Payroll & HR Support Services

Expanding across borders brings complexity in payroll tax compliance, social security, local labor laws, and cost structures. These factors, along the challenges of visas, relocation, pay parity, and multiple jurisdictions' make payroll management increasingly critical.

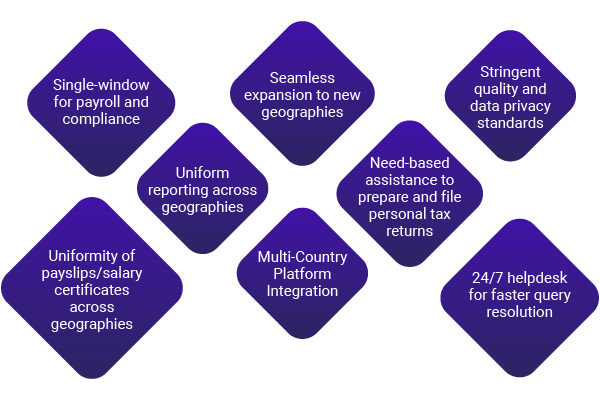

Nexdigm provides end-to-end, transparent, and single-point-of-contact Payroll and HR processes. Our global solutions are designed to support your growth objectives by reducing risk, improving efficiency, and helping you scale your business.

Payroll Processing

- Processing payroll and employee benefits computation

- Reimbursement management, including Leave Travel Allowance and flexible benefit components.

- Payroll registers and reports

- Full and final settlements

- Employee helpdesk support through Employee Self-Service portals

Income and Social Taxes

- Structuring tax-efficient salaries

- Registrations and declarations required for employer tax obligations

- Tax advisory for cash and non-cash remuneration and perquisites

- Social Security Contribution Calculation

- Payroll and tax processing for employers

- Preparation and filing of periodic returns

Reporting and Analytics

- Effective and meaningful analysis of data to help the management in decisionmaking

- Comparative analysis across countries (accuracy, timeliness, cost, quality, etc.)

Global Mobility Tax Advisory

- Salary, Payroll and tax management for inbound and outbound expatriates

- Advisory and assistance for double tax avoidance and social security totalization benefits

- Tax return preparation and compliance support for mobile employees

HR Support

- Assistance in framing and implementing HR policies

- Assistance in preparation of employee handbooks, employment letters/contracts, etc.

- Help with implementing HRMS, time and attendance systems, and performance management tools

Employee Benefits Management

- Compensation, benefits planning, and structuring

- Benefits administration

- Central Provident Fund / Provident Fund / Superfund contributions and deposits with different funds

- Labour law compliance (establishment compliance)

- ESOP implementation, computation, and reporting

- Tax advisory and implications

- Taxability of one-off payments – redundancy, severance pay, long service leave, etc.

- Income tax returns for employees across multiple tax jurisdictions

Employee Expense Claims Reimbursements

- End-to-end solutions centered around managing the business expense claims of employees

- Building digitized workflows and document management systems to enable paperless and seamless expense claims systems

Technology-Led Solution

- Customized HRMS implementation and other eTech Platform

- Integration with global HRMS software

- Single sign-on access

- Digital tool for labor law compliance

- Data-driven decision-making through analytics dashboards