and the risk of litigation.Phased rollout of the UAE APA Programme

Recognizing the significant administrative and technical thoroughness required to implement and administer APAs effectively, the FTA has introduced the APA regime through a phased implementation approach. This approach is aligned with international best practices and allows both taxpayers and the FTA to progressively build experience and ensure the consistent and robust application of the APA framework over time.Table comes here

This phased approach enables the FTA to gradually build administrative capacity while maintaining technical robustness and ensuring alignment with OECD consistent TP standards.Scope and eligibility of APA

APAs are not intended to apply uniformly to all taxpayers and are primarily targeted at businesses with high TP risk profiles. They are particularly relevant for taxpayers that:- Undertake material and recurring related-party transactions.

- Encounter pricing complexity, valuation subjectivity, or increased audit exposure.

- Operate across Free Zones, mainland UAE, and/or cross-border group structures.

Additionally, the taxpayer can apply for an APA with respect to domestic or cross-border controlled transactions, where the total/expected value of all the controlled transactions proposed to be covered under the APA is at least AED 100 million per Tax Period. However, the transaction value threshold is not determinative on a standalone basis for eligibility to be applied for APA. In evaluating APA applications, the FTA will also consider qualitative factors such as the complexity of the transactions, the taxpayer’s functional and risk profile, and whether entering into an APA would meaningfully enhance tax certainty.

Notably, for a Tax Group, the AED 100 million threshold shall apply at the Tax Group level. The value of all controlled transactions between the Tax Group and related parties outside the Tax Group shall be aggregated for the purpose of determining whether the threshold is met.

Duration of an APA

The UAE APA framework is clearly prospective in nature and provides certainty for future periods only. Key features include:- Validity period: Minimum of three tax periods and maximum of five tax periods.

- No roll-back provision for prior years.

- Transaction-specific coverage, focusing on selected controlled transactions.

- Exclusion of safe harbour transactions from APA scope.

Taxpayer must submit the UAPA application within two months from the date of approval notification of pre-filing consultation by the authority, or at least twelve months prior to the commencement of the first Tax Period to be covered under the UAPA, whichever is earlier. Where the FTA requests that the taxpayer should submit further information or documentation, the Taxpayer is expected to submit such information or documentation within 40 business days from the date of request.

Fees and Administrative Costs

The FTA has introduced a clear and transparent fee framework for the APA programme:- APA application fee: AED 30,000 (non-refundable)

- APA renewal fee: AED 15,000

While the application fees may appear substantial at the outset, they should be viewed in the context of the overall time, effort, and level of preparedness required to successfully pursue an APA. This investment is generally outweighed by the long-term benefits, including enhanced certainty, reduced audit and dispute exposure, and significant savings in management bandwidth and professional costs that would otherwise arise in a prolonged transfer pricing controversy environment.

