Introducing India

Economy

India is the third-largest economy in terms of Gross Domestic Product (GDP) based on Purchasing Power Parity (PPP). India has been one of the fastest-growing economies over the last decade.

The service sector has been driving economic growth in India, accounting for 55% of Gross Value Added (GVA) growth (at current prices), followed by the industry sector with a 29% share, and agriculture accounting for 16% in FY 2024-25. However, agriculture remains the largest employer, engaging over 46.1% of the total workforce, followed by the service sector employing 30%7.

The Indian economy has solidified its post-COVID recovery, with both fiscal and monetary policies contributing to economic and financial stability. In a challenging global environment, India has emerged as a key economic and geopolitical power. The country's focus on a rules-based international order, its advocacy for collaborative solutions to common challenges, and its commitment to democratic values have established it as a stabilizing force in an increasingly complex global geopolitical landscape. Through initiatives like Mission Lifestyle for Environment (LiFE), the push for Green Hydrogen, and investments in infrastructure and connectivity—such as the Bharatmala highway program, the Sagarmala project for port-led development, and the Smart Cities Mission, India is transforming its economic landscape and playing a pivotal role in global progress.

In line with India's vision of becoming 'Atmanirbhar,' Production Linked Incentive (PLI) Schemes have been introduced for 14 key sectors with a total outlay of USD 24.63 Billion. These schemes aim to significantly enhance domestic production, make Indian companies globally competitive, and drive economic growth. By August 2025, 806 applications have been approved across these sectors, attracting investments of USD 20.7 Billion and generating approximately 1.2 Million jobs.8.

In recent years, India has implemented a slew of reforms and initiatives aimed at improving the country’s attractiveness to foreign investors. This is clearly envisioned in the Global Innovation Index (GII) report 2024, where India ranks as the 38th innovative country amongst 139 countries in terms of political environment, education, infrastructure, and knowledge creation of economy3. This marks India as one of the top climbers of the decade in terms of ranking. Further, in Central and Southern Asia, India positions itself as rank 1. Further, with 0.16 Million startups, India is now world’s 3rd largest startup ecosystem10

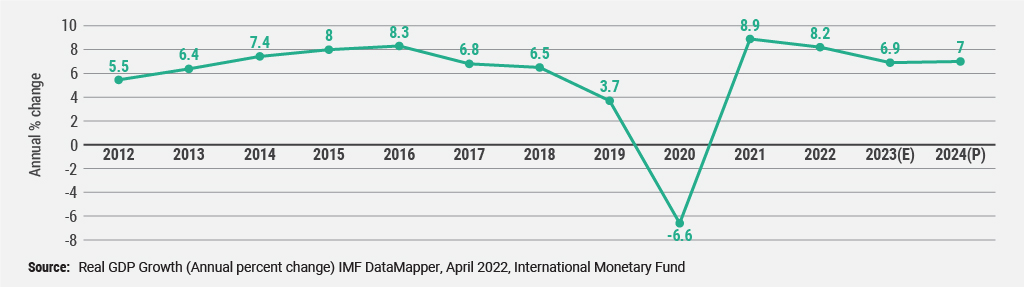

Amidst severe global economic headwinds, and supply chain disruptions, the Indian economy has recovered and expanded steadily over the past three years. India’s economy continues to grow at a steady and confident pace, with real GDP estimated to be 6.5% in FY 2024–25 significantly higher than the global average of 2.4%. Over the past decade, India’s GDP at current prices has nearly tripled, reaching USD 3.9 trillion, underscoring the nation’s sustained resilience and economic momentum11. In pursuit of the Government's vision of becoming a developed nation by 2047, the Government aims to11:

- Complement the macro-economic level growth focus with a micro-economic level all-inclusive welfare focus.

- Promote digital economy & fintech, technology-enabled development, energy transition, and climate action.

- Rely on the virtuous cycle starting from private investment with public capital investment helping to crowd-in private investment.

Aligned with this forward-looking and inclusive vision, the Government has implemented various initiatives, including efforts to enhance women's development, health, education, skill development, science and technology, infrastructure, employment, agriculture, manufacturing, industrial production, innovation, and the growth of indigenous industries.

Real GDP Growth in India: FY 2012-13 to FY 2025-26

Foreign Trade12: Despite persistent global challenges, total exports (services and goods) in FY 2024-25 exceeded the previous year's record, reaching an estimated USD 820.93 Billion, higher than the USD 778.13 Billion in FY 2023-24 (5.50% growth rate). Imports for FY 2024-25 are estimated at USD 915.19 Billion, up by ~6.8% from USD 856.52 Billion in FY 2023-24.