Contents of APA

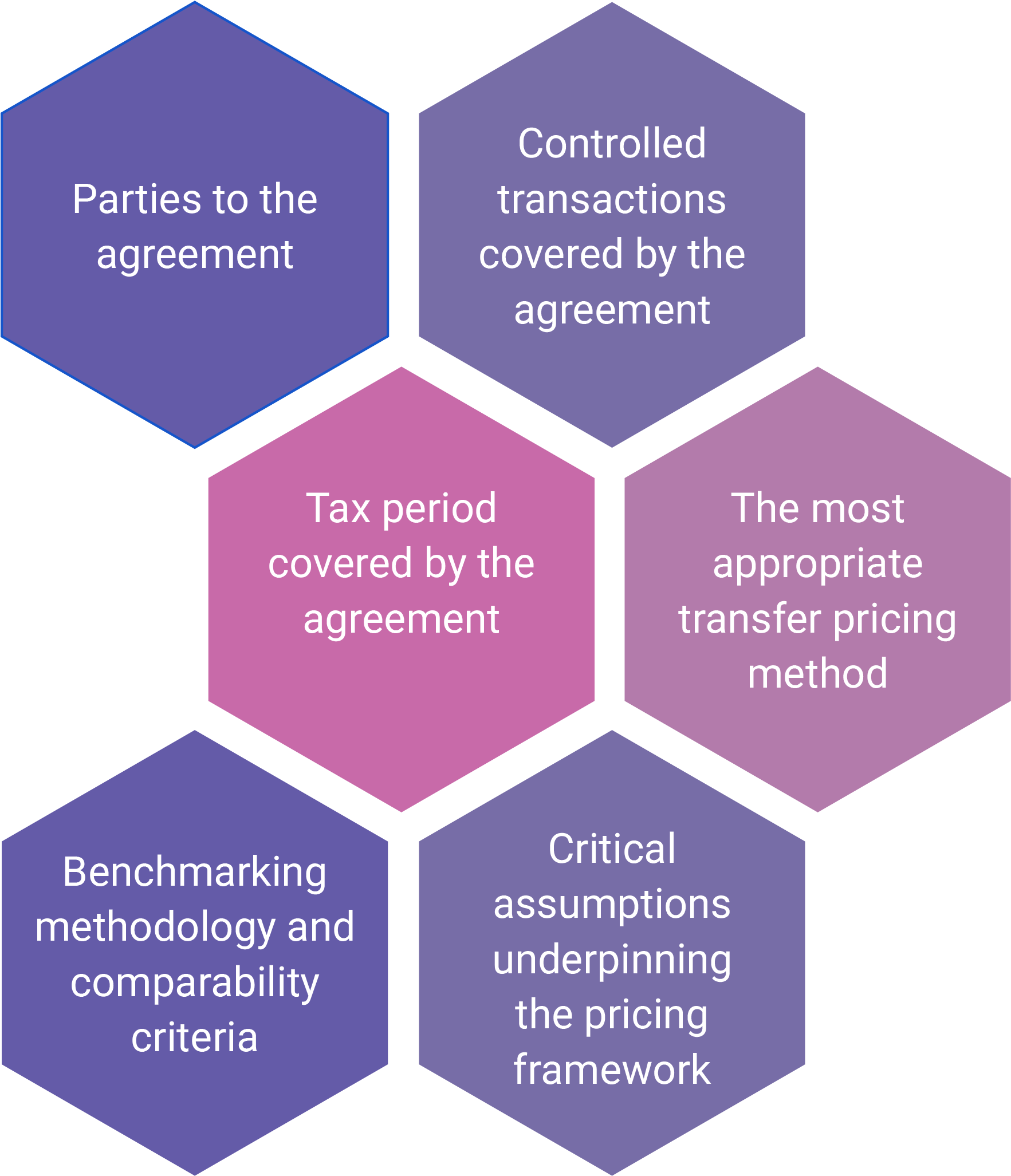

An APA will set out the criteria for determining the ALP in relation to controlled transactions entered or to be entered by that taxpayer, over a fixed period of time. An APA comprehensively documents the following:APA application process: Key stages

The APA process is designed to be structured and consultative, reflecting its cooperative and forward-looking intent between taxpayers and the tax authority.The process broadly unfolds across the following stages, which are explained in brief as follows:

Pre-filing Consultation

This initial, non-binding engagement with the FTA allows the taxpayer to assess the feasibility of an APA, define the proposed scope and covered transactions, and evaluate overall readiness before making a formal application. While some jurisdictions historically allowed a form of anonymous APA pre-filing consultation in which the applicant could initially conceal their identity to gauge FTA interest, this is not provided for under the UAE APA framework.Formal APA Application

At this stage, the taxpayer submits a comprehensive application supported by detailed functional and risk analysis, economic justification, and robust benchmarking studies to substantiate the proposed TP approach.FTA Review and Negotiation

The FTA undertakes an in-depth technical review of the application, which may involve clarifications, discussions, and negotiations with the taxpayer. This phase can include meetings and, where considered necessary, on-site visits to gain a deeper understanding of the business and transactions and to support detailed negotiations between the taxpayer and the FTA.Execution and Ongoing Monitoring

Once the APA is agreed and executed, the taxpayer is required to comply with its terms throughout the covered period. This includes submitting an annual APA compliance declaration confirming continued adherence to the agreed methodology, assumptions, and pricing outcomes.It has been clarified under the APA framework that an APA would not establish a precedent for any other tax periods of the taxpayer, nor for any other taxpayer that is not covered under the APA.

APA monitoring and review

Filing of an APA Annual Declaration

Once an APA is executed, the taxpayer is required to file an APA Annual Declaration for each year covered by the agreement. This declaration confirms that the taxpayer has complied with the agreed TP methodology, critical assumptions, and pricing outcomes during the relevant tax period. It typically includes confirmations on the continued validity of the underlying facts, functions, assets, and risks, as well as disclosures of any deviations or changes that may affect the APA.Review of APA Annual Declaration

The FTA reviews the APA Annual Declaration to assess ongoing compliance with the APA’s terms . This review focuses on verifying that the agreed methodology has been consistently applied and that the critical assumptions remain valid. Where necessary, the FTA may seek clarifications, additional information, or explanations from the taxpayer. A satisfactory review helps maintain the certainty provided by the APA and reduces the likelihood of TP audits for the covered transactions.Revision or cancellation of an APA

An APA may be revised or cancelled where there is a material change in facts or circumstances that affects the basis on which the agreement was concluded. This may include significant changes in business operations, functional or risk profiles, economic conditions, or regulatory frameworks. Revisions are generally prospective in nature and aim to realign the APA with the revised commercial reality, whereas cancellation may occur when the changes are so fundamental that the APA can no longer be applied as intended.Revocation or cancellation of an APA

The FTA may revoke or cancel an APA where there has been non-compliance with its terms, misrepresentation of facts, failure to disclose relevant information, or breach of critical assumptions. In such cases, the APA may be rendered void, potentially with retrospective effect, exposing the taxpayer to audits, adjustments, and penalties under the general TP provisions.Renewal of an APA

Taxpayer may apply for the renewal of an APA upon the expiry of its covered period, subject to meeting the prescribed timelines and conditions. Renewals typically involve a streamlined review process, provided there are no significant changes in the underlying facts or pricing arrangements.Why APAs are particularly relevant in the UAE context?

The relevance of APAs is particularly pronounced in the UAE, given the evolving tax audit landscape and the increasing emphasis on economic substance and arm’s length outcomes under the Corporate Tax regime. In this context, APAs serve as a proactive tool for managing TP risk and enhancing tax certainty.Key benefits of entering into an APA include reduced exposure to audits and disputes, greater predictability and stability of tax outcomes, and more constructive engagement with the FTA. APAs also help streamline annual TP compliance by providing a clear, agreed framework for pricing, while ensuring alignment with global TP governance and OECD-consistent standards. For cross-border transactions, APAs can further help mitigate the risk of double taxation.

For multinational enterprises, APAs offer additional strategic value by promoting consistency in TP positions across jurisdictions and strengthening internal TP governance, controls, and documentation processes.