India’s service sector saw a strong 12.5% increase in exports, rising from USD 341.06 Billion in FY 2023-24 to USD 383.51 Billion in FY 2024-25. Imports in this sector also registered a growth of 9.3%, from USD 178.31 Billion in FY 2023- 24 to USD 194.95 Billion in FY 2024-25, resulting in a trade balance of USD 189 Billion for FY 2024-25.

In the goods sector, exports in FY 2024–25 remained broadly in line with the previous year, at USD 437.42 Billion compared to USD 437.07 Billion in FY 2023–24. Imports, however, grew by 6.20%, rising to USD 720.24 Billion in FY 2024–25 from USD 678.21 Billion in FY 2023–24.

Key drivers of goods export growth in FY 2023-24 included Electronic Goods, Drugs and Pharmaceuticals, Engineering Goods, Iron Ore, Cotton Yarn/Fabrics/Made-ups, Handloom Products, along with Ceramic products and Glassware. Notably, exports of Drugs and Pharmaceuticals & Electronic Products rose by 31.21% and 29.57%, respectively, compared to the previous year.

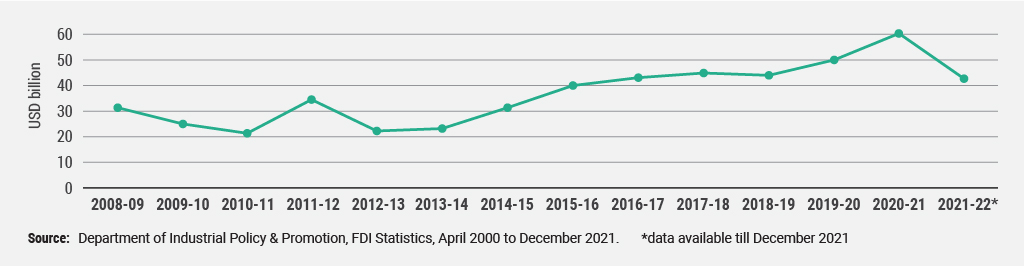

Foreign Direct Investment (FDI)13: India has emerged as a prime destination for Foreign Direct Investment (FDI) in recent years, driven by various factors that have significantly enhanced its appeal. The UNCTAD's World Investment Report 2023 ranks India as the eighth most preferred FDI destination globally. Moreover, India stands among the top three countries for greenfield investment announcements and ranks second in international project finance deals.

FDI Inflow14: From April 2000 to March 2025, cumulative FDI inflows into India stood at USD 1,072.34 Billion. In FY 2024-25 alone, FDI inflows amounted to USD 81.04 Billion, a 14% increase from FY 2023-24, with Maharashtra, Karnataka, and Gujarat accounting for over 60% of the total share.

Annual FDI Equity Inflows into India: Financial Years 2008-09 to 2024-25

Country-Wise FDI Equity Inflows

From April 2000 to March 2025, cumulative FDI equity inflows from Mauritius stood at USD 180.19 Billion, making it the largest source of FDI into India. Mauritius, Singapore and USA contributed to ~59% of cumulative India’s FDI equity inflows during this period. During FY 2024-25, Singapore was the top investor with USD 14.94 Billion, followed by Mauritius, USA, Netherlands, UAE, Japan, Cyprus, United Kingdom, Germany, and Cayman Islands. It is pertinent to note that some of the key countries mentioned here are favorable jurisdictions to make investments in India.

Sector-wise FDI Equity Inflows

From April 2000 to March 2025, the Service Sector and Computer Hardware and Software sector attracted the highest FDI equity inflow accounting for 16% and 15% respectively of all inflows followed by Trading (7%). In FY 2024-25, the Services sector received the highest amount of FDI equity inflows (USD 9.35 Billion) followed by the Computer Software & Hardware, Trading, Power, Construction (Infrastructure) Activities, Automobile Industry, Chemicals, Drugs and Pharmaceuticals, Construction Development, and Telecommunications.

- 1. Sector-wise GVA data, Economic Survey 2023-24, https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf

- 2. Ministry of Commerce & Industry, https://pib.gov.in/PressReleasePage.aspx?PRID=2039119

- 3. Global Innovation Index 2024, https://www.wipo.int/web-publications/global-innovation-index-2024/assets/67729/2000%20Global%20Innovation%20Index%202024_WEB3lite.pdf

- 4. PIB – Government of India, https://static.pib.gov.in/WriteReadData/specificdocs/documents/2024/jul/doc2024722351601.pdf

- 5. Vision India @2047, https://pib.gov.in/PressReleasePage.aspx?PRID=1794129

- 6. Ministry of Commerce & Industry, https://pib.gov.in/PressReleseDetailm.aspx?PRID=2017942

- 7. World Investment Report 2023, https://unctad.org/system/files/official-document/wir2023_en.pdf

- 8. Factsheet on FDI inflow, https://dpiit.gov.in/sites/default/files/FDI_Factsheet_30May2024.pdf